Apartment Insurance

Apartment living offers a unique set of considerations when it comes to insurance. Unlike homeowners, renters face distinct challenges and benefits when protecting their belongings and ensuring their liability. Apartment insurance, also known as renters insurance, is a specialized form of coverage designed to safeguard tenants and their possessions within the confines of their leased residences. This comprehensive guide delves into the intricacies of apartment insurance, exploring its importance, coverage options, and the peace of mind it brings to apartment dwellers across various locations.

Understanding Apartment Insurance: A Vital Layer of Protection

In the world of property insurance, apartment insurance stands as a critical component for renters. It serves as a financial safety net, offering protection against losses stemming from unforeseen events such as theft, fire, or natural disasters. This coverage extends beyond the physical apartment, encompassing personal belongings, liability, and even additional living expenses in the event of a covered loss.

One of the key advantages of apartment insurance is its adaptability. Policies can be tailored to suit individual needs, providing coverage for a wide range of scenarios. Whether you're a student renting your first apartment or a long-term tenant, apartment insurance ensures that your belongings are protected, and you're shielded from potential financial burdens arising from accidents or damage.

Moreover, apartment insurance is particularly crucial given the rising prevalence of natural disasters and extreme weather events. With climate change impacting regions worldwide, the likelihood of floods, hurricanes, or wildfires is higher than ever. Apartment insurance policies often include coverage for such events, offering a vital layer of protection against the unforeseen.

Key Components of Apartment Insurance

Apartment insurance policies typically encompass several critical components, each designed to address specific risks and provide comprehensive protection. These components include:

- Personal Property Coverage: This coverage protects your belongings, such as furniture, electronics, clothing, and personal items, against theft, fire, and other covered perils. It ensures that you can replace or repair damaged or stolen items, providing peace of mind and financial support in the event of a loss.

- Liability Coverage: Liability insurance is a vital aspect of apartment insurance, protecting you from financial losses resulting from accidents or injuries that occur within your apartment. If a guest trips and falls, for instance, this coverage can help cover medical expenses and potential legal fees, safeguarding your finances and providing crucial support during challenging times.

- Additional Living Expenses: In the event of a covered loss that renders your apartment uninhabitable, additional living expenses coverage steps in. It covers the costs of temporary housing, meals, and other necessary expenses until your apartment is restored or you find a new residence. This provision ensures that you can maintain your standard of living and manage unexpected expenses during a challenging period.

- Medical Payments Coverage: Medical payments coverage provides financial assistance for medical expenses incurred by guests who suffer injuries within your apartment. It offers a quick and straightforward way to cover medical bills without the need for a liability claim, streamlining the process and ensuring prompt assistance when it's needed most.

Tailoring Your Apartment Insurance Policy: A Personalized Approach

Every apartment dweller has unique needs and circumstances. Apartment insurance policies can be customized to address these specific requirements, ensuring that you’re adequately covered without paying for unnecessary coverage.

When tailoring your apartment insurance policy, consider the following factors:

- Value of Your Belongings: Assess the total value of your personal property, including furniture, electronics, and valuable items. Ensure that your policy limits are sufficient to cover the replacement or repair costs of these items.

- Liability Risks: Evaluate the potential liability risks associated with your apartment. Consider factors such as the number of guests you typically host, the presence of pets, and any potential hazards within your apartment. Adjust your liability coverage limits accordingly to provide adequate protection.

- Additional Living Expenses: Determine the average cost of living in your area and the length of time it would take to restore or relocate after a covered loss. Ensure that your additional living expenses coverage limits are sufficient to cover these costs during the estimated recovery period.

- Deductibles and Premiums: Choose deductibles that align with your financial comfort level. Higher deductibles can lead to lower premiums, but it's essential to select a deductible that you can afford in the event of a claim. Balancing deductibles and premiums is a crucial aspect of customizing your policy to meet your needs and budget.

By carefully considering these factors and working with an insurance professional, you can create a personalized apartment insurance policy that provides the right level of coverage at a competitive price.

Apartment Insurance for Students and Young Professionals

For students and young professionals renting their first apartments, apartment insurance is an essential consideration. This demographic often faces unique challenges, including limited financial resources and a higher likelihood of theft or damage due to shared living spaces and a transient lifestyle.

