Buying Auto Insurance Online

Welcome to the ultimate guide on buying auto insurance online. In today's digital age, purchasing insurance has become more accessible and convenient than ever before. With just a few clicks, you can compare policies, customize coverage, and secure the best deal for your vehicle. This article will walk you through the entire process, providing you with valuable insights, tips, and industry knowledge to make an informed decision.

As an expert in the field, I understand the importance of having comprehensive auto insurance to protect yourself and your assets. Whether you're a first-time buyer or looking to switch providers, this guide will help you navigate the online insurance landscape with confidence. So, let's dive into the world of digital auto insurance and explore the steps to finding the perfect policy for your needs.

Understanding Your Auto Insurance Needs

Before diving into the online insurance market, it's crucial to assess your specific auto insurance needs. Every driver has unique circumstances, and understanding these factors will help you tailor your coverage accordingly.

Assessing Your Risk Profile

Your risk profile is a key consideration when choosing auto insurance. Factors such as your driving history, age, gender, and location play a significant role in determining your insurance rates. For instance, younger drivers may face higher premiums due to their perceived higher risk of accidents. Similarly, living in an area with a higher crime rate can impact your insurance costs.

Take the time to evaluate your risk profile and consider any discounts or additional coverage you may qualify for. For example, safe drivers with a clean record often receive discounts on their insurance premiums. Additionally, certain occupations or affiliations may offer specialized insurance programs with reduced rates.

Determining Coverage Requirements

Auto insurance coverage is not a one-size-fits-all proposition. Depending on your vehicle, driving habits, and personal preferences, you may require different levels of coverage. Here are some key coverage types to consider:

- Liability Coverage: This is the most basic type of auto insurance, covering bodily injury and property damage claims made against you in the event of an accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it's damaged in a collision, regardless of fault.

- Comprehensive Coverage: This type of insurance covers damage to your vehicle caused by non-collision events, such as theft, vandalism, weather-related incidents, or animal collisions.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient coverage.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers, regardless of fault.

- Rental Car Reimbursement: If your vehicle is in the shop for repairs, this coverage provides reimbursement for rental car expenses.

Assessing your specific needs and the value of your vehicle will help you determine the right combination of coverage types and limits. Remember, while it's important to have adequate protection, over-insuring can lead to unnecessary expenses.

Comparing Auto Insurance Providers Online

The online insurance market is highly competitive, offering a wide range of providers and policies to choose from. Comparing these options is essential to finding the best value for your money.

Online Insurance Aggregators

Online insurance aggregators are websites that allow you to compare quotes from multiple insurance providers in one place. These platforms provide a convenient way to quickly assess different policies and their features. Some popular insurance aggregators include:

- InsuranceComparison.com: This platform allows you to compare quotes from various insurance providers, offering a comprehensive overview of different policies.

- PolicyBazaar.com: Known for its user-friendly interface, PolicyBazaar provides a seamless experience for comparing auto insurance options.

- InsureMe.com: With a focus on simplicity, InsureMe makes it easy to compare quotes and find the right coverage for your needs.

When using insurance aggregators, ensure that you provide accurate information to receive precise quotes. Additionally, take the time to read reviews and understand the reputation of each insurance provider before making a decision.

Direct-to-Consumer Insurance Providers

In addition to insurance aggregators, you can also purchase auto insurance directly from insurance providers. Many insurance companies now offer online platforms that allow you to compare policies, customize coverage, and purchase insurance directly. Some well-known direct-to-consumer insurance providers include:

