What Is Homeowner Insurance

Homeowner insurance, also known as home insurance or property insurance, is a crucial financial safeguard for homeowners and is an essential aspect of homeownership. It provides protection against various risks and unforeseen events that could lead to significant financial losses for homeowners. This comprehensive guide aims to delve into the intricacies of homeowner insurance, offering a detailed understanding of its purpose, coverage, and the benefits it brings to homeowners.

Understanding Homeowner Insurance

Homeowner insurance is a type of property insurance that safeguards a homeowner’s financial interests in their home and its contents. It is a contract between the homeowner (policyholder) and the insurance company, wherein the insurance provider agrees to compensate the homeowner for losses and damages covered by the policy, in exchange for a premium paid by the homeowner.

This insurance policy serves as a critical financial safety net, offering protection against a wide range of potential risks, including natural disasters, theft, accidents, and liability claims. By having homeowner insurance, homeowners can have peace of mind knowing that they are financially prepared to handle unexpected events that could otherwise lead to devastating financial consequences.

Key Components of Homeowner Insurance

Homeowner insurance policies typically consist of several key components, each offering specific types of coverage. Understanding these components is essential to ensure that homeowners have the right coverage to meet their unique needs.

Dwelling Coverage

Dwelling coverage, often considered the core of a homeowner insurance policy, provides protection for the physical structure of the home. This includes the main house, any attached structures like garages or porches, and even detached buildings like sheds or guest houses. In the event of damage or destruction caused by a covered peril, dwelling coverage ensures that the homeowner can rebuild or repair their home.

It's important to note that dwelling coverage typically covers only the actual cash value of the home, which takes into account depreciation. For homeowners who want to ensure they have enough coverage to rebuild their home at its current market value, they may opt for replacement cost coverage, which provides a higher level of protection.

Personal Property Coverage

Personal property coverage is another vital aspect of homeowner insurance. It provides protection for the homeowner’s personal belongings, such as furniture, appliances, electronics, clothing, and other items located within the insured home. In the event of theft, damage, or loss due to a covered peril, personal property coverage helps homeowners replace or repair their possessions.

The extent of personal property coverage can vary based on the policy and the insurer. Some policies may offer actual cash value coverage, while others provide replacement cost coverage. Additionally, certain high-value items like jewelry, art, or collectibles may require additional coverage or endorsements to ensure adequate protection.

Liability Coverage

Liability coverage is an essential component of homeowner insurance, providing protection against legal claims and financial liabilities arising from accidents or injuries that occur on the insured property. This coverage safeguards homeowners from lawsuits and the financial consequences that may result from accidents on their property, such as a visitor slipping and falling on their premises.

Liability coverage typically includes both bodily injury and property damage liability. It covers medical expenses and legal fees if a visitor or guest is injured on the insured property, as well as damage to another person's property caused by the policyholder or a member of their household.

Additional Living Expenses (ALE) Coverage

Additional Living Expenses (ALE) coverage is a valuable aspect of homeowner insurance, offering financial support to homeowners who need to relocate temporarily due to a covered loss. In the event that a homeowner’s home becomes uninhabitable due to a covered peril, ALE coverage helps cover the additional costs of living elsewhere while their home is being repaired or rebuilt.

This coverage can include expenses such as temporary housing, meals, and other necessary living expenses incurred during the period of displacement. It ensures that homeowners have the means to maintain their normal standard of living even while they are unable to reside in their own home.

Types of Homeowner Insurance Policies

Homeowner insurance policies come in various forms, each offering different levels of coverage and tailored to specific needs. Understanding the different types of policies available can help homeowners choose the right coverage for their situation.

HO-1 Policy

The HO-1 policy, also known as the Basic Form, is the most fundamental type of homeowner insurance policy. It provides coverage for specific named perils, including fire, lightning, windstorm, hail, explosion, riot, vandalism, and theft. However, it does not offer comprehensive coverage, and additional endorsements may be required to ensure adequate protection.

HO-2 Policy

The HO-2 policy, often referred to as the Broad Form, offers more extensive coverage compared to the HO-1 policy. It provides protection against named perils, as well as additional coverage for sudden and accidental damage. This policy typically includes coverage for personal belongings, liability, and additional living expenses.

HO-3 Policy

The HO-3 policy, commonly known as the Special Form, is the most common type of homeowner insurance policy. It provides comprehensive coverage for the dwelling, personal property, and liability. The HO-3 policy covers a wide range of perils, including those specified in the HO-2 policy, as well as additional named perils such as smoke, falling objects, and weight of ice, snow, or sleet.

HO-4 Policy

The HO-4 policy, or the Renter’s Insurance policy, is designed specifically for tenants or individuals who rent their living space. It provides coverage for personal belongings and liability, similar to the HO-3 policy, but does not include dwelling coverage since the tenant does not own the physical structure of the rental property.

HO-5 Policy

The HO-5 policy, often referred to as the Comprehensive Form, offers the highest level of coverage among homeowner insurance policies. It provides open perils coverage, meaning it covers all perils except those specifically excluded in the policy. The HO-5 policy typically includes coverage for the dwelling, personal property, liability, and additional living expenses, providing comprehensive protection for homeowners.

