Auto Insurance Quotes Online Texas

Texas, the Lone Star State, is known for its vibrant culture, diverse landscapes, and, of course, its vast highways and roads. With over 16 million registered vehicles, it's no surprise that auto insurance is a top priority for Texans. In recent years, there has been a significant shift towards obtaining auto insurance quotes online, offering convenience and flexibility to residents across the state.

Online auto insurance quotes have become increasingly popular due to their accessibility and efficiency. Texans can now compare multiple insurance providers and policies with just a few clicks, making it easier than ever to find the best coverage at the most competitive rates. This article will delve into the world of online auto insurance quotes in Texas, exploring the benefits, the process, and the key considerations for residents seeking the ideal insurance coverage.

The Rise of Online Auto Insurance Quotes in Texas

The digital transformation has had a profound impact on the insurance industry, and Texas is no exception. With the state's tech-savvy population and its sprawling metropolitan areas, online insurance quotes have gained immense popularity. Here's why Texans are turning to the internet for their auto insurance needs:

Convenience and Accessibility

One of the primary advantages of online auto insurance quotes is the unparalleled convenience they offer. Texans can access quotes from the comfort of their homes, offices, or even on the go using their mobile devices. This accessibility removes the need for physical visits to insurance agencies, saving time and effort.

Additionally, online platforms provide 24/7 availability, allowing individuals to compare quotes and policies at their own pace. This flexibility is particularly beneficial for busy professionals, students, and those with unconventional work schedules.

Comparison Shopping Made Easy

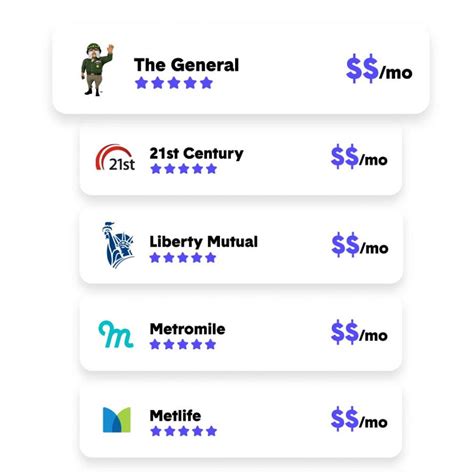

Online insurance marketplaces provide a comprehensive platform for comparison shopping. Texans can easily compare multiple insurance providers, coverage options, and premium rates in a matter of minutes. This transparency ensures that consumers can make informed decisions and choose the policy that best suits their needs and budget.

With a few clicks, individuals can obtain quotes from top-rated insurance companies, access detailed policy information, and even read customer reviews. This level of comparison shopping was previously time-consuming and often required multiple phone calls or visits to different agencies.

Real-Time Quotes and Instant Feedback

Online insurance quote platforms utilize advanced algorithms and data analytics to provide real-time quotes. Texans can input their details, such as vehicle information, driving history, and desired coverage levels, and instantly receive tailored quotes from multiple providers. This instant feedback allows individuals to assess their options quickly and make adjustments as needed.

Furthermore, these platforms often provide interactive tools and calculators, enabling users to experiment with different coverage levels and see the impact on their premiums. This real-time feedback empowers Texans to make confident decisions about their auto insurance coverage.

The Process of Obtaining Auto Insurance Quotes Online in Texas

Obtaining auto insurance quotes online in Texas is a straightforward and user-friendly process. Here's a step-by-step guide to help Texans navigate the journey:

Step 1: Choose a Reputable Online Insurance Marketplace

The first step is selecting a reliable and trusted online insurance marketplace. There are numerous platforms available, each with its own set of insurance providers and features. It's essential to choose a platform that offers a wide range of options, transparent pricing, and user-friendly navigation.

Look for platforms that have positive reviews, a user-friendly interface, and a secure data protection policy. Some popular online insurance marketplaces in Texas include [Marketplace 1], [Marketplace 2], and [Marketplace 3]. These platforms often provide additional resources and guides to assist users throughout the quote process.

