Average Renters Insurance Cost

Renters insurance is an essential yet often overlooked aspect of financial planning for those living in rental properties. This type of insurance provides coverage for personal belongings and liability protection, offering peace of mind to tenants in case of unexpected events like theft, fire, or accidents. The cost of renters insurance can vary significantly depending on various factors, and understanding these costs is crucial for anyone looking to secure their belongings and future.

Understanding Renters Insurance Costs

The average cost of renters insurance in the United States is approximately 15-30 per month, or 180-360 per year. However, this is just a general estimate, and the actual cost can be higher or lower based on numerous variables. Renters insurance policies are highly customizable, allowing individuals to tailor their coverage to their specific needs and budgets. This flexibility means that the cost can vary greatly from one person to another.

Factors Affecting Renters Insurance Costs

Several factors influence the cost of renters insurance, including the location of the rental property, the amount of coverage required, and the deductible chosen. Here’s a closer look at these factors and how they impact insurance premiums.

Location

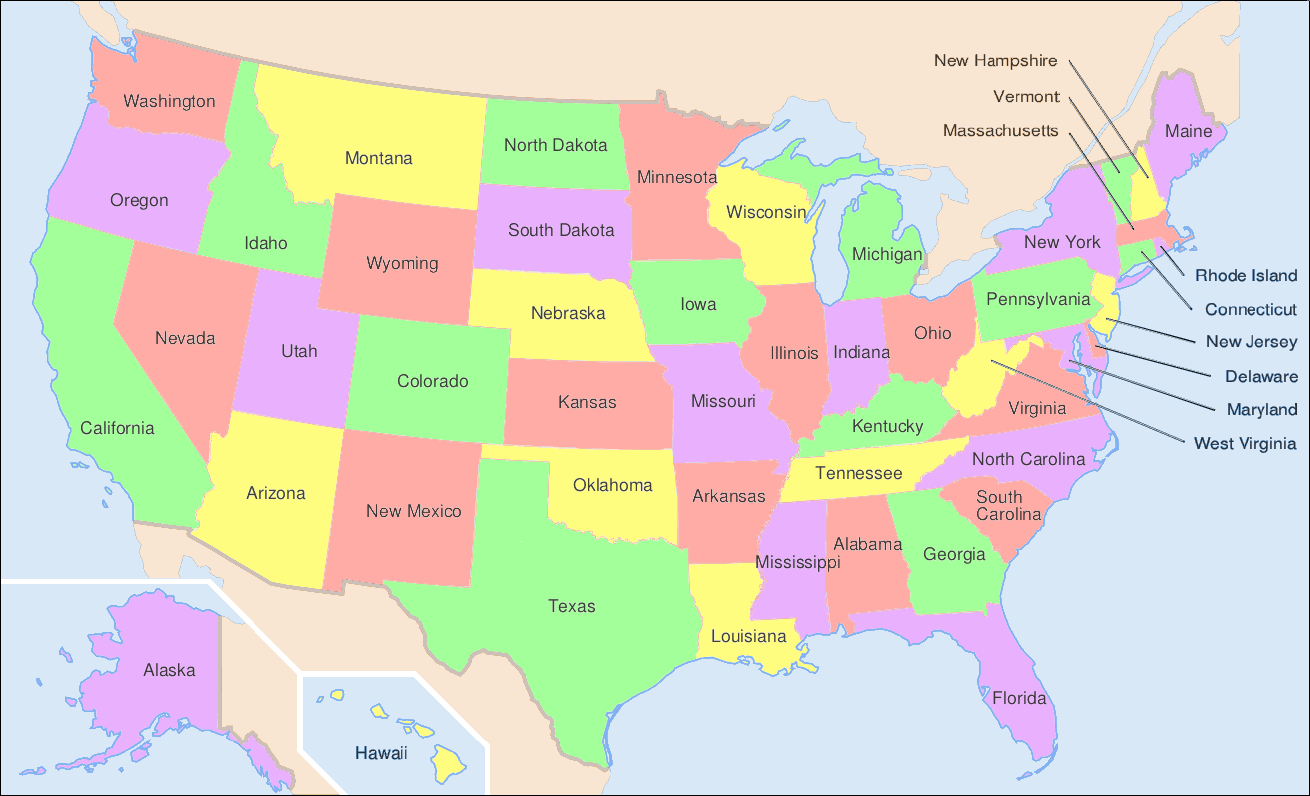

The state and city where the rental property is located play a significant role in determining insurance costs. Areas with a higher incidence of crimes, natural disasters, or claims tend to have higher insurance rates. For instance, renters insurance in states like California, Florida, or Texas, which are prone to natural disasters like earthquakes, hurricanes, or wildfires, may cost more than in states with lower risk factors.

| State | Average Annual Premium |

|---|---|

| California | $300 |

| Florida | $250 |

| Texas | $200 |

| New York | $180 |

Apart from state-level variations, insurance costs can also differ significantly between cities within the same state. Factors such as crime rates, local weather conditions, and the number of claims filed in a particular area can impact insurance rates.

