Best Insurance Company In California

In the diverse and populous state of California, finding the best insurance company that suits your specific needs can be a daunting task. With a vast array of options available, ranging from national giants to local, specialized providers, the choice can be overwhelming. This article aims to guide you through the intricate world of insurance, highlighting the key factors to consider and presenting a comprehensive analysis of the top insurance companies operating in California.

Understanding the California Insurance Landscape

California’s insurance market is a bustling hub, characterized by a unique blend of competitive giants and niche providers. The state’s diverse demographics and geographical variations mean that insurance needs can vary greatly from region to region. From the bustling cities of Los Angeles and San Francisco to the serene landscapes of the Central Valley and the rugged terrain of the Sierra Nevada, each area presents its own set of risks and insurance requirements.

Additionally, California's unique legal and regulatory environment adds another layer of complexity. The state has some of the most stringent insurance regulations in the nation, ensuring that consumers are well-protected. However, this also means that insurance providers must navigate a complex web of rules and guidelines, which can influence the services and coverage they offer.

Key Factors to Consider When Choosing an Insurance Company

When selecting an insurance company in California, several critical factors should be taken into account. These include, but are not limited to, the company’s financial stability, the breadth and depth of their insurance coverage, the quality of their customer service, and the technological capabilities they offer for policy management and claims processing.

Financial Stability

A critical aspect of choosing an insurance company is evaluating its financial strength and stability. Insurance is a long-term commitment, and you want to ensure that your provider will be able to honor their obligations, even in challenging economic times. Reputable rating agencies such as A.M. Best, Moody’s, and Standard & Poor’s provide financial strength ratings for insurance companies, which can offer valuable insights into their financial health.

