Best Low Cost Life Insurance

In today's world, life insurance is an essential aspect of financial planning, providing peace of mind and a safety net for both individuals and their loved ones. While life insurance is crucial, not everyone can afford expensive premiums, especially those with tight budgets or specific financial constraints. Fortunately, there are affordable life insurance options available that offer comprehensive coverage without breaking the bank. In this article, we will delve into the world of low-cost life insurance, exploring the best options, their features, and how they can benefit individuals seeking affordable protection.

Understanding Low-Cost Life Insurance

Low-cost life insurance, as the name suggests, refers to insurance policies designed to offer comprehensive coverage at an affordable price point. These policies cater to individuals who may have limited financial means or are seeking a more budget-friendly option without compromising on essential benefits. While traditional life insurance policies often come with higher premiums, low-cost alternatives provide an accessible and viable solution for those on a tight budget.

The primary goal of low-cost life insurance is to strike a balance between affordability and adequate coverage. These policies are tailored to meet the needs of individuals who require life insurance but may face challenges due to financial constraints or other reasons. By offering competitive rates and flexible payment options, low-cost life insurance providers aim to make protection accessible to a wider range of people.

Key Features of Low-Cost Life Insurance Policies

Low-cost life insurance policies offer a range of features that cater to different needs and preferences. Here are some key characteristics to consider when exploring these affordable options:

Affordable Premiums

The most appealing aspect of low-cost life insurance is, undoubtedly, the affordable premiums. These policies are designed with cost-effectiveness in mind, ensuring that individuals can secure coverage without straining their finances. By offering competitive rates, low-cost life insurance providers make it possible for a broader demographic to access the protection they need.

Simplified Application Process

Low-cost life insurance policies often have a streamlined application process, making it easier and quicker for individuals to obtain coverage. Unlike traditional policies that may require extensive medical examinations and detailed health histories, low-cost options typically have a simpler and faster application journey. This accessibility is a significant advantage for those seeking prompt coverage without the hassle of lengthy paperwork.

Flexible Coverage Options

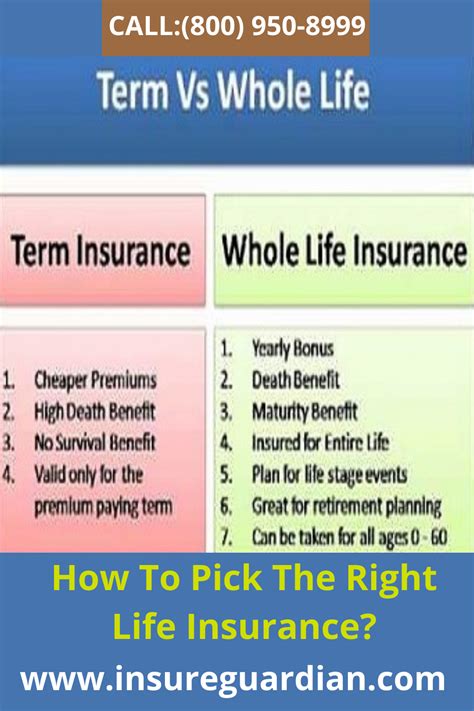

Despite their affordability, low-cost life insurance policies offer a surprising range of coverage options. Individuals can choose from various plan types, including term life insurance, whole life insurance, and even customized policies tailored to their specific needs. This flexibility allows individuals to select the coverage that aligns with their financial goals and provides the protection they desire.

Death Benefit Payments

Low-cost life insurance policies typically provide a lump-sum death benefit to the beneficiaries upon the insured individual’s passing. The amount of the death benefit can vary depending on the policy chosen and the individual’s circumstances. This financial payout can be a crucial source of support for loved ones, helping to cover expenses, pay off debts, or provide a financial cushion during a challenging time.

