Arizona Insurance Medical

In the state of Arizona, medical insurance is a vital aspect of healthcare, ensuring that residents have access to quality medical services without the burden of overwhelming costs. With a diverse population and varying healthcare needs, Arizona's insurance landscape offers a range of options to cater to different demographics and lifestyles. This article aims to delve into the specifics of Arizona insurance, with a focus on medical coverage, providing an in-depth analysis of the policies, providers, and the impact on the healthcare system.

Understanding Arizona’s Medical Insurance Market

Arizona boasts a robust medical insurance market, with a wide array of providers and plans tailored to meet the diverse needs of its residents. From comprehensive coverage plans to more specialized options, Arizonans have a variety of choices when it comes to safeguarding their health and financial well-being.

One of the key strengths of Arizona's insurance market is its competitiveness. With multiple insurers vying for customers, residents can often find competitive rates and a wide range of benefits. This dynamic market ensures that insurers must continuously innovate and adapt to remain relevant, often resulting in more comprehensive coverage and improved customer satisfaction.

Key Insurers and Their Offerings

Several major insurers dominate the Arizona medical insurance landscape, each bringing its unique strengths and coverage options to the table. Some of the prominent players include:

- Blue Cross Blue Shield of Arizona: Known for its extensive network of healthcare providers and flexible plan options, BCBSAZ is a go-to choice for many Arizonans. They offer a range of plans, from basic coverage to more comprehensive options, ensuring there's something for everyone.

- UnitedHealthcare: With a focus on digital innovation and personalized care, UnitedHealthcare provides a seamless experience for its members. Their plans often include additional benefits, such as fitness tracking incentives and virtual healthcare services.

- Cigna: Cigna is renowned for its global reach and strong network of providers, making it an excellent choice for those who travel frequently or require specialized medical attention. Their plans often cater to specific healthcare needs, ensuring personalized coverage.

- Health Net: Health Net is dedicated to community-based care, offering plans that prioritize local healthcare providers and services. Their focus on community engagement ensures a more personalized healthcare experience for members.

These insurers, among others, contribute to a vibrant and competitive medical insurance market in Arizona. Each brings its unique value proposition, ensuring that Arizonans have a diverse range of options to choose from when selecting their medical insurance plans.

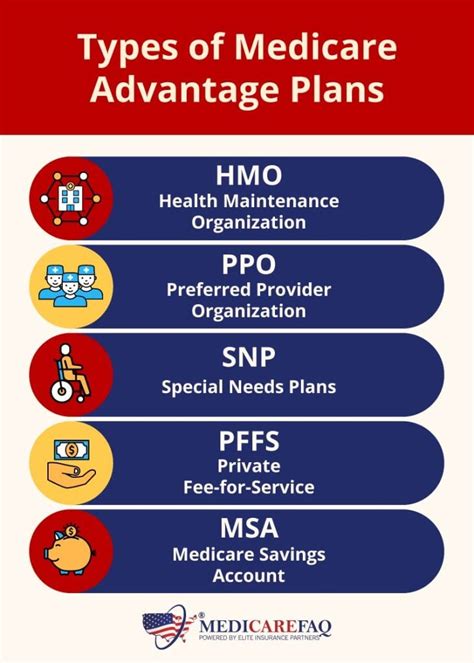

Types of Medical Insurance Plans in Arizona

Arizona offers a spectrum of medical insurance plans, each designed to cater to specific needs and preferences. Understanding the different types of plans is crucial for Arizonans to make informed decisions about their healthcare coverage.

Health Maintenance Organization (HMO) Plans

HMO plans are a popular choice in Arizona, offering comprehensive coverage at a fixed monthly cost. These plans typically require members to select a primary care physician (PCP) who coordinates their healthcare needs. Referrals are often necessary for specialized care, ensuring a more coordinated and cost-effective approach to healthcare.

HMO plans in Arizona often include a wide range of benefits, such as preventative care, prescription drug coverage, and specialized services. They are particularly beneficial for individuals who prefer a more structured healthcare approach and value the convenience of having a dedicated PCP.

Preferred Provider Organization (PPO) Plans

PPO plans provide Arizonans with more flexibility in choosing their healthcare providers. Unlike HMO plans, PPOs do not require a designated PCP, allowing members to visit any in-network provider without a referral. This freedom of choice makes PPO plans appealing to those who prefer a more spontaneous healthcare approach.

