Aetna Individual Health Insurance

In today's dynamic healthcare landscape, understanding your options for health insurance is crucial. This comprehensive guide will delve into the world of Aetna's Individual Health Insurance, exploring its intricacies, benefits, and impact on individuals seeking comprehensive coverage.

As one of the leading healthcare providers in the United States, Aetna offers a range of insurance plans tailored to meet the diverse needs of individuals and families. With a rich history spanning decades, Aetna has established itself as a trusted name in the industry, known for its innovative approaches to healthcare coverage and customer satisfaction.

Understanding Aetna’s Individual Health Insurance Plans

Aetna’s Individual Health Insurance plans are designed to provide personalized coverage for those who do not have access to group health insurance through their employers or other organizations. These plans offer a flexible and customizable approach to healthcare, allowing individuals to choose the level of coverage that best suits their unique circumstances.

One of the key advantages of Aetna's individual plans is the wide network of healthcare providers. Aetna has established partnerships with top medical facilities, specialists, and general practitioners across the country, ensuring that policyholders have access to quality care regardless of their location. This extensive network provides peace of mind, knowing that one's healthcare needs can be addressed conveniently and efficiently.

Furthermore, Aetna's commitment to customer-centric approaches sets it apart. The company offers a range of tools and resources to help individuals navigate their health insurance journey, from online portals for easy claim submissions and policy management to dedicated customer support teams. This focus on customer experience ensures that policyholders receive the support and guidance they need to make informed decisions about their healthcare.

Key Features of Aetna’s Individual Health Insurance

- Flexible Coverage Options: Aetna offers a variety of plan types, including HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), and POS (Point of Service) plans. These options cater to different preferences and budgets, allowing individuals to choose the plan that aligns with their healthcare needs and financial situation.

- Comprehensive Benefits: Aetna’s plans typically include coverage for essential health benefits such as doctor visits, hospital stays, prescription medications, preventive care, and specialty services. Additionally, many plans offer extra benefits like vision and dental coverage, further enhancing the overall healthcare experience.

- Cost-Sharing Options: Policyholders have the flexibility to choose plans with different levels of cost-sharing, including deductibles, copayments, and coinsurance. This allows individuals to balance their monthly premiums with their preferred level of out-of-pocket expenses, providing a tailored approach to healthcare costs.

- Discount Programs: Aetna recognizes the importance of promoting healthy lifestyles and offers various discount programs to encourage policyholders to adopt healthier habits. These programs may include discounts on gym memberships, weight loss programs, or even reduced costs for certain medical procedures, providing an incentive for individuals to take proactive steps towards their well-being.

The Enrollment Process and Coverage Period

Enrollment for Aetna’s Individual Health Insurance plans typically occurs during the Open Enrollment Period, which is a designated time frame each year when individuals can select or change their health insurance coverage. However, Aetna also offers the opportunity for Special Enrollment Periods under certain qualifying life events, such as marriage, divorce, or the birth of a child, allowing individuals to enroll outside of the standard Open Enrollment timeframe.

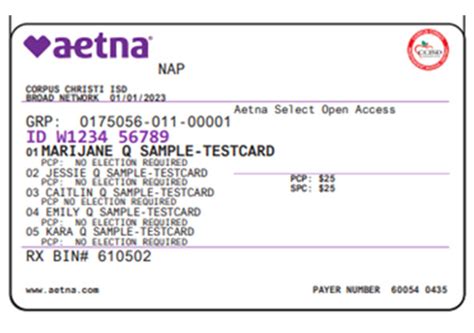

Once enrolled, policyholders receive their Aetna member ID card, which serves as their official proof of insurance coverage. This card provides access to the Aetna network of healthcare providers and enables individuals to receive the benefits outlined in their chosen plan. It is important to note that coverage typically starts on the first day of the month following enrollment, ensuring a seamless transition into the new plan.

