Saga Insurance

Saga Insurance is a well-established insurance provider in the United Kingdom, specializing in meeting the unique needs of the over-50s market. With a focus on delivering tailored insurance solutions and exceptional customer service, Saga has become a trusted brand in the industry. In this comprehensive article, we will delve into the world of Saga Insurance, exploring its history, services, and the key factors that have contributed to its success and popularity among its target audience.

A Journey into the Saga Insurance Story

Saga Insurance, a subsidiary of the renowned Saga Group, has been an integral part of the insurance landscape for over three decades. Founded in 1984, the company has undergone significant growth and evolution, solidifying its position as a leader in the over-50s insurance market.

The Saga Group, with its roots in providing travel and leisure services for the mature demographic, recognized the need for specialized insurance products tailored to this demographic. Thus, Saga Insurance was born, with a mission to offer comprehensive coverage and a seamless customer experience to individuals aged 50 and above.

Insurance Services Tailored for the Over-50s

Saga Insurance understands that the insurance needs of the over-50s demographic are diverse and often unique. The company has meticulously crafted a range of insurance products to address these specific requirements. Let’s explore some of the key services offered by Saga Insurance:

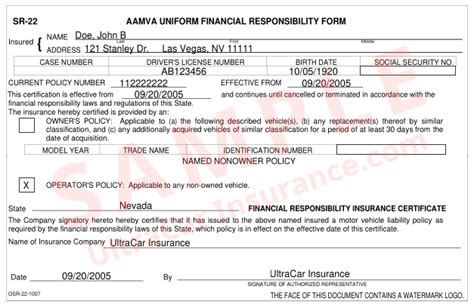

Car Insurance for Mature Drivers

Saga’s car insurance policies are designed with the needs of mature drivers in mind. They offer competitive premiums, comprehensive coverage, and additional benefits such as:

- No Upper Age Limit: Saga welcomes drivers of all ages, ensuring that even the most experienced motorists can find suitable coverage.

- Breakdown Cover: Comprehensive breakdown assistance is included, providing peace of mind on the road.

- Claims Support: Saga’s dedicated claims team offers prompt and efficient support, making the claims process less stressful.

Home Insurance for Peace of Mind

Saga’s home insurance policies provide comprehensive protection for homeowners and renters alike. Key features include:

- Buildings and Contents Insurance: Tailored coverage for both the structure of the home and its contents, with options to customize the policy to individual needs.

- Home Emergency Cover: This add-on provides assistance for unexpected home emergencies, such as boiler breakdowns or burst pipes.

- Personal Possessions Cover: Protection for personal belongings, even when away from home, offering added security for valuable items.

Travel Insurance for Adventurous Seniors

Saga’s travel insurance plans are specifically designed for the adventurous over-50s, offering extensive coverage and benefits:

- Medical Expenses: Comprehensive coverage for medical emergencies while abroad, including pre-existing conditions and specialist treatment.

- Trip Cancellation and Curtailment: Reimbursement for canceled or interrupted trips, providing financial protection for unforeseen circumstances.

- Cruise Cover: Dedicated coverage for cruise holidays, including excursion cover and personal liability insurance.

Health Insurance for Peace of Mind

Saga’s health insurance plans aim to provide over-50s with access to private healthcare, ensuring timely treatment and peace of mind. Key features include:

- Hospital Cash Benefits: Cash payments for each day spent in hospital, providing financial support during periods of hospitalization.

- Private Medical Treatment: Access to private medical facilities and specialists, reducing waiting times for treatment.

- Health Assessments: Inclusive health assessments to monitor and maintain good health, with options for further support and guidance.

Customer Experience and Service Excellence

At the heart of Saga Insurance’s success is its commitment to delivering an exceptional customer experience. The company prides itself on its dedicated customer service team, known for its friendliness and expertise. Saga’s customer-centric approach is evident in several key aspects:

Personalized Service

Saga Insurance understands that each customer has unique needs. Their advisors take the time to understand these needs, offering personalized insurance solutions and guidance. This tailored approach ensures customers receive the coverage they require, without unnecessary add-ons.

Easy Claims Process

Saga has streamlined its claims process to ensure efficiency and minimal stress for its customers. Policyholders can make claims online or over the phone, and the dedicated claims team provides regular updates and support throughout the process.

Online Convenience

While Saga values personal interaction, it also recognizes the importance of digital convenience. The company’s website offers an intuitive online experience, allowing customers to manage their policies, make payments, and access policy documents with ease.

Industry Recognition and Awards

Saga Insurance’s commitment to excellence has been recognized by various industry bodies and awards. Some notable accolades include:

| Award | Year |

|---|---|

| Moneyfacts Car Insurance Provider of the Year | 2021 |

| Moneyfacts Gold Award for Car Insurance | 2022 |

| Moneywise Customer Service Award | 2020 |

| Silver Winner, Which? Recommended Provider Awards for Car Insurance | 2022 |

Looking Ahead: The Future of Saga Insurance

As the insurance landscape continues to evolve, Saga Insurance remains committed to adapting and innovating to meet the changing needs of its customers. The company is focused on:

- Digital Transformation: Enhancing its digital capabilities to provide customers with even greater convenience and accessibility.

- Product Innovation: Continuously developing new insurance products and services to address emerging risks and customer requirements.

- Customer Engagement: Strengthening its relationship with customers through personalized communication and value-added services.

With its rich history, commitment to customer service, and focus on innovation, Saga Insurance is well-positioned to continue thriving in the insurance market and serving the unique needs of the over-50s demographic.

How can I contact Saga Insurance for inquiries or claims?

+You can reach Saga Insurance’s customer service team by calling 0330 058 0108 (8 am to 8 pm Monday to Friday, 9 am to 5 pm Saturday, and 10 am to 4 pm Sunday). Alternatively, you can contact them via email at info@saga.co.uk or through their online contact form on their website.

What makes Saga Insurance unique compared to other insurance providers?

+Saga Insurance is unique in its focus on serving the over-50s demographic. They offer specialized insurance products tailored to the needs of this age group, providing comprehensive coverage and an exceptional customer experience. Their dedication to understanding and catering to the specific requirements of mature customers sets them apart.

Does Saga Insurance offer any discounts or promotions?

+Yes, Saga Insurance frequently offers promotions and discounts to its customers. These may include multi-policy discounts, loyalty rewards, and introductory offers. It’s recommended to check their website or contact their customer service team for the latest promotional information.