While PPO plans often come with higher premiums, they offer the advantage of lower out-of-pocket costs when using in-network providers. Additionally, PPO plans typically cover a wider range of services, including emergency care and specialized treatments, making them a comprehensive choice for many Arizonans.

Exclusive Provider Organization (EPO) Plans

EPO plans represent a unique middle ground between HMO and PPO plans. Like HMO plans, EPO plans typically require members to choose a PCP and obtain referrals for specialized care. However, unlike HMOs, EPO plans do not cover out-of-network services, encouraging members to utilize a broad network of in-network providers.

EPO plans in Arizona often appeal to those who prioritize affordability and the convenience of a PCP while still valuing some flexibility in provider choice. With a focus on in-network care, EPO plans can offer cost-effective coverage without sacrificing the benefits of coordinated healthcare.

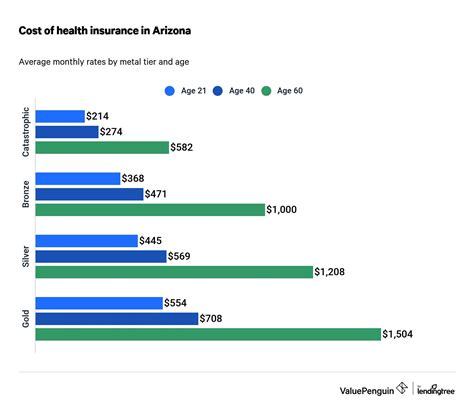

Comparing Costs and Coverage: A Detailed Analysis

When it comes to medical insurance, one of the most critical considerations is the balance between costs and coverage. Arizona residents must navigate a complex landscape of plans and providers to find the right fit for their healthcare needs and financial situations.

Understanding Premiums and Deductibles

Premiums are the monthly costs associated with medical insurance plans. In Arizona, premiums can vary significantly depending on the type of plan, the insurer, and the specific benefits included. HMO plans, for instance, often have lower premiums compared to PPO or EPO plans, as they require a more structured approach to healthcare.

Deductibles, on the other hand, are the amounts individuals must pay out of pocket before their insurance coverage kicks in. Higher deductibles can result in lower premiums, making this an important consideration for those looking to balance costs and coverage. Understanding the premium-deductible relationship is crucial for Arizonans to make informed decisions about their medical insurance.

Analyzing Coverage Limits and Benefits

Beyond premiums and deductibles, Arizonans must consider the specific coverage limits and benefits offered by different insurance plans. Some plans may have higher coverage limits for certain services, such as prescription drugs or mental health services, while others may provide more comprehensive coverage for preventative care.

Additionally, it's essential to examine the fine print of insurance policies. Some plans may have restrictions on certain treatments or services, while others may require prior authorization for specific procedures. Understanding these nuances can help Arizonans avoid unexpected costs and ensure they receive the care they need without financial strain.

| Plan Type | Premium Range | Deductible Range | Coverage Highlights |

|---|---|---|---|

| HMO | $250 - $450/month | $500 - $1,500 | Comprehensive coverage, coordinated care, often includes preventative services |

| PPO | $300 - $600/month | $1,000 - $2,500 | Flexible provider choice, covers a wide range of services, including emergency care |

| EPO | $275 - $500/month | $750 - $2,000 | Combination of HMO and PPO features, encourages in-network care, provides coordinated services |

Impact of Medical Insurance on Arizona’s Healthcare System

Medical insurance plays a pivotal role in shaping Arizona’s healthcare system, influencing access to care, the quality of services, and the overall health of the population. Understanding this impact is essential for policymakers, healthcare providers, and individuals alike.

Access to Healthcare Services

One of the most significant impacts of medical insurance is its ability to enhance access to healthcare services. With insurance coverage, Arizonans can afford the cost of medical treatments, preventative care, and specialized services, ensuring they receive the care they need when they need it.

Additionally, medical insurance often provides financial protection against catastrophic health events, ensuring individuals can access necessary treatments without facing bankruptcy. This financial security encourages Arizonans to seek timely medical attention, leading to better health outcomes and a reduced burden on the healthcare system.

Quality of Healthcare and Patient Outcomes

Medical insurance not only facilitates access to healthcare but also contributes to the overall quality of services. With insurance coverage, healthcare providers can invest in state-of-the-art equipment, advanced treatments, and specialized training, leading to improved patient outcomes.

