Best Insurance Motorcycle

When it comes to insuring your motorcycle, choosing the right insurance policy is crucial to ensure comprehensive protection for your ride. The best insurance for your motorcycle depends on various factors, including your specific needs, the value of your bike, and the coverage options available in your region. In this article, we will delve into the world of motorcycle insurance, exploring the key considerations and offering expert insights to help you make an informed decision.

Understanding Motorcycle Insurance Policies

Motorcycle insurance policies are designed to provide financial protection in the event of accidents, theft, or other unforeseen circumstances. These policies typically offer a range of coverage options, allowing riders to tailor their insurance to their unique requirements. Understanding the different components of a motorcycle insurance policy is essential to make an informed choice.

Liability Coverage

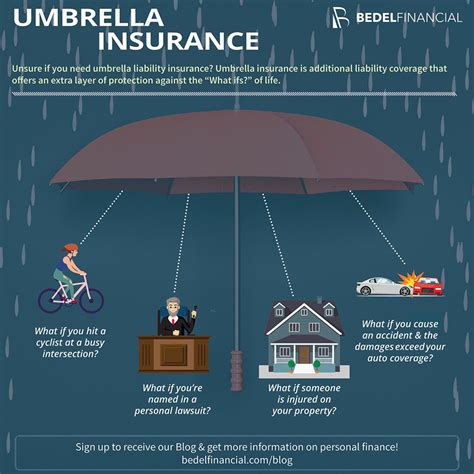

Liability coverage is a fundamental aspect of any insurance policy. It protects you financially in the event that you are found at fault for an accident that causes injury or property damage to others. This coverage is mandatory in most states and ensures that you are not personally liable for any expenses arising from such incidents.

The liability limits in your policy determine the maximum amount your insurance company will pay for claims. It is crucial to choose liability limits that align with your financial situation and the potential risks you may face. Higher liability limits provide more protection but also result in higher premiums.

Collision and Comprehensive Coverage

Collision coverage and comprehensive coverage are two additional key components of motorcycle insurance. Collision coverage helps cover the cost of repairing or replacing your motorcycle if it is damaged in an accident, regardless of who is at fault. This coverage is especially valuable for newer or high-value motorcycles.

Comprehensive coverage, on the other hand, protects your bike against non-accident-related damages, such as theft, vandalism, fire, or natural disasters. It provides financial protection for a wide range of unforeseen circumstances that could leave you with significant repair bills.

Medical Payments and Personal Injury Protection

Medical payments coverage, often referred to as MedPay, is designed to cover the medical expenses incurred by you or your passengers in the event of an accident, regardless of fault. This coverage can help alleviate the financial burden of medical bills, ensuring you receive the necessary treatment without delay.

Personal Injury Protection (PIP) is another valuable addition to your insurance policy. PIP provides broader coverage for medical expenses, lost wages, and other related costs, regardless of who is at fault in the accident. It offers added peace of mind by ensuring you have the necessary financial support to recover from any injuries sustained.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is an essential aspect of motorcycle insurance. It provides protection in the event that you are involved in an accident with a driver who either has no insurance or insufficient insurance to cover the damages. UM/UIM coverage can help cover your medical expenses, property damage, and other related costs, ensuring you are not left financially burdened.

Factors to Consider When Choosing the Best Insurance

When selecting the best insurance for your motorcycle, several factors come into play. Understanding these considerations will help you make a well-informed decision tailored to your specific needs.

Assessing Your Riding Habits and Risks

Your riding habits and the risks associated with them play a significant role in determining the best insurance policy for you. Consider factors such as the frequency of your rides, the types of roads you typically travel on, and the distance you cover. If you are a frequent rider who often ventures onto busy highways, you may require more comprehensive coverage than someone who rides locally and infrequently.

Additionally, take into account any modifications or customizations you have made to your motorcycle. Some insurers may offer specialized coverage for custom bikes or high-performance modifications, ensuring that your unique vehicle is adequately protected.

Evaluating Your Motorcycle’s Value

The value of your motorcycle is a critical factor in determining the level of insurance coverage you need. High-value bikes, such as classic or vintage models, may require specialized insurance policies that offer more comprehensive protection. These policies often include agreed-value coverage, which guarantees that you will receive the full value of your bike in the event of a total loss.

For newer motorcycles, it is essential to consider the depreciation factor. Many insurance companies offer replacement cost coverage, which ensures that you receive the full purchase price of your bike if it is stolen or totaled within a certain period after purchase. This coverage can provide added peace of mind for riders of newer, more valuable motorcycles.

