What Is A Gap Insurance

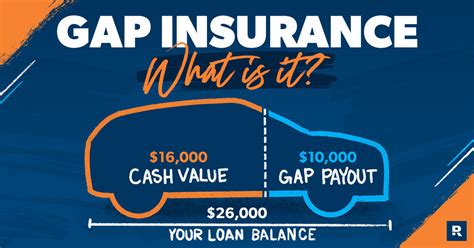

Gap insurance, or Guaranteed Asset Protection insurance, is a specialized type of coverage designed to bridge the financial gap that can occur when an insured vehicle is declared a total loss or stolen and not recovered. This unique form of insurance steps in to cover the difference between the actual cash value of the vehicle and any outstanding loan or lease balance, providing crucial financial protection for vehicle owners and lessees.

Understanding the Role of Gap Insurance

When a vehicle suffers significant damage or goes missing, the standard auto insurance policy typically covers only the current market value of the vehicle. However, if the vehicle is relatively new or has a high loan or lease balance, the compensation received may not be sufficient to cover the entire financial obligation. This is where Gap insurance becomes invaluable.

Consider a scenario where an individual leases a new car. Over time, the value of the car depreciates, but the lease payments remain the same. Should an accident occur that totals the car, the insurance company would typically pay out the current market value, which is often less than the remaining lease amount. Gap insurance ensures that the difference, or "gap," between the payout and the lease balance is covered, protecting the lessee from unexpected financial burden.

Key Benefits of Gap Insurance

- Financial Protection: Gap insurance safeguards individuals from potentially devastating financial losses, ensuring they are not held responsible for paying off a vehicle they no longer own.

- Peace of Mind: With Gap insurance, vehicle owners and lessees can drive with the confidence that they are fully covered, even in the event of a total loss.

- Flexibility: This insurance can be tailored to individual needs, making it suitable for both personal vehicle owners and businesses with fleet vehicles.

How Gap Insurance Works

Gap insurance is an optional coverage that can be added to an existing auto insurance policy. It is typically offered by dealerships, lenders, or insurance companies, and the cost can vary depending on the vehicle’s value, the loan or lease terms, and the insurer.

Upon purchasing Gap insurance, the policyholder gains an additional layer of protection. In the event of a total loss, the Gap insurance provider will step in to cover the difference between the vehicle's actual cash value and the outstanding loan or lease balance. This coverage is especially beneficial for individuals who have leased a vehicle or those who have purchased a car with a significant loan amount.

| Scenario | Without Gap Insurance | With Gap Insurance |

|---|---|---|

| Total Loss Vehicle | Insurance payout covers only market value. The owner is responsible for the remaining loan balance. | Gap insurance covers the difference, ensuring the owner is not left with a financial deficit. |

| High Loan-to-Value Ratio | If the loan amount exceeds the vehicle's value, the owner may face a significant financial loss. | Gap insurance ensures the loan is fully covered, regardless of the vehicle's depreciated value. |

Real-Life Examples of Gap Insurance in Action

Imagine a young professional, Sarah, who leases a brand-new SUV. After a year of driving, Sarah is involved in a severe accident that totals her vehicle. Without Gap insurance, Sarah would be responsible for paying off the remaining lease balance, despite no longer having the vehicle. However, with Gap insurance, the insurance provider covers the difference, ensuring Sarah is not financially burdened by the accident.

In another scenario, John purchases a new pickup truck with a substantial loan. Over time, the truck's value depreciates significantly. When John is in an accident and the truck is declared a total loss, his standard insurance policy would only cover the current market value, leaving him with a substantial loan balance to pay off. However, with Gap insurance, the insurer covers the entire loan amount, protecting John from financial hardship.

The Future of Gap Insurance

As the automotive industry evolves, Gap insurance continues to play a vital role in protecting vehicle owners and lessees. With the rise of electric vehicles and innovative financing options, the need for comprehensive coverage, including Gap insurance, is expected to grow. As more individuals and businesses turn to leasing and loans to acquire vehicles, the financial protection offered by Gap insurance becomes increasingly valuable.

Furthermore, with the increasing prevalence of advanced safety features and autonomous driving technologies, the risk of accidents and total losses may decrease. However, the value of Gap insurance remains unchanged, as it provides a crucial safety net for vehicle owners, ensuring they are not left with unexpected financial obligations.

Is Gap insurance necessary for all vehicle owners?

+

Gap insurance is most beneficial for individuals who have leased a vehicle or purchased a car with a significant loan. Those who own their vehicles outright or have minimal loans may not need Gap insurance.

Can Gap insurance be added to any auto insurance policy?

+

Yes, Gap insurance is typically an optional add-on to an existing auto insurance policy. However, some lenders or dealerships may require it as a condition of the loan or lease agreement.

What is the typical cost of Gap insurance?

+

The cost of Gap insurance can vary depending on several factors, including the vehicle’s value, the loan or lease terms, and the insurer. It is often a one-time fee or a small monthly premium added to the insurance policy.

Does Gap insurance cover any type of vehicle loss or theft?

+

Gap insurance specifically covers the gap between the vehicle’s actual cash value and the outstanding loan or lease balance in cases of total loss or theft. It does not cover other types of losses or damages.