Average Cost Of Health Insurance For Family Of 5

Health insurance is a crucial aspect of financial planning, especially for families. As the cost of healthcare continues to rise, understanding the average expenses associated with health insurance coverage becomes increasingly important. This comprehensive guide will delve into the average cost of health insurance for a family of five, exploring various factors that influence these expenses and providing valuable insights for those seeking affordable and comprehensive healthcare coverage.

Understanding the Average Cost

The average cost of health insurance for a family of five can vary significantly based on numerous factors. It is essential to consider these variables to gain a comprehensive understanding of the financial commitment required for adequate healthcare coverage.

According to recent industry data, the average annual premium for family health insurance plans in the United States ranges from approximately $20,000 to $25,000. However, this figure is merely an estimate and can fluctuate based on several key factors.

Factors Influencing Costs

Several factors contribute to the variability in health insurance costs for families of five. These include:

- Geographic Location: Health insurance premiums can vary significantly between states and even within different regions of the same state. Factors such as the cost of living, availability of healthcare services, and state-specific regulations all play a role in determining insurance rates.

- Plan Type and Coverage: The type of health insurance plan chosen, such as PPO, HMO, or EPO, significantly impacts the overall cost. Additionally, the level of coverage, including deductibles, copayments, and out-of-pocket maximums, directly affects the premium.

- Age and Gender of Family Members: Insurance premiums are often influenced by the ages and genders of the family members. Younger individuals generally have lower premiums, while older family members may incur higher costs. Additionally, certain gender-specific health conditions can impact insurance rates.

- Tobacco Usage: Insurance companies often charge higher premiums for individuals who use tobacco products. This practice is based on the increased health risks associated with tobacco usage.

- Pre-existing Conditions: Families with members who have pre-existing medical conditions may face higher insurance costs. These conditions can trigger additional charges or even exclusions from certain plans.

- Family Size and Demographics: The size of the family, including the number of adults and children, can impact insurance premiums. Additionally, the demographic composition of the family, such as the presence of teenagers or elderly members, may influence costs.

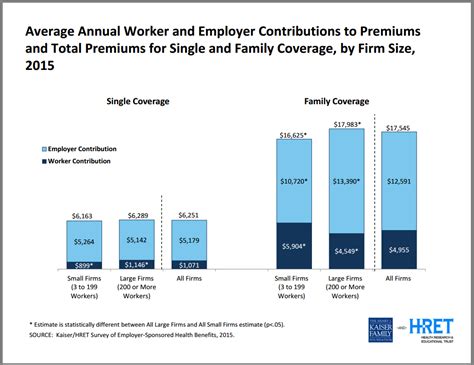

- Employer-Sponsored Plans: Many families obtain health insurance through their employers. The cost of these plans can vary based on the employer’s contribution and the specific plan chosen. In some cases, employer-sponsored plans may offer more affordable options due to group rates.

Real-World Examples

To illustrate the variability in health insurance costs, let’s consider a few real-world examples. These examples provide a glimpse into the diverse range of premiums families of five may encounter across different scenarios.

| Scenario | Estimated Annual Premium |

|---|---|

| Family with two working parents, two children, and one elderly grandparent living in a rural area with limited healthcare access. | $22,000 |

| Young family with three children, all under the age of 10, living in an urban area with access to multiple healthcare providers. | $18,500 |

| Family with a stay-at-home parent, two teenagers, and one adult with a pre-existing condition, residing in a suburban area with moderate healthcare costs. | $24,500 |

Analyzing the Data: A Comparative Approach

To gain a deeper understanding of the average cost of health insurance for a family of five, let’s delve into some comparative analyses. By examining different variables and their impact on insurance premiums, we can uncover valuable insights into the factors that drive these costs.

Geographic Comparison

The geographic location of a family significantly influences their health insurance expenses. To illustrate this, let’s compare the average annual premiums for families of five in two distinct regions of the United States.

| Region | Average Annual Premium |

|---|---|

| Northeast Urban Center | $24,000 |

| Southwestern Rural Area | $19,500 |

As seen in the table above, families residing in the Northeastern urban center face higher average premiums compared to those in the Southwestern rural area. This disparity can be attributed to various factors, including the higher cost of living and increased healthcare expenses in urban areas.

