Verizon Phone Insurance Cost

Verizon, one of the leading telecommunications companies in the United States, offers a comprehensive insurance plan known as Verizon Protect to safeguard its customers' mobile devices. This plan covers a range of smartphones, tablets, and other devices, providing peace of mind for users who want to protect their investments. The cost of Verizon phone insurance is a key consideration for many, and it varies based on several factors, including the type of device, the level of coverage, and the customer's location.

Understanding Verizon Protect

Verizon Protect is a comprehensive insurance program designed to protect customers’ devices against a variety of risks, including accidental damage, mechanical and electrical malfunctions, and theft. It offers two main levels of coverage: Verizon Protect and Verizon ProtectMultiDevice.

Verizon Protect

This is the standard insurance plan offered by Verizon. It provides coverage for a single device, typically a smartphone or tablet. The cost of this plan varies depending on the make and model of the device. For instance, the insurance cost for an iPhone 13 Pro Max may differ from that of an older iPhone model or an Android device.

| Device | Monthly Premium |

|---|---|

| iPhone 13 Pro Max | $14.99 |

| Samsung Galaxy S21 Ultra | $12.99 |

| Google Pixel 6 Pro | $10.99 |

These monthly premiums are typically billed along with the customer's regular Verizon service charges. It's important to note that these prices are subject to change and may vary based on the device's age and the customer's Verizon plan.

Verizon ProtectMultiDevice

This plan is designed for customers who want to insure multiple devices under one plan. It offers a cost-effective solution for families or individuals with multiple devices. The cost of this plan depends on the number of devices and their total retail value.

| Number of Devices | Monthly Premium |

|---|---|

| 2 Devices | $19.99 |

| 3 Devices | $24.99 |

| 4+ Devices | Contact Verizon for a quote |

Verizon ProtectMultiDevice offers a more flexible and potentially cost-saving option for customers with multiple devices. It's worth noting that this plan may have different terms and conditions, so it's essential to review the details carefully.

Benefits of Verizon Phone Insurance

Verizon phone insurance offers several advantages to customers, providing them with a safety net for their devices.

Accidental Damage Coverage

One of the most common causes of smartphone repair or replacement is accidental damage. This includes situations like drops, spills, or cracks on the screen. With Verizon Protect, customers can rest assured that these types of incidents are covered, saving them from potentially expensive repair bills.

Theft Protection

Smartphones and tablets can be valuable targets for theft. Verizon’s insurance plan covers theft, providing customers with a replacement device in case their original one is stolen. This feature adds an extra layer of security and peace of mind.

Mechanical and Electrical Failures

Devices can sometimes fail due to mechanical or electrical issues. Verizon Protect covers these failures, ensuring that customers receive a repair or replacement if their device experiences such problems. This is particularly useful for older devices that may be more prone to such failures.

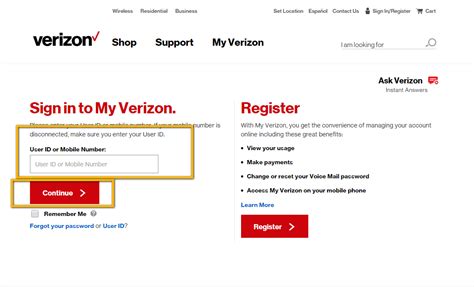

How to Enroll in Verizon Phone Insurance

Enrolling in Verizon phone insurance is a straightforward process. Customers can sign up for Verizon Protect or Verizon ProtectMultiDevice online through their My Verizon account or by visiting a Verizon store. During enrollment, customers will need to provide details about their device(s) and select the appropriate level of coverage.

It's important to note that there may be a waiting period before the insurance coverage becomes effective, and certain pre-existing conditions may not be covered. Therefore, it's advisable to enroll in the insurance plan as soon as you purchase a new device.

Conclusion: Weighing the Costs and Benefits

Verizon phone insurance, with its two main plans, offers a range of benefits to protect customers’ devices. The cost of insurance varies based on the plan and the device(s) being insured. While it can provide significant peace of mind, customers should carefully consider their needs and budget before enrolling. Understanding the terms and conditions, including any deductibles or waiting periods, is crucial to making an informed decision.

FAQ

Can I add phone insurance to my existing Verizon plan?

+

Yes, you can add phone insurance to your existing Verizon plan. Simply log into your My Verizon account or visit a Verizon store to enroll. The insurance premium will be added to your monthly bill.

What is the deductible for Verizon phone insurance?

+

The deductible varies depending on the device and the level of coverage. For instance, the deductible for an iPhone 13 Pro Max under Verizon Protect could be $299, while it might be lower for other devices or under different plans.

Does Verizon phone insurance cover water damage?

+

Yes, Verizon phone insurance typically covers water damage as part of its accidental damage coverage. However, it’s important to review the specific terms and conditions, as some plans may have exclusions or limitations for water damage.

Can I cancel my Verizon phone insurance at any time?

+

Yes, you can cancel your Verizon phone insurance at any time. However, keep in mind that you may not receive a refund for the portion of the premium that has already been used to cover the days you were insured.

What happens if I need to file a claim with Verizon phone insurance?

+

If you need to file a claim, you can do so by contacting Verizon’s customer service or visiting their website. You’ll need to provide details about the incident and the device. Verizon will then guide you through the claims process, which may involve sending your device for inspection or receiving a replacement.