Best Pet Insurance 2024

Pet ownership is a rewarding journey, but it comes with its fair share of responsibilities and potential expenses. As pet parents, we want to ensure our furry companions receive the best care possible, and that's where pet insurance steps in as a valuable tool to safeguard their health and our finances.

With numerous pet insurance providers in the market, choosing the right one can be a daunting task. Each insurer offers unique features, coverage limits, and pricing structures, making it crucial to understand your pet's specific needs and your financial capabilities. In this comprehensive guide, we will delve into the world of pet insurance, exploring the top providers, their offerings, and the factors to consider when selecting the best plan for your beloved pet.

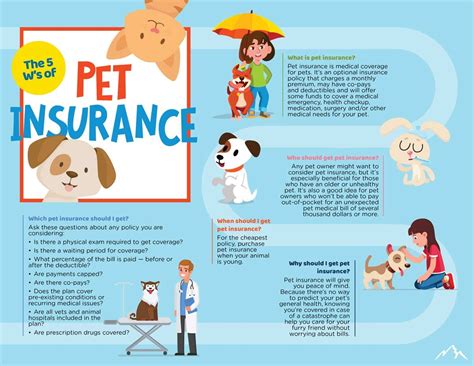

Understanding Pet Insurance: An Essential Overview

Pet insurance is a contractual agreement between you and an insurance provider, wherein you pay a monthly premium in exchange for financial coverage for your pet’s veterinary expenses. These expenses can include accidents, illnesses, routine care, and even specific conditions or breeds. Just like human health insurance, pet insurance aims to provide peace of mind and financial support during unexpected health crises.

There are three primary types of pet insurance plans: Accident-only, which covers only accidents and emergencies; Basic, which includes accident coverage along with some essential illness coverage; and Comprehensive, which offers the broadest range of coverage, including accidents, illnesses, routine care, and even specific breed-related conditions.

The Importance of Pet Insurance

The cost of veterinary care has been steadily rising, and unexpected illnesses or accidents can result in significant financial strain. Pet insurance acts as a safety net, ensuring that you can provide the best medical care for your pet without worrying about the financial implications. It allows you to focus on your pet’s well-being, knowing that the majority of their medical expenses are covered.

Furthermore, pet insurance often encourages preventive care, as many policies cover routine procedures like vaccinations, check-ups, and spaying/neutering. This proactive approach can lead to early detection of health issues and better overall pet health.

Top Pet Insurance Providers for 2024

The pet insurance market is highly competitive, with several reputable providers offering a range of plans to cater to different pet needs and owner budgets. Here’s an in-depth look at some of the top providers for the year 2024:

1. Embrace Pet Insurance

Embrace Pet Insurance stands out for its innovative approach to pet healthcare. They offer comprehensive coverage, including accident, illness, and routine care, with no per-condition or annual limits. Embrace’s unique WellPet Rewards program provides coverage for routine care and preventive measures, ensuring your pet receives the best possible care throughout their life.

Key Features:

- No per-condition or annual limits

- WellPet Rewards for routine care coverage

- 24/7 access to veterinary experts through their app

- Customizable plans to suit individual needs

2. ASPCA Pet Insurance

ASPCA Pet Insurance is a trusted name in the industry, known for its affordable and flexible plans. They offer accident-only, basic, and comprehensive coverage options, making it accessible to a wide range of pet owners. ASPCA's plans cover accidents, illnesses, and specific breed-related conditions, providing comprehensive protection for your furry friend.

Key Features:

- Affordable pricing with various plan options

- Customizable coverage limits and deductibles

- Access to the ASPCA's Pet Poison Control hotline

- Discounts for ASPCA members and multiple pets

3. Petplan

Petplan is a leading pet insurance provider, offering comprehensive coverage for a wide range of conditions. Their plans cover accidents, illnesses, hereditary conditions, and even alternative therapies. Petplan's unique feature is their Lifetime Limit, which provides ongoing coverage as long as you renew your policy annually.

Key Features:

- Lifetime Limit with no per-condition or annual caps

- Coverage for hereditary and congenital conditions

- 24/7 access to veterinary advice

- Flexible plans with customizable coverage

4. Lemonade Pet Insurance

Lemonade Pet Insurance is a tech-savvy insurer, offering an easy-to-use mobile app for policy management. Their plans cover accidents, illnesses, and specific breed-related conditions, with the option to add routine care coverage. Lemonade's unique "Giveback" program donates a portion of your premium to animal charities, making it an attractive choice for socially conscious pet owners.

Key Features:

- User-friendly mobile app for policy management

- "Giveback" program for animal charities

- Customizable plans with flexible deductibles

- Quick claim processing and reimbursements

5. MetLife Pet Insurance

MetLife Pet Insurance, powered by PetFirst, offers comprehensive coverage for accidents, illnesses, and specific breed-related conditions. Their plans include routine care coverage for vaccinations and wellness exams. MetLife's insurance is known for its excellent customer service and easy claim processes.