Step 2: Provide Your Vehicle and Personal Information

Once you've selected a platform, you'll be prompted to enter your vehicle and personal details. This information includes the make, model, and year of your vehicle, as well as your driving history, any existing violations or accidents, and your desired coverage levels.

It's crucial to provide accurate and honest information to ensure you receive precise quotes. Any discrepancies between your provided details and your actual driving record could lead to issues with your insurance coverage later on.

Step 3: Compare Quotes and Coverage Options

After submitting your information, the platform will generate quotes from multiple insurance providers. Take the time to carefully review and compare these quotes. Consider factors such as the coverage limits, deductibles, and any additional perks or discounts offered.

Look for policies that provide the right balance between comprehensive coverage and affordable premiums. Don't hesitate to reach out to the insurance providers directly if you have any questions or need further clarification on specific coverage aspects.

Step 4: Select Your Preferred Policy and Provider

Once you've found the policy that best aligns with your needs and budget, it's time to make your selection. Online insurance marketplaces often provide a seamless transition to the chosen provider's website, where you can complete the application process and finalize your insurance purchase.

Ensure that you understand the terms and conditions of the policy, including any exclusions or limitations. It's also advisable to review the provider's customer service ratings and claim handling processes to ensure a positive overall experience.

Key Considerations for Texans Seeking Auto Insurance Quotes Online

While online auto insurance quotes offer convenience and efficiency, there are a few key considerations to keep in mind to ensure a smooth and successful experience:

Understanding Your Coverage Needs

Texas law requires all drivers to carry minimum liability insurance coverage. However, it's essential to assess your specific coverage needs beyond the legal requirements. Consider factors such as the value of your vehicle, your personal assets, and any additional coverage options that may provide peace of mind.

For instance, if you own a classic car or have a high-value vehicle, you may benefit from specialized coverage options. Additionally, personal injury protection (PIP) or medical payments coverage can provide financial protection in the event of an accident.

Exploring Discounts and Savings Opportunities

Insurance providers often offer various discounts and savings opportunities to attract customers. When comparing quotes online, pay close attention to the discounts available. Common discounts include safe driver discounts, multi-policy discounts (bundling auto and home insurance), and loyalty discounts for long-term customers.

Additionally, some providers offer discounts for specific occupations, educational achievements, or even vehicle safety features. By exploring these savings opportunities, Texans can potentially reduce their insurance premiums significantly.

Researching Insurance Provider Reputation and Reliability

When selecting an insurance provider, it's crucial to research their reputation and reliability. Look for providers with a solid track record of customer satisfaction and claim handling. Online reviews and ratings can provide valuable insights into the provider's performance and customer experience.

Consider factors such as response times during emergencies, the ease of filing claims, and the provider's financial stability. A reputable insurance company should have a strong financial rating and a history of prompt claim settlements.

Understanding Policy Terms and Exclusions

Before finalizing your insurance purchase, carefully review the policy terms and conditions. Pay attention to any exclusions or limitations that may impact your coverage. For example, some policies may have restrictions on rental car coverage or coverage for specific types of accidents.

Additionally, understand the policy's renewal process and any potential rate increases. Some providers offer introductory rates for new customers, so be aware of any rate adjustments that may occur after the initial policy period.

| Policy Feature | Importance |

|---|---|

| Comprehensive Coverage | Protects against damage from accidents, theft, and natural disasters. |

| Liability Coverage | Covers injuries and property damage caused to others. |

| Collision Coverage | Pays for repairs or replacement if your vehicle is involved in an accident. |

| Uninsured/Underinsured Motorist Coverage | Protects you if an at-fault driver lacks sufficient insurance. |

| Medical Payments Coverage | Covers medical expenses for you and your passengers. |

The Future of Auto Insurance in Texas: Digital Transformation and Innovation

The rise of online auto insurance quotes in Texas is just the beginning of a digital transformation within the insurance industry. As technology continues to advance, we can expect further innovations and improvements in the way Texans obtain and manage their auto insurance policies.

