California Cheap Auto Insurance

Welcome to our comprehensive guide on understanding and navigating the complex world of auto insurance in California. With a focus on affordability, we delve into the factors that influence insurance rates, explore strategies to secure the best deals, and provide insights into the unique considerations for drivers in the Golden State. Our aim is to empower you with the knowledge to make informed choices and find the most cost-effective auto insurance coverage tailored to your needs.

Understanding California’s Auto Insurance Landscape

California, with its diverse population and vast geography, presents a unique challenge when it comes to auto insurance. The state’s stringent insurance requirements, coupled with a variety of risk factors, create a dynamic market where rates can vary significantly. Understanding these factors is crucial for drivers seeking affordable coverage.

The Impact of State Regulations

California is known for its comprehensive insurance laws. The state mandates that all drivers carry a minimum amount of liability coverage to protect against bodily injury and property damage. This minimum requirement, while ensuring a basic level of financial protection, also sets a floor for insurance rates.

Furthermore, California's unique laws, such as the California Low-Cost Auto Insurance Program (CLCA), offer specialized coverage for low-income drivers. This program provides reduced premiums for eligible individuals, making insurance more accessible. However, the eligibility criteria are strict, and not all drivers qualify.

Regional Variations and Risk Factors

California’s vast expanse, spanning from urban centers like Los Angeles and San Francisco to rural areas, influences insurance rates. High-density urban areas often experience higher rates due to increased traffic congestion and accident risks. In contrast, rural areas may offer more affordable options but may lack certain coverage options due to limited access.

Additionally, natural disasters like earthquakes and wildfires, which are more prevalent in certain parts of California, can significantly impact insurance rates. Insurance companies factor in these risks when determining premiums, leading to higher costs in disaster-prone regions.

The Role of Demographics and Driving Behavior

Individual driving behavior and demographic factors also play a crucial role in determining insurance rates. Young drivers, for instance, often face higher premiums due to their perceived higher risk of accidents. Similarly, drivers with a history of traffic violations or accidents may see their rates increase significantly.

California's diverse population also means that insurance rates can vary based on factors like age, gender, and even occupation. Insurance companies use statistical data to assess risk, and certain demographics are associated with higher claims, which can impact rates.

Strategies for Securing Cheap Auto Insurance in California

Navigating California’s auto insurance market can be challenging, but with the right strategies, it’s possible to find affordable coverage. Here are some key approaches to consider:

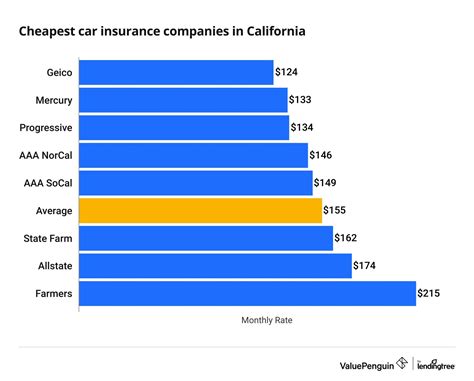

Shop Around and Compare Quotes

One of the most effective ways to find cheap auto insurance is to compare quotes from multiple providers. California’s insurance market is competitive, and rates can vary significantly between companies. By obtaining quotes from various insurers, you can identify the most cost-effective options for your specific needs.

Online quote comparison tools can be particularly useful, allowing you to quickly assess rates from a wide range of insurers. However, it's important to note that quotes are estimates and may not reflect the final cost. Always review the policy details and ask questions to ensure you understand the coverage and any potential exclusions.

Understand Your Coverage Needs

California’s insurance requirements set a minimum standard for liability coverage, but it’s essential to assess your specific needs. Factors such as the value of your vehicle, your financial situation, and your personal risk tolerance all play a role in determining the appropriate level of coverage.

Consider additional coverages like collision, comprehensive, and uninsured/underinsured motorist protection. While these options increase the cost, they provide crucial financial protection in the event of an accident. Assess your risks and choose a coverage level that provides adequate protection without breaking the bank.

