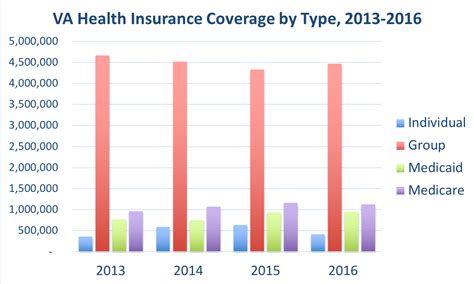

Virginia Health Insurance

In the realm of healthcare, navigating the complexities of insurance coverage is an essential aspect of securing one's well-being. For residents of Virginia, understanding the intricacies of Virginia Health Insurance is a vital step towards ensuring access to quality healthcare services. This comprehensive guide aims to delve into the nuances of Virginia's health insurance landscape, providing a detailed analysis of the options available, the benefits they offer, and the factors that influence coverage choices.

Understanding Virginia Health Insurance

Virginia’s health insurance market is diverse, offering a range of plans and coverage options to cater to the varied needs of its residents. From comprehensive major medical plans to more specialized coverage, the state provides a robust framework for individuals and families to secure the healthcare protection they require.

The Commonwealth of Virginia has implemented various initiatives to enhance healthcare accessibility and affordability. These include initiatives like the Virginia Health Benefit Exchange, a marketplace where individuals and small businesses can shop for and compare health insurance plans. This platform, also known as Cover Virginia, simplifies the process of selecting suitable coverage, ensuring a transparent and efficient experience for enrollees.

Key Features of Virginia Health Insurance

-

Individual and Family Plans: Virginia offers a variety of plans tailored to meet the unique needs of individuals and families. These plans provide coverage for essential health benefits, including doctor visits, hospital stays, prescription medications, and more.

-

Small Business Health Options Program (SHOP): For small business owners in Virginia, the SHOP marketplace provides a platform to offer health insurance to their employees. This program promotes accessibility and affordability, allowing small businesses to provide valuable healthcare benefits to their workforce.

-

Medicaid Expansion: Virginia has expanded its Medicaid program, making healthcare coverage more accessible to low-income individuals and families. This expansion ensures that more residents can receive essential healthcare services without financial strain.

-

Pre-Existing Condition Coverage: Virginia’s health insurance plans guarantee coverage for individuals with pre-existing conditions. This ensures that no one is denied healthcare due to their medical history, promoting inclusivity and comprehensive healthcare access.

Comparing Virginia Health Insurance Plans

When selecting a health insurance plan in Virginia, it’s crucial to consider various factors that influence coverage and cost. Here’s a breakdown of some key aspects to aid in the decision-making process.

Premium Costs

Premiums are the regular payments made to maintain health insurance coverage. In Virginia, the cost of premiums can vary based on factors such as the plan’s coverage level, the insured’s age, tobacco use, and the number of people covered under the plan. Plans with higher coverage levels (e.g., Platinum or Gold) generally have higher premiums, while Bronze or Silver plans offer more cost-effective options.

| Plan Type | Premium Range (per month) |

|---|---|

| Platinum | $500 - $800 |

| Gold | $400 - $650 |

| Silver | $300 - $500 |

| Bronze | $250 - $400 |

Deductibles and Out-of-Pocket Costs

Deductibles and out-of-pocket costs are expenses that insured individuals must pay before their insurance coverage kicks in. Virginia health insurance plans typically have deductibles ranging from a few hundred dollars to several thousand dollars. It’s essential to consider these costs when choosing a plan, especially if one anticipates frequent medical visits or procedures.

| Plan Type | Average Deductible | Maximum Out-of-Pocket Costs |

|---|---|---|

| Platinum | $500 - $1,500 | $2,500 - $4,000 |

| Gold | $1,000 - $2,000 | $3,000 - $5,000 |

| Silver | $1,500 - $3,000 | $4,000 - $6,000 |

| Bronze | $2,000 - $4,000 | $5,000 - $8,000 |

Coverage Benefits

Virginia health insurance plans offer a wide range of coverage benefits, including essential health services like preventive care, doctor visits, hospitalization, and prescription medications. Additionally, many plans cover mental health services, maternity care, and pediatric dental and vision services. It’s crucial to review the specific benefits included in each plan to ensure they align with your healthcare needs.

Enrolling in Virginia Health Insurance

Enrolling in Virginia health insurance is a straightforward process, thanks to the state’s dedicated marketplace, Cover Virginia. Here’s a step-by-step guide to help you through the enrollment process.

Step 1: Determine Eligibility

Before enrolling, it’s essential to determine your eligibility for health insurance coverage. This includes considering factors such as your income, family size, and whether you qualify for any government-subsidized programs like Medicaid or CHIP (Children’s Health Insurance Program). Virginia’s healthcare marketplace provides a simple eligibility tool to help you determine your coverage options.

Step 2: Compare Plans

Once you’ve established your eligibility, it’s time to compare the available health insurance plans. Cover Virginia offers a user-friendly platform where you can filter plans based on your specific needs and preferences. Consider factors like premium costs, deductibles, and coverage benefits when making your selection.

Step 3: Complete the Application

After choosing the plan that best suits your needs, the next step is to complete the application process. This typically involves providing personal information, such as your name, date of birth, and social security number. You’ll also need to verify your eligibility by providing income and family size details. The application process is designed to be straightforward and user-friendly, ensuring a smooth experience.

Step 4: Receive Confirmation

Upon submitting your application, you’ll receive a confirmation of enrollment, which outlines the details of your chosen health insurance plan. This confirmation will include information about your coverage start date, premium costs, and any important documents you may need to provide.

Conclusion

Virginia Health Insurance offers a comprehensive and inclusive approach to healthcare coverage, ensuring that residents have access to the medical services they need. With a range of plans, competitive pricing, and a user-friendly enrollment process, Virginia’s healthcare system provides a reliable safety net for its citizens. By understanding the options available and taking the necessary steps to enroll, individuals and families can secure the peace of mind that comes with quality healthcare coverage.

What is the average cost of health insurance in Virginia?

+The average cost of health insurance in Virginia varies depending on factors such as age, location, and the type of plan chosen. On average, monthly premiums range from 300 to 500 for individual plans and 800 to 1,200 for family plans. However, these costs can be significantly reduced with government subsidies for eligible individuals.

Are there any special programs or discounts for specific groups in Virginia’s health insurance market?

+Yes, Virginia offers several programs and discounts to specific groups. For example, the Commonwealth Care Program provides low-cost or free health insurance to eligible low-income adults. Additionally, there are programs like the Virginia Premium Assistance Program, which provides financial assistance to help individuals and families afford health insurance premiums.

Can I enroll in Virginia Health Insurance outside of the open enrollment period?

+Yes, you can enroll in Virginia Health Insurance outside of the open enrollment period if you qualify for a Special Enrollment Period (SEP). SEPs are granted for certain life events, such as losing other health coverage, getting married, having a baby, or moving to a new area. You can also enroll if you’re eligible for Medicaid or CHIP.