Key Features:

- Comprehensive coverage with routine care

- Excellent customer service and claim support

- Customizable plans with flexible limits

- Discounts for multiple pets and certain associations

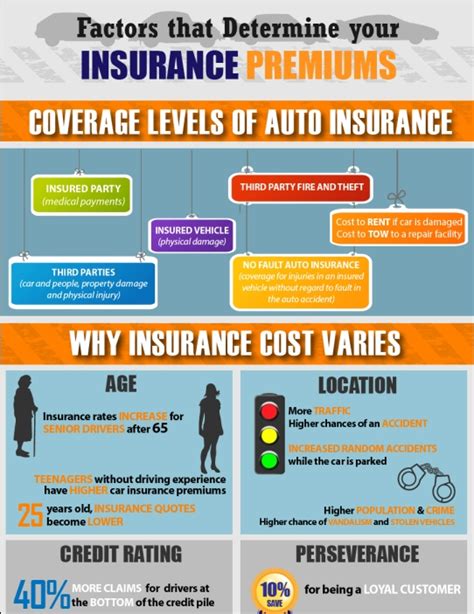

Factors to Consider When Choosing Pet Insurance

Selecting the right pet insurance provider involves careful consideration of various factors. Here are some key aspects to keep in mind:

Coverage Limits and Deductibles

Review the coverage limits and deductibles offered by each provider. Consider your pet’s specific health needs and choose a plan with adequate coverage limits to ensure they receive the care they require. Additionally, assess the deductibles to determine how much you’re comfortable paying out-of-pocket before insurance coverage kicks in.

Pre-Existing Conditions

Check if the provider covers pre-existing conditions. Some insurers may exclude coverage for conditions that existed before the policy was purchased, while others may offer limited coverage. It’s crucial to understand these exclusions to ensure you’re not paying for coverage that won’t benefit your pet.

Reimbursement Options

Understand the reimbursement process and options offered by the insurer. Some providers offer direct reimbursement to the veterinary clinic, while others reimburse you after you’ve paid the vet. Consider which option is more convenient and aligns with your financial preferences.

Wellness and Routine Care Coverage

Assess if the provider offers coverage for routine care, such as vaccinations, check-ups, and preventive measures. This can be a valuable addition to your policy, ensuring your pet receives regular care and early detection of potential health issues.

Customer Service and Claim Support

Research the insurer’s reputation for customer service and claim support. Read reviews and testimonials to understand the ease of the claim process and the responsiveness of their customer support team. Efficient claim processing can make a significant difference during a pet health emergency.

Discounts and Additional Benefits

Look for providers that offer discounts or additional benefits. These could include discounts for multiple pets, association memberships, or even loyalty rewards. Additionally, some insurers may provide access to exclusive veterinary resources or emergency hotlines, which can be valuable in times of need.

Tips for Maximizing Your Pet Insurance Coverage

Once you’ve chosen a pet insurance provider, here are some tips to make the most of your coverage:

Understand Your Policy

Take the time to thoroughly read and understand your policy. Know the coverage limits, exclusions, and any specific conditions that may affect your coverage. This knowledge will help you make informed decisions about your pet’s healthcare and avoid any surprises.

Keep Accurate Records

Maintain a detailed record of your pet’s medical history, including all veterinary visits, treatments, and medications. This information will be crucial when filing claims and can help expedite the reimbursement process.

Choose a Primary Veterinarian

Select a primary veterinarian for your pet and establish a long-term relationship. This can lead to better care coordination and potentially faster claim processing, as the vet will be familiar with your pet’s medical history.

Utilize Preventive Care

If your policy covers preventive care, take advantage of it. Regular check-ups, vaccinations, and early detection of potential issues can lead to better overall pet health and potentially reduce the need for more extensive (and costly) treatments down the line.

The Future of Pet Insurance

The pet insurance industry is evolving rapidly, with insurers continuously improving their offerings to meet the needs of modern pet owners. We can expect to see further innovations in the coming years, including more comprehensive coverage for specific conditions, enhanced digital tools for policy management, and potentially even more affordable pricing structures.

Additionally, with the rise of telemedicine for pets, we may see insurers incorporating virtual veterinary care into their policies, providing pet owners with even more convenient and accessible healthcare options for their furry companions.

Conclusion

Choosing the best pet insurance for your beloved pet involves a careful evaluation of your pet’s needs, your financial capabilities, and the features offered by various providers. By understanding the different types of plans, coverage options, and key factors to consider, you can make an informed decision to ensure your pet receives the best care possible.

Remember, pet insurance is an investment in your pet's health and your peace of mind. With the right policy, you can focus on the joy of pet ownership, knowing that your furry friend is protected and cared for, no matter what life brings.

What is the average cost of pet insurance?

+The cost of pet insurance can vary significantly depending on factors such as your pet’s breed, age, location, and the level of coverage you choose. On average, monthly premiums range from 30 to 70 for dogs and 20 to 40 for cats. However, these costs can increase with higher coverage limits and additional features.

Can I insure an older pet?

+Yes, many insurers offer coverage for older pets. However, the cost of insurance may be higher for older pets due to the increased risk of health issues. It’s important to shop around and compare providers to find the best coverage and pricing for your senior pet.

What is the process for filing a claim with pet insurance?

+The claim process can vary between insurers, but generally, you’ll need to provide documentation of the veterinary treatment, including invoices and a detailed report from your vet. Some insurers offer direct reimbursement to the veterinary clinic, while others reimburse you after you’ve paid the vet. It’s important to understand the specific claim process of your chosen insurer.

Does pet insurance cover pre-existing conditions?

+Most insurers exclude coverage for pre-existing conditions, which are illnesses or injuries that existed before the policy was purchased. However, some providers may offer limited coverage for specific pre-existing conditions or provide an option to add an additional premium for pre-existing condition coverage.

Can I switch pet insurance providers?

+Yes, you can switch pet insurance providers at any time. However, it’s important to note that pre-existing conditions may not be covered by your new insurer, and you may need to wait for a certain period (known as a waiting period) before new conditions are covered. It’s recommended to carefully review the terms and conditions of your new policy before making the switch.