Average House Insurance Cost Per Month

House insurance, often referred to as homeowners insurance, is a vital aspect of financial protection for homeowners and property owners. It provides coverage for various risks, including damage to the structure, personal belongings, and liability protection. The cost of house insurance can vary significantly depending on several factors, making it essential to understand the average monthly premiums and the elements that influence them.

Understanding the Average Monthly Cost of House Insurance

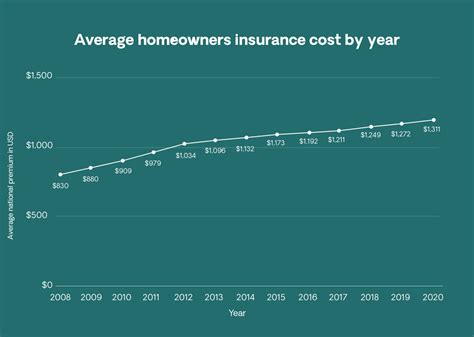

On average, homeowners across the United States can expect to pay approximately 1,200 annually</strong> for house insurance, which equates to around <strong>100 per month. However, it’s crucial to note that this average figure can be misleading due to the wide range of variables that affect insurance premiums. These variables include the location of the property, the age and condition of the house, the level of coverage desired, and the insurance company’s pricing policies.

For instance, the average annual premium in Florida, known for its hurricane risks, is $2,953, which is significantly higher than the national average. On the other hand, states like Ohio and Pennsylvania have average annual premiums of $842 and $1,065, respectively, showcasing the impact of regional factors on insurance costs.

Factors Influencing House Insurance Costs

The cost of house insurance is determined by a combination of factors, each playing a crucial role in the overall premium. Here’s a breakdown of some key elements:

- Location: The geographical location of your property is one of the most significant factors influencing insurance costs. Regions prone to natural disasters like hurricanes, tornadoes, or earthquakes often have higher premiums. Additionally, areas with higher crime rates or a history of frequent claims may also see increased insurance costs.

- Value of the Property: The value of your home and its contents directly impacts the insurance premium. Higher-value properties typically require more extensive coverage, leading to increased costs.

- Age and Condition of the Property: Older homes may require more extensive repairs or have outdated electrical or plumbing systems, increasing the risk of accidents or damage. This can result in higher insurance premiums.

- Coverage Options: The level of coverage you choose plays a significant role in the cost. Basic coverage may be more affordable, but it might not provide adequate protection for your specific needs. Comprehensive coverage, which includes additional protections like flood or earthquake insurance, can be more expensive but offers greater peace of mind.

- Insurance Company and Pricing Policies: Different insurance companies have varying pricing structures and policies. Some may offer discounts for bundling policies (e.g., homeowners and auto insurance), while others might provide loyalty discounts for long-term customers. It's essential to compare quotes from multiple providers to find the best rate.

| State | Average Annual Premium |

|---|---|

| Florida | $2,953 |

| Ohio | $842 |

| Pennsylvania | $1,065 |

| Texas | $1,424 |

| California | $1,071 |

Tips for Reducing House Insurance Costs

While house insurance is a necessary expense for homeowners, there are strategies to help reduce the overall cost without compromising on coverage. Here are some tips to consider:

- Shop Around and Compare Quotes: Obtain quotes from multiple insurance providers to find the best rates. Online comparison tools can be a convenient way to start, but it's also beneficial to speak with agents to understand the specific coverage offered.

- Review Your Coverage Regularly: Insurance needs can change over time. Regularly review your policy to ensure it still meets your requirements. If your circumstances have changed, you may be able to adjust your coverage and save money.

- Bundle Policies: If you have multiple insurance needs, such as homeowners, auto, and life insurance, consider bundling them with the same provider. Many insurers offer discounts for bundling policies, resulting in potential savings.

- Increase Your Deductible: Opting for a higher deductible can reduce your premium. However, it's essential to ensure that you can afford the deductible in the event of a claim. A higher deductible means you'll pay more out of pocket when filing a claim, so it's a trade-off between premium savings and potential costs.

- Make Home Improvements: Investing in home improvements, especially those that enhance safety and security, can lead to insurance discounts. For example, installing a security system, smoke detectors, or reinforcing your roof can reduce the risk of accidents and theft, resulting in lower premiums.

- Ask About Discounts: Many insurance companies offer discounts for various reasons. Common discounts include loyalty discounts for long-term customers, safety device discounts for installing certain safety features, and even discounts for belonging to specific professional organizations or alumni associations.

The Importance of Adequate Coverage

While it’s important to keep insurance costs manageable, it’s equally crucial to ensure you have adequate coverage. Inadequate coverage can leave you vulnerable to financial losses in the event of a disaster or accident. Here are some considerations when evaluating your coverage needs:

- Replacement Cost vs. Actual Cash Value: When choosing coverage, consider the difference between replacement cost and actual cash value. Replacement cost coverage ensures that your home and belongings are replaced at current market rates, whereas actual cash value coverage provides compensation based on the item's depreciated value.

- Liability Protection: Liability coverage is essential to protect yourself from financial losses in the event of accidents or injuries that occur on your property. Ensure your policy provides adequate liability protection to cover potential legal costs and damages.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered event, additional living expenses coverage can provide financial assistance for temporary housing and other necessary expenses until your home is repaired or rebuilt.

- Personal Property Coverage: Take an inventory of your personal belongings and assess their value. Ensure your policy provides sufficient coverage for your valuables, including electronics, jewelry, and other high-value items.

Conclusion: Navigating the World of House Insurance

Understanding the average cost of house insurance is just the first step in navigating the complex world of homeowners insurance. It’s crucial to strike a balance between affordable premiums and adequate coverage to protect your home and belongings. By familiarizing yourself with the factors that influence insurance costs and exploring strategies to reduce premiums, you can make informed decisions about your house insurance coverage.

Remember, every homeowner's situation is unique, and it's essential to tailor your insurance policy to your specific needs. Regularly reviewing and adjusting your coverage, as well as exploring discounts and cost-saving measures, can help ensure you have the protection you need at a price you can afford.

What is the difference between house insurance and homeowners insurance?

+House insurance and homeowners insurance are often used interchangeably, but there can be subtle differences. House insurance typically refers to the coverage for the physical structure of the house and may not include coverage for personal belongings or liability. Homeowners insurance, on the other hand, is a more comprehensive policy that covers the structure, personal property, and liability risks.

How often should I review my house insurance policy?

+It’s recommended to review your house insurance policy annually or whenever there are significant changes to your property or personal circumstances. This ensures that your coverage remains up-to-date and adequately protects your assets.

Can I negotiate my house insurance premium?

+While insurance premiums are generally based on standardized rates, you can negotiate with your insurance provider to explore potential discounts or adjustments. Discussing your specific needs and circumstances with your agent may lead to customized coverage options or premium reductions.