What Is Auto Insurance Premium

Auto insurance, a crucial aspect of financial protection and risk management, is an essential consideration for every vehicle owner. The concept of an auto insurance premium lies at the heart of this complex yet vital financial arrangement, representing the cost an individual pays for their vehicle's insurance coverage. This payment is a contractual agreement between the policyholder and the insurance company, and it can vary significantly based on a multitude of factors, making it a fascinating and often intricate component of the insurance landscape.

Understanding Auto Insurance Premiums

An auto insurance premium is the periodic payment made by a policyholder to an insurance company to secure insurance coverage for their vehicle. This payment, typically made monthly, quarterly, or annually, ensures that the policyholder is financially protected in the event of accidents, theft, or other unforeseen circumstances related to their vehicle.

The amount of the premium is influenced by a myriad of factors, each contributing to the overall risk profile of the insured vehicle and driver. These factors can include the type of vehicle, its make and model, the driver's age and driving history, the geographical location where the vehicle is primarily driven, and even the intended use of the vehicle. For instance, a sports car driven by a young adult in an urban area will likely attract a higher premium compared to a sedan driven by a mature adult in a rural area, due to the perceived higher risk associated with the former scenario.

Key Factors Influencing Auto Insurance Premiums

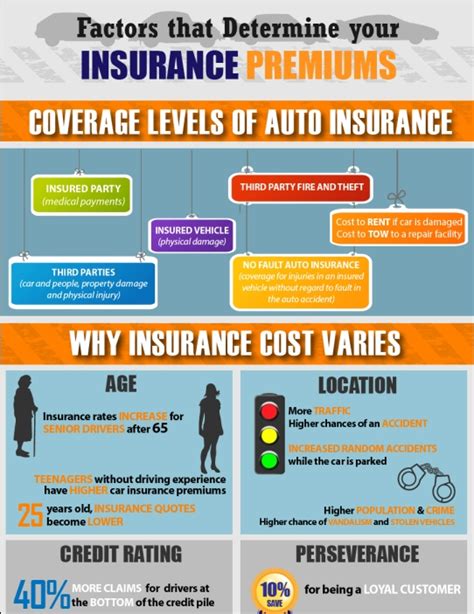

When it comes to determining auto insurance premiums, insurance companies consider a wide range of factors to assess the level of risk associated with insuring a particular vehicle and driver. These factors can be broadly categorized as follows:

- Vehicle-Related Factors: This includes the type of vehicle, its age, make, and model. Certain vehicle types, such as sports cars or luxury vehicles, are typically more expensive to insure due to their higher repair costs and greater likelihood of being involved in accidents. The vehicle's safety features and anti-theft devices can also impact the premium, often leading to discounts for vehicles with advanced safety systems.

- Driver-Related Factors: The driver's age, gender, and driving record play a significant role in determining the premium. Younger drivers, especially males, are often considered high-risk due to their propensity for speeding and other reckless behaviors. Conversely, mature drivers with a clean driving record and extensive driving experience are typically seen as lower-risk and may benefit from lower premiums. The driver's credit score can also influence the premium, with higher credit scores often leading to lower insurance costs.

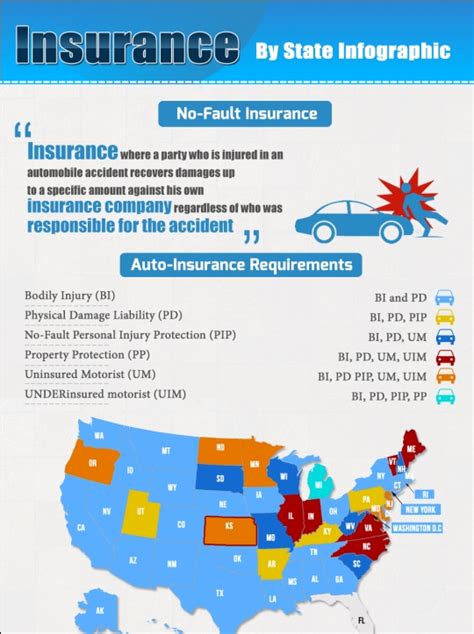

- Geographical Factors: The location where the vehicle is primarily driven and garaged can significantly impact the premium. Urban areas often have higher premiums due to increased traffic congestion, higher accident rates, and a greater likelihood of vehicle theft. In contrast, rural areas may offer lower premiums due to reduced traffic and a lower incidence of vehicle-related crimes.