| Rating Agency | Financial Strength Rating |

|---|---|

| A.M. Best | A (Excellent) or higher |

| Moody's | A2 or higher |

| Standard & Poor's | A- or higher |

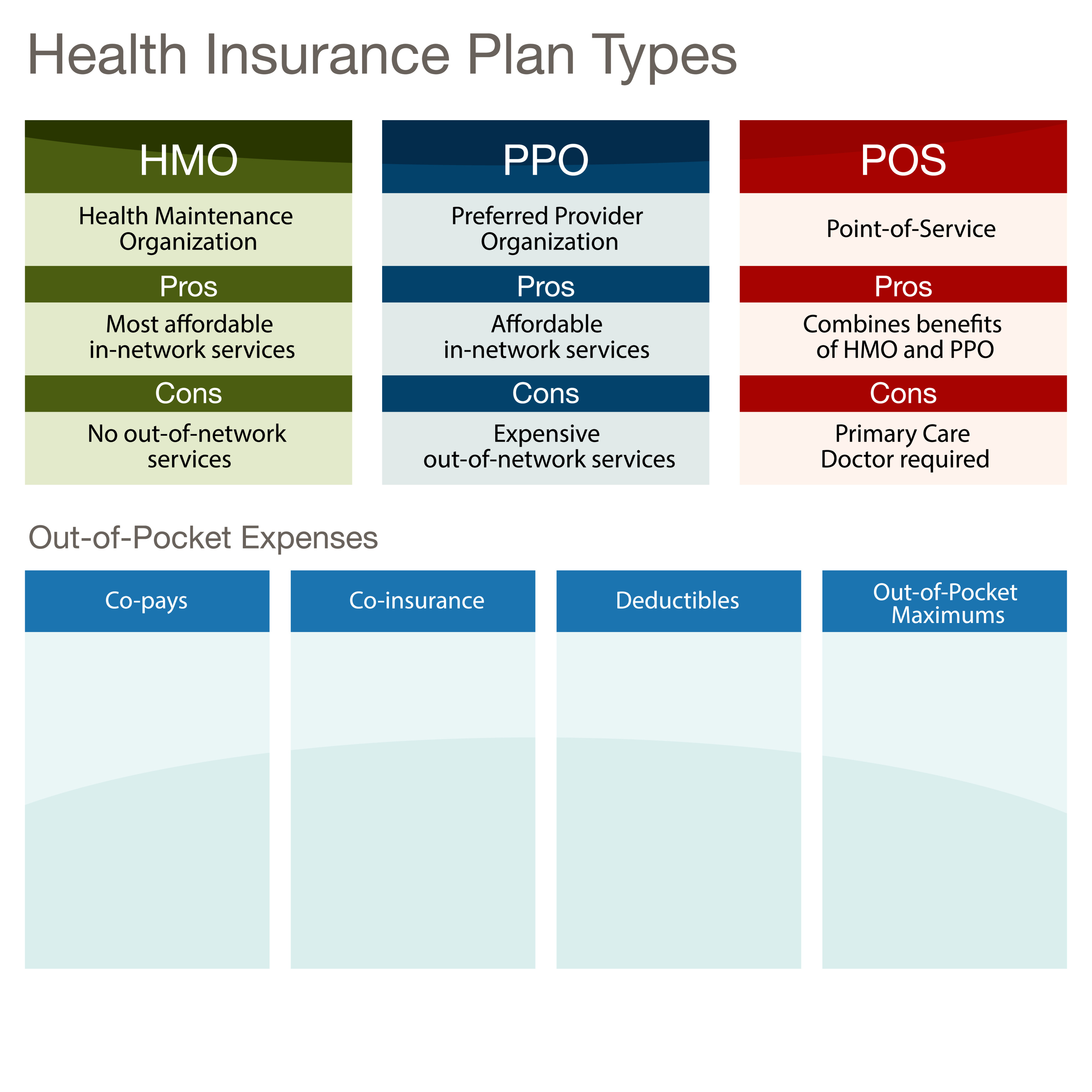

Coverage Options

The range and flexibility of insurance coverage offered by a company is another vital consideration. California residents have diverse needs, from auto and homeowners’ insurance to health, life, and business insurance. The best insurance companies should offer a comprehensive suite of products to cater to these varied requirements.

Moreover, it's important to delve into the specifics of each coverage option. For instance, auto insurance policies may vary significantly in terms of liability limits, comprehensive and collision coverage, and optional add-ons like rental car coverage or roadside assistance. Similarly, homeowners' insurance policies can differ in their coverage of natural disasters, personal liability, and additional living expenses.

Customer Service and Claims Handling

The quality of customer service and claims handling can make or break your experience with an insurance company. In times of crisis, you want to ensure that your insurer is responsive, efficient, and fair in handling your claims. Reviews from current and past customers, as well as industry ratings for customer satisfaction, can provide valuable insights into an insurer’s performance in this regard.

Additionally, the accessibility of customer service representatives, the availability of online and mobile tools for policy management, and the speed and transparency of the claims process are all important considerations.

Technological Capabilities

In today’s digital age, the technological capabilities of an insurance company can significantly impact your experience as a policyholder. Leading insurers are investing heavily in digital platforms and tools to enhance policy management, claims processing, and overall customer engagement. From easy-to-use mobile apps for policyholders to advanced analytics for risk assessment and fraud detection, technological innovation is reshaping the insurance landscape.

For instance, some insurers offer digital tools that allow policyholders to quickly and easily report claims, track their progress, and receive updates. Others use advanced data analytics to personalize insurance products and services, offering tailored coverage and pricing based on individual risk profiles.

Top Insurance Companies in California: A Comprehensive Review

Based on the key factors outlined above, here’s an in-depth review of some of the top insurance companies operating in California.

State Farm

Financial Strength: State Farm is a financial powerhouse, consistently earning top ratings from major agencies. Its financial stability is a testament to its long-standing reputation and strong market position.

Coverage Options: State Farm offers a comprehensive range of insurance products, including auto, homeowners, renters, life, and health insurance. They also provide specialized coverage for boats, RVs, and other recreational vehicles. Additionally, State Farm offers a range of financial services, including banking and investment products.

Customer Service and Claims Handling: State Farm is renowned for its excellent customer service. They have a network of local agents who provide personalized service and support. Their claims process is efficient and straightforward, with a focus on customer satisfaction. State Farm also offers online and mobile tools for policy management and claims reporting, making it convenient for policyholders to access their accounts and services.

Technological Capabilities: State Farm has embraced digital innovation, investing in modern technology to enhance its services. They offer a user-friendly mobile app that allows policyholders to manage their policies, view ID cards, report claims, and more. Additionally, State Farm leverages data analytics to offer personalized insurance solutions, ensuring customers receive coverage that suits their specific needs.

Allstate

Financial Strength: Allstate is a financially robust company, backed by strong ratings from leading agencies. Its financial stability is a key factor in its long-term success and market presence.

Coverage Options: Allstate provides a wide array of insurance products, including auto, homeowners, renters, life, and business insurance. They also offer specialized coverage for motorcycles, boats, and other recreational vehicles. Additionally, Allstate provides a range of financial products and services, including retirement planning and investment options.

Customer Service and Claims Handling: Allstate is known for its commitment to customer service. They have a network of local agents who provide personalized support and guidance. Their claims process is efficient and transparent, with a focus on timely resolution. Allstate offers a range of digital tools for policy management and claims reporting, including a mobile app that allows policyholders to manage their policies, view documents, and report claims.

Technological Capabilities: Allstate has embraced digital transformation, investing in technology to enhance its services. They offer a comprehensive digital platform that allows policyholders to manage their policies, view coverage details, and access important documents. Allstate also leverages data analytics to personalize insurance offerings, ensuring customers receive tailored coverage and pricing.