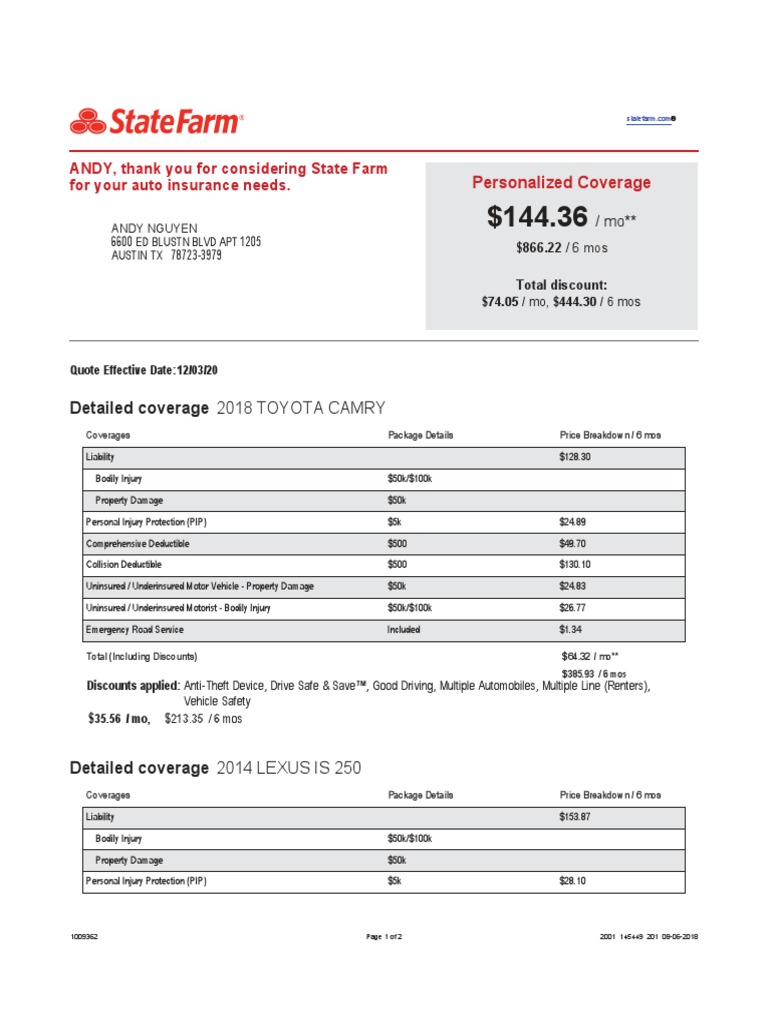

- State Farm: One of the largest insurance providers in the US, State Farm offers a range of auto insurance policies with customizable coverage options.

- Geico: Known for its catchy advertising campaigns, Geico provides online tools to help you compare policies and get a quote instantly.

- Progressive: Progressive offers a "Name Your Price" tool, allowing you to choose your desired coverage level and premium, making the process more personalized.

- Esurance: This online-focused insurance provider offers a seamless digital experience, making it easy to compare policies and manage your insurance.

When dealing with direct-to-consumer providers, ensure that you thoroughly understand the policy terms and conditions before making a purchase. Some providers may offer additional benefits or discounts for direct purchases, so it's worth exploring these options.

Evaluating Auto Insurance Policies

Once you've compared insurance providers and received quotes, it's time to evaluate the policies themselves. This step is crucial to ensuring you choose a policy that provides the right coverage at a competitive price.

Analyzing Coverage Details

When reviewing auto insurance policies, pay close attention to the coverage details. Ensure that the policy aligns with your assessed needs and provides adequate protection for your vehicle and personal circumstances. Here are some key aspects to consider:

- Coverage Limits: Check the liability, collision, and comprehensive coverage limits to ensure they meet your requirements. Higher limits typically offer more protection but may result in higher premiums.

- Deductibles: Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can reduce your premium, but ensure it's an amount you can afford to pay in the event of a claim.

- Additional Coverages : Review any additional coverages offered by the policy, such as rental car reimbursement, roadside assistance, or gap insurance. These can provide valuable protection but may come at an extra cost.

- Policy Exclusions: Carefully read the policy exclusions to understand what is not covered. This can include specific types of accidents, locations, or situations. Ensure that the exclusions do not impact your specific needs.

