Verizon Cell Insurance

In today's world, where smartphones have become an integral part of our lives, protecting these devices has become equally crucial. With the high cost of smartphones and the potential for damage or loss, having adequate insurance coverage can provide peace of mind. One of the prominent names in the cell phone insurance industry is Verizon Cell Insurance, offering comprehensive protection plans to its customers. In this article, we will delve into the details of Verizon Cell Insurance, exploring its coverage, benefits, and the impact it has on customers' experiences.

Understanding Verizon Cell Insurance

Verizon Cell Insurance, offered by Verizon Wireless, is a popular insurance option for smartphone users. It is designed to provide coverage against a range of unexpected events that can cause damage to or loss of your device. This insurance plan aims to safeguard customers’ investments and offer a reliable solution for potential repair or replacement costs.

Coverage and Benefits

Verizon Cell Insurance offers a comprehensive range of coverage options, ensuring that customers can find a plan that suits their specific needs. Here’s an overview of the key benefits and coverage provided by Verizon Cell Insurance:

- Accidental Damage Coverage: One of the primary benefits of Verizon Cell Insurance is its coverage for accidental damage. This includes incidents such as drops, spills, and cracks on the screen or body of the device. With this coverage, customers can have their devices repaired or replaced without incurring hefty out-of-pocket expenses.

- Theft and Loss Protection: Verizon Cell Insurance also extends protection to instances of theft and loss. In the unfortunate event of your device being stolen or lost, the insurance plan covers the cost of a replacement, providing a valuable safeguard against financial loss.

- Liquid Damage Coverage: Water damage can be a common and costly issue for smartphone users. Verizon Cell Insurance recognizes this and includes coverage for liquid damage, ensuring that even accidental exposure to liquids does not leave customers with a non-functional device.

- Battery Replacement: Over time, smartphone batteries can deteriorate, leading to reduced performance and shorter battery life. Verizon Cell Insurance includes battery replacement coverage, allowing customers to have their batteries replaced without having to purchase a new device.

- Dedicated Customer Support: Verizon understands the importance of prompt and efficient customer support when it comes to insurance claims. With Verizon Cell Insurance, customers have access to a dedicated team that assists with claim filings, ensuring a smooth and hassle-free process.

- Device Warranty Extension: In addition to the above coverage, Verizon Cell Insurance often includes an extended warranty period. This extends the manufacturer's warranty, providing further protection for the device and its components.

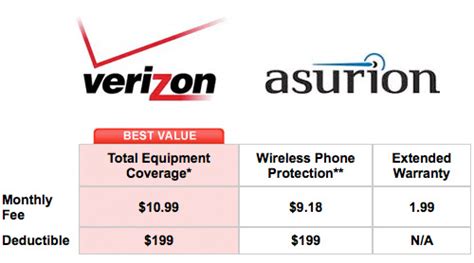

Pricing and Enrollment

The pricing of Verizon Cell Insurance varies depending on the device model and the level of coverage chosen. Generally, the cost is a monthly fee added to the customer’s Verizon wireless bill. The specific pricing structure may differ based on the device’s value and the selected plan.

Enrollment in Verizon Cell Insurance is a straightforward process. Customers can sign up for the insurance plan when purchasing a new device from Verizon or at any time during their device's lifecycle. It is important to note that there may be a waiting period before the insurance coverage becomes effective, so early enrollment is recommended.

Real-World Impact and Customer Experiences

Verizon Cell Insurance has gained popularity among smartphone users due to its comprehensive coverage and the positive impact it has had on customers’ experiences. Here are some real-world scenarios where Verizon Cell Insurance has made a difference:

- Accidental Damage Claims: Customers who have experienced accidental damage, such as a cracked screen due to a drop, have been able to utilize Verizon Cell Insurance to get their devices repaired or replaced promptly. This has saved them from the high costs of out-of-warranty repairs or the need to purchase a new device.

- Theft and Loss Protection: In instances where smartphones have been stolen or lost, Verizon Cell Insurance has provided a financial safety net. Customers have been able to replace their devices without incurring significant financial burdens, ensuring they can stay connected and continue their daily activities.

- Liquid Damage Incidents: Water damage can render smartphones unusable, and without insurance, the cost of repair or replacement can be substantial. Verizon Cell Insurance has come to the rescue in such situations, covering the costs and allowing customers to restore their devices or obtain a replacement.

