What Insurance Do You Get With Social Security Disability

Social Security Disability Insurance (SSDI) is a vital program that provides financial support to individuals who have become disabled and are unable to work. This comprehensive insurance program, offered by the Social Security Administration (SSA), aims to ensure that those facing long-term disability have access to essential benefits and resources. In this in-depth article, we will explore the various aspects of SSDI, including its eligibility criteria, the application process, and the range of insurance benefits it provides.

Understanding Social Security Disability Insurance (SSDI)

SSDI is designed to assist individuals who have a physical or mental impairment that is expected to last for at least one year or result in death. It is crucial to note that SSDI is not a form of welfare; instead, it is an insurance program funded by payroll taxes paid by workers, employers, and self-employed individuals. This means that most people who have worked in the past and paid into the Social Security system may be eligible for SSDI benefits if they become disabled.

Eligibility Criteria for SSDI

To qualify for SSDI, individuals must meet specific criteria set by the SSA. Here are the key eligibility factors:

- Work History: SSDI is primarily for individuals who have a substantial work history and have paid into the Social Security system through their payroll taxes. The exact work credits required depend on your age when you became disabled. Generally, you need to have worked for a certain number of years, with each year counting as a credit.

- Disability Definition: The SSA defines disability as the inability to engage in any substantial gainful activity due to a medically determinable physical or mental impairment(s) that is expected to result in death or has lasted or is expected to last for a continuous period of at least 12 months. This means that your condition must significantly impact your ability to perform basic work activities.

- Recent Work Test: In addition to the work credits, you must have worked recently enough to meet the Recent Work Test. This test varies based on your age and the year you became disabled. For instance, if you are under 24, you generally need to have worked for at least half of the time between age 21 and the time you became disabled.

- Duration of Disability: Your disability must be expected to last for at least 12 months or result in death. The SSA will review your medical records and other evidence to determine the severity and duration of your condition.

The Application Process

Applying for SSDI involves several steps, and it’s essential to gather the necessary documentation to support your claim. Here’s an overview of the application process:

- Initial Application: You can apply for SSDI online through the SSA’s website, by calling their toll-free number, or by visiting your local SSA office. During the initial application, you will provide information about your work history, medical condition, and any supporting documentation.

- Medical Evidence: The SSA will request detailed medical records from your healthcare providers to assess the severity of your disability. It’s crucial to ensure that your doctors provide comprehensive reports that describe your condition, its impact on your daily life, and any treatment you are receiving.

- Social Security Administration Review: Once your application is submitted, the SSA will review your work history, medical records, and other supporting evidence. This process can take several months, as the SSA must carefully evaluate each case.

- Decision: The SSA will make a determination on your claim, approving or denying your application. If your claim is approved, you will receive a notice outlining your benefit amount and the date your benefits will start.

- Appeals Process: If your initial application is denied, you have the right to appeal the decision. The SSA provides a multi-level appeals process, allowing you to request a reconsideration, request a hearing before an administrative law judge, or file a lawsuit in federal court.

Insurance Benefits Offered by SSDI

SSDI provides a range of insurance benefits to help individuals with disabilities meet their financial needs. Here are some of the key benefits:

