Best Insurance For Seniors

As we age, our insurance needs evolve, and finding the best coverage becomes crucial for ensuring a secure and comfortable retirement. With a plethora of insurance options available, navigating the market can be daunting. This comprehensive guide aims to provide an expert analysis of the insurance landscape specifically tailored for seniors, helping you make informed decisions about your financial future.

Understanding Senior Insurance Needs

Seniors have unique insurance requirements that differ from those of younger individuals. Here’s a breakdown of the key areas where insurance plays a vital role in senior life:

- Health Insurance: Adequate health coverage is essential for seniors to manage chronic conditions, access necessary medications, and cover unexpected medical expenses. Medicare, the primary health insurance program for seniors, offers various plans, but navigating the options can be complex.

- Life Insurance: While life insurance is often associated with younger individuals, it can still be beneficial for seniors. It provides financial protection for loved ones and can help cover funeral expenses or outstanding debts.

- Long-Term Care Insurance: This type of insurance is designed to cover the costs of extended care, which may become necessary due to age-related health issues or disabilities. It can include assistance with daily activities, nursing home care, or home healthcare services.

- Home and Property Insurance: As seniors often own their homes, having proper insurance to protect against damage, theft, or liability claims is crucial. This includes coverage for natural disasters, as well as additional riders for valuable possessions.

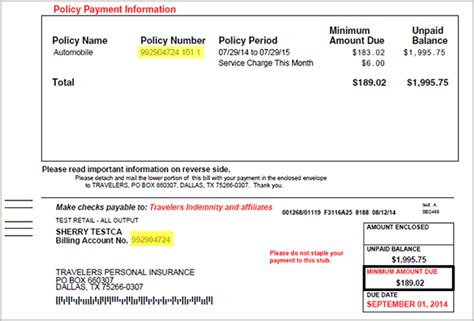

- Auto Insurance: Senior drivers may require specialized auto insurance plans that offer discounts for safe driving records or provide coverage for specific medical conditions that may impact driving abilities.

The Best Health Insurance Options for Seniors

Health insurance is arguably the most critical aspect of senior insurance coverage. With the right plan, seniors can access quality healthcare without worrying about financial strain. Here are some of the top health insurance options tailored for seniors:

Medicare Advantage Plans (Part C)

Medicare Advantage Plans are an alternative to Original Medicare (Parts A and B). These plans are offered by private insurance companies and often include additional benefits beyond standard Medicare coverage. Some key features include:

- Expanded Coverage: Medicare Advantage Plans typically cover prescription drugs (Part D), which is a significant benefit for seniors managing multiple medications.

- Lower Out-of-Pocket Costs: Many plans have lower deductibles and copayments compared to Original Medicare, making healthcare more affordable.

- Additional Benefits: Some plans offer extra benefits like dental, vision, and hearing coverage, as well as fitness programs and wellness incentives.

- Coordinated Care: These plans often provide a more streamlined and coordinated healthcare experience, with many offering access to a network of providers and specialized care teams.

| Plan Type | Provider Network | Out-of-Pocket Costs |

|---|---|---|

| Health Maintenance Organization (HMO) | Requires use of network providers | Generally lower costs |

| Preferred Provider Organization (PPO) | More flexibility, but higher costs | Higher deductibles and copays |

| Private Fee-for-Service (PFFS) | Flexible provider choice | Variable costs based on providers |

Medigap (Medicare Supplement Insurance)

Medigap policies are designed to fill the gaps in Original Medicare coverage. They cover some or all of the deductibles, copayments, and coinsurance that seniors would otherwise have to pay out of pocket. Here are some key considerations:

- Standardized Plans: Medigap plans are standardized, meaning the benefits are the same regardless of the insurance company. This makes comparison shopping easier.

- Plan Selection: There are ten different Medigap plans (labeled A through N), each offering a unique combination of benefits. Choose the plan that best suits your needs and budget.

- Availability: Medigap policies are only available to seniors who are enrolled in Original Medicare (Parts A and B). They do not cover prescription drugs, so a separate Part D plan is necessary.

Life Insurance Options for Seniors

While life insurance is often associated with younger adults, it can still be a valuable asset for seniors. It provides financial protection for loved ones and can help cover final expenses. Here are some life insurance options tailored for seniors:

Final Expense Insurance

Final Expense Insurance, also known as burial insurance or funeral insurance, is designed to cover the costs associated with end-of-life expenses. These policies typically have smaller face values (amount of coverage) and are often guaranteed issue, meaning seniors with health conditions can still qualify.

- Guaranteed Acceptance: Many final expense policies do not require a medical exam, making them accessible to seniors with pre-existing conditions.

- Flexible Premiums: Premiums can be paid in a lump sum or on a monthly basis, depending on the policy and the senior's financial situation.

