American General Auto Insurance

Welcome to a comprehensive guide on one of the leading auto insurance providers in the United States: American General Auto Insurance. With a rich history spanning decades, American General has established itself as a trusted name in the industry, offering a range of comprehensive insurance solutions tailored to meet the diverse needs of American drivers. In this article, we will delve into the world of American General Auto Insurance, exploring its origins, the breadth of its coverage, and the unique features that set it apart from other insurance providers.

A Legacy of Excellence: American General’s Historical Overview

American General Auto Insurance, a subsidiary of American General Life Insurance Company, boasts a proud heritage that dates back to the early 20th century. The company was founded in 1926 with a vision to provide reliable and accessible insurance solutions to Americans across the nation. Over the years, American General has grown exponentially, expanding its reach and building a solid reputation for integrity and customer satisfaction.

One of the key milestones in American General's history was its acquisition by AIG (American International Group) in 1962. This strategic move allowed the company to leverage AIG's global expertise and resources, further enhancing its ability to offer innovative insurance products and exceptional service to its customers.

Throughout its existence, American General has been committed to staying at the forefront of the insurance industry. It has consistently adapted to the evolving needs of its customers, introducing new coverage options and utilizing advanced technologies to streamline the insurance experience. This dedication to innovation has positioned American General as a leader in the auto insurance market, earning the trust of millions of policyholders nationwide.

Comprehensive Coverage Options: Tailoring Protection for Every Driver

American General Auto Insurance understands that every driver has unique requirements when it comes to auto insurance. To cater to this diversity, the company offers a comprehensive range of coverage options, ensuring that policyholders can customize their plans to align with their specific needs and preferences.

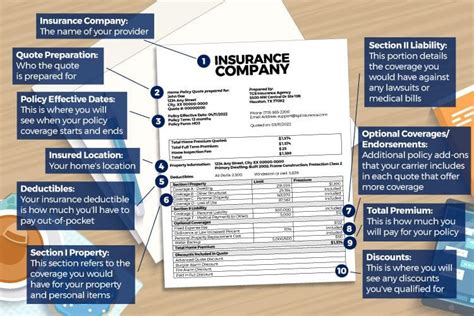

Liability Coverage

At the core of American General’s auto insurance policies is liability coverage, which provides financial protection in the event of bodily injury or property damage caused by the policyholder. This coverage is mandatory in most states and is essential for safeguarding policyholders against potential legal and financial liabilities arising from accidents.

Collision and Comprehensive Coverage

American General also offers optional collision and comprehensive coverage, providing an additional layer of protection for policyholders. Collision coverage helps cover repair or replacement costs for the insured vehicle in the event of an accident, regardless of fault. Comprehensive coverage, on the other hand, protects against damages caused by non-collision events such as theft, vandalism, natural disasters, or collisions with animals.

Personal Injury Protection (PIP)

Personal Injury Protection, commonly known as PIP, is another vital coverage option offered by American General. This coverage helps cover medical expenses and lost wages for the policyholder and their passengers, regardless of who is at fault in an accident. PIP ensures that policyholders can focus on their recovery without worrying about the financial burden of medical bills.

Uninsured/Underinsured Motorist Coverage

American General recognizes the importance of protecting policyholders against the risks posed by uninsured or underinsured drivers. Their uninsured/underinsured motorist coverage provides financial protection in the event of an accident involving a driver who either lacks insurance or has insufficient coverage to compensate for the damages caused.

Rental Car Coverage

For policyholders who frequently rent cars, American General offers rental car coverage as an optional add-on. This coverage helps cover the cost of renting a vehicle if the insured car is damaged or stolen, ensuring policyholders can maintain their mobility during unforeseen circumstances.

Unique Features and Benefits: Enhancing the Insurance Experience

Beyond its comprehensive coverage options, American General Auto Insurance sets itself apart with a suite of unique features and benefits designed to enhance the overall insurance experience for its policyholders.

