Auto Insurance Quote State Farm

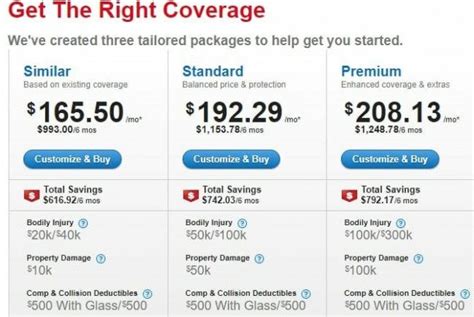

In the world of auto insurance, having a reliable and trusted provider is essential for peace of mind. State Farm, one of the leading insurance companies in the United States, offers a wide range of coverage options to cater to various needs. Obtaining an auto insurance quote from State Farm is a straightforward process, and understanding the factors that influence these quotes is key to making informed decisions about your coverage.

Understanding Auto Insurance Quotes: A State Farm Perspective

When it comes to auto insurance, State Farm provides comprehensive coverage options tailored to individual needs. Their quotes are designed to offer an accurate representation of the cost of insurance, taking into account various factors that influence premiums. By delving into the specifics of State Farm’s auto insurance quotes, we can gain a deeper understanding of how the company assesses risk and determines the appropriate level of coverage for each policyholder.

Factors Influencing State Farm Auto Insurance Quotes

Several key factors play a role in determining the cost of auto insurance with State Farm. These factors are used to assess the level of risk associated with insuring a particular individual or vehicle. Let’s explore some of the most significant influences on State Farm auto insurance quotes.

- Driving History: State Farm places a strong emphasis on an individual's driving record. A clean driving history with no accidents or violations can lead to more favorable insurance quotes. On the other hand, a history of accidents, speeding tickets, or other infractions may result in higher premiums.

- Vehicle Type and Usage: The type of vehicle being insured and its intended usage are crucial factors. High-performance sports cars, for instance, may incur higher insurance costs due to their association with increased risk. Similarly, vehicles used primarily for business purposes or long-distance travel may attract different rates compared to those used solely for personal commuting.

- Age and Experience: Age is a significant factor in auto insurance, with younger drivers often facing higher premiums due to their lack of experience on the road. State Farm takes into account the age of the primary driver and may offer discounts for more experienced drivers with a proven track record of safe driving.

- Location: The geographical location where the vehicle is primarily driven and garaged can impact insurance rates. Areas with higher rates of accidents, theft, or vandalism may result in increased premiums. State Farm considers regional factors when determining insurance quotes to ensure an accurate assessment of risk.

- Coverage Options: The level of coverage chosen by the policyholder significantly influences the insurance quote. State Farm offers a range of coverage options, including liability, collision, comprehensive, and additional add-ons. The more comprehensive the coverage, the higher the premium is likely to be.

- Discounts and Rewards: State Farm is known for offering various discounts and rewards to policyholders. These can include multi-policy discounts (bundling auto insurance with other State Farm policies), safe driver discounts, good student discounts, and loyalty rewards for long-term customers. Taking advantage of these discounts can lead to significant savings on insurance quotes.

| Discount Type | Description |

|---|---|

| Multi-Policy Discount | Save by bundling your auto insurance with other State Farm policies like home or renters insurance. |

| Safe Driver Discount | Reward for maintaining a clean driving record with no accidents or violations. |

| Good Student Discount | Offered to students with good grades, encouraging academic excellence. |

| Loyalty Rewards | Long-term customers may be eligible for loyalty discounts, rewarding their continued trust. |

Obtaining a State Farm Auto Insurance Quote: A Step-by-Step Guide

Securing an auto insurance quote from State Farm is a simple and straightforward process. Whether you prefer online convenience or personalized assistance, State Farm offers multiple avenues to obtain a quote that aligns with your preferences.

Online Quote Process

State Farm’s official website provides an easy-to-use online quote tool. Follow these steps to obtain an auto insurance quote online:

- Visit the State Farm Website: Navigate to www.statefarm.com and locate the "Get a Quote" or "Auto Insurance Quote" option, typically found in the navigation bar or a prominent banner on the homepage.

- Enter Basic Information: You'll be prompted to provide some initial details, including your name, contact information, and the state where your vehicle is registered. This information helps State Farm understand your specific needs and provide an accurate quote.

- Vehicle Details: Enter the make, model, and year of your vehicle. State Farm will use this information to assess the vehicle's value, safety features, and potential risks associated with its type and usage.

- Driver Information: Provide details about the primary driver, including their age, driving history, and any relevant licenses or endorsements. This step allows State Farm to evaluate the driver's risk profile and offer an appropriate quote.

