Best Home And Auto Insurance

When it comes to safeguarding your home and vehicle, choosing the right insurance provider is crucial. With numerous options available, it can be overwhelming to navigate the insurance market. In this comprehensive guide, we delve into the world of home and auto insurance, offering expert insights to help you make informed decisions. Join us as we explore the key factors, coverage options, and strategies to secure the best protection for your assets.

Understanding Home Insurance: A Comprehensive Overview

Home insurance is a vital aspect of financial security for homeowners. It provides protection against various risks, including damage to your property, theft, and liability claims. When selecting a home insurance policy, it’s essential to consider factors such as the type of coverage, deductibles, and the insurer’s reputation for claim handling.

Coverage Options and Personalized Protection

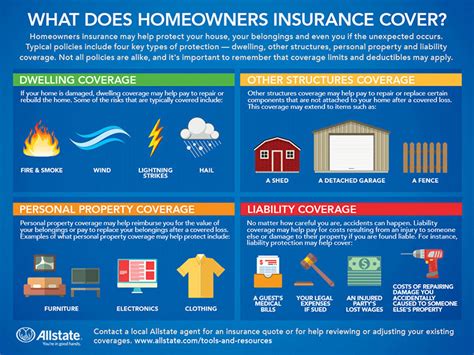

Home insurance policies offer a range of coverage options to tailor protection to your specific needs. These may include:

- Dwelling Coverage: This covers the physical structure of your home, including repairs or rebuilding after a covered loss.

- Personal Property Coverage: Protects your belongings against theft, damage, or loss.

- Liability Coverage: Provides financial protection if someone is injured on your property or if you are held responsible for an accident.

- Additional Living Expenses: Covers temporary living expenses if your home becomes uninhabitable due to a covered incident.

When selecting coverage, it's crucial to assess your specific risks and the value of your assets. For instance, if you live in an area prone to natural disasters like hurricanes or earthquakes, you may need to consider additional coverage to ensure adequate protection.

Understanding Deductibles and Policy Limits

Deductibles and policy limits are key components of a home insurance policy. A deductible is the amount you pay out of pocket before the insurance coverage kicks in. Higher deductibles often result in lower premiums, so it’s essential to strike a balance between affordability and adequate coverage.

Policy limits, on the other hand, represent the maximum amount the insurer will pay for a covered loss. Understanding these limits is crucial to ensure you have sufficient coverage for your home's value and potential risks. It's recommended to regularly review and adjust your policy limits to reflect any changes in your home's value or improvements made.

Auto Insurance: Securing Protection for Your Vehicle

Auto insurance is a legal requirement in most states and provides financial protection in the event of an accident or other vehicle-related incidents. When choosing auto insurance, it’s crucial to consider factors such as coverage options, premiums, and the insurer’s reputation for customer service and claim handling.

Comprehensive and Collision Coverage

In addition to the mandatory liability coverage, auto insurance policies often offer optional coverage such as comprehensive and collision coverage. These provide protection for your vehicle in various scenarios:

- Comprehensive Coverage: Covers damages caused by non-collision incidents, such as theft, vandalism, natural disasters, or collisions with animals.

- Collision Coverage: Pays for repairs or replacement of your vehicle if you’re involved in a collision, regardless of fault.

It's essential to assess your needs and risks when choosing these optional coverages. For instance, if you own an older vehicle, comprehensive and collision coverage may not be cost-effective, as the premiums could exceed the vehicle's actual cash value.

Understanding Premiums and Discounts

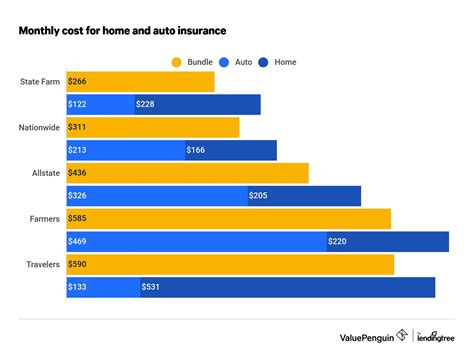

Auto insurance premiums can vary significantly depending on factors such as your driving record, the make and model of your vehicle, and your location. It’s crucial to shop around and compare quotes from multiple insurers to find the best value for your specific circumstances.

Many insurers offer discounts to reduce the cost of auto insurance. These may include discounts for safe driving records, multiple policy discounts (bundling home and auto insurance), or discounts for specific vehicle safety features. It's worth exploring these options to potentially lower your premiums.

The Importance of Insurer Reputation and Claim Handling

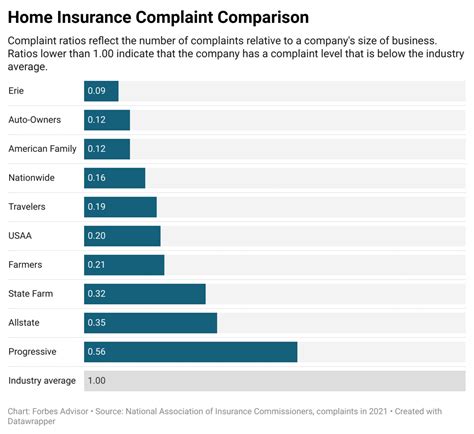

When selecting a home or auto insurance provider, it’s crucial to consider their reputation and track record for claim handling. A reputable insurer should have a solid financial standing, ensuring they can pay out claims promptly and fairly. Additionally, look for insurers with a strong customer service reputation, as this can significantly impact your overall experience.