Digital Convenience and Accessibility

In today’s fast-paced world, convenience and accessibility are paramount. American General understands this and has invested heavily in developing a robust digital platform to cater to the needs of modern customers. Policyholders can easily manage their insurance policies online, make payments, file claims, and access important documents at their convenience.

Claim Processing Efficiency

American General prides itself on its efficient claim processing procedures. The company has implemented streamlined processes to ensure that policyholders receive prompt and fair settlements for their claims. This commitment to efficiency is backed by a dedicated team of claims adjusters who work diligently to assess and resolve claims quickly and accurately.

Roadside Assistance and Emergency Services

American General offers its policyholders access to roadside assistance and emergency services as part of their insurance packages. This includes services such as towing, battery jumps, flat tire changes, and even fuel delivery in case of emergencies. Having these services readily available provides policyholders with added peace of mind while on the road.

Discounts and Savings

American General believes in rewarding its loyal customers with a range of discounts and savings opportunities. Policyholders can take advantage of multi-policy discounts, good student discounts, safe driver discounts, and more. These incentives not only help policyholders save money but also encourage safe driving practices and responsible insurance management.

Customer Education and Resources

American General is dedicated to empowering its policyholders with the knowledge and resources they need to make informed insurance decisions. The company provides a wealth of educational materials, articles, and guides on its website, covering topics such as insurance basics, claim processes, and safety tips. By investing in customer education, American General aims to foster a community of informed and responsible drivers.

Performance Analysis and Customer Satisfaction

American General Auto Insurance’s commitment to excellence is reflected in its consistent performance and high customer satisfaction ratings. The company has consistently received positive feedback from policyholders, praising its efficient claim handling, responsive customer service, and comprehensive coverage options.

Independent consumer research and ratings agencies have also recognized American General's strengths. The company has been awarded top ratings for financial stability and customer satisfaction by reputable organizations such as A.M. Best and J.D. Power. These accolades further cement American General's position as a leading auto insurance provider, trusted by millions of Americans for its reliability and dedication to customer well-being.

Future Implications and Industry Leadership

As the auto insurance landscape continues to evolve, American General remains at the forefront of innovation and industry leadership. The company is actively exploring new technologies, such as telematics and artificial intelligence, to further enhance its insurance offerings and provide even more personalized experiences for its policyholders.

American General's focus on technological advancements is evident in its recent partnerships and collaborations with tech startups and industry leaders. By embracing these partnerships, the company aims to stay ahead of the curve, offering cutting-edge solutions that meet the evolving needs of its customers. This commitment to innovation positions American General as a forward-thinking leader in the auto insurance industry, poised to shape the future of insurance for years to come.

Conclusion

American General Auto Insurance stands as a testament to the company’s rich heritage and unwavering commitment to its customers. With a comprehensive range of coverage options, a suite of unique features, and a dedication to customer satisfaction, American General has solidified its position as a trusted provider in the American insurance market. As the company continues to evolve and innovate, it remains a reliable choice for drivers seeking peace of mind and exceptional insurance protection.

What is the average cost of American General Auto Insurance policies?

+The cost of American General Auto Insurance policies can vary significantly based on several factors, including the policyholder’s location, driving record, vehicle type, and coverage options chosen. On average, policyholders can expect to pay anywhere from 500 to 1,500 annually for their auto insurance. However, it’s important to note that rates can be significantly lower or higher depending on individual circumstances.

Does American General offer discounts for multiple policies or safe driving practices?

+Absolutely! American General is committed to rewarding its policyholders with various discounts. Policyholders can take advantage of multi-policy discounts by bundling their auto insurance with other insurance products offered by American General, such as home or life insurance. Additionally, safe driving practices are incentivized through discounts for accident-free records and safe driver programs.

How does American General handle claims and what is the typical turnaround time for settlements?

+American General prides itself on its efficient claim handling procedures. Policyholders can expect a prompt and professional response when filing a claim. The company utilizes a dedicated claims team that works diligently to assess and process claims quickly. While turnaround times can vary based on the complexity of the claim, American General aims to provide settlements within a matter of days or weeks, ensuring policyholders receive the financial support they need during challenging times.