Average Cost Of Health Insurance For A Family Of 5

Understanding the average cost of health insurance for a family of five is essential for financial planning and ensuring adequate healthcare coverage. This comprehensive guide will delve into the factors influencing these costs, provide real-world examples, and offer insights into making informed decisions regarding family health insurance plans.

Factors Influencing Health Insurance Costs for Families

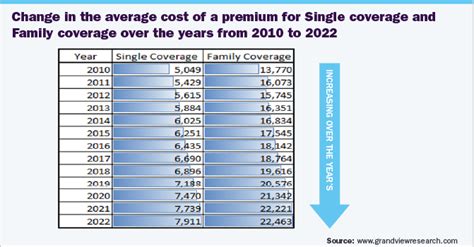

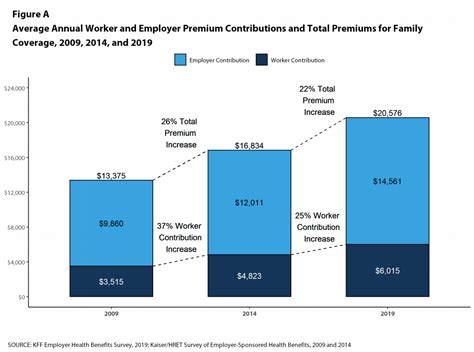

The cost of health insurance for a family of five is influenced by several key factors. These include the geographical location of the family, with urban areas often commanding higher premiums. The age and health status of family members play a significant role, as older individuals or those with pre-existing conditions may face higher costs. The type of insurance plan chosen, such as HMO or PPO, and the coverage limits and deductibles selected also impact the overall premium.

Additionally, family size is a critical factor, as larger families typically require more comprehensive coverage. The choice of healthcare providers and the network of hospitals and specialists included in the plan can affect both cost and convenience. Finally, government regulations and insurance company policies can influence the availability and pricing of family health insurance plans.

Real-World Examples of Health Insurance Costs for Families

To illustrate the variability in health insurance costs for a family of five, let’s consider some real-world examples. These scenarios will provide a more tangible understanding of the financial commitments involved.

Urban Family with High-Deductible Plan

A family of five residing in an urban area, such as New York City, may opt for a high-deductible health plan (HDHP) to keep premiums affordable. In this case, the annual premium for the family could range from 12,000 to 15,000, depending on the specific plan and insurance provider. However, it’s important to note that this plan would likely have a higher deductible, potentially reaching $5,000 or more, before the insurance coverage kicks in.

Rural Family with Comprehensive Coverage

For a family of five living in a rural area, the cost of health insurance might be lower due to reduced healthcare costs in the region. A comprehensive health insurance plan with lower deductibles and extensive coverage could cost around 8,000 to 10,000 annually. This plan would provide more immediate coverage, with lower out-of-pocket expenses for the family.

Family with Pre-Existing Conditions

A family with pre-existing health conditions, such as diabetes or cardiovascular disease, may face higher insurance premiums. The annual cost for such a family could range from 18,000 to 25,000, depending on the severity of the conditions and the chosen insurance plan. It’s crucial for families with pre-existing conditions to carefully select a plan that adequately covers their specific healthcare needs.

| Scenario | Annual Premium Range |

|---|---|

| Urban Family (HDHP) | $12,000 - $15,000 |

| Rural Family (Comprehensive) | $8,000 - $10,000 |

| Family with Pre-Existing Conditions | $18,000 - $25,000 |

Tips for Choosing the Right Health Insurance Plan

When selecting a health insurance plan for a family of five, it’s crucial to consider the following factors to make an informed decision:

- Assess Healthcare Needs: Evaluate the family's current and potential future healthcare requirements. Consider any pre-existing conditions, the age range of family members, and the proximity to quality healthcare facilities.

- Compare Plans and Premiums: Research and compare different insurance plans offered by various providers. Look at the coverage limits, deductibles, and any additional benefits or exclusions. The Affordable Care Act marketplace can be a valuable resource for comparing plans.

- Consider Network and Providers: Ensure that the chosen plan includes a network of healthcare providers and hospitals that align with the family's needs. Verify that the family's preferred doctors and specialists are in-network to avoid higher out-of-network costs.

- Understand Cost-Sharing: Be aware of the cost-sharing arrangements, including deductibles, copayments, and coinsurance. Understand how these costs will be distributed among family members and plan accordingly.

- Explore Tax Benefits: Investigate any tax advantages associated with health insurance plans, such as the use of Health Savings Accounts (HSAs) or tax credits for qualifying health plans.

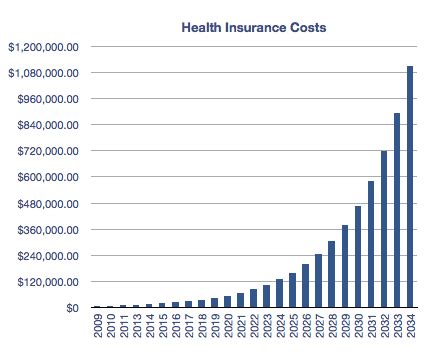

The Future of Family Health Insurance

The landscape of family health insurance is continually evolving, influenced by advancements in healthcare technology, changing government policies, and shifting consumer preferences. Here’s a glimpse into the potential future of family health insurance:

Digital Health and Telemedicine

The integration of digital health technologies and telemedicine is expected to play a more prominent role in family health insurance. This could include virtual consultations, remote monitoring of chronic conditions, and the use of wearable devices for health tracking. These innovations may lead to more efficient and cost-effective healthcare delivery, benefiting families.

Value-Based Care Models

There is a growing trend towards value-based care models, which focus on the quality and outcomes of healthcare rather than the quantity of services provided. This shift could result in more affordable and efficient family health insurance plans, as insurers and providers work together to deliver better care at a lower cost.

Personalized Health Insurance Plans

In the future, health insurance plans may become more personalized, taking into account individual health risks and preferences. This could involve the use of genetic testing and data-driven insights to tailor insurance coverage to the unique needs of each family member. Such personalized plans could offer more comprehensive and cost-effective coverage.

Expanded Coverage Options

With ongoing discussions around healthcare reform, there may be expanded coverage options for families in the future. This could include more affordable insurance plans, increased subsidies for low-income families, and potentially universal healthcare coverage, which would simplify the process of obtaining adequate health insurance for families.

How can I reduce the cost of health insurance for my family of five?

+To reduce health insurance costs for your family, consider comparing plans to find the most cost-effective option that meets your needs. Explore high-deductible plans, which may have lower premiums, but ensure you can afford the deductible. Additionally, maintaining a healthy lifestyle can reduce insurance costs over time, as insurers offer incentives for healthy behaviors. Finally, investigate government programs or subsidies that may be available to help lower your insurance premiums.

Are there any government programs to assist with health insurance costs for families?

+Yes, there are government programs designed to assist families with health insurance costs. These include Medicaid for low-income families, the Children’s Health Insurance Program (CHIP) for children, and tax credits and subsidies under the Affordable Care Act. It’s important to research and understand your eligibility for these programs to ensure you’re taking advantage of all available support.

What should I do if I can’t afford health insurance for my family of five?

+If you’re struggling to afford health insurance for your family, there are several steps you can take. First, explore government programs like Medicaid or CHIP, which offer free or low-cost insurance for eligible families. Additionally, the Affordable Care Act provides tax credits and subsidies to make insurance more affordable. You can also research local community health centers, which often provide low-cost or sliding-scale healthcare services. Finally, consider reaching out to non-profit organizations that may offer assistance with healthcare costs.