Usaa Automobile Insurance Company

Welcome to an in-depth exploration of USAA Automobile Insurance Company, a renowned player in the world of automotive insurance. With a rich history spanning decades, USAA has established itself as a trusted provider, catering specifically to the needs of military members, veterans, and their families. In this comprehensive article, we will delve into the unique features, offerings, and impact of USAA's automobile insurance services, shedding light on why it has become a go-to choice for so many.

A Legacy of Service and Protection

USAA Automobile Insurance Company traces its roots back to 1922 when a group of US Army officers, recognizing the need for affordable insurance coverage, formed the United Services Automobile Association. This initial endeavor aimed to provide insurance solutions tailored to the unique circumstances and challenges faced by military personnel. Over the years, USAA has expanded its services, becoming a full-service financial institution offering a diverse range of products, including insurance, banking, investments, and more.

The company's commitment to its core values of integrity, service, and value has propelled it to become one of the most trusted brands in the industry. USAA's reputation is built on a foundation of exceptional customer service, innovative products, and a deep understanding of the specific needs of its target market.

Comprehensive Automobile Insurance Solutions

USAA’s automobile insurance offerings are designed to provide comprehensive coverage options that cater to a wide range of needs. Whether it’s protecting a vintage military vehicle or insuring a modern family car, USAA has tailored its policies to meet these diverse requirements.

Personalized Coverage Options

USAA offers a variety of coverage options, allowing policyholders to customize their plans according to their specific needs. These include liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), uninsured/underinsured motorist coverage, and medical payments coverage. Policyholders can choose the levels of coverage that best suit their circumstances, ensuring they have the right protection in place.

One unique aspect of USAA's coverage is its recognition of the unique challenges faced by military personnel and their families. For instance, the company offers coverage for vehicles that may be temporarily stored or left idle during deployments, ensuring protection even when the vehicle is not in active use. This understanding of military life sets USAA apart and adds a layer of security for its policyholders.

Competitive Rates and Discounts

USAA is known for offering competitive rates on its automobile insurance policies. The company’s strong financial standing and efficient operations allow it to pass on cost savings to its members. Additionally, USAA provides a range of discounts that can further reduce insurance premiums. These discounts include safe driver discounts, good student discounts, multiple policy discounts, and loyalty rewards, among others.

| Discount Type | Description |

|---|---|

| Safe Driver Discount | Recognizes members with a clean driving record. |

| Good Student Discount | Rewards young drivers who maintain good grades. |

| Multiple Policy Discount | Offers savings for members with multiple policies (e.g., auto and home insurance) with USAA. |

| Loyalty Rewards | Provides benefits to long-term members, rewarding loyalty and tenure. |

Military-Specific Benefits

USAA’s automobile insurance policies come with several benefits specifically designed for military members and their families. These include deployment protection, which ensures coverage even when a vehicle is temporarily stored or left idle during a deployment. There’s also the option for “lay-up” coverage, which provides limited coverage for vehicles that are not in use but may need to be driven occasionally.

Additionally, USAA offers a rental car benefit, which covers rental car expenses in the event of a covered loss. This benefit is particularly valuable for military families who may need a rental car while their vehicle is being repaired or replaced.

Exceptional Customer Service and Support

USAA is renowned for its exceptional customer service and support, a key differentiator in the insurance industry. The company’s customer service representatives are highly trained and knowledgeable, providing personalized assistance to policyholders. Whether it’s answering questions about coverage, helping with policy changes, or assisting with claims, USAA’s customer service team is dedicated to ensuring a positive experience.

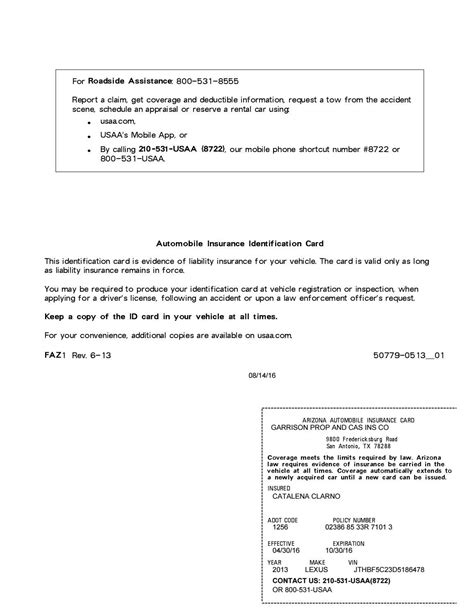

Online and Mobile Accessibility

USAA understands the importance of convenience and accessibility in today’s fast-paced world. The company offers a robust online and mobile platform, allowing policyholders to manage their insurance policies, make payments, file claims, and access important documents from anywhere, at any time. This digital accessibility streamlines the insurance process and ensures policyholders can stay on top of their coverage with ease.

