Apartments Renters Insurance

Securing your peace of mind and protecting your valuable possessions is essential, especially when you're renting an apartment. Apartment renters insurance is a vital component of your financial security and can provide much-needed coverage in various situations. In this comprehensive guide, we will delve into the world of apartment renters insurance, exploring its benefits, what it covers, how to choose the right policy, and more. Whether you're a seasoned renter or new to the world of insurance, this article will equip you with the knowledge to make informed decisions about protecting your rental home.

Understanding Apartment Renters Insurance

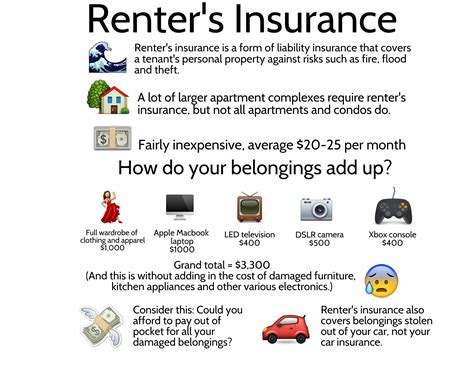

Apartment renters insurance, also known as tenants insurance, is a type of property insurance specifically designed for individuals who rent apartments, condos, or homes. Unlike homeowners insurance, which covers the dwelling itself and its structures, renters insurance focuses on safeguarding your personal belongings and providing liability coverage.

Here's a breakdown of the key components of apartment renters insurance:

Personal Property Coverage

The primary purpose of renters insurance is to protect your personal belongings. This coverage typically includes:

- Furniture and Appliances: From your cozy sofa to the fridge that keeps your groceries fresh, renters insurance covers these items if they are damaged or lost due to a covered event.

- Electronics: Your television, laptop, and gaming consoles are valuable investments. Renters insurance can help replace them if they are stolen or damaged.

- Clothing and Jewelry: Whether it's your favorite pair of shoes or a precious family heirloom, renters insurance can provide coverage for these items.

- Artwork and Collectibles: If you have a passion for art or collect rare items, renters insurance can ensure they are protected.

It's important to note that personal property coverage usually has limits, so it's crucial to assess the value of your belongings and choose a policy with adequate coverage.

Liability Coverage

Liability coverage is an essential aspect of renters insurance, as it protects you from financial loss if someone is injured in your rental unit or if you accidentally cause damage to someone else's property.

Here's what liability coverage typically entails:

- Guest Injuries: If a guest sustains an injury while in your apartment, renters insurance can help cover the medical expenses and potential legal fees.

- Property Damage: In case you accidentally cause damage to someone else's property, liability coverage can provide financial protection.

- Legal Defense: If you are sued due to an accident or injury, renters insurance may cover the costs of hiring a lawyer to defend you.

Additional Living Expenses

In the unfortunate event that your rental unit becomes uninhabitable due to a covered loss, additional living expenses coverage can provide financial assistance. This coverage typically covers the cost of temporary housing and meals until you can return to your apartment.

Why Do Renters Need Insurance?

Renters insurance offers a range of benefits that can provide peace of mind and financial protection. Here are some key reasons why it's essential for apartment dwellers:

Protection Against Loss

Apartment renters insurance ensures that your belongings are covered in case of unforeseen events such as fire, theft, or vandalism. Losing your possessions can be devastating, but with the right insurance, you can rest easy knowing you can replace them.

Liability Protection

Accidents happen, and renters insurance provides a safety net if you are held responsible for causing injury or property damage. This coverage can protect you from potentially devastating financial consequences.

Peace of Mind

Knowing that you have adequate insurance coverage allows you to focus on enjoying your rental home without constant worry. Renters insurance provides a sense of security and can help you sleep better at night.

Affordability

Renters insurance is often more affordable than many people realize. The cost of a policy can vary based on factors such as location, the value of your belongings, and the level of coverage you choose. However, the peace of mind it provides is well worth the investment.

Choosing the Right Renters Insurance

When selecting a renters insurance policy, it's crucial to consider various factors to ensure you get the best coverage for your needs. Here are some key steps to guide you through the process:

Assess Your Needs

Start by evaluating the value of your personal belongings. Consider the cost of replacing your furniture, electronics, and other valuables. This will help you determine the appropriate amount of coverage you require.

Compare Providers

Shop around and compare different insurance providers. Look for companies that offer comprehensive coverage at competitive rates. Read reviews and check their financial stability to ensure they are reputable and reliable.

