Business Insurance Agents

In the dynamic world of entrepreneurship, one of the most crucial aspects that often goes unnoticed is the role of business insurance agents. These professionals are the unsung heroes who ensure that businesses, big or small, are adequately protected against unforeseen risks and potential liabilities. Their expertise and guidance can make a significant difference in the long-term success and sustainability of any enterprise. This article aims to delve into the critical role these agents play, the services they offer, and how they can be a vital asset for any business owner.

Understanding the Role of Business Insurance Agents

Business insurance agents, also known as commercial insurance brokers or specialists, are licensed professionals who specialize in understanding the unique risks and exposures faced by businesses. Their primary role is to advise and guide business owners in selecting appropriate insurance coverage that aligns with their specific needs and goals. They act as intermediaries between insurance companies and their clients, offering impartial advice and tailored solutions.

These agents possess a deep understanding of various insurance policies and their intricacies. They stay updated with the latest industry trends, regulations, and market offerings, ensuring that their clients have access to the most comprehensive and cost-effective insurance solutions. Their expertise extends beyond mere policy selection; they also provide invaluable risk management advice to help businesses mitigate potential losses and navigate complex insurance landscapes.

Key Responsibilities and Services Offered

- Policy Selection: Business insurance agents help identify the right combination of insurance policies to cover a business’s assets, operations, and liabilities. This includes property insurance, liability insurance, workers’ compensation, business interruption insurance, and more.

- Risk Assessment: They conduct thorough assessments of a business’s operations, identifying potential risks and vulnerabilities. This process involves evaluating factors like industry-specific hazards, location-based risks, and the business’s unique practices to tailor an insurance strategy accordingly.

- Claims Assistance: In the event of an insured loss, these agents provide invaluable support in filing and managing claims. They ensure that the business receives the full benefits of its insurance policy, navigating the complex claims process on behalf of their clients.

- Renewal and Policy Updates: As insurance needs can evolve with time, business insurance agents play a crucial role in reviewing and updating policies during renewal periods. They ensure that coverage remains relevant and adequate, making necessary adjustments as the business grows or its risk profile changes.

- Risk Management Consulting: Beyond insurance, these agents often provide consulting services to help businesses implement effective risk management strategies. This can include advice on safety protocols, loss prevention measures, and best practices to minimize potential losses and reduce insurance premiums.

The Impact of Business Insurance Agents on Enterprises

The influence of business insurance agents extends far beyond the mere selection of insurance policies. Their expertise can significantly impact a business’s overall health and longevity. Here’s a deeper look at how these agents can positively influence various aspects of a business:

Financial Security and Stability

Adequate insurance coverage is a cornerstone of financial stability for any business. Business insurance agents ensure that enterprises are protected against various risks, from property damage to liability claims. This financial security provides a safety net, allowing businesses to weather unexpected storms without facing bankruptcy or severe financial strain.

| Insurance Type | Protection Offered |

|---|---|

| Property Insurance | Covers physical assets like buildings, equipment, and inventory against damage or loss. |

| Liability Insurance | Protects businesses from claims arising from bodily injury, property damage, or other liabilities. |

| Workers' Compensation | Provides coverage for employees' medical expenses and lost wages due to work-related injuries. |

| Business Interruption Insurance | Offers financial support during periods when a business is forced to suspend operations due to covered events. |

Peace of Mind and Focus on Core Operations

With the right insurance coverage in place, business owners can focus on their core operations without constant worry about potential liabilities or unforeseen events. This peace of mind is invaluable, allowing entrepreneurs to make strategic decisions and innovate without the burden of uncertainty.

Compliance and Legal Protection

Business insurance agents also guide their clients in meeting regulatory and legal requirements. Certain industries or activities may have specific insurance mandates, and agents ensure that businesses comply with these regulations, avoiding potential legal pitfalls.