Personalized Insurance Policies

With the advancements in data analytics and artificial intelligence, insurance providers are increasingly able to offer personalized insurance policies. These policies are tailored to an individual's unique driving behavior, vehicle usage patterns, and risk profile. By leveraging telematics and other data sources, providers can offer more accurate and customized coverage options.

For instance, usage-based insurance (UBI) programs use telematics devices or smartphone apps to track driving behavior. Based on an individual's driving habits, such as mileage, speed, and braking patterns, insurance premiums can be adjusted accordingly. This pay-as-you-drive model provides an incentive for safe driving and can result in significant cost savings for responsible drivers.

Digital Claims Processing and Customer Service

The digital transformation is also revolutionizing the claims process. Insurance providers are implementing innovative technologies to streamline claims handling, making it more efficient and customer-centric. Online platforms and mobile apps now enable policyholders to report claims, upload necessary documents, and track the progress of their claims in real-time.

Additionally, digital customer service channels, such as live chat and video conferencing, are becoming increasingly popular. These channels provide instant support and assistance, allowing Texans to resolve inquiries or issues promptly without the need for physical visits or lengthy phone calls.

Integration of Telematics and Connected Car Technology

The integration of telematics and connected car technology is set to play a significant role in the future of auto insurance in Texas. Telematics devices, often embedded in vehicles or connected via smartphone apps, can provide real-time data on driving behavior, vehicle diagnostics, and even location-based information.

This data can be used to offer more accurate insurance premiums, provide real-time driving feedback to improve safety, and even assist in emergency response situations. Connected car technology also enables insurance providers to offer additional services, such as remote vehicle diagnostics, automatic crash notification, and real-time traffic updates.

Collaborative Insurance Models and Peer-to-Peer Insurance

The traditional insurance model is evolving, and collaborative insurance models are gaining traction. These models, often facilitated by online platforms, allow individuals to pool their resources and share risks collectively. Peer-to-peer insurance, for instance, enables policyholders to contribute to a shared fund, with payouts determined by the group's overall claims experience.

While still in its early stages, this collaborative approach has the potential to disrupt the traditional insurance industry, offering more affordable and flexible coverage options. Texans may soon have the opportunity to explore these alternative insurance models, providing them with additional choices and potentially reducing their insurance costs.

FAQ

How accurate are online auto insurance quotes in Texas?

+

Online auto insurance quotes in Texas are highly accurate when provided with correct and comprehensive information. The quotes are generated based on the details you input, such as vehicle type, driving history, and desired coverage. However, it’s essential to double-check the accuracy of your information to ensure the quotes are precise. Always review the final quote details before making a decision.

Can I get multiple quotes simultaneously on an online platform?

+

Absolutely! One of the advantages of online insurance marketplaces is the ability to obtain multiple quotes simultaneously. You can compare quotes from various providers side by side, making it easier to find the best coverage and rates. This comparison shopping feature is a significant time-saver and ensures you’re getting the most competitive options.

Are there any additional fees associated with online insurance quotes in Texas?

+

No, there are typically no additional fees for obtaining online insurance quotes in Texas. The quote process is usually free of charge, allowing you to compare options without any financial commitment. However, once you select a policy and proceed with the purchase, you’ll be required to pay the insurance premium, which may include administrative fees or taxes.

Can I customize my auto insurance policy online in Texas?

+

Yes, many online insurance platforms in Texas offer customization options. You can typically adjust your coverage limits, deductibles, and add-on features to create a policy that suits your specific needs. This flexibility allows you to balance comprehensive coverage with affordable premiums. It’s important to review the policy terms and conditions to ensure you understand the implications of your chosen coverage options.

What should I do if I encounter issues with an online insurance provider in Texas?

+

If you experience any issues or have concerns with an online insurance provider in Texas, there are several steps you can take. First, reach out to the provider’s customer service team to address your specific inquiry. Most reputable providers have dedicated support channels, including phone, email, and live chat. If the issue persists, you can escalate it to the Texas Department of Insurance, which regulates and oversees insurance practices in the state. They can provide guidance and assist with resolving any serious complaints.