Understand Policy Details

Carefully review the policy details to ensure you understand what is and isn't covered. Pay attention to exclusions, deductibles, and any additional endorsements or riders you may need.

Choose the Right Coverage Limits

Select coverage limits that align with the value of your possessions. Ensure you have adequate liability coverage to protect against potential lawsuits. It's better to be over-insured than under-insured in case of an unfortunate event.

Consider Additional Coverage

Apartment renters insurance policies often come with optional endorsements or riders that can enhance your coverage. Consider adding coverage for valuable items, such as jewelry or artwork, if needed.

Real-Life Examples of Renters Insurance Claims

Understanding how renters insurance works in real-life scenarios can provide valuable insights into its importance. Here are a few examples of how renters insurance has come to the rescue:

Fire Damage

Imagine a fire breaks out in your apartment building, causing significant damage to your unit. With renters insurance, you can file a claim to cover the cost of replacing your furniture, electronics, and clothing that were destroyed in the fire.

Theft Protection

If you become a victim of theft, renters insurance can provide coverage for stolen items. Whether it's your laptop, jewelry, or other valuables, the insurance can help you recover their value.

Liability Coverage in Action

Suppose a guest slips and falls in your apartment, resulting in an injury. Renters insurance can provide liability coverage to help cover the medical expenses and any legal fees associated with the accident.

Tips for Maximizing Your Renters Insurance

To ensure you make the most of your renters insurance policy, consider these valuable tips:

Create an Inventory

Maintain a detailed inventory of your belongings. Take photos or videos of your possessions and store them in a safe place. This documentation can be invaluable when filing a claim.

Review Your Policy Regularly

Life changes, and so do your insurance needs. Review your policy annually to ensure it aligns with your current situation. Update your coverage limits and consider adding any new valuable items you acquire.

Understand Your Deductible

Familiarize yourself with your policy's deductible. The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Choose a deductible that aligns with your financial situation.

Consider Bundling with Other Policies

Many insurance companies offer discounts when you bundle your renters insurance with other policies, such as auto insurance. This can be a cost-effective way to save on your insurance premiums.

The Future of Renters Insurance

As technology advances and insurance companies embrace innovation, the future of renters insurance looks promising. Here's a glimpse into what we can expect:

Digital Insurance Solutions

Insurance providers are increasingly adopting digital platforms to enhance the customer experience. Expect more user-friendly interfaces, convenient online claims processes, and real-time policy management.

Personalized Coverage

With the advent of data analytics, insurance companies can offer more personalized coverage options. This means renters insurance policies may become even more tailored to individual needs and circumstances.

Enhanced Claims Processing

Advancements in technology can streamline the claims process, making it faster and more efficient. Insurance companies may leverage AI and machine learning to expedite claim assessments and payouts.

Insurtech Partnerships

The collaboration between insurance companies and Insurtech startups is on the rise. These partnerships can lead to innovative solutions, such as smart home integration and risk assessment tools, to further enhance renters insurance.

Frequently Asked Questions

What does renters insurance typically cover?

+Renters insurance typically covers personal property, liability, and additional living expenses. Personal property coverage protects your belongings in case of damage or loss due to covered events. Liability coverage safeguards you if you are held responsible for injuries or property damage. Additional living expenses coverage provides financial assistance if your rental unit becomes uninhabitable.

Is renters insurance mandatory for apartment dwellers?

+While renters insurance is not mandatory, it is highly recommended. Renters insurance provides valuable protection for your belongings and offers liability coverage, which can be crucial in case of accidents or injuries. It's a wise investment to ensure your financial well-being.

How much does renters insurance cost?

+The cost of renters insurance can vary depending on factors such as location, the value of your belongings, and the level of coverage you choose. On average, renters insurance policies range from $15 to $30 per month. However, it's important to compare quotes from different providers to find the best coverage at a competitive rate.

Can I add additional coverage for valuable items?

+Yes, many renters insurance policies offer the option to add additional coverage for valuable items such as jewelry, artwork, or electronics. These endorsements or riders can provide enhanced protection for your most precious possessions.

How do I file a claim with my renters insurance policy?

+To file a claim, contact your insurance provider and provide them with the details of the incident. They will guide you through the claims process, which typically involves documenting the loss or damage and submitting supporting evidence. It's important to act promptly and follow the insurer's instructions to ensure a smooth claims experience.

Apartment renters insurance is a vital aspect of financial planning for renters. By understanding the benefits, coverage options, and real-life applications, you can make informed decisions to protect your rental home and valuable possessions. Remember, it’s always better to be prepared and have the right insurance coverage in place.