Best Insurance Companies For Home

Protecting your home is a crucial aspect of financial planning, and choosing the right insurance company is a vital step. With a myriad of options available, finding the best fit for your specific needs can be challenging. This comprehensive guide aims to provide you with an in-depth analysis of some of the top insurance companies in the market, helping you make an informed decision.

Understanding the Insurance Landscape

The insurance industry is vast and diverse, offering a wide range of policies and coverage options. When it comes to home insurance, several factors come into play, including the type of coverage needed, the location of your home, and your specific requirements. Here’s a breakdown of some key considerations:

- Coverage Options: Different insurance companies offer varying coverage types, such as standard home insurance, rental insurance, condominium insurance, and specialty policies for unique homes. It's essential to understand the specific coverage you require and ensure the company you choose provides it.

- Location: The location of your home plays a significant role in determining the cost and availability of insurance. Some companies may specialize in certain regions or have more competitive rates in specific areas.

- Additional Services: Beyond basic coverage, many insurance companies offer additional services like disaster response teams, restoration services, or even identity theft protection. These added benefits can provide extra peace of mind.

- Customer Service: The quality of customer service can make a significant difference in your experience. Look for companies with a solid reputation for prompt and efficient service, especially during claims processes.

- Financial Stability: Ensuring the financial stability of the insurance company you choose is crucial. You want to select a provider with a strong financial background to ensure they can fulfill their obligations even in challenging economic times.

Top Insurance Companies for Homeowners

Now, let’s delve into some of the leading insurance companies in the market and explore their offerings, customer satisfaction, and unique features.

State Farm

State Farm is a prominent player in the insurance industry, offering a comprehensive range of services. They provide standard home insurance, as well as specialty coverage for unique homes, such as historic homes or those with unique architectural features. One of their standout features is their “Disaster Response Unit,” which provides rapid response and support during natural disasters.

In terms of customer satisfaction, State Farm consistently ranks highly. Their claim process is known to be efficient and straightforward, and they offer a range of additional services, including identity theft protection and 24⁄7 customer support.

Allstate

Allstate is another well-established insurance company with a strong presence in the home insurance market. They offer a wide range of coverage options, including standard home insurance, renters insurance, and specialty policies for unique homes. Allstate’s “Claim Satisfaction Guarantee” program ensures a quick and hassle-free claims process, providing customers with peace of mind.

Additionally, Allstate provides a suite of digital tools and resources to help customers manage their policies and stay informed. Their mobile app, for instance, allows policyholders to file claims, access policy documents, and even get real-time updates on their claims status.

USAA

USAA is a highly regarded insurance provider, primarily serving active military members, veterans, and their families. They offer a comprehensive range of insurance products, including home insurance, auto insurance, and life insurance. USAA is known for its exceptional customer service, with a focus on providing personalized support and tailored coverage options for its unique customer base.

One of USAA’s standout features is their “Catastrophe Claims Team,” which is deployed to affected areas during natural disasters to assist policyholders with their claims and provide on-the-ground support.

Liberty Mutual

Liberty Mutual is a leading insurance company with a strong focus on customer satisfaction and innovative solutions. They offer a comprehensive range of insurance products, including standard home insurance, renters insurance, and specialty coverage for unique homes. Liberty Mutual’s “Identity Protection Service” provides an added layer of security, helping policyholders protect their personal information and identities.

Additionally, Liberty Mutual offers a unique “Home AdvantEdge” program, which provides policyholders with access to a network of trusted contractors and service providers for home maintenance and improvement projects.

Amica Mutual Insurance

Amica Mutual Insurance is a highly respected insurance provider known for its exceptional customer service and personalized approach. They offer a comprehensive range of insurance products, including home insurance, auto insurance, and life insurance. Amica’s “Claim-Free Rewards” program provides policyholders with discounts and benefits for maintaining a claim-free record.

One of Amica’s standout features is their “Customer Care Team,” which is dedicated to providing personalized support and assistance to policyholders. They offer a range of resources and tools to help customers understand their coverage and make informed decisions.

Comparative Analysis: Choosing the Right Insurance Company

When it comes to choosing the best insurance company for your home, it’s essential to consider your specific needs and priorities. Here’s a comparative analysis of the key features and considerations to help you make an informed decision:

| Insurance Company | Coverage Options | Additional Services | Customer Satisfaction |

|---|---|---|---|

| State Farm | Wide range of coverage, including specialty policies Disaster Response Unit |

Identity theft protection, 24/7 customer support | High satisfaction ratings, efficient claims process |

| Allstate | Comprehensive coverage options, digital tools Claim Satisfaction Guarantee |

Mobile app for policy management, claim updates | Solid reputation, focus on customer convenience |

| USAA | Specialized coverage for military members Catastrophe Claims Team |

Tailored support for unique customer base | Exceptional customer service, personalized approach |

| Liberty Mutual | Innovative solutions, comprehensive coverage Identity Protection Service Home AdvantEdge program |

Access to trusted contractors, service providers | Strong focus on customer satisfaction, digital tools |

| Amica Mutual Insurance | Personalized coverage, auto and life insurance Claim-Free Rewards program |

Customer Care Team for personalized support | Highly respected, known for exceptional customer service |

Remember, when choosing an insurance company, it's essential to assess your specific needs, prioritize the features that matter most to you, and thoroughly research the companies' offerings, customer satisfaction records, and financial stability.

FAQs

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually to ensure it aligns with your current needs and any changes in your home’s value or coverage requirements. Regular reviews help ensure you have adequate coverage and avoid any gaps.

What factors influence the cost of home insurance?

+The cost of home insurance can be influenced by various factors, including the location of your home, the value of your property, the level of coverage you require, and your claims history. It’s essential to shop around and compare quotes to find the best value.

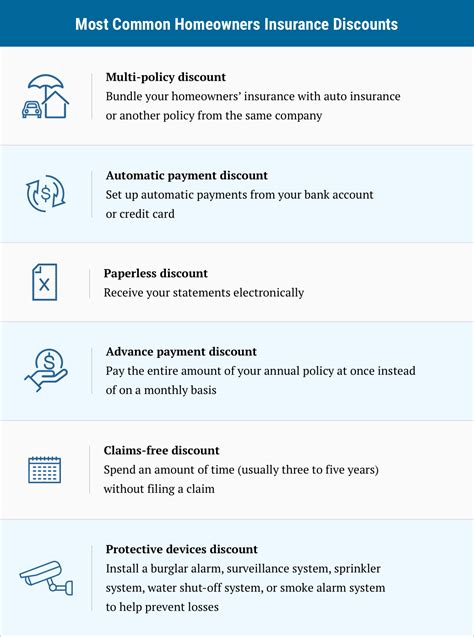

Can I bundle my home and auto insurance for better rates?

+Yes, many insurance companies offer discounts when you bundle multiple policies, such as home and auto insurance. Bundling can provide significant savings and streamline your insurance management. It’s worth exploring this option with your preferred insurance provider.