- Coverage Preferences: Select the level of coverage you desire. State Farm offers customizable options, allowing you to choose the specific types and limits of coverage that best suit your needs and budget. Consider factors like liability limits, collision coverage, comprehensive coverage, and any additional add-ons you may require.

- Discount Eligibility: During the quote process, State Farm will prompt you to identify any applicable discounts. As mentioned earlier, discounts can significantly reduce your insurance costs. Make sure to explore all eligible discounts, such as multi-policy discounts, safe driver discounts, or loyalty rewards.

- Review and Customize: Once you've provided all the necessary information, State Farm will generate a quote based on your inputs. Carefully review the quote, ensuring that all details are accurate and reflect your desired coverage. You can customize the quote by adjusting coverage limits, deductibles, or adding/removing optional coverages to find the best balance between cost and protection.

- Purchase or Continue Shopping: If you're satisfied with the quote, you can proceed with purchasing the policy. State Farm offers secure online payment options for your convenience. Alternatively, if you'd like to explore further or compare quotes with other providers, you can save the quote for future reference or continue shopping around.

In-Person or Phone Quote

For those who prefer a more personalized approach, State Farm offers the option of obtaining an auto insurance quote through an in-person meeting with a local agent or over the phone. Here’s how you can secure a quote through these channels:

- Find a Local Agent: Use State Farm's agent locator tool on their website to find a local agent near you. Alternatively, you can search for State Farm agents in your area using online directories or referrals from friends and family.

- Schedule an Appointment: Contact the local agent's office and schedule a convenient time for an in-person meeting. During the appointment, the agent will guide you through the quote process, asking relevant questions to understand your insurance needs and provide personalized recommendations.

- Provide Necessary Information: Similar to the online quote process, you'll need to provide details about your vehicle, driving history, and desired coverage. The agent will use this information to generate a quote tailored to your circumstances.

- Review and Discuss: Once the quote is generated, the agent will walk you through the coverage options and explain the various components of the policy. This allows you to ask questions, clarify any doubts, and make informed decisions about your coverage. The agent can also assist you in exploring available discounts and customizing the policy to meet your specific needs.

- Purchase or Continue Shopping: If you're satisfied with the quote and feel comfortable with the coverage and pricing, you can proceed with purchasing the policy directly from the agent. State Farm agents are equipped to process payments and assist with any necessary paperwork. If you prefer to compare quotes or seek additional information, the agent can provide the quote for your consideration and allow you to make a decision at your own pace.

Comparing Quotes: Weighing Your Options

Obtaining multiple quotes is a common practice when shopping for auto insurance. It allows you to compare different providers, coverage options, and pricing to find the best fit for your needs. Here’s how you can effectively compare State Farm quotes with those from other insurance companies:

- Gather Multiple Quotes: In addition to your State Farm quote, obtain quotes from at least two or three other reputable insurance providers. This ensures a comprehensive comparison and helps you identify the most competitive rates and coverage options available.

- Review Coverage Details: Carefully examine the coverage limits, deductibles, and any additional features or exclusions in each quote. Ensure that you're comparing quotes with similar coverage levels to make an accurate assessment of value.

- Consider Discounts and Rewards: Compare the discounts and rewards offered by each provider. State Farm's discounts, as mentioned earlier, can be quite competitive. However, other providers may also offer unique discounts or rewards that could potentially lower your overall insurance costs.

- Evaluate Customer Service and Reputation: Beyond pricing and coverage, consider the reputation and customer service track record of each provider. Research online reviews, customer testimonials, and industry ratings to assess the level of satisfaction and trustworthiness associated with each insurance company.

- Assess Financial Stability: When comparing quotes, it's important to consider the financial stability of the insurance providers. State Farm, as a well-established company, has a strong financial foundation. However, it's worth checking the financial ratings and stability of other providers to ensure they can provide long-term security and reliable coverage.

- Choose the Best Fit: After thoroughly reviewing and comparing the quotes, choose the provider that offers the best combination of coverage, pricing, discounts, and overall customer satisfaction. Consider your specific needs, budget, and preferences when making your final decision.

State Farm Auto Insurance: A Comprehensive Overview

State Farm’s auto insurance policies offer a wide range of coverage options to protect policyholders against various risks associated with owning and operating a vehicle. Understanding the different types of coverage available is crucial for making informed decisions about your insurance needs. Here’s an overview of the key coverage components offered by State Farm.

Liability Coverage

Liability coverage is a fundamental component of auto insurance, providing protection in the event that you are found at fault for an accident. State Farm offers various liability coverage options to safeguard policyholders against financial losses resulting from bodily injury or property damage claims made by others.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by individuals injured in an accident caused by the policyholder. State Farm recommends carrying sufficient bodily injury liability coverage to protect against potential lawsuits and ensure financial stability.