Additional Riders and Benefits

Some low-cost life insurance policies also offer optional riders and additional benefits that can enhance the overall value of the coverage. These riders may include features like accelerated death benefits, waiver of premium options, or even critical illness coverage. By adding these riders, individuals can further customize their policy to meet their unique needs and preferences.

| Policy Type | Description |

|---|---|

| Term Life Insurance | Offers coverage for a specific term, typically 10-30 years. Ideal for those seeking temporary protection. |

| Whole Life Insurance | Provides lifelong coverage with a guaranteed death benefit. Ideal for long-term financial planning. |

| Customized Policies | Tailored to individual needs, offering flexibility in coverage and premium payments. |

Benefits of Choosing Low-Cost Life Insurance

Opting for low-cost life insurance can bring several advantages, making it an attractive choice for many individuals. Here are some key benefits to consider:

Financial Accessibility

The most significant advantage of low-cost life insurance is its financial accessibility. These policies are designed to be affordable, allowing individuals with limited means to secure essential protection for themselves and their loved ones. By offering competitive rates, low-cost insurance providers ensure that financial constraints do not become a barrier to obtaining life insurance coverage.

Peace of Mind

Life insurance provides a sense of security and peace of mind, knowing that your loved ones will be financially supported in the event of your passing. Low-cost life insurance policies offer this same peace of mind without the burden of high premiums. Individuals can rest assured that their beneficiaries will receive the necessary financial assistance to cover expenses and maintain their standard of living.

Flexibility and Customization

Low-cost life insurance policies often provide a high degree of flexibility and customization. Individuals can choose coverage amounts, policy terms, and even add optional riders to suit their specific needs. This flexibility allows individuals to create a policy that aligns perfectly with their financial goals and circumstances, ensuring they receive the protection they require without unnecessary expenses.

Streamlined Application Process

The streamlined application process of low-cost life insurance policies is a significant advantage. Unlike traditional policies that may require extensive medical examinations and lengthy paperwork, low-cost options typically have a faster and more efficient application journey. This simplicity saves time and effort, allowing individuals to obtain coverage promptly without unnecessary delays.

Budget-Friendly Payment Options

Low-cost life insurance providers often offer flexible payment options to accommodate different financial situations. Individuals can choose to pay premiums annually, semi-annually, quarterly, or even monthly, depending on their preferences and budget. This flexibility ensures that policyholders can manage their payments in a way that aligns with their financial plans and cash flow.

Comparing Low-Cost Life Insurance Providers

When exploring low-cost life insurance options, it’s essential to compare different providers to find the best fit for your needs. Here are some key factors to consider during your comparison process:

Reputation and Financial Stability

Start by researching the reputation and financial stability of the insurance providers you are considering. Look for companies with a solid track record of providing reliable coverage and honoring their policy obligations. Financial stability is crucial to ensure that the provider will be able to pay out claims in the future.

Policy Terms and Conditions

Carefully review the policy terms and conditions of each provider. Pay attention to details such as coverage limits, renewal options, and any exclusions or limitations. Understanding the fine print will help you make an informed decision and ensure that the policy aligns with your expectations.

Customer Service and Claims Process

Evaluate the customer service reputation and claims process of each provider. Look for companies with a history of prompt and efficient claim handling. Positive customer reviews and feedback can indicate a provider’s commitment to providing excellent service and ensuring a smooth claims experience.

Additional Benefits and Riders

Explore the additional benefits and riders offered by each provider. Some policies may include valuable features like accelerated death benefits, waiver of premium options, or critical illness coverage. These additions can enhance the overall value of your policy and provide additional protection in specific circumstances.

Pricing and Payment Flexibility

Compare the pricing structures and payment options of different providers. Look for policies that offer competitive rates and flexible payment plans to suit your budget. Some providers may also offer discounts or incentives for certain policy terms or coverage amounts, so be sure to inquire about any available promotions.