Renewal and Continuity of Coverage

Aetna understands the importance of continuous coverage, especially for individuals with pre-existing conditions or ongoing medical needs. As such, the company offers a straightforward renewal process, allowing policyholders to maintain their coverage year after year without interruption. This commitment to continuity ensures that individuals can rely on their Aetna plan as a stable and dependable source of healthcare coverage.

Furthermore, Aetna actively engages with its policyholders to provide educational resources and guidance on plan renewal. This proactive approach helps individuals understand the benefits of maintaining their coverage and ensures a smooth transition into the next coverage period.

| Coverage Type | Features |

|---|---|

| HMO Plans | Focus on primary care, typically requiring referrals for specialist visits. Offers cost-effective coverage with a narrower network. |

| PPO Plans | Provide flexibility in choosing healthcare providers, both in and out of network. Typically offer a broader network and more options for specialist care. |

| POS Plans | Combine features of HMO and PPO plans, offering flexibility with primary care and specialist referrals. May have different cost-sharing structures based on in-network or out-of-network care. |

Comparative Analysis: Aetna vs. Other Health Insurance Providers

When it comes to choosing an individual health insurance plan, it is essential to compare options and understand the unique value that each provider brings to the table. Here’s a comparative analysis of Aetna’s Individual Health Insurance plans against other leading providers in the market.

Network Size and Provider Access

Aetna’s extensive network of healthcare providers sets it apart from many competitors. With a nationwide presence, Aetna ensures that policyholders have access to a diverse range of medical professionals, from primary care physicians to specialists. This extensive network provides convenience and peace of mind, knowing that quality healthcare is readily available.

In contrast, some competitors may have more limited networks, especially in certain geographic regions. This can lead to challenges in finding in-network providers or accessing certain specialized services, potentially impacting the overall healthcare experience.

Plan Flexibility and Customization

Aetna’s commitment to offering a wide range of plan options allows individuals to tailor their coverage to their specific needs. Whether it’s selecting an HMO, PPO, or POS plan, or choosing between different levels of cost-sharing, Aetna provides the flexibility to create a plan that aligns with one’s healthcare preferences and budget.

While other providers also offer plan customization, Aetna's comprehensive approach ensures that policyholders have a diverse range of options to choose from, catering to various healthcare scenarios and financial considerations.

Customer Support and Digital Tools

Aetna’s focus on customer-centric approaches is evident in its dedication to providing excellent customer support and innovative digital tools. From easy-to-use online portals for policy management and claim submissions to dedicated support teams, Aetna ensures that policyholders have the resources and guidance they need to navigate their healthcare journey seamlessly.

While many competitors also offer digital tools and customer support, Aetna's emphasis on user-friendly interfaces and proactive engagement sets it apart. This commitment to enhancing the customer experience ensures that policyholders feel supported and empowered throughout their insurance journey.

Real-World Examples: Success Stories and Testimonials

Aetna’s Individual Health Insurance plans have impacted the lives of countless individuals, providing them with the peace of mind and support they need to navigate their healthcare journeys. Here are a few real-world examples showcasing the positive impact of Aetna’s coverage.

John’s Story: A Smooth Transition to Retirement

John, a 62-year-old retiree, had always relied on his employer’s health insurance plan. As he transitioned into retirement, he was concerned about finding affordable and comprehensive coverage. That’s when he discovered Aetna’s Individual Health Insurance plans.

With Aetna's guidance, John was able to select a plan that suited his retirement budget while still providing him with the essential health benefits he needed. The process was seamless, and John appreciated the support he received from Aetna's customer service team throughout his enrollment. Now, with his Aetna coverage, John can focus on enjoying his retirement years without worrying about unexpected healthcare costs.

Sarah’s Journey: Managing Chronic Conditions

Sarah, a 38-year-old mother of two, was diagnosed with a chronic condition that required ongoing medical care. She needed a health insurance plan that would provide her with the support and coverage she required to manage her condition effectively.