- Usage and Coverage Factors: The intended use of the vehicle, such as personal, commercial, or leisure, can influence the premium. Additionally, the level of coverage chosen by the policyholder, including liability, collision, comprehensive, and additional coverages like rental car reimbursement or roadside assistance, will impact the premium. Higher levels of coverage generally result in higher premiums.

| Factor | Impact on Premium |

|---|---|

| Vehicle Type | Sports cars and luxury vehicles often attract higher premiums due to higher repair costs and accident risks. |

| Driver's Age and Gender | Younger drivers, especially males, are considered high-risk and may face higher premiums. Mature drivers with clean records may receive discounts. |

| Geographical Location | Urban areas with high traffic and crime rates often have higher premiums, while rural areas may offer lower rates. |

| Coverage Level | Comprehensive coverage, including collision and liability, often results in higher premiums compared to basic coverage. |

How Auto Insurance Premiums Are Calculated

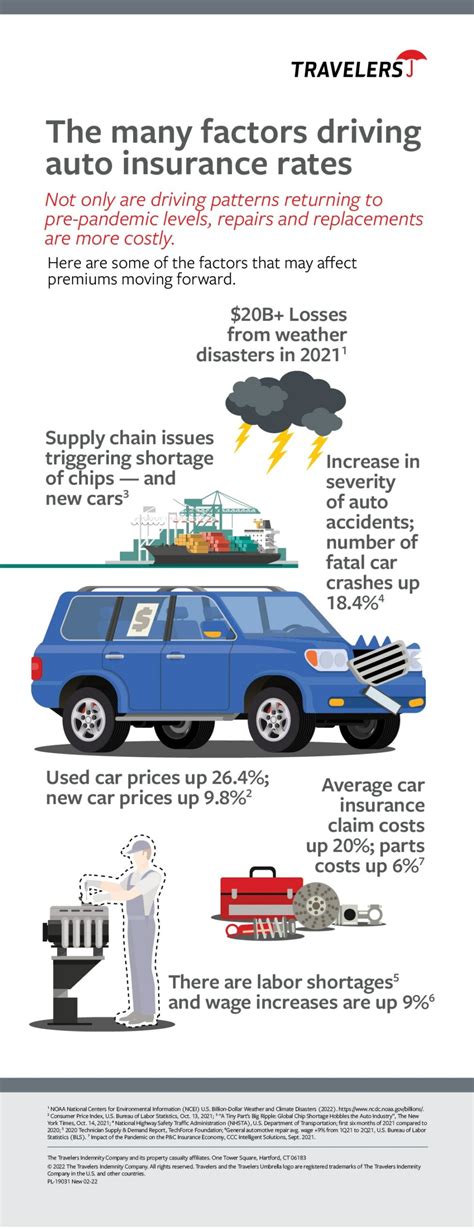

The calculation of auto insurance premiums is a complex process that involves sophisticated algorithms and statistical models. Insurance companies use vast amounts of historical data to assess the likelihood of various types of claims and the potential costs associated with them. This data is then used to assign a risk score to each policyholder, which directly influences the premium they pay.

The risk score is determined by a variety of factors, including those mentioned earlier, such as vehicle type, driver demographics, geographical location, and coverage level. Additionally, insurance companies may consider other factors, such as the policyholder's claims history, the number of miles driven annually, and even their occupation. For instance, a person with a long-distance commuting job may pay a higher premium due to the increased mileage and potential exposure to risk.