Real-Life Examples of Low-Cost Life Insurance Success Stories

To better understand the impact and benefits of low-cost life insurance, let’s explore some real-life success stories. These examples showcase how low-cost policies have made a positive difference in individuals’ lives:

Young Family’s Financial Security

Sarah, a young mother of two, understood the importance of life insurance but faced financial constraints due to her family’s growing expenses. She opted for a low-cost term life insurance policy, ensuring that her family would receive a substantial death benefit if anything were to happen to her. With affordable premiums and a simplified application process, Sarah secured the protection her family needed without straining their finances.

Entrepreneur’s Peace of Mind

John, an aspiring entrepreneur, wanted to start his own business but was concerned about the financial risks involved. He chose a low-cost whole life insurance policy, providing lifelong coverage and a guaranteed death benefit. This policy offered him peace of mind, knowing that his business and personal finances would be protected, even if the unexpected were to occur. The flexible payment options allowed John to manage his premiums effectively, ensuring he could focus on growing his business without financial worries.

Retirement Planning

Emily, a retired individual, sought life insurance to ensure her spouse would have financial support during their golden years. She opted for a low-cost customized policy, allowing her to choose a coverage amount and term that aligned with her retirement goals. With affordable premiums and the flexibility to adjust coverage as needed, Emily secured the protection she needed to maintain her retirement lifestyle and provide for her spouse in the future.

Future Implications and Considerations

As we look to the future, it’s essential to consider the evolving landscape of low-cost life insurance. Here are some key points to keep in mind:

Advancements in Technology

The insurance industry is rapidly embracing technology, and this trend is expected to continue. Insurtech innovations, such as digital applications, streamlined claim processes, and personalized coverage options, will likely enhance the overall experience of low-cost life insurance. These advancements will make policies even more accessible and efficient, benefiting both policyholders and providers.

Increasing Awareness and Education

As more individuals become aware of the importance of life insurance, there will likely be a growing demand for accessible and affordable options. Educating the public about the benefits of low-cost life insurance and its role in financial planning will be crucial. Increased awareness will lead to a more informed consumer base, resulting in better decision-making and a broader adoption of these policies.

Regulatory and Industry Changes

The insurance industry is subject to regulatory changes and evolving market dynamics. Low-cost life insurance providers must adapt to these changes to remain competitive and provide the best possible value to their customers. Staying updated on industry trends and regulatory shifts will be essential for both providers and consumers to ensure a sustainable and beneficial future for low-cost life insurance.

Tailored Coverage for Specific Needs

As low-cost life insurance gains popularity, providers are likely to offer more specialized policies catering to specific needs. This could include coverage for unique circumstances, such as individuals with pre-existing conditions or those seeking coverage for a specific period, like during a career transition or business venture. Tailored policies will provide even more flexibility and customization to meet diverse financial planning requirements.

How much does low-cost life insurance typically cost?

+The cost of low-cost life insurance varies depending on several factors, including age, health status, coverage amount, and policy type. On average, you can expect to pay anywhere from 50 to 150 per month for a term life insurance policy with a coverage amount of 250,000 to 500,000. Whole life insurance policies may have slightly higher premiums but provide lifelong coverage.

Can I customize my low-cost life insurance policy?

+Yes, many low-cost life insurance providers offer customizable policies. You can choose the coverage amount, policy term, and even add optional riders to tailor the policy to your specific needs. This flexibility allows you to create a policy that aligns with your financial goals and circumstances.

Are there any limitations or exclusions in low-cost life insurance policies?

+Like any insurance policy, low-cost life insurance policies may have certain limitations or exclusions. It’s essential to carefully review the policy terms and conditions to understand any restrictions or circumstances under which coverage may not be provided. Common exclusions may include pre-existing conditions, suicide, or engaging in hazardous activities.

How can I find the best low-cost life insurance provider for my needs?

+Researching and comparing different low-cost life insurance providers is crucial to finding the best fit for your needs. Consider factors such as reputation, financial stability, policy terms, customer service, and additional benefits. Online reviews and financial ratings can also provide valuable insights. Additionally, consulting with an insurance professional can help you navigate the options and make an informed decision.