Coverage Amount

The amount of coverage one chooses for their personal belongings is another critical factor affecting insurance costs. Renters insurance typically provides coverage for personal property, liability, and additional living expenses. The more coverage an individual opts for, the higher the insurance premium will be. It’s essential to find a balance between adequate coverage and an affordable premium.

| Coverage Type | Average Cost |

|---|---|

| Personal Property | $10-$20 per month |

| Liability | $5-$10 per month |

| Additional Living Expenses | $5-$10 per month |

Deductible

The deductible is the amount an insured individual must pay out of pocket before the insurance company covers the rest of the claim. Choosing a higher deductible can lower insurance premiums, as it reduces the insurer’s potential liability. However, it’s essential to ensure that the deductible is affordable in case a claim needs to be made.

Additional Factors

Apart from location, coverage amount, and deductible, other factors can influence insurance costs. These include the age and type of the rental property, the credit score of the insured individual, and any additional coverage options chosen, such as coverage for high-value items or identity theft protection.

Strategies to Lower Renters Insurance Costs

While renters insurance is an essential financial tool, it’s understandable that individuals may want to keep costs as low as possible. Here are some strategies to consider when looking to reduce insurance premiums:

Shop Around

Insurance rates can vary significantly between providers, so it’s crucial to compare quotes from multiple insurers. Online comparison tools can make this process easier, allowing individuals to quickly see quotes from various companies. Shopping around ensures one gets the best possible deal for their insurance needs.

Increase Deductible

As mentioned earlier, opting for a higher deductible can reduce insurance premiums. While this strategy may not be suitable for everyone, especially those on a tight budget, it can be an effective way to lower costs for those who can afford a higher out-of-pocket expense in the event of a claim.

Bundle Policies

Many insurance companies offer discounts when individuals bundle multiple policies together. For instance, if you already have auto insurance with a particular company, you may be eligible for a discount on your renters insurance if you purchase it from the same provider. Bundling policies can lead to significant savings and is worth considering if you’re already insured with a particular company.

Take Advantage of Discounts

Insurance companies often offer discounts for various reasons. These could include discounts for being a non-smoker, having a home security system, or being a member of certain organizations or professions. It’s worth inquiring about these discounts when obtaining quotes, as they can significantly reduce insurance costs.

Maintain a Good Credit Score

Insurance companies often consider an individual’s credit score when determining insurance rates. A good credit score can lead to lower insurance premiums, as it indicates a lower risk of filing a claim. Maintaining a good credit score is, therefore, an indirect way of reducing insurance costs.

The Importance of Renters Insurance

Despite the cost, renters insurance is an essential investment for anyone living in a rental property. It provides crucial financial protection in case of unexpected events, such as a fire, theft, or an accident that leads to property damage or injury. Renters insurance can help cover the cost of replacing personal belongings, provide liability protection, and even cover additional living expenses if a rental property becomes uninhabitable due to a covered event.

Real-Life Examples

Consider the case of Sarah, a tenant in a busy city center. Her rental apartment caught fire due to an electrical fault, and she lost most of her belongings. Without renters insurance, Sarah would have had to bear the cost of replacing her furniture, clothes, and other personal items, which could have amounted to thousands of dollars. However, with renters insurance, Sarah was able to claim for the cost of her lost belongings, providing her with the financial support she needed to get back on her feet.

Another example is John, a tenant who accidentally left his front door unlocked, leading to a theft of his valuable electronics. Without renters insurance, John would have had to pay for the cost of replacing these items himself. However, with renters insurance, he was able to claim for the loss and receive compensation, mitigating the financial impact of the theft.

Conclusion

Renters insurance is a vital aspect of financial planning for tenants, offering protection for personal belongings and liability. While the average cost of renters insurance is around 180-360 per year, the actual cost can vary significantly based on various factors. By understanding these factors and employing strategies to lower costs, individuals can ensure they have adequate coverage at an affordable price. Remember, while cost is an important consideration, having the right level of insurance is crucial for peace of mind and financial security.

What is the average renters insurance cost in the United States?

+The average cost of renters insurance in the United States is approximately 15-30 per month, or 180-360 per year. However, this can vary significantly based on factors like location, coverage amount, and deductible.

How does location affect renters insurance costs?

+The state and city where the rental property is located can significantly impact insurance costs. Areas with higher crime rates, natural disaster risks, or a higher number of claims tend to have higher insurance rates.

Can I customize my renters insurance coverage?

+Yes, renters insurance policies are highly customizable. Individuals can choose the amount of coverage they require for their personal belongings, as well as add optional coverages like liability protection or coverage for high-value items.