Once the risk score is determined, it is used to calculate the premium. This calculation involves applying various rates and surcharges to the base premium, which is the minimum cost of insurance. The rates and surcharges are based on the level of risk associated with the policyholder and their vehicle. For instance, a driver with a history of accidents or traffic violations may face higher rates, resulting in a higher premium.

Insurance companies also use a process known as rating to adjust premiums based on the specific characteristics of the policyholder and their vehicle. Rating factors can include the vehicle's make and model, its safety features, and the driver's age and driving record. By using rating factors, insurance companies can more accurately assess the risk associated with each policyholder and set premiums accordingly.

Discounts and Savings on Auto Insurance Premiums

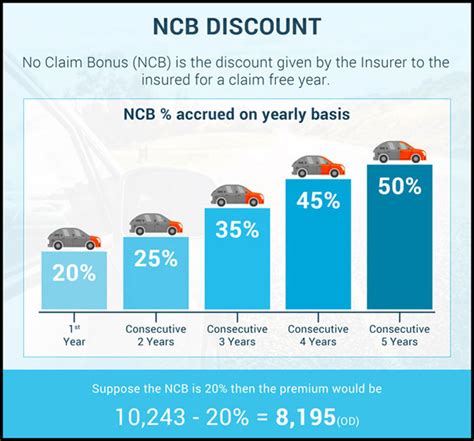

Despite the complex nature of auto insurance premiums, there are several ways policyholders can reduce their costs. Insurance companies often offer a range of discounts to incentivize safe driving and responsible behavior. These discounts can significantly reduce the premium and are worth exploring for any policyholder looking to save money.

- Safe Driver Discounts: Many insurance companies offer discounts to policyholders with a clean driving record. This often includes drivers who have not been involved in accidents or received traffic violations for a certain period, typically three to five years. The size of the discount can vary depending on the insurance company and the policyholder's specific driving history.

- Vehicle Safety Discounts: Policyholders with vehicles equipped with advanced safety features, such as anti-lock brakes, air bags, or collision avoidance systems, may be eligible for discounts. These features are designed to reduce the risk of accidents and can therefore lower the insurance premium.

- Multi-Policy Discounts: Bundling multiple insurance policies with the same company, such as auto and home insurance, can often lead to significant savings. Insurance companies often offer discounts to policyholders who have multiple policies with them, as it reduces administrative costs and increases customer loyalty.

- Low Mileage Discounts: Policyholders who drive fewer miles annually may be eligible for a low mileage discount. This is because the less a vehicle is driven, the lower the risk of it being involved in an accident or experiencing other types of damage. Insurance companies often reward this behavior with reduced premiums.

- Payment Method Discounts: Some insurance companies offer discounts to policyholders who pay their premiums annually rather than monthly. This is because it reduces administrative costs for the insurance company and ensures a stable cash flow. Additionally, certain payment methods, such as electronic funds transfer (EFT), may also attract discounts due to their efficiency and reduced processing fees.

Auto Insurance Premium Adjustments and Changes

Auto insurance premiums are not static and can change over time. Insurance companies regularly review their policyholders’ risk profiles and adjust premiums accordingly. This can lead to both increases and decreases in premiums, depending on the changes in the policyholder’s circumstances or the insurance company’s risk assessment.

For instance, a policyholder who moves from a rural area to an urban area may see an increase in their premium due to the higher risk associated with urban driving. Similarly, a young driver who accumulates a clean driving record over time may see their premium decrease as they are no longer considered a high-risk driver. These adjustments are a normal part of the insurance process and help ensure that premiums accurately reflect the current risk profile of the policyholder and their vehicle.

It's important for policyholders to regularly review their insurance policies and premiums to ensure they are still getting the best value. This can involve shopping around for new quotes, especially when their circumstances change significantly, such as a move to a new location, a change in vehicle, or an improvement in their driving record. By staying proactive and informed, policyholders can ensure they are not overpaying for their auto insurance coverage.