Researching Insurer Reviews and Ratings

Before committing to an insurance provider, take the time to research their reputation. Online reviews and ratings from independent agencies can provide valuable insights into the insurer’s performance. Look for reviews that highlight prompt claim processing, fair settlements, and overall customer satisfaction.

Additionally, consider checking the insurer's financial strength ratings from reputable agencies like AM Best or Standard & Poor's. These ratings assess the insurer's financial stability and ability to meet their obligations, providing peace of mind that your claims will be honored.

Comparative Analysis: Top Home and Auto Insurance Providers

In the competitive insurance market, several providers offer comprehensive home and auto insurance coverage. Here’s a comparative analysis of some of the top insurance companies:

| Insurance Provider | Coverage Options | Reputation | Customer Satisfaction |

|---|---|---|---|

| Allstate | Wide range of coverage options, including specialty coverage for unique needs. | Strong financial stability and positive customer reviews for claim handling. | 4.5⁄5 stars based on customer feedback. |

| State Farm | Customizable coverage with a focus on auto insurance. | Well-known for excellent customer service and claim satisfaction. | 4.3⁄5 stars, with a reputation for prompt and fair claim settlements. |

| Liberty Mutual | Flexible coverage options and discounts for safe driving. | Financial strength and positive reviews for customer support. | 4.2⁄5 stars, with a focus on personalized insurance plans. |

| Progressive | Innovative coverage solutions, including usage-based insurance. | Strong reputation for competitive pricing and customer satisfaction. | 4.1⁄5 stars, with a focus on digital convenience and customizable plans. |

Remember, when choosing an insurance provider, it's essential to consider your specific needs and circumstances. These top providers offer a range of coverage options and competitive pricing, but it's always beneficial to compare quotes and reviews to find the best fit for your home and auto insurance needs.

Navigating the Home and Auto Insurance Market: Strategies for Success

Securing the best home and auto insurance coverage requires a strategic approach. Here are some key strategies to consider:

- Bundle Your Policies: Combining your home and auto insurance policies with the same insurer can often result in significant discounts and simplified claim processes.

- Assess Your Needs: Evaluate your specific risks and requirements to ensure you have adequate coverage without unnecessary expenses.

- Shop Around: Compare quotes from multiple insurers to find the best value and coverage for your needs. Use online tools and resources to streamline the comparison process.

- Understand Policy Terms: Carefully read and understand the terms and conditions of your insurance policies. This includes knowing the exclusions and limitations of your coverage.

- Maintain a Clean Driving Record: For auto insurance, a clean driving record can lead to lower premiums and better coverage options. Avoid accidents and violations to keep your rates as low as possible.

The Future of Home and Auto Insurance: Emerging Trends

The insurance industry is evolving, and several trends are shaping the future of home and auto insurance. Here’s a glimpse into what lies ahead:

- Usage-Based Insurance: This innovative approach to auto insurance pricing takes into account how, when, and where you drive. It offers personalized premiums based on your actual driving behavior, encouraging safer driving habits.

- Smart Home Technology: With the rise of smart home devices, insurers are exploring ways to integrate this technology into home insurance policies. This could potentially lead to discounts for homes with enhanced security features or early warning systems for potential risks.

- Digital Convenience: The insurance industry is increasingly embracing digital platforms and tools. From online policy management to digital claim submissions, insurers are focusing on providing a seamless and convenient experience for their customers.

- Data-Driven Personalization: Insurers are leveraging data analytics to offer more personalized coverage options. By analyzing customer data, they can provide tailored policies that meet individual needs and circumstances.

Staying informed about these emerging trends can help you make more informed decisions when choosing home and auto insurance. As the industry evolves, you can expect more innovative solutions and personalized coverage options to protect your assets effectively.

FAQ

What is the average cost of home insurance per year?

+The average cost of home insurance can vary significantly depending on factors such as location, property value, and coverage limits. On average, homeowners can expect to pay between 500 and 2,000 annually for home insurance. However, it’s essential to tailor your coverage to your specific needs and circumstances to ensure adequate protection.

How can I lower my auto insurance premiums?

+There are several strategies to reduce your auto insurance premiums. These include maintaining a clean driving record, bundling your auto insurance with other policies (like home insurance), shopping around for the best rates, and considering higher deductibles if you’re comfortable with a higher out-of-pocket expense in the event of a claim.

What factors determine my home insurance rates?

+Home insurance rates are influenced by various factors, including the location and age of your home, its replacement cost, the level of coverage you choose, and any additional endorsements or riders you add to your policy. Additionally, your claims history and credit score can impact your rates.

Is it necessary to have comprehensive and collision coverage for my vehicle?

+While comprehensive and collision coverage are not mandatory, they provide valuable protection for your vehicle. These coverages can help cover the cost of repairs or replacement if your vehicle is damaged in an accident, regardless of fault. They also cover non-collision incidents like theft or natural disasters. Consider your vehicle’s value and your ability to absorb the cost of potential damages when deciding on these coverages.

How often should I review my home and auto insurance policies?

+It’s a good practice to review your home and auto insurance policies annually or whenever your circumstances change significantly. This includes changes in your home’s value, additions or renovations, updates to your vehicle, or changes in your personal situation (e.g., marriage, new drivers in the household). Regular reviews ensure your coverage remains adequate and up-to-date.