Understanding Perils and Coverage

Homeowner insurance policies cover a wide range of perils, or events that can cause damage or loss. Understanding the perils covered by a policy is crucial to ensure that homeowners have the right protection for their specific needs.

Covered Perils

Common perils covered by homeowner insurance policies include fire, lightning, windstorm, hail, explosion, riot, vandalism, theft, smoke, falling objects, weight of ice, snow, or sleet, and water damage caused by plumbing or household appliances. These perils are typically covered under most standard homeowner insurance policies.

Exclusions and Limitations

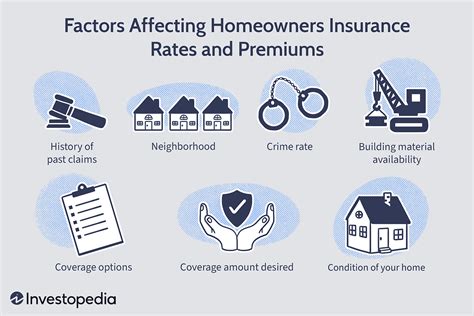

While homeowner insurance provides comprehensive coverage, there are certain perils and situations that are typically excluded from coverage. These exclusions and limitations can vary depending on the policy and the insurer. Some common exclusions include flood, earthquake, war, nuclear hazards, intentional acts, and wear and tear.

It's important for homeowners to carefully review their policy to understand the specific exclusions and limitations, as well as any endorsements or additional coverages that may be required to ensure adequate protection for their unique circumstances.

The Benefits of Homeowner Insurance

Homeowner insurance offers numerous benefits to homeowners, providing financial protection and peace of mind. Understanding these benefits can help homeowners appreciate the value of having adequate insurance coverage.

Financial Protection

Homeowner insurance provides financial protection against a wide range of risks and losses. In the event of a covered peril, such as a fire or a break-in, the insurance policy can help cover the costs of repairing or rebuilding the home, replacing personal belongings, and handling liability claims. This financial protection ensures that homeowners are not left with devastating financial burdens in the wake of an unexpected event.

Peace of Mind

Having homeowner insurance brings peace of mind to homeowners. Knowing that they are financially prepared to handle unforeseen events and have the support of an insurance provider can reduce stress and anxiety. Homeowner insurance provides a sense of security, allowing homeowners to focus on enjoying their home and protecting their investment without constant worry about potential financial losses.

Protection Against Inflation

Homeowner insurance policies typically offer inflation protection, which helps ensure that the coverage limits keep pace with rising construction and replacement costs. As the cost of building materials and labor increases over time, inflation protection ensures that the policy limits adjust accordingly, providing adequate coverage for rebuilding or repairing the home.

Choosing the Right Homeowner Insurance

Selecting the right homeowner insurance policy is a crucial decision that requires careful consideration. Homeowners should take into account their unique circumstances, including the value of their home, the location, and their personal belongings, to choose a policy that provides adequate coverage.

It's important to review policy limits, deductibles, and exclusions to ensure that the policy meets the homeowner's specific needs. Additionally, comparing quotes from different insurers can help homeowners find the best coverage at a competitive price. Working with an insurance agent or broker can provide valuable guidance in choosing the right policy and understanding the nuances of homeowner insurance.

FAQs

What is the difference between homeowner insurance and renters insurance?

+

Homeowner insurance and renters insurance differ in their scope of coverage. Homeowner insurance is designed for homeowners and covers the dwelling, personal property, and liability. On the other hand, renters insurance is tailored for tenants and primarily covers personal belongings and liability, as it does not include coverage for the physical structure of the rental property.

Does homeowner insurance cover flood damage?

+

No, standard homeowner insurance policies typically do not cover flood damage. Flood insurance is a separate policy that is often required in high-risk flood zones. Homeowners in flood-prone areas should consider purchasing flood insurance to ensure adequate protection against flood-related losses.

How often should I review my homeowner insurance policy?

+

It is recommended to review your homeowner insurance policy at least once a year, or whenever significant changes occur in your life or circumstances. These changes may include renovations to your home, the acquisition of valuable possessions, or changes in your family’s needs. Regular reviews ensure that your coverage remains up-to-date and aligned with your current situation.

Can I customize my homeowner insurance policy to meet my specific needs?

+

Yes, homeowner insurance policies can be customized to meet your specific needs. Insurance providers offer various endorsements and additional coverages that can be added to your policy to enhance protection for high-value items, such as jewelry, artwork, or collectibles. Additionally, you can choose higher coverage limits and lower deductibles to further tailor your policy to your preferences.

In conclusion, homeowner insurance is a vital component of responsible homeownership, providing financial protection and peace of mind to homeowners. By understanding the key components, coverage options, and benefits of homeowner insurance, homeowners can make informed decisions to ensure they have the right coverage to protect their homes and possessions. Regularly reviewing and updating your insurance policy is essential to maintain adequate protection as your circumstances change.