- Coverage Amount: Face values typically range from $5,000 to $25,000, which is sufficient to cover funeral costs and other final expenses.

Guaranteed Universal Life Insurance

Guaranteed Universal Life Insurance (GUL) is a type of permanent life insurance that offers a death benefit and the potential for cash value accumulation. It’s a popular choice for seniors who want to leave a legacy or provide financial protection for their beneficiaries.

- Level Premiums: GUL policies typically have level premiums that remain the same throughout the life of the policy, providing stability and predictability.

- Guaranteed Death Benefit: The death benefit is guaranteed as long as the policyholder pays the premiums, ensuring financial security for loved ones.

- Cash Value Accumulation: Over time, the policy may accumulate cash value, which can be borrowed against or used to pay premiums, providing additional financial flexibility.

Long-Term Care Insurance: Protecting Your Future

Long-term care insurance is an essential consideration for seniors, as it provides financial protection against the high costs of extended care. Here’s an overview of this crucial insurance type:

What Does Long-Term Care Insurance Cover?

Long-term care insurance covers a range of services that assist individuals with activities of daily living (ADLs) due to age-related issues or chronic conditions. These services include:

- Home healthcare

- Assisted living facilities

- Adult day care

- Nursing home care

- Respite care

Key Factors to Consider When Choosing Long-Term Care Insurance

When selecting a long-term care insurance policy, seniors should evaluate the following factors:

- Benefit Amount: Choose a policy that provides adequate coverage for the expected level of care needed. Consider your assets and the potential costs of long-term care in your area.

- Benefit Period: Determine how long you want the benefits to last. Policies typically offer benefit periods ranging from 2 to 6 years, with some offering lifetime benefits.

- Elimination Period: This is the waiting period before benefits kick in. A longer elimination period (e.g., 90 days) can lower premiums, but ensure you have savings or other resources to cover this period.

- Inflation Protection: Opt for a policy with inflation protection to ensure your benefits keep up with rising healthcare costs over time.

Home and Auto Insurance: Protecting Your Assets

As seniors often own their homes and vehicles, having adequate insurance coverage is crucial to protect their assets. Here’s a breakdown of the key considerations:

Home Insurance for Seniors

Home insurance provides financial protection against damage to your home and its contents, as well as liability coverage. For seniors, here are some important factors to consider:

- Replacement Cost Coverage: Ensure your policy offers replacement cost coverage, which pays the full cost to rebuild your home and replace its contents, regardless of the policy limits.

- Personal Property Coverage: Review your policy to ensure it provides adequate coverage for your belongings. Consider adding riders for valuable items like jewelry or artwork.

- Liability Coverage: Make sure your policy includes sufficient liability coverage to protect you against lawsuits or medical payments for injuries that occur on your property.

Auto Insurance for Seniors

Auto insurance is essential for senior drivers to protect against accidents and other vehicle-related incidents. Here are some key considerations:

- Liability Coverage: Choose a policy with adequate liability coverage to protect your assets in case of an at-fault accident. Consider adding umbrella insurance for additional liability protection.

- Comprehensive and Collision Coverage: These coverages protect your vehicle against damage from accidents, theft, and natural disasters. Ensure your policy includes both to fully protect your investment.

- Discounts: Many insurance companies offer discounts for seniors with safe driving records. Additionally, consider usage-based insurance programs that reward safe driving behaviors with lower premiums.

Conclusion: Navigating the Senior Insurance Landscape

Navigating the insurance landscape as a senior can be complex, but with the right knowledge and resources, you can make informed decisions to protect your health, assets, and loved ones. Remember, insurance is a vital tool for ensuring a secure and comfortable retirement.

Always consult with an insurance professional who specializes in senior coverage to tailor a plan that meets your unique needs. By staying informed and proactive, you can secure your financial future and enjoy your golden years with peace of mind.

Can I enroll in a Medicare Advantage Plan at any time?

+Enrollment in Medicare Advantage Plans typically occurs during the Annual Enrollment Period (AEP), which runs from October 15 to December 7 each year. However, there are also Special Enrollment Periods (SEPs) for certain life events, such as moving or losing other health coverage. It’s important to consult with a Medicare expert to understand your specific enrollment options.

What happens if I don’t have life insurance when I pass away?

+If you don’t have life insurance, your loved ones may face financial challenges in covering your final expenses, such as funeral costs and outstanding debts. While life insurance is not mandatory, it is a valuable tool to provide financial protection and peace of mind for your family.

How much does long-term care insurance cost?

+The cost of long-term care insurance can vary significantly based on factors such as your age, health status, the level of coverage you choose, and the benefits included in the policy. It’s best to consult with a long-term care insurance specialist to get an accurate quote based on your specific needs and circumstances.