Furthermore, medical insurance often includes incentives for preventative care and wellness programs. These initiatives encourage Arizonans to adopt healthier lifestyles, leading to reduced healthcare costs and improved long-term health. By focusing on prevention, insurance providers and healthcare professionals can work together to create a healthier Arizona.

Financial Sustainability of Healthcare Providers

Medical insurance is a crucial component in ensuring the financial sustainability of healthcare providers in Arizona. With insurance coverage, healthcare facilities can secure a steady stream of revenue, allowing them to invest in infrastructure, research, and advanced technologies.

Additionally, insurance providers often negotiate rates with healthcare facilities, ensuring a fair and sustainable financial model for both parties. This balance between insurance coverage and provider revenue is essential for maintaining a robust healthcare system in Arizona, ensuring that residents have access to quality care without placing an undue burden on providers.

The Future of Medical Insurance in Arizona

As Arizona continues to evolve and adapt to changing healthcare needs, the future of medical insurance holds exciting possibilities and challenges. Understanding these potential developments is crucial for stakeholders to prepare for the evolving landscape and ensure continued access to quality healthcare.

Emerging Trends and Innovations

The medical insurance industry in Arizona is poised for significant innovations and trends that will shape the future of healthcare. One emerging trend is the increasing focus on value-based care, where insurance providers and healthcare facilities collaborate to deliver high-quality, cost-effective services.

Additionally, the integration of technology is expected to play a pivotal role in the future of medical insurance. From telemedicine services to digital health records, technology will enhance the efficiency and accessibility of healthcare, making it more convenient and personalized for Arizonans.

Addressing Healthcare Disparities

Despite the progress made in healthcare access and quality, Arizona, like many other states, faces challenges in addressing healthcare disparities. Certain demographics, such as rural communities or underserved populations, often face barriers to accessing quality healthcare. The future of medical insurance must prioritize strategies to bridge these gaps and ensure equitable access for all Arizonans.

Insurance providers and policymakers can work together to develop targeted initiatives, such as community-based healthcare programs or expanded coverage options, to address these disparities. By focusing on inclusivity and accessibility, the future of medical insurance in Arizona can contribute to a healthier and more resilient population.

Conclusion: A Brighter Healthcare Future for Arizona

Arizona’s medical insurance landscape is a dynamic and evolving ecosystem, offering a range of options to meet the diverse needs of its residents. From competitive insurance providers to a spectrum of plan choices, Arizonans have the tools to take control of their healthcare and financial well-being.

As we look to the future, the potential for innovation and improvement in medical insurance is vast. By embracing emerging trends, addressing healthcare disparities, and prioritizing value-based care, Arizona can ensure a brighter and healthier future for its residents. The journey towards a more accessible and equitable healthcare system is ongoing, and with the right strategies and collaboration, Arizona can lead the way.

What is the average cost of medical insurance in Arizona?

+The average cost of medical insurance in Arizona can vary based on several factors, including the type of plan, the insurer, and individual demographics. As of [current year], the average monthly premium for an individual HMO plan is approximately 350, while PPO plans average around 425. EPO plans, offering a middle ground, typically cost around $375 per month. It’s important to note that these averages can fluctuate based on various factors, and individuals should carefully review their options to find the best fit for their needs and budget.

How do I choose the right medical insurance plan for me?

+Choosing the right medical insurance plan involves careful consideration of your healthcare needs and financial situation. Assess your current and potential future healthcare requirements, including any ongoing medical conditions or anticipated treatments. Evaluate the coverage limits, benefits, and out-of-pocket costs of different plans. Additionally, consider the flexibility of provider choice and the overall value proposition of each plan. It’s often beneficial to consult with an insurance broker or advisor who can guide you through the process and help you make an informed decision.

What are some tips for reducing the cost of medical insurance in Arizona?

+Reducing the cost of medical insurance in Arizona involves a combination of strategic choices and lifestyle considerations. Opting for higher deductibles can result in lower premiums, providing a cost-effective option for those who prioritize affordability. Additionally, maintaining a healthy lifestyle and utilizing preventative care services can reduce the need for costly treatments in the long run. Finally, comparing plans and insurers is essential to finding the best value. Shopping around and seeking expert advice can help you identify the most cost-effective options tailored to your needs.