Monthly Disability Benefits

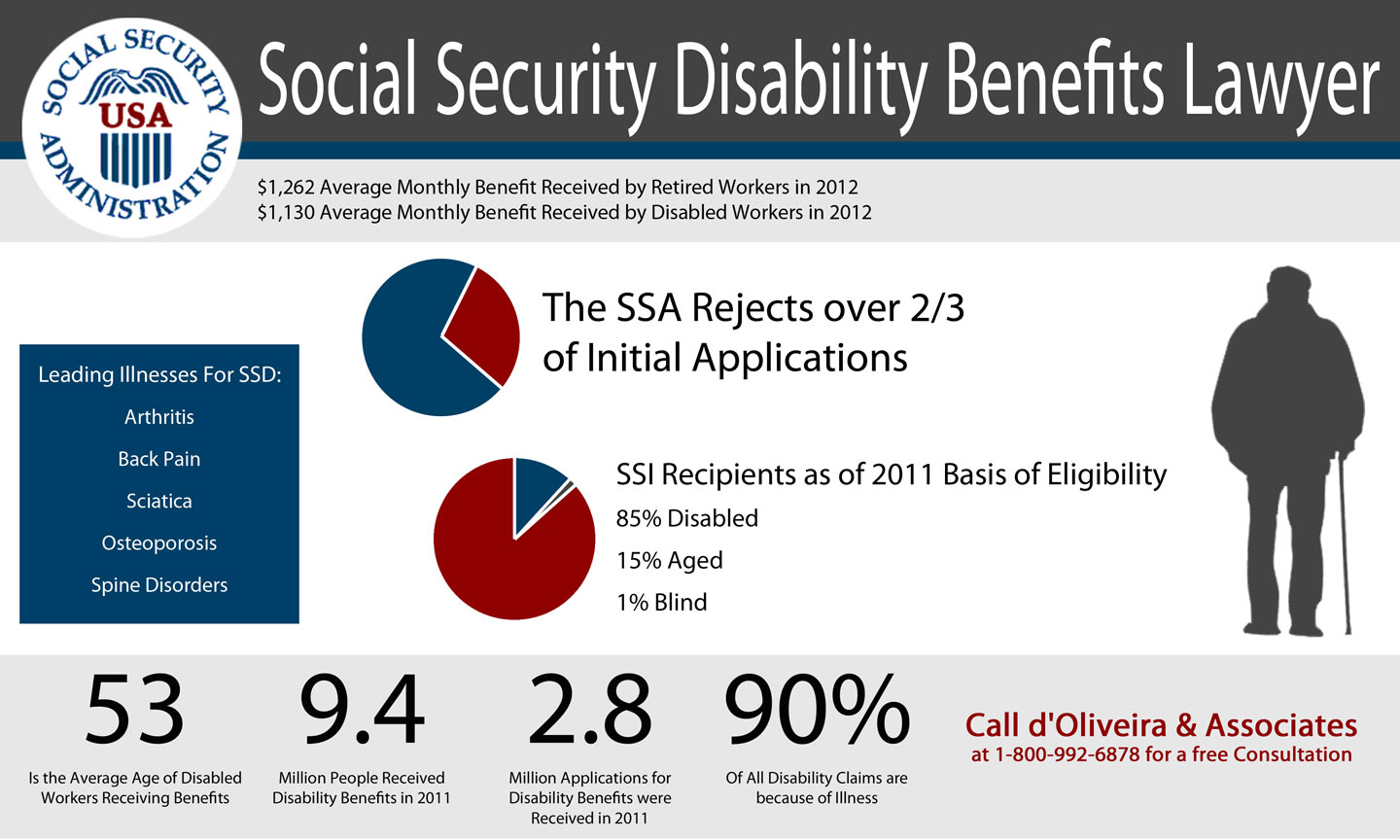

SSDI beneficiaries receive monthly cash benefits to replace a portion of their lost income due to disability. The benefit amount is based on your average lifetime earnings and is calculated using a complex formula. On average, the monthly SSDI benefit is around $1,277, but it can vary significantly depending on your work history and earnings.

| Year | Average Monthly SSDI Benefit |

|---|---|

| 2023 | $1,277 |

| 2022 | $1,268 |

| 2021 | $1,258 |

Medicare Coverage

SSDI beneficiaries are eligible for Medicare coverage after they have received disability benefits for 24 months. Medicare is a federal health insurance program that helps cover the cost of medical services, including doctor visits, hospital stays, and prescription drugs. This benefit is particularly valuable as it ensures access to necessary healthcare services without worrying about the financial burden.

Vocational Rehabilitation Services

SSDI offers vocational rehabilitation services to help beneficiaries return to work or pursue new career paths. These services include job training, education, and support to assist individuals in developing the skills and confidence needed to re-enter the workforce. The goal is to promote independence and reduce reliance on disability benefits.

Family Benefits

SSDI provides benefits not only to the disabled individual but also to their family members. Eligible family members may receive auxiliary benefits, including payments for spouses, children, and dependent parents. These benefits can help ensure the financial well-being of the entire family during a time of disability.

Employment Support

SSDI encourages individuals to return to work through the Ticket to Work program. This program provides free employment support services, such as career counseling, job training, and job placement assistance. The goal is to help beneficiaries find suitable employment that accommodates their disabilities, allowing them to maintain financial independence.

Conclusion

Social Security Disability Insurance is a vital program that offers a safety net to individuals facing long-term disabilities. By providing financial support, healthcare coverage, and employment assistance, SSDI helps disabled individuals and their families navigate the challenges of living with a disability. Understanding the eligibility criteria, application process, and the range of benefits offered by SSDI is crucial for anyone considering applying for this essential insurance program.

How long does it take to receive a decision on my SSDI application?

+The time it takes to receive a decision on your SSDI application can vary. On average, it takes around 3 to 5 months for the initial application to be processed. However, if your claim is denied and you choose to appeal, the process can take significantly longer, often up to a year or more.

Can I work while receiving SSDI benefits?

+Yes, SSDI beneficiaries can work, but there are certain limits and rules to follow. The SSA offers the Ticket to Work program, which encourages beneficiaries to return to work without losing their benefits. However, if your earnings exceed a certain threshold, your SSDI benefits may be reduced or stopped.

What happens if my disability improves, and I can work again?

+If your disability improves to the point where you can engage in substantial gainful activity, you may need to notify the SSA. The SSA will review your case and determine if you are still eligible for SSDI benefits. If you are found to be no longer disabled, your benefits may be terminated.