Affordable Health Insurance Virginia

Health insurance is a crucial aspect of life, ensuring that individuals and families have access to necessary medical care without incurring overwhelming financial burdens. In the state of Virginia, there are various options available for those seeking affordable health insurance plans. This article aims to provide an in-depth analysis of the affordable health insurance landscape in Virginia, covering the key providers, plans, and strategies to help residents navigate their healthcare coverage options effectively.

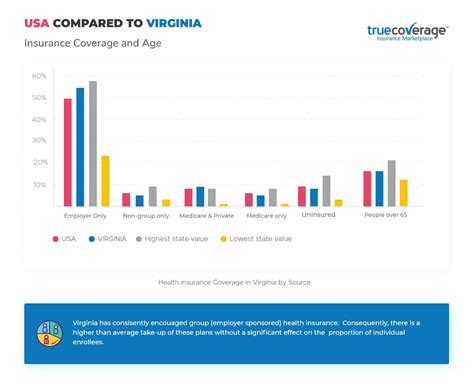

Understanding Affordable Health Insurance in Virginia

Virginia, like many states, offers a range of health insurance options designed to cater to different income levels and healthcare needs. The concept of affordable health insurance often refers to plans that provide adequate coverage while remaining financially accessible to a wide range of individuals and families. In Virginia, this translates to a diverse selection of insurance providers and plans, each with its own unique features and cost structures.

One of the primary drivers of affordable health insurance in Virginia is the Affordable Care Act (ACA), which has led to significant changes in the healthcare industry. The ACA has introduced measures such as income-based premium subsidies, expanded Medicaid eligibility, and the creation of health insurance marketplaces, all of which have made healthcare more accessible and affordable for many Virginians.

Key Providers of Affordable Health Insurance in Virginia

Several insurance providers offer a variety of plans tailored to meet the diverse needs of Virginians. These providers include:

- Anthem Blue Cross and Blue Shield: Anthem is one of the largest health insurance providers in Virginia, offering a wide range of plans, from comprehensive coverage to more budget-friendly options. They participate in the Health Insurance Marketplace, making their plans accessible to those eligible for premium subsidies.

- Aetna: Aetna provides a selection of affordable health insurance plans in Virginia, including HMO and PPO options. They often cater to those seeking flexibility in their healthcare choices, with various network options available.

- CareFirst BlueCross BlueShield: CareFirst offers a range of affordable plans, particularly for those who value a broad network of healthcare providers. Their plans often include additional benefits, such as wellness programs and telemedicine services.

- UnitedHealthcare: UnitedHealthcare provides a comprehensive portfolio of health insurance plans in Virginia, covering various healthcare needs. They are known for their focus on innovation, offering digital health tools and resources to enhance the member experience.

- Optima Health: Optima Health is a Virginia-based provider specializing in offering affordable and accessible healthcare options. They provide a range of plans, including those designed specifically for families and individuals with specific healthcare needs.

Strategies for Finding Affordable Health Insurance in Virginia

When navigating the landscape of affordable health insurance in Virginia, it’s beneficial to employ certain strategies to ensure you find the best plan for your needs and budget:

- Research and Compare Plans: Take the time to explore the various plans offered by different providers. Compare the coverage, deductibles, copayments, and out-of-pocket maximums to find the plan that aligns with your healthcare needs and financial situation.

- Utilize the Health Insurance Marketplace: The Health Insurance Marketplace, available through Healthcare.gov, is a valuable resource for Virginians seeking affordable health insurance. This platform allows you to compare plans from multiple providers and determine if you're eligible for premium subsidies or other financial assistance.

- Consider Medicaid and CHIP: Virginia has expanded its Medicaid program, making it accessible to more residents. Additionally, the Children's Health Insurance Program (CHIP) provides low-cost health coverage for children in families that earn too much to qualify for Medicaid but may still need financial assistance.

- Explore Short-Term and Catastrophic Plans: For those who are generally healthy and may not require frequent medical care, short-term or catastrophic health insurance plans can be more affordable options. These plans typically have lower premiums but may have higher deductibles and limited coverage.

- Negotiate and Bundle Services: Don't be afraid to negotiate with insurance providers, especially if you have a specific healthcare need or a history of consistent premium payments. Additionally, consider bundling services, such as dental, vision, and life insurance, to potentially save on overall costs.

Performance Analysis and Real-World Examples

To understand the effectiveness of affordable health insurance plans in Virginia, it’s beneficial to examine real-world examples and analyze their performance:

| Provider | Plan Type | Annual Premium | Deductible | Copayment | Out-of-Pocket Max |

|---|---|---|---|---|---|

| Anthem Blue Cross and Blue Shield | Silver Plan | $4,200 | $2,000 | $35 | $6,500 |

| Aetna | Bronze Plan | $3,800 | $3,000 | $40 | $7,000 |

| CareFirst BlueCross BlueShield | Gold Plan | $5,200 | $1,500 | $25 | $5,500 |

| UnitedHealthcare | Platinum Plan | $6,800 | $1,000 | $20 | $4,000 |

| Optima Health | Catastrophic Plan | $2,800 | $6,000 | N/A | $6,500 |

The table above showcases a sample of health insurance plans offered by various providers in Virginia. It's important to note that actual costs and plan details may vary based on factors such as age, location, and specific healthcare needs. These plans represent a range of options, from more comprehensive coverage with higher premiums to more budget-friendly plans with higher deductibles.

Future Implications and Industry Insights

The landscape of affordable health insurance in Virginia, as in many states, is continually evolving. The ongoing impact of the Affordable Care Act and other healthcare reforms will shape the future of insurance coverage. As more Virginians gain access to healthcare through expanded Medicaid and marketplace plans, the focus may shift towards improving the quality and accessibility of healthcare services, particularly in underserved areas.

Additionally, the rise of telemedicine and digital health tools is likely to play a significant role in the future of affordable health insurance. These technologies can enhance access to care, particularly for those in rural or remote areas, and potentially reduce overall healthcare costs. Insurance providers who embrace these innovations may be better positioned to offer more affordable and accessible plans in the future.

Conclusion

Affordable health insurance is a critical component of ensuring the well-being of Virginians. By understanding the key providers, exploring a range of plans, and employing strategic approaches, individuals and families can navigate the complex healthcare landscape to find coverage that meets their needs and fits their budget. As the industry continues to evolve, staying informed and proactive in managing healthcare costs will be essential for maintaining accessibility and financial stability.

How can I determine if I’m eligible for premium subsidies on the Health Insurance Marketplace?

+Eligibility for premium subsidies on the Health Insurance Marketplace is primarily based on your household income. Generally, if your income is between 100% and 400% of the federal poverty level, you may qualify for subsidies. You can use the premium tax credit estimator on Healthcare.gov to determine your eligibility.

What is the difference between HMO and PPO plans?

+HMO (Health Maintenance Organization) plans typically require you to choose a primary care physician (PCP) and obtain referrals for specialty care. They often have lower premiums and deductibles but a more restricted network of providers. PPO (Preferred Provider Organization) plans offer more flexibility, allowing you to see any in-network provider without referrals. They usually have higher premiums and deductibles but provide broader coverage options.

Are there any additional costs or fees associated with health insurance plans in Virginia?

+In addition to premiums, health insurance plans may have other associated costs. These can include deductibles, copayments for specific services, and coinsurance (a percentage of the total cost of a covered service). It’s important to review the plan’s summary of benefits and coverage to understand all potential costs.