Allstate Quote For Home Insurance

Allstate Home Insurance: A Comprehensive Guide to Protecting Your Residence

In the world of homeownership, one of the most crucial decisions you'll make is choosing the right insurance coverage. Allstate, a trusted name in the insurance industry, offers a range of policies designed to safeguard your home and provide peace of mind. This comprehensive guide will delve into the world of Allstate home insurance, exploring the various coverage options, the claims process, and the benefits that make it a top choice for homeowners.

Understanding Allstate's Home Insurance Policies

Allstate understands that every home is unique, and so are the risks it may face. Their home insurance policies are tailored to meet these diverse needs, offering a range of coverage options to protect your residence and its contents.

Coverage Options

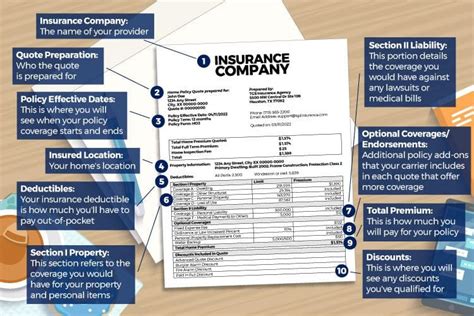

Allstate's home insurance policies typically include the following key coverages:

- Dwelling Coverage: This is the cornerstone of your policy, providing protection for the physical structure of your home. It covers repairs or rebuilding costs in the event of damage caused by covered perils, such as fire, windstorms, or vandalism.

- Personal Property Coverage: Your belongings are valuable, and Allstate's policy ensures they're protected. It covers the cost of replacing or repairing your personal items, including furniture, electronics, and clothing, if they're damaged or lost due to a covered event.

- Liability Coverage: This aspect of the policy protects you from financial loss if someone is injured on your property or if you're found legally responsible for an accident that causes property damage to others.

- Additional Living Expenses: In the event your home becomes uninhabitable due to a covered loss, this coverage helps cover the additional costs of temporary housing and other necessary expenses until you can return home.

- Optional Coverages: Allstate offers a range of optional coverages to enhance your policy. These can include protection for high-value items like jewelry or artwork, coverage for identity theft, and even discounts for installing certain safety features in your home.

Allstate's policies are highly customizable, allowing you to tailor your coverage to fit your specific needs and budget. Whether you're a first-time homeowner or have years of experience, their agents can guide you through the process of selecting the right coverage limits and deductibles.

Allstate's Claims Process

One of the key strengths of Allstate is their efficient and comprehensive claims process. When you experience a covered loss, their goal is to make the claims process as smooth and stress-free as possible.

- Reporting a Claim: You can report a claim 24/7 by calling their dedicated claims hotline or using their online claims portal. Their team of trained professionals will guide you through the process, ensuring you understand each step.

- Claims Investigation: Allstate's claims adjusters will thoroughly investigate your claim, assessing the damage and determining the scope of coverage. They work diligently to ensure an accurate assessment, providing you with regular updates throughout the process.

- Payment and Repairs: Once the claim is approved, Allstate will work with you to arrange repairs or provide payment for covered losses. They have a network of preferred vendors and contractors to ensure high-quality repairs, but you're also free to choose your own service providers.

- Customer Support: Throughout the claims process, Allstate's customer support team is available to answer any questions or address concerns you may have. They aim to provide prompt and personalized assistance, ensuring you feel supported during this challenging time.

Benefits of Choosing Allstate for Home Insurance

Allstate's home insurance policies offer a range of benefits that make them an appealing choice for homeowners:

- Financial Strength: Allstate is a financially stable company, rated A+ by AM Best. This rating signifies their ability to meet their financial obligations, providing you with peace of mind that your policy is backed by a reliable insurer.

- Personalized Service: Allstate understands that every homeowner has unique needs. Their agents take the time to get to know you and your property, ensuring your policy is tailored to your specific situation. This personalized approach extends to their claims service as well.