Risk Mitigation and Loss Prevention

Through their risk management expertise, business insurance agents help businesses identify and mitigate potential risks. This proactive approach can lead to reduced insurance premiums and, more importantly, a safer and more efficient workplace. By implementing suggested loss prevention measures, businesses can minimize the frequency and severity of incidents, ultimately improving their overall performance.

Finding the Right Business Insurance Agent

Choosing the right business insurance agent is a critical decision that can significantly impact a business’s future. Here are some key factors to consider when selecting an agent:

Experience and Expertise

Look for agents with a proven track record in the industry. Experience in handling diverse business needs and a deep understanding of various insurance policies and their applicability are essential. An agent’s ability to offer tailored solutions based on their expertise can greatly benefit your business.

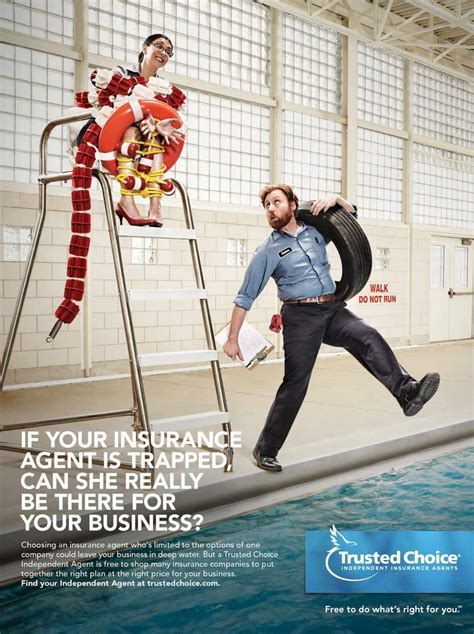

Impartiality and Reputation

Ensure that the agent you choose is impartial and not tied to a specific insurance company. An independent agent can provide unbiased advice, offering a range of options from different carriers. Additionally, check their reputation in the industry and among their clients. Positive reviews and testimonials can indicate a reliable and trustworthy agent.

Communication and Service

Effective communication is key in the insurance industry. Choose an agent who communicates clearly and regularly, ensuring you understand the policies and their benefits. Additionally, assess their level of service. Are they responsive to your needs and queries? Do they offer comprehensive support throughout the policy lifecycle, including claims assistance?

Customization and Tailored Solutions

Every business is unique, and its insurance needs are equally distinct. Select an agent who takes the time to understand your specific business, its operations, and its risks. They should offer customized solutions rather than a one-size-fits-all approach. This ensures that your business is adequately protected without unnecessary or excessive coverage.

Conclusion: The Value of Expert Guidance

In the complex world of business, risks are an inevitable reality. However, with the right guidance and insurance coverage, these risks can be effectively managed and mitigated. Business insurance agents provide the expert advice and tailored solutions that businesses need to thrive. Their role extends beyond mere insurance; they are strategic partners who help businesses navigate challenges and seize opportunities.

As your business grows and evolves, having a trusted insurance agent by your side can make all the difference. They ensure that your business remains protected, compliant, and resilient in the face of uncertainty. With their expertise and guidance, you can focus on what truly matters: driving your business forward and achieving success.

How do business insurance agents determine the right coverage for a business?

+

Business insurance agents conduct a thorough risk assessment, considering factors like the nature of the business, its size, industry-specific risks, location, and potential liabilities. Based on this assessment, they recommend a combination of insurance policies that provide comprehensive coverage tailored to the business’s unique needs.

What sets independent business insurance agents apart from those affiliated with specific insurance companies?

+

Independent agents are not tied to a single insurance carrier, allowing them to offer unbiased advice and a broader range of policy options. They can compare rates and coverage from multiple providers, ensuring their clients get the best value. In contrast, agents affiliated with specific companies may only offer their carrier’s products, limiting the choices available to their clients.

How often should I review my business’s insurance coverage with my agent?

+

It’s advisable to review your insurance coverage annually, or whenever there are significant changes to your business. This could include expansions, relocations, changes in operations, or increased revenue. Regular reviews ensure that your coverage remains adequate and aligned with your business’s evolving needs.