Aetna's Individual Health Insurance plan offered Sarah the comprehensive benefits she needed, including coverage for specialist visits, prescription medications, and regular check-ups. The plan's flexibility allowed her to choose a provider network that included her trusted specialists, ensuring continuity of care. With Aetna's support, Sarah was able to focus on her health and well-being, knowing that her insurance coverage had her back every step of the way.

Mike’s Experience: Accessing Specialty Care

Mike, a 45-year-old professional, had always prioritized his health and well-being. When he was diagnosed with a rare medical condition, he needed access to specialized care and treatment. That’s where Aetna’s extensive provider network came into play.

Aetna's Individual Health Insurance plan provided Mike with the resources he needed to connect with leading specialists in his field of medicine. The plan's coverage for specialty care and procedures ensured that Mike could receive the highest level of treatment without financial strain. Thanks to Aetna's network and support, Mike was able to overcome his health challenges and continue pursuing his professional goals with renewed confidence.

The Future of Aetna’s Individual Health Insurance

As the healthcare landscape continues to evolve, Aetna remains committed to innovation and adaptability. The company’s focus on customer-centric approaches and technological advancements positions it well for the future. Here’s a glimpse into the potential developments and impact of Aetna’s Individual Health Insurance plans in the coming years.

Digital Health and Telemedicine Integration

Aetna recognizes the growing importance of digital health solutions and telemedicine. The company is actively exploring ways to integrate these technologies into its individual health insurance plans, providing policyholders with convenient and accessible healthcare options.

By leveraging telemedicine platforms, Aetna aims to offer policyholders the ability to consult with healthcare professionals remotely, reducing the need for in-person visits for certain non-emergency situations. This not only enhances convenience but also contributes to cost savings, as remote consultations can be more efficient and cost-effective.

Wellness Programs and Preventive Care Initiatives

Aetna understands the significance of preventive care and wellness initiatives in promoting overall health and well-being. The company is dedicated to expanding its offerings in this area, providing policyholders with access to comprehensive wellness programs and resources.

These initiatives may include online wellness platforms, discounts on fitness memberships, and educational resources to encourage healthy lifestyle choices. By investing in preventive care, Aetna aims to empower individuals to take control of their health, reduce the risk of chronic conditions, and ultimately lead healthier, more fulfilling lives.

Continuous Innovation and Adaptability

Aetna’s commitment to innovation and adaptability is evident in its approach to individual health insurance. The company actively monitors industry trends, regulatory changes, and technological advancements to ensure that its plans remain relevant and responsive to the evolving needs of its policyholders.

Whether it's incorporating new coverage options, enhancing customer support channels, or exploring cutting-edge technologies, Aetna remains dedicated to staying at the forefront of the healthcare industry. This continuous innovation ensures that Aetna's Individual Health Insurance plans remain a trusted and reliable choice for individuals seeking comprehensive and personalized coverage.

How do I choose the right Aetna Individual Health Insurance plan for my needs?

+Choosing the right Aetna plan depends on your specific healthcare needs and budget. Consider factors like your preferred network size, the level of coverage you require, and your ability to manage out-of-pocket expenses. Review the plan options carefully, and don’t hesitate to seek guidance from Aetna’s customer support team to find the plan that best suits your circumstances.

Can I enroll in an Aetna Individual Health Insurance plan outside of the Open Enrollment Period?

+Yes, Aetna offers Special Enrollment Periods for qualifying life events such as marriage, divorce, or the birth of a child. These events allow you to enroll outside of the standard Open Enrollment timeframe. It’s important to promptly report these qualifying events to ensure seamless coverage.

What is the renewal process like for Aetna’s Individual Health Insurance plans?

+Aetna simplifies the renewal process to ensure continuity of coverage. Policyholders will receive reminders and guidance on renewing their plans. It’s important to review your coverage options and make any necessary updates to ensure your plan continues to meet your healthcare needs.