Apartment insurance policies for students and young professionals can be tailored to provide comprehensive coverage at an affordable price. These policies typically include personal property coverage, liability protection, and additional living expenses, ensuring that young renters are protected from financial losses and have the support they need to recover from unforeseen events.

| Policy Component | Coverage Details |

|---|---|

| Personal Property | Covers belongings like laptops, clothing, and furniture against theft, fire, and other perils. |

| Liability | Protects against financial losses due to accidents or injuries within the apartment, covering medical expenses and legal fees. |

| Additional Living Expenses | Provides funds for temporary housing and other necessary expenses if the apartment becomes uninhabitable due to a covered loss. |

Additionally, many apartment insurance providers offer discounts for students and young professionals, making it more affordable to obtain the necessary coverage. These discounts may be based on factors such as good grades, enrollment in specific educational programs, or membership in certain organizations.

Apartment Insurance and Landlord-Tenant Relationships

Apartment insurance plays a crucial role in maintaining a harmonious relationship between landlords and tenants. While landlords typically carry insurance for the building itself, it’s essential for tenants to understand that this insurance does not cover their personal belongings or liability.

By obtaining apartment insurance, tenants demonstrate their commitment to responsible tenancy. It shows that they are proactive in protecting their belongings and taking responsibility for any accidents or injuries that may occur within their apartment. This can foster a positive relationship with the landlord, as it reduces the risk of financial burdens and potential conflicts.

Moreover, apartment insurance can provide tenants with valuable legal protection. In the event of a dispute or legal action, having apartment insurance can offer a layer of defense and support, ensuring that tenants have the resources to navigate complex legal proceedings with confidence.

Benefits for Landlords

Apartment insurance also benefits landlords in several ways. When tenants have their own insurance, landlords can rest assured that their tenants are covered for personal property losses and liability issues. This reduces the likelihood of financial strain on the landlord’s insurance policy and helps maintain a positive rental experience for all parties involved.

Additionally, apartment insurance can contribute to a more secure and well-maintained rental property. Tenants with insurance are often more vigilant about security and maintenance, knowing that their belongings and investments are protected. This can lead to a lower risk of property damage and a more harmonious living environment for all tenants.

Choosing the Right Apartment Insurance Provider: A Comprehensive Guide

Selecting the right apartment insurance provider is a critical decision that can impact your coverage and peace of mind. With numerous options available, it’s essential to consider various factors to find a provider that meets your specific needs.

Factors to Consider

- Reputation and Financial Stability: Choose an insurance provider with a solid reputation and financial stability. This ensures that the company will be able to fulfill its obligations and provide reliable coverage in the event of a claim.

- Coverage Options: Evaluate the range of coverage options offered by the provider. Look for a comprehensive policy that includes personal property, liability, and additional living expenses coverage. Ensure that the provider offers customizable policies to meet your specific needs.

- Deductibles and Premiums: Compare deductibles and premiums across different providers. Consider your financial comfort level and choose a provider that offers a balance between affordable premiums and reasonable deductibles.

- Claims Process: Research the claims process of each provider. Look for a company with a streamlined and efficient claims process, ensuring that you receive prompt assistance and support in the event of a covered loss.

- Customer Service: Assess the quality of customer service provided by the insurance company. Choose a provider with a reputation for excellent customer service, as this can make a significant difference in resolving issues and providing support when needed.

By carefully considering these factors and researching multiple providers, you can make an informed decision and select an apartment insurance provider that offers the right combination of coverage, affordability, and customer service.

Online Quotes and Comparison Tools

Utilizing online quotes and comparison tools can be a valuable resource when shopping for apartment insurance. These tools allow you to quickly and easily compare policies, coverage options, and prices from multiple providers in one place. This simplifies the process of finding the best apartment insurance policy for your needs and budget.

When using online quotes and comparison tools, it's essential to provide accurate and detailed information about your apartment and personal circumstances. This ensures that you receive accurate quotes and can make an informed decision based on your specific needs.

The Future of Apartment Insurance: Adapting to Changing Needs

The landscape of apartment insurance is continually evolving to meet the changing needs of renters. As technology advances and societal trends shift, insurance providers are adapting their policies and offerings to provide comprehensive coverage for a wide range of scenarios.

