Affordable Insurance In Florida

Introduction:

Florida, known for its vibrant beaches and sunny climate, is a popular destination for residents and tourists alike. However, the unique characteristics of this beautiful state also present specific challenges when it comes to insurance coverage. From natural disasters to a diverse population, Florida requires tailored insurance solutions to meet the needs of its residents. This comprehensive guide aims to shed light on the world of affordable insurance options in Florida, offering insights and strategies to help you secure the best coverage at the right price.

Florida's insurance landscape is shaped by a combination of factors, including its geographical location, demographic diversity, and a history of severe weather events. These factors contribute to a unique set of insurance considerations that residents must navigate. From homeowners' policies that account for hurricane risks to auto insurance with varying coverage requirements, understanding the intricacies of Florida's insurance market is crucial for finding affordable and comprehensive protection.

Understanding Florida’s Insurance Landscape

Homeowners’ Insurance: Navigating Storm Coverage

Florida’s homeowners’ insurance market is distinct due to the state’s susceptibility to hurricanes and other natural disasters. Standard homeowners’ policies in Florida typically include coverage for wind damage, but exclusions and deductibles can vary significantly. When shopping for homeowners’ insurance, it’s essential to compare policies carefully, ensuring that you understand the scope of coverage and any potential gaps.

One strategy to mitigate costs is to explore multi-policy discounts. By bundling your homeowners' and auto insurance with the same provider, you may be eligible for substantial savings. Additionally, consider the impact of deductibles on your overall costs. While higher deductibles can lower your premiums, they also mean you'll be responsible for a larger portion of any claim, so it's a delicate balance to strike.

Auto Insurance: Balancing Coverage and Costs

Auto insurance in Florida is mandatory, but the state’s unique “no-fault” system adds a layer of complexity. This system requires drivers to carry Personal Injury Protection (PIP) coverage, which can be more expensive than traditional liability-only policies. However, understanding your options and shopping around can help you find the right balance between coverage and affordability.

When comparing auto insurance policies, pay attention to the coverage limits and any additional perks, such as roadside assistance or rental car coverage. Some insurers also offer usage-based insurance programs, where your driving habits and mileage directly impact your premiums. These programs can be a great option for safe drivers looking to save.

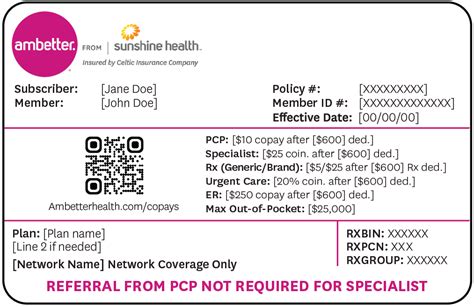

Health Insurance: Affordable Care Act (ACA) Compliance

Florida’s health insurance market is governed by the Affordable Care Act (ACA), offering a range of options for individuals and families. The ACA’s Marketplace provides a platform for comparing and enrolling in health insurance plans, with financial assistance available for those who qualify. It’s crucial to understand your eligibility and the enrollment periods to ensure you have continuous coverage.

Outside of the Marketplace, Florida also has a robust private health insurance market. These plans can offer more flexibility in terms of provider networks and coverage options, but they may come at a higher cost. It's essential to assess your healthcare needs and financial situation when choosing a health insurance plan to find the best fit.

Life Insurance: Protecting Your Loved Ones

Life insurance is an essential component of financial planning, and Florida residents have access to a wide range of policies to suit their needs. Term life insurance offers coverage for a specific period, typically at a lower cost, making it an attractive option for those on a budget. On the other hand, permanent life insurance, such as whole life or universal life, provides lifelong coverage but at a higher premium.

When shopping for life insurance, consider your long-term goals and the financial needs of your beneficiaries. It's also worth exploring the potential tax benefits of certain life insurance policies, especially if you're looking to build cash value over time.

Strategies for Affordable Insurance in Florida

Shop Around and Compare

The insurance market in Florida is highly competitive, offering a wide range of providers and policies. Shopping around and comparing quotes is essential to finding the best rates. Utilize online comparison tools and reach out to multiple insurers to get a comprehensive understanding of the options available.

