Federal Insurance Contributions Act Definition

The Federal Insurance Contributions Act (FICA) is a pivotal legislation in the United States that forms the foundation for understanding and navigating the country's social security and Medicare programs. Enacted in 1935 as part of the Social Security Act, FICA has undergone numerous amendments over the decades to adapt to changing economic and social landscapes.

Understanding FICA

FICA is a federal law that mandates employers and employees to contribute a percentage of an employee’s earnings to fund Social Security and Medicare. These contributions are critical for ensuring the financial sustainability of these vital social programs, which provide income and healthcare support to millions of Americans.

The act applies to almost all forms of income, including wages, salaries, tips, and other forms of compensation received by an employee for services rendered. It's important to note that certain categories of workers, such as self-employed individuals, have different rules and responsibilities for FICA contributions.

Key Components of FICA

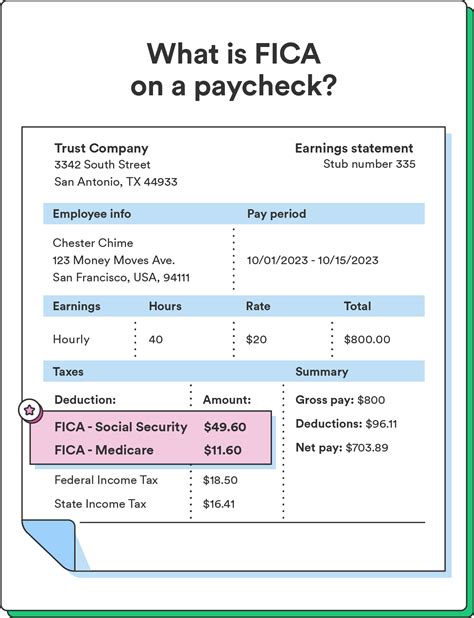

FICA contributions are divided into two main components: Social Security and Medicare taxes. Each serves a distinct purpose within the broader social safety net.

- Social Security Tax: This tax is earmarked for funding Social Security benefits, which include retirement income, disability insurance, and survivor benefits. The Social Security tax rate is currently set at 6.2% for employers and employees, with a wage base limit of $147,000 as of 2023. This means that the tax is only applied to the first $147,000 of an employee's income.

- Medicare Tax: Medicare taxes support the Medicare program, which provides healthcare coverage to individuals aged 65 and older, as well as certain younger individuals with disabilities. The standard Medicare tax rate is 1.45% for both employers and employees, with no wage base limit. In addition, high-income earners may be subject to an Additional Medicare Tax of up to 0.9%, which is solely the employee's responsibility.

| FICA Component | Tax Rate | Wage Base Limit |

|---|---|---|

| Social Security Tax | 6.2% (Employer) + 6.2% (Employee) | $147,000 (2023) |

| Medicare Tax | 1.45% (Employer) + 1.45% (Employee) + 0.9% (Additional Medicare Tax for high-income earners) | None |

FICA’s Impact and Relevance

FICA’s significance extends far beyond its role in funding social programs. It plays a critical part in shaping the financial landscape for both individuals and businesses. Here’s a deeper look at its impact:

Financial Security for Individuals

FICA contributions are the lifeblood of Social Security and Medicare, two of the most crucial safety nets for Americans. Social Security provides a guaranteed income during retirement, disability, or in the event of the death of a family breadwinner. Medicare ensures access to healthcare services, which can be a financial burden, especially for the elderly and those with chronic conditions.

By contributing to FICA, individuals are essentially investing in their own financial future. These contributions build up over time, and the benefits they unlock can make a significant difference in an individual's quality of life during their golden years or in times of physical or financial hardship.

Business and Employment Considerations

For businesses, FICA has significant implications in terms of payroll management and employment costs. Employers are responsible for matching the FICA contributions made by their employees, which can add up to a substantial portion of payroll expenses. Additionally, businesses must ensure accurate withholding and timely remittance of FICA taxes to avoid penalties and maintain good standing with the IRS.

From an employment perspective, FICA taxes are a significant factor in the total compensation package. While they are an essential component of a well-functioning social safety net, they also represent a substantial deduction from an employee's gross income. Understanding and communicating about FICA taxes is crucial for both employers and employees to manage expectations and ensure financial planning.

FICA and Economic Policy

FICA is not only a matter of individual financial planning and business operations but also a key component of broader economic policy. The rates and wage base limits set for FICA taxes are regularly reviewed and adjusted by the federal government. These adjustments can have wide-reaching effects, impacting the solvency of Social Security and Medicare programs, influencing employment and business decisions, and even shaping broader economic trends.

For instance, changes in FICA tax rates or wage base limits can affect consumer spending, savings rates, and investment decisions. They can also influence business strategies, particularly in industries with high labor costs. Moreover, FICA tax adjustments are often part of broader fiscal policy initiatives aimed at addressing budget deficits or promoting economic growth.

Future Implications and Considerations

As the United States continues to navigate demographic shifts, technological advancements, and evolving economic landscapes, the role and relevance of FICA are likely to remain a subject of ongoing debate and policy adjustment.

One of the key challenges is ensuring the long-term solvency of Social Security and Medicare. With an aging population and increasing healthcare costs, finding a balance between funding these programs and keeping employment costs manageable is a delicate task. Policy adjustments, such as increasing the wage base limit or tax rates, or exploring alternative funding mechanisms, will likely be necessary to sustain these vital programs.

Additionally, the digital economy and the rise of gig work present new challenges and opportunities for FICA. As more workers move into independent contractor roles or participate in the gig economy, the traditional employee-employer relationship for FICA purposes may need to be reevaluated. Policy makers and stakeholders will need to find innovative solutions to ensure that these workers are adequately covered by social safety net programs while also maintaining a fair and efficient tax system.

In conclusion, the Federal Insurance Contributions Act is more than just a piece of legislation. It is a cornerstone of the U.S. social safety net, shaping the financial security of individuals, the operations of businesses, and the broader economic landscape. As such, it is a topic of critical importance for anyone seeking to understand the financial and social fabric of the United States.

How often are FICA tax rates and wage base limits reviewed and adjusted?

+FICA tax rates and wage base limits are typically reviewed annually by the Social Security Administration (SSA) and the Internal Revenue Service (IRS). Adjustments are made based on various factors, including the cost-of-living index, economic trends, and the financial health of the Social Security and Medicare trust funds.

Are there any exemptions or special cases for FICA contributions?

+Yes, there are certain categories of workers who are exempt from FICA contributions or have different rules. These include some government employees, certain religious workers, and self-employed individuals, who are responsible for paying both the employer and employee portions of FICA taxes.

How do FICA contributions impact an individual’s Social Security benefits?

+FICA contributions directly influence the amount of Social Security benefits an individual receives upon retirement or in the event of disability. The Social Security Administration uses a formula that takes into account an individual’s earnings history, including their FICA contributions, to calculate the monthly benefit amount.