- Innovative Tools and Resources: Allstate provides a suite of digital tools and resources to enhance your insurance experience. Their mobile app allows you to manage your policy, report claims, and access important documents anytime, anywhere. Additionally, their online resources offer valuable tips and information to help you better understand your coverage and protect your home.

- Discounts and Savings: Allstate offers a variety of discounts to help you save on your home insurance premiums. These can include discounts for bundling your home and auto insurance policies, installing safety features like smoke detectors or security systems, and maintaining a good credit score.

- Flexible Payment Options: Allstate understands that paying for insurance is a significant financial commitment. They offer flexible payment plans, allowing you to choose the option that best suits your budget. Whether you prefer monthly, quarterly, or annual payments, they aim to make the process as convenient as possible.

Real-Life Success Stories

Allstate's commitment to protecting homes and providing exceptional service is reflected in the experiences of their satisfied customers. Here are a few real-life success stories:

John's Peace of Mind

"As a first-time homeowner, I wanted to ensure my new home was properly protected. Allstate's agent took the time to explain the different coverage options and helped me tailor a policy that fit my needs and budget. When a storm caused some minor damage to my roof, their claims process was efficient and stress-free. The adjuster was professional and knowledgeable, and the repairs were completed promptly. I'm grateful for the peace of mind Allstate provides."

Sarah's Home Renovation

"When I decided to renovate my kitchen, I was concerned about potential accidents or damage. Allstate's agent suggested adding a personal liability rider to my policy, which provided the extra coverage I needed. Thankfully, no incidents occurred, but knowing I had that extra protection gave me the confidence to proceed with my renovation plans."

Mike's Unexpected Flood

"Living in a flood-prone area, I knew flood insurance was crucial. Allstate's agent helped me understand the benefits of their flood insurance policy and guided me through the process of obtaining the necessary coverage. When a heavy rainstorm caused flooding in my basement, their claims team was incredibly supportive. They helped me navigate the complex process of filing a flood claim, and the repairs were completed to a high standard."

Get Your Allstate Home Insurance Quote Today

Protecting your home is one of the most important decisions you'll make as a homeowner. Allstate's comprehensive home insurance policies offer the coverage and peace of mind you need. With their financial strength, personalized service, and innovative tools, they're dedicated to ensuring your home is protected. Get your personalized Allstate home insurance quote today and take the first step towards safeguarding your residence.

Frequently Asked Questions

How do I know if I have adequate coverage for my home and its contents?

+Determining adequate coverage involves considering the replacement cost of your home and its contents. Allstate’s agents can help you assess your needs and recommend coverage limits based on your home’s value, location, and any unique features. It’s important to regularly review and update your coverage to ensure it keeps pace with any changes or improvements made to your home.

What should I do if I experience a loss and need to file a claim with Allstate?

+If you experience a covered loss, it’s important to act promptly. Contact Allstate’s claims department as soon as possible to report the incident. They will guide you through the claims process, providing support and assistance every step of the way. Take photos of any damage and gather any relevant documentation to help expedite the claims investigation.

Can I choose my own contractor or repair service when filing a claim with Allstate?

+Absolutely! Allstate understands that you may have preferred contractors or repair services you trust. While they may suggest their network of preferred vendors, you are free to choose your own service providers. They aim to ensure you have the flexibility to select the professionals you feel most comfortable with.

Are there any discounts available for Allstate home insurance policies?

+Yes, Allstate offers a variety of discounts to help you save on your home insurance premiums. These discounts can include bundle discounts for combining your home and auto insurance policies, safety feature discounts for installing approved safety devices, and loyalty discounts for long-term customers. Speak with your Allstate agent to explore the available discounts and see how you can save.

How often should I review and update my Allstate home insurance policy?

+It’s recommended to review your home insurance policy annually or whenever significant changes occur in your life or home. This includes renovations, additions, or upgrades to your home, as well as changes in your personal circumstances or financial situation. Regular policy reviews ensure your coverage remains up-to-date and aligned with your needs.