When comparing quotes, pay attention to the details. Look beyond the headline price and consider the coverage limits, deductibles, and any additional benefits or exclusions. It's also a good idea to read customer reviews and check the financial stability of the insurers you're considering.

Bundle Policies for Discounts

Bundling your insurance policies, such as homeowners’ and auto insurance, with the same provider can lead to significant savings. Many insurers offer multi-policy discounts, which can lower your overall premiums. This strategy is particularly effective for those who own both a home and a vehicle.

However, it's important to ensure that you're not sacrificing coverage for the sake of a discount. Always review the terms and conditions of each policy to ensure you have the protection you need. Consider seeking advice from an insurance broker or agent who can help you navigate the bundling process and find the best combination of policies.

Explore Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is gaining popularity in Florida. This type of insurance uses data from your driving habits, such as mileage and driving behavior, to determine your premiums. For safe drivers who don’t rack up excessive mileage, this can be a cost-effective option.

Usage-based insurance is particularly beneficial for young drivers or those who only use their vehicles occasionally. It rewards responsible driving and can lead to substantial savings over time. However, it's important to note that not all insurers offer this type of insurance, and the availability may vary by region.

Consider High Deductibles

While it may seem counterintuitive, opting for higher deductibles on your insurance policies can lower your premiums. This strategy is particularly effective for homeowners’ insurance, where the risk of a major claim is relatively low. By increasing your deductible, you’re effectively sharing more of the risk with your insurer, which can result in significant savings.

However, it's crucial to ensure that you can afford the higher deductible in the event of a claim. A good rule of thumb is to choose a deductible that aligns with your emergency savings or a sum that you can comfortably set aside. This way, you're prepared for any unexpected expenses and can still enjoy the benefits of lower premiums.

Take Advantage of Discounts and Rewards

Insurance providers in Florida often offer a variety of discounts and rewards to attract and retain customers. These can include discounts for safe driving records, loyalty rewards for long-term customers, or even discounts for belonging to certain professional organizations or alumni associations.

When shopping for insurance, ask about the discounts and rewards programs available. You may be eligible for savings based on your profession, educational background, or even the safety features in your vehicle. It's also worth exploring loyalty programs, where you can accumulate points or rewards for maintaining your policies over time.

Conclusion: Finding the Right Balance

Navigating the insurance landscape in Florida requires a careful balance of coverage and affordability. By understanding the unique challenges and opportunities presented by the Sunshine State, you can make informed decisions about your insurance needs. Whether it’s homeowners’, auto, health, or life insurance, the key is to shop around, compare policies, and tailor your coverage to your specific circumstances.

Remember, insurance is a long-term investment in your financial security and peace of mind. By staying informed and proactive, you can find the best insurance solutions that fit your budget and provide the protection you deserve. So, whether you're a lifelong Floridian or a new resident, embrace the sunshine and rest easy knowing you've secured the right insurance coverage at the right price.

FAQ

What is the average cost of homeowners’ insurance in Florida?

+The average cost of homeowners’ insurance in Florida varies depending on factors such as location, property value, and coverage limits. As of [latest data], the average annual premium is approximately [average cost], but it can range from [lowest] to [highest] depending on individual circumstances.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any discounts available for auto insurance in Florida?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, Florida insurers offer a range of discounts for auto insurance. These can include safe driver discounts, multi-policy discounts, loyalty rewards, and even discounts for belonging to certain organizations or associations. It's worth exploring these options to potentially lower your premiums.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>How can I find affordable health insurance in Florida outside of the ACA Marketplace?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Florida has a competitive private health insurance market with various options. To find affordable coverage, consider comparing plans based on your specific healthcare needs and budget. Look for plans with a balance of coverage and cost, and don't hesitate to negotiate with insurers to secure the best rates.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What is the minimum required auto insurance coverage in Florida?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Florida's minimum required auto insurance coverage includes 10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). However, it’s important to note that these minimums may not provide sufficient coverage for all situations. Consider increasing your coverage limits to ensure adequate protection.