Farmers Insurance

Financial Strength: Farmers Insurance is a financially strong company, with solid ratings from major agencies. Its financial stability is a key factor in its ability to provide reliable insurance services.

Coverage Options: Farmers Insurance offers a comprehensive range of insurance products, including auto, homeowners, renters, and business insurance. They also provide specialized coverage for mobile homes, motorcycles, and other recreational vehicles. Additionally, Farmers Insurance offers a range of financial services, including retirement planning and investment options.

Customer Service and Claims Handling: Farmers Insurance is dedicated to providing excellent customer service. They have a network of local agents who offer personalized support and guidance. Their claims process is efficient and customer-centric, with a focus on prompt resolution. Farmers Insurance offers a range of digital tools for policy management and claims reporting, including a mobile app that allows policyholders to access their policies, view documents, and report claims.

Technological Capabilities: Farmers Insurance has invested in digital innovation, enhancing its services with modern technology. They offer a user-friendly mobile app that allows policyholders to manage their policies, view coverage details, and access important documents. Additionally, Farmers Insurance leverages data analytics to offer personalized insurance solutions, ensuring customers receive coverage that aligns with their specific needs.

GEICO

Financial Strength: GEICO is a financially robust company, backed by strong ratings from leading agencies. Its financial stability is a key factor in its long-term success and market presence.

Coverage Options: GEICO offers a wide array of insurance products, including auto, homeowners, renters, and life insurance. They also provide specialized coverage for boats, RVs, and other recreational vehicles. Additionally, GEICO offers a range of financial services, including banking and investment options.

Customer Service and Claims Handling: GEICO is known for its exceptional customer service. They offer 24/7 customer support, ensuring policyholders can access assistance whenever they need it. Their claims process is efficient and customer-focused, with a dedication to timely resolution. GEICO provides a range of digital tools for policy management and claims reporting, including a user-friendly mobile app.

Technological Capabilities: GEICO has embraced digital transformation, investing in technology to enhance its services. They offer a comprehensive digital platform that allows policyholders to manage their policies, view coverage details, and access important documents. GEICO also leverages data analytics to personalize insurance offerings, ensuring customers receive tailored coverage and pricing.

Progressive

Financial Strength: Progressive is a financially strong company, with solid ratings from major agencies. Its financial stability is a key factor in its ability to provide reliable insurance services.

Coverage Options: Progressive offers a comprehensive range of insurance products, including auto, homeowners, renters, and business insurance. They also provide specialized coverage for motorcycles, boats, and other recreational vehicles. Additionally, Progressive offers a range of financial services, including retirement planning and investment options.

Customer Service and Claims Handling: Progressive is dedicated to providing excellent customer service. They have a network of local agents who offer personalized support and guidance. Their claims process is efficient and customer-centric, with a focus on prompt resolution. Progressive offers a range of digital tools for policy management and claims reporting, including a mobile app that allows policyholders to access their policies, view documents, and report claims.

Technological Capabilities: Progressive has invested in digital innovation, enhancing its services with modern technology. They offer a user-friendly mobile app that allows policyholders to manage their policies, view coverage details, and access important documents. Additionally, Progressive leverages data analytics to offer personalized insurance solutions, ensuring customers receive coverage that aligns with their specific needs.

Conclusion: Making an Informed Choice

Choosing the best insurance company in California is a complex decision, influenced by a variety of factors. By considering the financial stability, coverage options, customer service, and technological capabilities of each insurer, you can make an informed choice that aligns with your specific needs and preferences.

Remember, the best insurance company for you may not be the same as the best company for your neighbor or friend. It's crucial to evaluate your unique insurance needs and select a provider that offers the coverage, service, and technological tools that best suit your requirements. With the diverse range of insurance companies operating in California, there's sure to be an insurer that's the perfect fit for you.

What are the key factors to consider when choosing an insurance company in California?

+When selecting an insurance company in California, key factors to consider include financial stability, the breadth and depth of coverage options, the quality of customer service and claims handling, and the technological capabilities offered by the insurer. These factors can significantly impact your experience as a policyholder and should be carefully evaluated to ensure you make an informed choice.

How important is financial stability when choosing an insurance company?

+Financial stability is a critical factor when choosing an insurance company. You want to ensure that your insurer is financially sound and can honor their obligations, even in challenging economic times. Reputable rating agencies provide financial strength ratings, which can offer valuable insights into an insurer’s financial health and stability.

What types of coverage should I look for when choosing an insurance company in California?

+When choosing an insurance company in California, you should look for a comprehensive range of coverage options to meet your specific needs. This may include auto, homeowners, renters, life, and health insurance, as well as specialized coverage for boats, RVs, and other recreational vehicles. It’s important to assess your unique insurance needs and select a provider that offers the coverage you require.