Claims Process and Support

In the event of an accident or other covered loss, USAA’s claims process is designed to be efficient and supportive. Policyholders can report claims online, over the phone, or through the mobile app. USAA’s claims adjusters are experienced in handling a wide range of claims, ensuring a fair and timely resolution. The company’s commitment to customer satisfaction extends to the claims process, with a focus on providing quick and accurate assessments and payouts.

Innovative Features and Technology

USAA continually invests in innovative technologies and features to enhance its automobile insurance offerings. One notable example is the USAA Mobile App, which provides policyholders with a convenient and secure way to manage their insurance policies and access important information on the go.

Digital Tools and Resources

The USAA Mobile App offers a range of digital tools and resources, including a digital ID card, which allows policyholders to quickly and easily access their insurance information. The app also provides a comprehensive claims center, where policyholders can track the status of their claims, upload necessary documentation, and communicate directly with claims adjusters. Additionally, the app includes a garage feature, which allows policyholders to store important vehicle information, maintenance records, and even take photos of their vehicles for future reference.

Telematics and Safe Driving Programs

USAA has embraced telematics technology, offering programs that reward safe driving behaviors. These programs utilize GPS and accelerometer data to monitor driving habits, providing feedback and incentives to policyholders who maintain safe driving practices. By encouraging safer driving, USAA not only helps reduce the risk of accidents but also potentially lowers insurance premiums for its members.

Community Engagement and Education

Beyond its insurance offerings, USAA is deeply committed to community engagement and education. The company actively supports military-related causes and initiatives, demonstrating its commitment to giving back to the communities it serves. USAA’s community engagement efforts focus on supporting military families, veterans, and their caregivers, ensuring they have access to the resources and support they need.

Educational Resources and Programs

USAA recognizes the importance of financial literacy and offers a range of educational resources and programs to help its members make informed decisions about their finances. These resources cover a wide range of topics, including insurance, banking, investments, and more. By providing accessible and comprehensive financial education, USAA empowers its members to make wise financial choices and plan for their future.

Industry Recognition and Awards

USAA’s commitment to excellence has been recognized by numerous industry awards and accolades. The company consistently ranks among the top insurance providers in terms of customer satisfaction, financial strength, and innovation. USAA’s automobile insurance offerings have been praised for their comprehensive coverage, competitive rates, and exceptional customer service, cementing its position as a leader in the industry.

| Award | Description |

|---|---|

| J.D. Power Awards | USAA has received top ratings in J.D. Power's Auto Insurance Studies, recognizing its outstanding customer satisfaction and claims handling. |

| Forbes America's Top-Rated Insurers | Forbes has ranked USAA among the top insurance companies for its financial strength and customer satisfaction. |

| A.M. Best Rating | USAA has maintained a strong financial rating from A.M. Best, a leading insurance rating agency, reflecting its financial stability and security. |

Future Outlook and Innovations

Looking ahead, USAA is poised to continue its legacy of innovation and service excellence. The company is constantly evolving its offerings to meet the changing needs of its members and the insurance industry. With a focus on technology, data analytics, and member experience, USAA is well-positioned to provide cutting-edge insurance solutions while maintaining its commitment to military families and veterans.

As USAA continues to adapt and innovate, it remains a trusted partner for its members, offering comprehensive automobile insurance coverage, exceptional customer service, and a deep understanding of the unique needs of military personnel and their families. With a rich history and a bright future, USAA Automobile Insurance Company stands as a beacon of reliability and service in the insurance industry.

What makes USAA’s automobile insurance unique for military members and their families?

+

USAA’s automobile insurance is tailored to the specific needs of military members and their families. This includes coverage for vehicles stored during deployments, rental car benefits, and military-specific discounts. USAA’s deep understanding of military life and its commitment to supporting military families set it apart in the insurance industry.

How does USAA’s telematics program work, and what benefits does it offer to policyholders?

+

USAA’s telematics program utilizes GPS and accelerometer data to monitor driving habits. It provides feedback to policyholders on their driving behaviors and offers incentives for maintaining safe driving practices. This program not only encourages safer driving but can also lead to lower insurance premiums for members.

What resources does USAA offer for financial education and planning?

+

USAA provides a wide range of financial education resources, including articles, webinars, and tools, covering topics like insurance, banking, investments, and more. These resources are designed to help members make informed financial decisions and plan for their future.