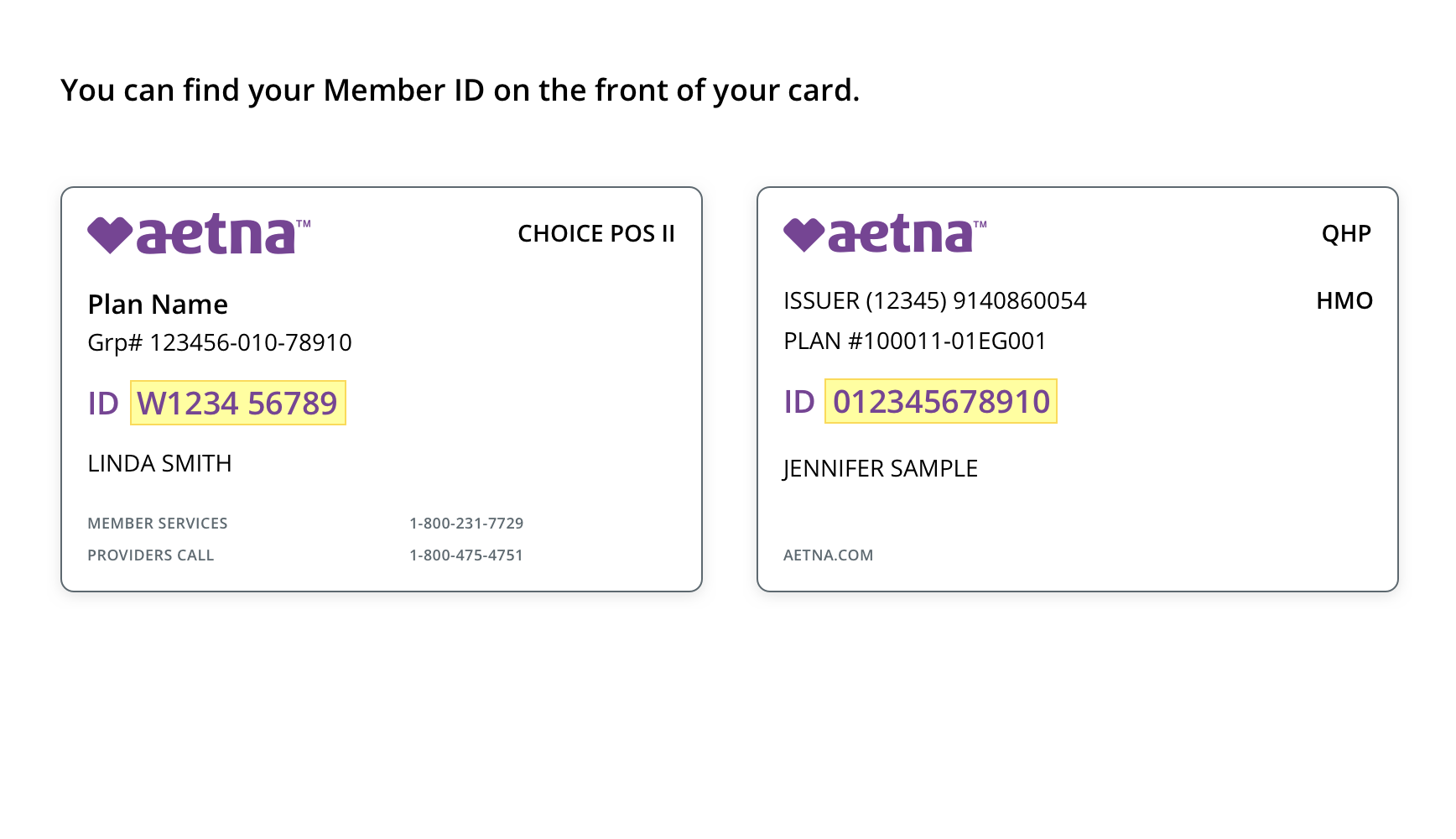

How can I access my Aetna member ID card and what are its benefits?

+Your Aetna member ID card is typically mailed to you upon enrollment or renewal. It serves as your official proof of insurance and provides access to the Aetna network of healthcare providers. Always carry your ID card with you to ensure smooth and efficient healthcare services.