- Battery Life Extension: As smartphones age, battery performance often declines. Verizon Cell Insurance's battery replacement coverage has proven beneficial for customers, extending the lifespan of their devices and avoiding the need for costly battery replacements outside of insurance.

- Efficient Claim Process: Verizon's dedicated customer support team has received praise for its efficiency in processing insurance claims. Customers have appreciated the streamlined process, which often results in quick turnarounds for repairs or replacements, minimizing the inconvenience of being without their devices.

Customer Satisfaction and Testimonials

Verizon Cell Insurance has consistently received positive feedback from customers who have experienced its benefits firsthand. Here are a few testimonials from satisfied customers:

"I accidentally dropped my phone in a pool, and I thought it was a total loss. But with Verizon Cell Insurance, I was able to get it replaced quickly, and I didn't have to worry about the costly repair. It was a relief to know that my device was protected."

"My phone was stolen while I was traveling, and I was worried about the financial impact. However, Verizon Cell Insurance covered the cost of a replacement, and I was back up and running within a few days. It's a great peace of mind to have this insurance."

"The battery life on my older phone was becoming an issue, but with Verizon Cell Insurance's battery replacement coverage, I was able to get a new battery installed. It saved me from having to buy a new phone, and my device feels like new again."

Comparative Analysis

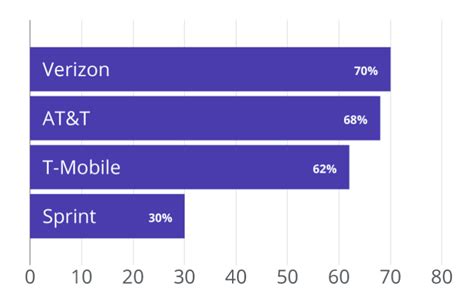

When comparing Verizon Cell Insurance to other cell phone insurance providers, it stands out for its comprehensive coverage and customer-centric approach. While there are alternative insurance options available, Verizon’s plan offers a competitive combination of benefits and customer support.

Some key factors that set Verizon Cell Insurance apart include its dedication to providing coverage for a wide range of incidents, including accidental damage, theft, and liquid damage. Additionally, the efficient claim process and dedicated customer support team ensure a seamless experience for policyholders.

Industry Recognition and Reputation

Verizon Wireless, as a leading telecommunications company, has established a strong reputation in the industry. This reputation extends to its insurance offerings, with Verizon Cell Insurance being recognized for its reliability and customer satisfaction. The company’s commitment to providing excellent service and support has contributed to its positive standing among customers and industry experts alike.

Future Implications and Innovations

As technology advances and smartphones become more integral to our daily lives, the demand for reliable cell phone insurance is expected to grow. Verizon Cell Insurance is well-positioned to meet this demand, and the company is continuously exploring ways to enhance its insurance offerings.

Looking ahead, Verizon may consider expanding its coverage options to include additional benefits, such as coverage for specific hardware components or enhanced data protection. Furthermore, with the rise of 5G technology and the potential for more advanced devices, Verizon Cell Insurance could adapt its plans to accommodate these new devices and their unique features.

Conclusion

Verizon Cell Insurance offers a comprehensive and reliable solution for smartphone users seeking protection against various unexpected events. With its wide range of coverage options, efficient claim process, and dedicated customer support, Verizon Cell Insurance has become a trusted choice for many. As the world of technology evolves, Verizon is poised to continue innovating and adapting its insurance plans to meet the changing needs of its customers.

What devices are eligible for Verizon Cell Insurance coverage?

+Verizon Cell Insurance is available for a wide range of devices, including smartphones, tablets, and even certain wearables. However, it’s important to check the specific eligibility criteria for each device as some models may have different coverage options.

How long does it take to process an insurance claim with Verizon Cell Insurance?

+The processing time for insurance claims can vary depending on the nature of the claim and the required documentation. In most cases, Verizon aims to provide a prompt resolution, and customers can expect a response within a few business days.

Can I add Verizon Cell Insurance to an existing device that I already own?

+Yes, Verizon Cell Insurance can be added to existing devices, provided they meet the eligibility criteria and are within the coverage period. Customers can enroll in the insurance plan at any time during the device’s lifecycle.