Plan Type Comparison

The choice of health insurance plan type can have a substantial impact on the overall cost. Let’s explore the differences in premiums between three common plan types for families of five.

| Plan Type | Average Annual Premium |

|---|---|

| PPO (Preferred Provider Organization) | $22,000 |

| HMO (Health Maintenance Organization) | $19,000 |

| EPO (Exclusive Provider Organization) | $20,500 |

The data above highlights that PPO plans generally carry higher premiums compared to HMO and EPO plans. This is because PPO plans offer more flexibility in choosing healthcare providers, often resulting in increased costs for insurance companies.

Demographic Comparison

The demographics of a family, including the ages and genders of its members, can influence insurance premiums. Let’s examine how these factors impact costs by comparing two hypothetical families.

| Family Composition | Average Annual Premium |

|---|---|

| Family with two parents (ages 35 and 38) and three children (ages 8, 12, and 15) | $21,000 |

| Family with two parents (ages 45 and 48) and three children (ages 18, 20, and 22) | $23,500 |

In this comparison, we observe that the family with older parents and adult children incurs higher insurance premiums. This is due to the increased healthcare needs and potential health risks associated with aging.

Strategies for Affordable Coverage

Navigating the complex landscape of health insurance can be challenging, especially when aiming for affordable coverage for a family of five. However, by employing strategic approaches and making informed decisions, families can optimize their insurance plans and potentially reduce overall costs.

Employer-Sponsored Plans

One of the most effective ways to obtain affordable health insurance is through employer-sponsored plans. Many employers offer group health insurance, which can provide significant cost savings due to the larger pool of participants. Additionally, some employers contribute a portion of the premium, further reducing the financial burden on employees.

High-Deductible Health Plans (HDHP)

Consider exploring High-Deductible Health Plans, which are often paired with Health Savings Accounts (HSAs). These plans have lower premiums but higher deductibles. While this may require a more substantial upfront payment, it can lead to long-term savings, especially for families with minimal healthcare needs.

Government Programs

Families with lower incomes may be eligible for government-sponsored health insurance programs, such as Medicaid or the Children’s Health Insurance Program (CHIP). These programs provide comprehensive coverage at little to no cost, ensuring that families receive the necessary healthcare services without financial strain.

Shopping Around and Comparison

Comparing insurance plans from different providers is essential to finding the best value. Online marketplaces, insurance brokers, and direct insurance company websites offer a wide range of options. By carefully evaluating the coverage, premiums, and out-of-pocket expenses, families can identify plans that align with their needs and budget.

Maximizing Preventive Care

Many health insurance plans offer free or low-cost preventive care services, such as annual check-ups, vaccinations, and screenings. Taking advantage of these services can help identify potential health issues early on, potentially preventing more costly treatments down the line.

FAQ

How do I choose the right health insurance plan for my family of five?

+Choosing the right health insurance plan involves careful consideration of your family’s unique needs. Evaluate factors such as your preferred healthcare providers, the level of coverage required (including deductibles and copays), and any pre-existing conditions. Additionally, compare premiums, out-of-pocket costs, and the overall value of the plan to make an informed decision.

Are there any government programs that can help with health insurance costs for families of five?

+Yes, there are government programs designed to assist families with limited financial resources. Medicaid and the Children’s Health Insurance Program (CHIP) are two such programs. Eligibility criteria vary by state, but they offer comprehensive coverage at little to no cost for qualifying families.

What is the difference between a PPO and an HMO health insurance plan?

+A PPO (Preferred Provider Organization) plan offers more flexibility in choosing healthcare providers, often without requiring referrals. However, it typically comes with higher premiums. An HMO (Health Maintenance Organization) plan, on the other hand, requires members to select a primary care physician and obtain referrals for specialist visits. HMO plans generally have lower premiums but may restrict access to certain providers.

Can I negotiate the cost of my family’s health insurance plan with the insurance company?

+Negotiating with insurance companies can be challenging, but it is not impossible. If you have a strong relationship with your insurance provider or broker, you may be able to discuss potential discounts or alternative plan options. Additionally, advocating for yourself and your family’s needs can sometimes lead to favorable outcomes.