Assessing Policy Pricing

While coverage is a priority, it's also important to consider the policy's pricing. Auto insurance premiums can vary significantly between providers, so it's worth comparing quotes to find the best deal.

Here are some factors to keep in mind when assessing policy pricing:

- Discounts: Many insurance providers offer discounts for various reasons, such as good driving records, loyalty, or safety features in your vehicle. Be sure to ask about available discounts and apply them to your policy.

- Bundling Options: If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with one provider. This can often lead to significant savings.

- Payment Plans: Some insurance providers offer flexible payment plans, allowing you to pay your premium in installments. While this can be convenient, be aware of any additional fees or interest charges that may apply.

- Price Comparison Tools: Use online price comparison tools to quickly assess the cost of different policies. These tools can provide a snapshot of pricing across multiple providers, making it easier to find the most competitive rates.

Purchasing Auto Insurance Online

Once you've thoroughly evaluated your options and chosen the best auto insurance policy for your needs, it's time to make the purchase. The online purchasing process is designed to be straightforward and secure.

Completing the Application

When purchasing auto insurance online, you'll typically be guided through an application process. This involves providing personal and vehicle information, as well as details about your driving history and any additional coverage requirements. Ensure that you accurately complete all sections of the application to avoid any delays or issues with your policy.

Some key details to have ready when completing the application include:

- Your personal information, such as name, date of birth, and contact details.

- Vehicle information, including make, model, year, and vehicle identification number (VIN).

- Your driving history, including any accidents or violations.

- Details of any additional coverage you require, such as rental car reimbursement or roadside assistance.

Reviewing and Finalizing the Policy

After completing the application, you'll receive a quote and a summary of the policy terms and conditions. Take the time to carefully review this information to ensure it aligns with your expectations and needs. Check the coverage limits, deductibles, and any additional benefits or exclusions.

If you're satisfied with the policy, you can proceed to finalize the purchase. This typically involves making the initial payment and providing payment details for future premiums. Ensure that you understand the payment schedule and any options for adjusting or canceling the policy if needed.

Receiving and Managing Your Policy

Once you've purchased your auto insurance policy online, you'll receive confirmation and access to your policy documents. These documents will outline the coverage details, policy limits, and any specific terms or conditions. It's essential to thoroughly review and understand these documents to ensure you're aware of your rights and responsibilities.

Most insurance providers offer online platforms or mobile apps that allow you to manage your policy, make payments, and access important information. Familiarize yourself with these tools to stay on top of your insurance coverage and make any necessary updates or changes.

FAQs

Can I get auto insurance quotes without providing personal information?

+While some insurance providers may offer initial quotes without personal details, a more accurate quote will require information such as your name, date of birth, and driving history. Providing accurate information ensures you receive precise quotes and can make informed decisions.

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I need to make changes to my policy after purchasing it online?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Most insurance providers allow you to make policy changes online or by contacting their customer support. Changes may include updating personal information, adding or removing vehicles, or adjusting coverage limits. Be sure to understand the process and any potential fees associated with policy modifications.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any hidden fees or charges associated with online auto insurance purchases?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While online auto insurance purchases are generally straightforward, it's essential to review the policy terms and conditions carefully. Some providers may charge additional fees for certain services, such as policy changes or cancellations. Understanding these fees upfront can help you manage your insurance costs effectively.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I ensure I'm getting the best deal on auto insurance when purchasing online?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To get the best deal on auto insurance, compare quotes from multiple providers, both through insurance aggregators and direct-to-consumer platforms. Evaluate the coverage details, including limits, deductibles, and exclusions. Additionally, consider any available discounts and explore bundling options to potentially save on your premiums.</p>

</div>

</div>

</div>

Buying auto insurance online has become a convenient and efficient process, allowing you to compare policies, customize coverage, and make an informed decision. By assessing your needs, comparing providers, evaluating policies, and following a structured purchasing process, you can secure the right auto insurance coverage at a competitive price. Remember to regularly review and update your policy to ensure it continues to meet your changing needs and circumstances.