California Homeowner Insurance

Navigating the complex world of insurance is a task many homeowners face, especially in regions prone to natural disasters and unique risks. This article delves into the intricacies of California Homeowner Insurance, providing an in-depth analysis to empower homeowners with the knowledge needed to make informed decisions.

Understanding the Basics of California Homeowner Insurance

California, with its diverse landscapes and varying climates, presents a unique set of challenges when it comes to insuring homes. From earthquakes to wildfires, the Golden State demands a comprehensive insurance strategy. Let’s break down the fundamentals of homeowner insurance in this region.

The Importance of Coverage Types

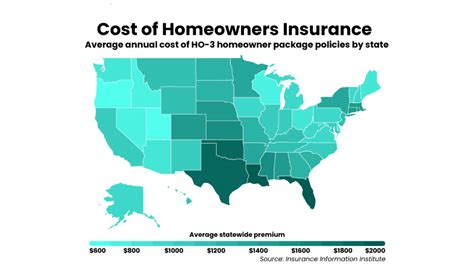

California homeowners are offered a range of coverage types, each designed to protect against specific perils. HO-3, the standard policy, provides coverage for the structure of the home and its contents, while HO-6 is tailored for condominium owners. For those seeking more comprehensive protection, HO-5 offers open perils coverage, providing coverage for all causes of loss except those specifically excluded.

Key Coverage Areas

- Dwelling Coverage: Protects the physical structure of the home, including walls, roofs, and permanent fixtures.

- Personal Property Coverage: Covers belongings inside the home, such as furniture, electronics, and clothing.

- Liability Coverage: Provides financial protection if someone is injured on the insured property or if the insured is legally responsible for causing injury or property damage elsewhere.

- Additional Living Expenses: Covers temporary living expenses if the home becomes uninhabitable due to a covered loss.

Understanding Policy Limits and Deductibles

Policy limits and deductibles are crucial components of any insurance policy. Policy limits refer to the maximum amount an insurance company will pay for a covered loss, while deductibles are the portion of the loss that the policyholder must pay out-of-pocket before the insurance coverage kicks in. In California, it’s essential to understand these terms, as they can significantly impact the cost and coverage of your insurance policy.

| Policy Type | Average Policy Limit | Typical Deductible |

|---|---|---|

| HO-3 | $500,000 - $1,000,000 | $1,000 - $2,500 |

| HO-6 | Varies based on condo association rules | Similar to HO-3 |

| HO-5 | $500,000 and above | $1,000 - $5,000 |

California-Specific Risks and Coverage

California’s unique geographical features and climate make it vulnerable to a range of natural disasters. Understanding these risks and how they impact insurance coverage is crucial for homeowners.

Earthquake Coverage

Earthquakes are a significant concern for California homeowners. While standard homeowner policies typically do not cover earthquake damage, separate earthquake insurance policies are available. These policies provide coverage for damage to the structure of the home and its contents due to seismic activity. It’s important to note that earthquake insurance often has a separate deductible, which can be a percentage of the home’s value.

Wildfire Coverage

Wildfires are a growing concern in California, with devastating impacts on homes and communities. Standard homeowner policies typically cover fire damage, but it’s essential to ensure your policy includes coverage for wildfires. Some insurance companies may offer additional endorsements or riders to provide enhanced wildfire coverage, including debris removal and temporary living expenses.

Flood and Water Damage

Flooding is another significant risk in California, particularly in coastal areas and regions prone to heavy rainfall. Standard homeowner policies do not cover flood damage, so it’s crucial to consider purchasing separate flood insurance. The National Flood Insurance Program (NFIP) offers policies to homeowners, renters, and business owners through participating insurance agents. It’s important to review the coverage limits and exclusions of these policies to ensure adequate protection.

Comparative Analysis of Top Insurance Providers in California

With numerous insurance providers offering homeowner policies in California, it can be challenging to choose the right one. Here’s a comparative analysis of some of the top providers, based on factors such as coverage options, customer satisfaction, and financial stability.

State Farm

State Farm is one of the leading insurance providers in California, offering a range of homeowner insurance policies. They provide standard HO-3 policies, as well as specialized coverage for high-value homes and unique risks such as earthquakes and floods. State Farm’s policies include additional living expenses coverage and optional endorsements for coverage enhancements.

Allstate

Allstate offers comprehensive homeowner insurance policies in California, including HO-3 and HO-5 coverage options. Their policies provide coverage for a wide range of perils, including theft, fire, and windstorm damage. Allstate also offers optional endorsements for earthquake and flood coverage. Additionally, they provide a range of discounts, including multi-policy discounts and safe homeowner discounts.

Farmers Insurance

Farmers Insurance is known for its personalized approach to insurance. They offer a range of homeowner policies, including HO-3 and HO-5, as well as specialized coverage for high-value homes and unique risks. Farmers Insurance provides coverage for additional living expenses and offers optional endorsements for earthquake and flood coverage. They also provide discounts for multi-policy holders and homeowners with certain safety features in their homes.

The Impact of Climate Change on California Homeowner Insurance

Climate change is having a significant impact on California’s insurance landscape. With increasing frequency and severity of natural disasters, insurance providers are adjusting their policies and rates. Here’s an in-depth look at how climate change is shaping the future of homeowner insurance in California.

Increasing Frequency of Natural Disasters

California has experienced a rise in the frequency and intensity of natural disasters, including wildfires, droughts, and heatwaves. These events are causing increased insurance losses, leading to higher premiums and more stringent underwriting criteria. Insurance providers are now more likely to exclude coverage for certain perils or implement higher deductibles to manage their risk exposure.

Underwriting Challenges

The changing climate poses significant challenges for insurance underwriters in California. With the increased risk of natural disasters, underwriters must carefully assess the risk profile of each homeowner to accurately price the insurance policy. This can lead to more detailed risk assessments and potentially higher premiums for homeowners in high-risk areas.

Innovations in Insurance

Insurance providers are adapting to the challenges posed by climate change by developing innovative solutions. This includes the use of technology to better assess risk, such as satellite imagery and advanced data analytics. Additionally, insurance providers are exploring new coverage options and risk management strategies to better protect homeowners in the face of changing climate conditions.

FAQs

How can I lower my homeowner insurance premiums in California?

+There are several strategies to reduce your homeowner insurance premiums. These include increasing your policy deductibles, bundling your insurance policies with the same provider, maintaining a good credit score, and investing in home safety features such as fire alarms and security systems. Additionally, reviewing your coverage annually and making sure it aligns with your current needs can help ensure you’re not overpaying for unnecessary coverage.

What should I do if my homeowner insurance claim is denied in California?

+If your homeowner insurance claim is denied, it’s important to understand the reason for the denial and take appropriate action. Review the denial letter carefully and gather any necessary documentation to support your claim. Consider reaching out to your insurance agent or broker for assistance, and if necessary, seek legal advice or file a complaint with the California Department of Insurance.

Are there any government programs to assist with homeowner insurance in California?

+Yes, California offers several government programs to assist homeowners with insurance coverage. The California Earthquake Authority (CEA) provides earthquake insurance to California residents. Additionally, the National Flood Insurance Program (NFIP) offers flood insurance to homeowners, renters, and business owners. These programs aim to make insurance more accessible and affordable for California residents.