- Property Damage Liability: Property damage liability coverage reimburses the cost of repairing or replacing damaged property, such as other vehicles, structures, or personal belongings, in accidents caused by the policyholder. It helps cover the expenses associated with repairing or replacing damaged property, providing financial protection for the policyholder.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are essential components of auto insurance, providing protection for the policyholder’s own vehicle in various scenarios. Let’s explore these coverage options in more detail.

- Collision Coverage: Collision coverage pays for repairs or replacement of the insured vehicle if it is damaged in an accident, regardless of fault. It covers a wide range of incidents, including collisions with other vehicles, objects, or animals, as well as rollovers. Collision coverage is particularly beneficial for newer or more valuable vehicles, ensuring that repair or replacement costs are covered.

- Comprehensive Coverage: Comprehensive coverage provides protection for the insured vehicle against damages caused by non-collision incidents. This includes events such as theft, vandalism, natural disasters, falling objects, and other unforeseen circumstances. Comprehensive coverage is essential for protecting your vehicle from risks beyond your control and ensuring that you're not left with unexpected repair or replacement costs.

Additional Coverage Options

In addition to the core liability, collision, and comprehensive coverage, State Farm offers a range of optional coverage enhancements to cater to specific needs and provide added peace of mind. Here are some of the additional coverage options available:

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection in the event that you are involved in an accident with a driver who does not have sufficient insurance to cover the damages. It helps ensure that you are financially protected and can recover damages from the at-fault driver.

- Medical Payments Coverage: Medical payments coverage, often referred to as MedPay, provides additional coverage for medical expenses incurred by the policyholder and their passengers in the event of an accident, regardless of fault. It can help cover costs such as doctor visits, hospital stays, and other medical treatments, ensuring that you have the necessary funds to cover these expenses promptly.

- Rental Car Reimbursement: Rental car reimbursement coverage provides financial assistance when you need to rent a vehicle due to an insured loss. It covers the cost of renting a substitute vehicle while your own vehicle is being repaired or replaced, ensuring that you have a reliable means of transportation during this period.

- Gap Coverage: Gap coverage, also known as loan/lease payoff coverage, is designed to protect policyholders who lease or finance their vehicles. In the event of a total loss, gap coverage bridges the gap between the actual cash value of the vehicle and the outstanding balance on the lease or loan, ensuring that you're not left with a financial burden.

- Roadside Assistance: Roadside assistance coverage provides emergency services such as towing, battery jump-starts, flat tire changes, and fuel delivery. It offers peace of mind by ensuring that you have access to immediate assistance when your vehicle breaks down or experiences mechanical issues.

Customizing Your Coverage: Finding the Right Balance

When selecting auto insurance coverage, it’s important to find the right balance between cost and protection. State Farm understands that every individual has unique needs and offers customizable coverage options to meet those needs. Here are some considerations to help you customize your coverage:

- Assess Your Risks: Evaluate your personal driving habits, the value of your vehicle, and the likelihood of accidents or other incidents. Consider factors such as your daily commute, the type of driving you do (e.g., city vs. highway), and any potential risks associated with your geographical location.

- Determine Your Budget: Set a realistic budget for your auto insurance coverage. While it's important to have adequate protection, you also want to ensure that your insurance premiums are affordable and fit within your financial means.

- Explore Coverage Options: Familiarize yourself with the various coverage options offered by State Farm. Understand the differences between liability, collision, comprehensive, and additional coverages, and consider which options are most relevant to your needs and circumstances.

- Adjust Coverage Limits: State Farm allows you to customize your coverage limits within certain parameters. Consider increasing your liability limits to provide greater financial protection in the event of an accident. Similarly, you can adjust collision and comprehensive coverage limits to align with the value of your vehicle and your desired level of protection.

- Consider Deductibles: Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. By selecting a higher deductible, you can often lower your insurance premiums. However, it's important to choose a deductible that you can comfortably afford in the event of a claim.

- Evaluate Additional Coverages: Assess whether the additional coverage options offered by State Farm are relevant to your needs. For example, if you frequently drive in areas with a high risk of theft or vandalism, comprehensive coverage may be a wise choice. Similarly, if you lease or finance your vehicle, gap coverage can provide valuable protection.

State Farm Auto Insurance: A Trusted Choice for Comprehensive Protection

State Farm has established itself as a trusted provider of auto insurance, offering a comprehensive range of coverage options to meet the diverse needs of policyholders. With a strong focus on customer satisfaction and a commitment to providing personalized service, State Farm ensures that its policyholders receive the protection and support they require. By understanding the factors that influence State Farm auto insurance quotes and exploring the