Future Trends and Innovations in Auto Insurance Premiums

The world of auto insurance is continually evolving, and several emerging trends and innovations are set to influence how premiums are determined and managed in the future. These developments are driven by advancements in technology, changing consumer behaviors, and shifts in the regulatory landscape.

- Telematics and Usage-Based Insurance (UBI): Telematics technology allows insurance companies to track a vehicle's usage and driving behavior in real-time. This data can be used to set premiums based on actual driving habits, rather than on general risk profiles. UBI policies offer policyholders the opportunity to pay premiums based on their actual driving behavior, potentially leading to significant savings for safe drivers. This trend is expected to grow in popularity, as it offers a more personalized and fair approach to insurance pricing.

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning technologies are being increasingly utilized by insurance companies to improve risk assessment and premium calculation. These technologies can analyze vast amounts of data, including historical claims data, vehicle performance data, and even social media data, to more accurately predict the likelihood of accidents and set premiums accordingly. This advanced risk assessment can lead to more precise premiums and better protection for policyholders.

- Connected Car Technology: With the increasing adoption of connected car technology, insurance companies are gaining access to a wealth of vehicle data. This data, which includes information on driving behavior, vehicle performance, and even maintenance records, can be used to assess risk and set premiums. For instance, data showing a vehicle's frequent hard braking or rapid acceleration may indicate a higher risk of accidents, leading to higher premiums. Conversely, data showing consistent safe driving behavior may result in lower premiums.

- Regulation and Legal Changes: Changes in regulations and legal frameworks can also impact auto insurance premiums. For instance, the introduction of autonomous vehicles is expected to bring about significant changes in the insurance landscape. As the risk of accidents shifts from human error to technological failures, insurance coverage and premiums are likely to evolve to accommodate this new paradigm. Additionally, changes in laws regarding ride-sharing or electric vehicles can also influence insurance requirements and premiums.

Conclusion

Understanding auto insurance premiums is crucial for every vehicle owner, as it allows them to make informed decisions about their insurance coverage and costs. The premium is a complex calculation that takes into account a multitude of factors, each contributing to the overall risk profile of the insured vehicle and driver. By staying informed about these factors and the various ways to reduce premiums, policyholders can ensure they are getting the best value for their insurance coverage.

As the world of auto insurance continues to evolve, driven by technological advancements and changing consumer behaviors, it's more important than ever for policyholders to stay proactive and engaged. By understanding the factors that influence premiums and keeping up with emerging trends and innovations, policyholders can navigate the complex world of auto insurance with confidence and ensure they are adequately protected at a fair price.

How often do auto insurance premiums change?

+Auto insurance premiums can change at various intervals, typically annually, but they may also be adjusted more frequently based on changes in the policyholder’s circumstances or the insurance company’s risk assessment. Policyholders should regularly review their premiums to ensure they are still receiving the best value.

What is the average cost of auto insurance premiums in the United States?

+The average cost of auto insurance premiums in the U.S. varies significantly depending on factors such as the policyholder’s location, vehicle type, and driving record. According to recent data, the national average cost for auto insurance is approximately 1,674 per year, but this can range from around 1,000 to over $3,000 depending on the state and individual circumstances.

Can I negotiate my auto insurance premium?

+While insurance premiums are largely based on calculated risk assessments, it is possible to negotiate certain aspects of your policy. This could involve discussing discounts, coverage levels, or even switching insurance providers to find a better deal. It’s always worth exploring your options and discussing them with your insurance agent.

What happens if I can’t afford my auto insurance premium?

+If you’re struggling to afford your auto insurance premium, it’s important to discuss your situation with your insurance provider. They may be able to offer you a payment plan or suggest ways to reduce your premium, such as by adjusting your coverage levels or exploring discounts. It’s crucial to maintain insurance coverage to avoid legal and financial penalties.