Emerging Trends in Apartment Insurance

- Digitalization: The rise of digital technologies has led to the development of online platforms and apps that simplify the insurance process. Tenants can now easily obtain quotes, purchase policies, and manage their insurance online, providing convenience and accessibility.

- Customizable Policies: Insurance providers are offering more flexible and customizable policies to meet the diverse needs of renters. This includes the ability to choose specific coverage limits, deductibles, and additional endorsements to tailor the policy to individual circumstances.

- Expanded Coverage Options: Apartment insurance policies are expanding to cover a wider range of risks. This includes coverage for cyber threats, identity theft, and even pet-related incidents, addressing the evolving concerns of modern renters.

- Sustainability and Green Initiatives: With a growing focus on sustainability, some insurance providers are offering discounts or incentives for tenants who adopt eco-friendly practices or install energy-efficient upgrades in their apartments.

By embracing these emerging trends, apartment insurance providers are ensuring that renters have access to the most up-to-date and relevant coverage options, providing peace of mind and financial protection in an ever-changing world.

Conclusion: Securing Your Peace of Mind with Apartment Insurance

Apartment insurance is a vital component of responsible tenancy, offering a comprehensive layer of protection for renters and their belongings. By understanding the importance of apartment insurance and tailoring a policy to your specific needs, you can ensure that you’re adequately covered and prepared for unforeseen events.

Whether you're a student, young professional, or long-term tenant, apartment insurance provides the financial support and peace of mind to navigate life's unexpected challenges. With the right coverage, you can focus on enjoying your apartment and building a secure future without the worry of potential losses.

FAQs

What does apartment insurance typically cover?

+Apartment insurance, or renters insurance, typically covers personal property (furniture, electronics, clothing), liability (protection against accidents or injuries within your apartment), and additional living expenses (if your apartment becomes uninhabitable due to a covered loss). Some policies may also include medical payments coverage for guests’ medical expenses.

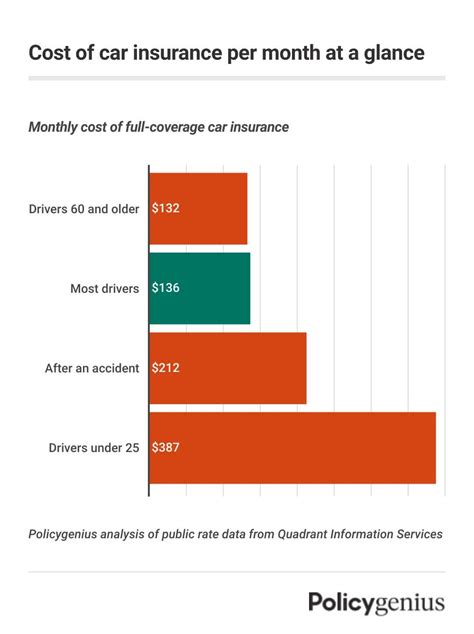

How much does apartment insurance cost?

+The cost of apartment insurance varies depending on factors such as the value of your belongings, location, and the coverage limits you choose. On average, renters insurance policies can range from 150 to 300 per year, with higher coverage limits and additional endorsements potentially increasing the cost.

Is apartment insurance required by law?

+Apartment insurance is generally not required by law, but it is highly recommended. While landlords typically have insurance for the building, it does not cover your personal belongings or liability. Obtaining apartment insurance is a proactive step to protect yourself and your possessions.

How can I get the best apartment insurance coverage for my needs?

+To get the best apartment insurance coverage, consider your specific needs and circumstances. Assess the value of your belongings, evaluate potential liability risks, and determine your additional living expenses in the event of a covered loss. Choose an insurance provider with a solid reputation and customizable policies. Compare quotes and coverage options from multiple providers to find the best fit for your needs and budget.

What should I do if I need to file an apartment insurance claim?

+If you need to file an apartment insurance claim, contact your insurance provider as soon as possible. Provide detailed information about the incident, including any supporting documentation such as photos or receipts. Cooperate with the insurance adjuster and follow their instructions. Remember to keep records of all communications and expenses related to the claim.