Comparing Insurance Providers and Coverage Options

Researching and comparing different insurance providers and their coverage options is crucial to finding the best policy for your needs. Each insurer may offer unique benefits and discounts, so it is worth exploring multiple options. Look for providers that specialize in motorcycle insurance, as they often have a better understanding of the specific risks and requirements associated with riding.

When comparing policies, pay close attention to the coverage limits, deductibles, and any additional benefits or perks offered. Some insurers may provide roadside assistance, rental car coverage, or coverage for riding gear, which can add value to your insurance package. Consider the overall cost of the policy, but also evaluate the quality of coverage and the reputation of the insurance company.

Obtaining Multiple Quotes and Customizing Your Policy

To ensure you are getting the best deal on your motorcycle insurance, it is advisable to obtain multiple quotes from different providers. This allows you to compare prices, coverage options, and the overall value of each policy. Many insurance companies offer online quote tools, making it convenient to gather quotes and assess your options.

Once you have a few quotes, take the time to review and customize your policy to align with your specific needs. Consider adding optional coverages, such as accessory coverage or custom parts coverage, to ensure that your unique motorcycle and its additions are adequately protected. Work closely with your insurance agent or broker to tailor the policy to your requirements, ensuring you have the right balance of coverage and cost.

Understanding Deductibles and Coverage Limits

When selecting a motorcycle insurance policy, it is crucial to understand the concept of deductibles and coverage limits. Deductibles represent the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it also means you will have to pay more out of pocket in the event of a claim. Consider your financial situation and risk tolerance when deciding on the appropriate deductible.

Coverage limits, on the other hand, define the maximum amount your insurance company will pay for a covered loss. It is essential to review these limits carefully, ensuring they align with the value of your motorcycle and the potential risks you may face. Higher coverage limits provide more protection but may result in higher premiums. Evaluate your coverage limits based on the value of your bike, the likelihood of accidents, and the potential costs associated with repairs or replacement.

Benefits of Comprehensive Insurance Coverage

Opting for comprehensive insurance coverage for your motorcycle offers several advantages. Comprehensive coverage provides protection beyond the basic liability requirements, ensuring that you are covered in a wide range of situations. Here are some key benefits of comprehensive insurance:

Financial Protection for Accidental Damages

Accidents can happen, and comprehensive coverage steps in to provide financial protection when they do. Whether you are at fault or not, comprehensive coverage helps cover the costs of repairing or replacing your motorcycle after an accident. This can include damage caused by collisions with other vehicles, objects, or even single-vehicle accidents.

Coverage for Non-Accident-Related Incidents

Comprehensive coverage goes beyond accidents, offering protection for various non-accident-related incidents. This includes coverage for theft, vandalism, natural disasters, and even damage caused by falling objects or animals. With comprehensive coverage, you can have peace of mind knowing that your motorcycle is protected from a wide array of potential risks.

Peace of Mind for Riders

Having comprehensive insurance coverage provides riders with added peace of mind. Knowing that you are protected against a broad range of potential losses can alleviate the stress and financial burden associated with unexpected events. It allows you to focus on enjoying your riding experience without worrying about the financial consequences of accidents or other unforeseen circumstances.

Additional Tips for Obtaining the Best Insurance Rates

Apart from choosing the right coverage options, there are several additional strategies you can employ to obtain the best insurance rates for your motorcycle.

Maintaining a Clean Riding Record

Insurance companies often reward riders with a clean driving record by offering lower premiums. Maintaining a safe and responsible riding record can significantly impact your insurance rates. Avoid accidents, traffic violations, and speeding tickets, as these can lead to increased premiums or even policy cancellations.

Bundling Insurance Policies

If you have multiple vehicles or own other assets, consider bundling your insurance policies with the same provider. Many insurance companies offer discounts when you combine multiple policies, such as motorcycle insurance with auto insurance or homeowners’ insurance. Bundling can result in significant savings and provide added convenience by managing all your insurance needs with a single provider.

Exploring Discounts and Special Offers

Insurance providers often offer a variety of discounts and special offers to attract new customers and retain existing ones. These discounts can be based on factors such as your age, riding experience, membership in certain organizations, or even the safety features installed on your motorcycle. Take the time to research and inquire about available discounts to maximize your savings.

Maintaining a Good Credit Score

Believe it or not, your credit score can impact your insurance rates. Many insurance companies use credit-based insurance scoring to assess the risk associated with insuring a particular individual. Maintaining a good credit score can lead to lower premiums, as it indicates a lower risk profile. Work on improving your credit score to potentially save on your motorcycle insurance.