Explore Discounts and Special Programs

Insurance companies offer a variety of discounts to attract and retain customers. Common discounts include those for safe driving records, multi-policy bundles (combining auto and home insurance), and loyalty rewards for long-term customers. Some insurers also provide discounts for specific occupations, educational achievements, or vehicle safety features.

In California, the California Low-Cost Auto Insurance Program (CLCA) is a notable example of a special program offering reduced rates for eligible drivers. Other programs, such as those targeting good students or seniors, may also provide cost savings. Research and inquire about these opportunities to see if you qualify.

Maintain a Good Driving Record

Your driving history is a significant factor in determining your insurance rates. A clean driving record with no accidents or violations can lead to significant savings. On the other hand, a single speeding ticket or accident can cause your rates to surge. Practice safe driving habits, obey traffic laws, and consider taking defensive driving courses to improve your record and potentially reduce your insurance costs.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that allows insurers to tailor rates based on your actual driving behavior. These policies use devices or smartphone apps to track your driving habits, such as mileage, time of day, and sudden braking. Safe drivers who use their vehicles sparingly may benefit from significant cost savings.

While usage-based insurance is not for everyone, it can be an attractive option for low-mileage drivers or those who are confident in their safe driving skills. It's worth exploring this option, as it can provide a more personalized and potentially cheaper insurance experience.

Performance Analysis: Real-World Examples

To illustrate the impact of these strategies, let’s examine a few real-world scenarios and their potential outcomes:

Scenario 1: Young Driver in Urban Area

John, a 22-year-old living in downtown Los Angeles, is looking for affordable auto insurance. With a clean driving record and a low-value vehicle, he compares quotes from multiple insurers and finds that his rates vary significantly. By opting for a usage-based insurance policy and taking advantage of a good student discount, John is able to secure a policy with a 20% reduction in his premium.

Scenario 2: Senior Driver in Rural Area

Mary, a 65-year-old retired teacher living in a rural area of California, is seeking insurance for her vintage car. With a long history of safe driving and no recent claims, she qualifies for several discounts. By bundling her auto insurance with her home insurance and taking advantage of senior discounts, Mary reduces her premium by 35% compared to the initial quotes she received.

Scenario 3: Family with Multiple Vehicles

The Smith family, consisting of two parents and two teenage children, owns multiple vehicles. By bundling their auto insurance policies with their home insurance and maintaining a clean driving record, they are able to negotiate significant discounts. Additionally, the parents encourage their teenagers to take defensive driving courses, which further reduces the family’s overall insurance costs.

Future Implications and Industry Insights

The auto insurance landscape in California is constantly evolving, influenced by technological advancements, regulatory changes, and market dynamics. Here are some key considerations for the future:

Technological Innovations

The rise of telematics and usage-based insurance is likely to continue, offering more personalized and potentially cheaper insurance options. Additionally, advancements in autonomous vehicle technology may eventually lead to further reductions in accident rates, impacting insurance costs in the long term.

Regulatory Changes

California’s insurance regulations are subject to change, and any modifications to the state’s minimum coverage requirements or other laws can significantly impact insurance rates. Staying informed about these changes is crucial for understanding how they may affect your insurance costs.

Market Competition

The competitive nature of California’s insurance market is likely to persist, with insurers vying for customers through innovative products and competitive pricing. This competition can benefit consumers by driving down costs and improving the range of coverage options available.

FAQ

What is the minimum liability coverage required in California?

+

The minimum liability coverage required in California is 15,000 for bodily injury per person, 30,000 for bodily injury per accident, and $5,000 for property damage.

How can I qualify for the California Low-Cost Auto Insurance Program (CLCA)?

+

To qualify for the CLCA, you must meet certain income requirements, own a vehicle that meets specific value criteria, and have a valid California driver’s license. You must also have a clean driving record and be a U.S. citizen or legal resident.

Are there any apps or devices that can help me save on insurance through usage-based tracking?

+

Yes, several insurance companies offer apps or devices that track your driving behavior. These tools can help you qualify for discounts or even pay-as-you-drive insurance policies. Some popular options include Metromile’s Mileage-Based Insurance and Progressive’s Snapshot.