Usaa Casualty Insurance

USAA Casualty Insurance stands as a cornerstone in the financial services industry, offering comprehensive coverage and tailored solutions to a unique segment of the population: military service members, veterans, and their families. With a rich history deeply rooted in the military community, USAA has earned a reputation for its commitment to providing exceptional insurance products and customer service. This article delves into the intricacies of USAA Casualty Insurance, exploring its origins, key features, and the impact it has had on the lives of those it serves.

A Legacy of Service: USAA’s Origins and Evolution

The story of USAA Casualty Insurance begins in the early 20th century, amidst the backdrop of a nation preparing for war. In 1922, a group of forward-thinking Army officers recognized the unique insurance needs of military personnel and their families. They founded United Services Automobile Association (USAA), with the initial goal of providing affordable automobile insurance to Army officers.

Over the decades, USAA's scope expanded to meet the evolving needs of the military community. It introduced casualty insurance, offering protection against accidents, liability, and property damage. This move solidified USAA's position as a trusted provider of comprehensive insurance solutions tailored to the specific risks faced by those in uniform.

The company's commitment to its members is evident in its unwavering support during times of conflict. Throughout World War II, the Korean War, and the Vietnam War, USAA remained a steadfast partner, ensuring that service members and their families had the financial protection they needed, even in the face of uncertainty and danger.

Key Features of USAA Casualty Insurance

USAA Casualty Insurance offers a range of products designed to address the diverse needs of its members:

Automobile Insurance

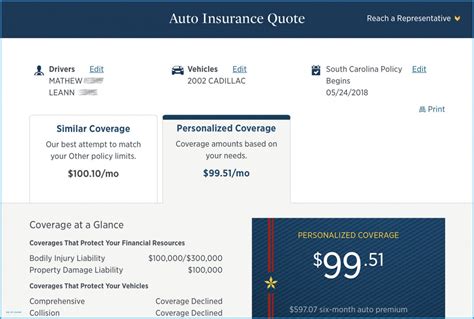

The cornerstone of USAA’s insurance offerings, automobile insurance provides coverage for a variety of vehicles, including cars, motorcycles, and RVs. Policies can be customized to include comprehensive and collision coverage, rental car reimbursement, and medical payments protection.

One unique aspect of USAA's automobile insurance is the Discounts for Safe Driving program. Members who maintain a clean driving record can qualify for significant discounts, making insurance more affordable and incentivizing safe driving practices.

Homeowners Insurance

USAA understands that for many military families, homeownership is a significant milestone. Their homeowners insurance policies offer protection against damage to the home and its contents, as well as liability coverage. USAA also provides specialized coverage for military-related risks, such as damage caused by military orders or service-related duties.

Additionally, USAA's Home Buying Assistance program offers resources and guidance to members navigating the home-buying process, ensuring they make informed decisions and receive the best value for their investment.

Renters Insurance

For those who rent, USAA’s renters insurance provides essential coverage for personal belongings and liability. This policy is particularly valuable for service members who frequently relocate, ensuring their possessions are protected no matter where their duty takes them.

Life Insurance

USAA’s life insurance products offer financial protection to members and their families in the event of an untimely death. Policies can be customized to meet individual needs, with options ranging from term life insurance to whole life insurance, which builds cash value over time.

Umbrella Insurance

Umbrella insurance provides an additional layer of liability protection beyond what is covered by standard policies. This is especially beneficial for high-net-worth individuals or those with unique assets to protect.

Benefits and Value-Added Services

USAA Casualty Insurance goes beyond traditional insurance products, offering a range of benefits and services that enhance the overall member experience:

- 24/7 Customer Service: Members have access to dedicated customer service representatives around the clock, ensuring prompt assistance and support whenever needed.

- Online and Mobile Tools: USAA provides user-friendly online and mobile platforms, allowing members to manage their policies, file claims, and access important documents from anywhere, at any time.

- Discounts and Rewards: USAA offers a variety of discounts, such as the Multi-Policy Discount for members who bundle their insurance policies, and Loyalty Rewards, which provide additional savings for long-term members.

- Military-Specific Benefits: USAA's insurance policies include coverage for military-related risks, such as damage caused by military operations or deployment-related incidents. This tailored approach demonstrates USAA's deep understanding of the unique challenges faced by military families.

Performance and Industry Recognition

USAA Casualty Insurance has consistently earned accolades for its exceptional performance and customer satisfaction. The company’s focus on innovation and member-centric solutions has positioned it as a leader in the insurance industry.

Key performance indicators reflect USAA's success:

| Metric | Value |

|---|---|

| J.D. Power Customer Satisfaction Rating | 4.5 out of 5 (2023) |

| AM Best Financial Strength Rating | A++ (Superior) |

| Claim Satisfaction Rate | 97% (2022) |

| Member Retention Rate | 93% (2022) |

These metrics highlight USAA's commitment to delivering exceptional service and maintaining a strong financial position, ensuring the long-term stability and reliability of its insurance offerings.

Conclusion: A Trusted Partner for Military Families

USAA Casualty Insurance has emerged as a trusted provider of comprehensive insurance solutions tailored to the unique needs of military service members and their families. With a rich history of service and a deep understanding of the military community, USAA has built a reputation for excellence, earning the loyalty and trust of its members.

As the company continues to innovate and adapt to the evolving needs of its members, USAA Casualty Insurance remains a beacon of financial protection and support for those who serve our nation. Its commitment to delivering exceptional value and service ensures that military families can focus on their missions, knowing their financial well-being is secure.

Can USAA members access their insurance policies and services online or through a mobile app?

+Absolutely! USAA offers a user-friendly online platform and mobile app that allow members to manage their policies, view coverage details, file claims, and access important documents. These digital tools provide convenience and ease of use, ensuring members can access their insurance information anytime, anywhere.

Does USAA offer discounts for multiple policies or loyalty rewards?

+Yes, USAA understands the value of loyalty and encourages members to bundle their insurance policies. The Multi-Policy Discount provides savings for those who have multiple policies with USAA. Additionally, the Loyalty Rewards program offers additional discounts and benefits to long-term members, rewarding their continued trust and support.

What sets USAA Casualty Insurance apart from other insurance providers?

+USAA’s unique focus on the military community sets it apart. The company’s deep understanding of the specific risks and challenges faced by service members and their families allows it to tailor insurance solutions accordingly. USAA’s commitment to its members and its dedication to providing exceptional service and financial protection make it a trusted partner for those who serve.