The Role of Technology in Motorcycle Insurance

Advancements in technology have had a significant impact on the motorcycle insurance industry. Insurers are increasingly leveraging technology to enhance the insurance experience, improve risk assessment, and offer personalized coverage options.

Telematics and Usage-Based Insurance

Telematics technology allows insurance companies to monitor and analyze driving behavior in real-time. Usage-based insurance, also known as pay-as-you-go or pay-per-mile insurance, utilizes telematics devices to track factors such as miles driven, time of day, and driving habits. This data is then used to calculate premiums, offering riders the opportunity to pay for insurance based on their actual usage and driving behavior.

Telematics-based insurance can provide significant benefits, especially for riders with safe and responsible driving habits. It rewards riders who practice safe driving practices and offers them lower premiums as a result. Additionally, telematics data can help insurance companies identify potential risks and offer personalized coverage recommendations.

Digital Claims Processing and Customer Service

Technology has also revolutionized the claims processing and customer service aspects of motorcycle insurance. Many insurers now offer digital platforms and mobile apps that allow riders to file claims, track their progress, and receive updates in real-time. This streamlines the claims process, making it more efficient and convenient for policyholders.

Furthermore, insurance companies are investing in customer service technologies, such as chatbots and virtual assistants, to provide instant support and assistance to riders. These digital tools can answer common insurance-related questions, guide riders through the claims process, and offer personalized recommendations, enhancing the overall customer experience.

Future Trends and Innovations in Motorcycle Insurance

The motorcycle insurance industry is continuously evolving, and several trends and innovations are shaping the future of coverage options.

Personalized Insurance Policies

With advancements in data analytics and artificial intelligence, insurance companies are increasingly able to offer personalized insurance policies. By analyzing rider behavior, riding habits, and risk factors, insurers can tailor coverage options to meet the unique needs of individual riders. This level of personalization ensures that riders receive the right coverage at a fair price, maximizing the value of their insurance policy.

Incorporating Safety Features and Advanced Technologies

As motorcycle technology advances, insurance companies are recognizing the potential benefits of safety features and advanced technologies. Insurers are beginning to offer discounts or premium reductions for motorcycles equipped with advanced safety systems, such as anti-lock brakes, traction control, and collision avoidance systems. By incentivizing riders to invest in safety features, insurance companies aim to reduce the risk of accidents and promote safer riding practices.

Enhanced Fraud Detection and Prevention

Fraud is a significant concern in the insurance industry, and motorcycle insurance is no exception. To combat fraud and ensure the integrity of the insurance system, insurers are investing in advanced fraud detection technologies. These technologies utilize machine learning and data analytics to identify suspicious claims and patterns, helping to prevent fraudulent activities and protect policyholders from inflated premiums.

Conclusion: Making an Informed Decision

Choosing the best insurance for your motorcycle requires careful consideration of your specific needs, the value of your bike, and the coverage options available. By understanding the different components of a motorcycle insurance policy, assessing your riding habits and risks, and comparing insurance providers, you can make an informed decision that provides comprehensive protection for your ride.

Remember to evaluate your coverage limits, deductibles, and the benefits offered by different insurers. Consider the advantages of comprehensive insurance coverage and explore additional strategies to obtain the best insurance rates. Stay up-to-date with the latest trends and innovations in motorcycle insurance, as they can offer enhanced protection and personalized coverage options.

With the right insurance policy in place, you can ride with confidence, knowing that you are protected against a wide range of potential risks. Take the time to research, compare, and customize your policy to ensure you have the best insurance for your motorcycle.

How much does motorcycle insurance typically cost?

+The cost of motorcycle insurance can vary significantly depending on several factors, including your riding history, the value of your bike, and the coverage options you choose. On average, motorcycle insurance premiums range from 300 to 700 per year. However, prices can be higher or lower based on individual circumstances.

Are there any discounts available for motorcycle insurance?

+Yes, many insurance companies offer a variety of discounts for motorcycle insurance. These can include discounts for safe riding records, multiple policy bundles, membership in certain organizations, and even discounts for completing motorcycle safety courses. It’s worth inquiring about available discounts to lower your premiums.

What happens if I cancel my motorcycle insurance policy mid-term?

+Canceling your motorcycle insurance policy mid-term may result in a refund of the unused portion of your premium, depending on the insurer’s policies. However, there may be administrative fees or penalties associated with canceling the policy. It’s important to review your policy terms and conditions to understand the cancellation process and any potential fees.