Top Insurance Companies For Homeowners

Choosing the right insurance company for your home is a crucial decision that can significantly impact your financial security and peace of mind. With countless options available in the market, it can be challenging to identify the top insurers that offer the best coverage, competitive rates, and exceptional customer service. This comprehensive guide aims to help you navigate the complex world of homeowners' insurance, presenting you with a detailed analysis of the top insurance companies in the industry.

A Deep Dive into the Top Insurance Companies for Homeowners

When it comes to safeguarding your home and possessions, selecting a reputable insurance provider is paramount. These are the companies that consistently rank among the best in the industry, offering a combination of comprehensive coverage, competitive pricing, and exceptional customer satisfaction.

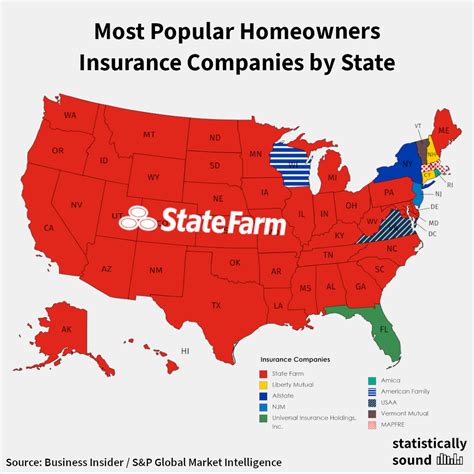

State Farm

State Farm has been a trusted name in the insurance industry for decades. With a vast network of agents across the United States, they offer a personalized touch to their services. State Farm's comprehensive homeowners' insurance policies cover a wide range of perils, including fire, theft, and natural disasters. They also provide additional coverage options for specific risks like identity theft and water backup.

One of the key advantages of State Farm is their claims process, which is known for being efficient and customer-friendly. They offer 24/7 claims assistance, ensuring that policyholders can receive help whenever needed. Additionally, State Farm's discounts are a major draw, with options for bundling policies, loyalty, and safety features installed in the home.

| Category | State Farm Rating |

|---|---|

| Financial Stability | A++ (Superior) |

| Customer Satisfaction | 4.3/5 (Excellent) |

| Claims Process | 4.5/5 (Excellent) |

Allstate

Allstate is another well-established insurance company that provides a wide range of coverage options for homeowners. Their flexible policies allow customers to customize their coverage, ensuring they get the protection they need without paying for unnecessary add-ons.

Allstate's Claims Satisfaction Guarantee is a standout feature, assuring policyholders that they will be satisfied with the claims process. If not, Allstate will reimburse the policyholder for their deductible and work with another contractor to complete the repairs. Additionally, Allstate offers a free roof inspection for homeowners, providing peace of mind and the opportunity to address any potential issues proactively.

| Category | Allstate Rating |

|---|---|

| Financial Strength | A+ (Excellent) |

| Customer Service | 4.4/5 (Very Good) |

| Discounts | 4.5/5 (Excellent) |

USAA

USAA is a unique insurance provider, catering specifically to military members, veterans, and their families. Known for their exceptional customer service and competitive rates, USAA offers a range of insurance products tailored to the needs of the military community.

Their homeowners' insurance policies provide comprehensive coverage, including protection against natural disasters and personal liability. USAA also offers discounts for policyholders who bundle their insurance policies, have safety features installed, or are loyal customers. Additionally, USAA provides 24/7 claims assistance, ensuring prompt support for their policyholders.

| Category | USAA Rating |

|---|---|

| Financial Strength | A++ (Superior) |

| Customer Satisfaction | 4.6/5 (Excellent) |

| Discounts | 4.5/5 (Excellent) |

Amica Mutual Insurance

Amica Mutual Insurance is a well-respected company known for its exceptional customer service and financial stability. They offer a range of insurance products, including homeowners' insurance, with a focus on providing personalized coverage and excellent support.

Amica's homeowners' insurance policies cover a wide range of perils, including fire, theft, and liability. They also provide additional coverage options for specific risks, such as water damage and identity theft. Amica's claims process is highly praised, with a dedicated team of claims adjusters who work closely with policyholders to ensure a smooth and efficient resolution.

| Category | Amica Rating |

|---|---|

| Financial Stability | A+ (Excellent) |

| Customer Satisfaction | 4.7/5 (Exceptional) |

| Claims Process | 4.8/5 (Exceptional) |

Farmers Insurance

Farmers Insurance is a leading insurance provider, offering a comprehensive suite of insurance products, including homeowners' insurance. They are known for their customizable policies, allowing customers to tailor their coverage to their specific needs and budget.

Farmers Insurance's claims process is highly efficient, with a dedicated claims team that works swiftly to resolve issues. They offer 24/7 claims assistance, ensuring that policyholders can receive support whenever needed. Additionally, Farmers Insurance provides a range of discounts, including options for bundling policies, loyalty, and safety features.

| Category | Farmers Rating |

|---|---|

| Financial Strength | A (Excellent) |

| Customer Service | 4.3/5 (Excellent) |

| Discounts | 4.4/5 (Very Good) |

Factors to Consider When Choosing an Insurance Company

While the aforementioned insurance companies are among the top in the industry, it's essential to consider your specific needs and circumstances when choosing an insurance provider. Here are some key factors to keep in mind:

- Coverage Options: Ensure that the insurance company offers the type of coverage you require, including specific perils and additional coverage options.

- Financial Stability: Check the financial ratings of the insurance company to ensure they are financially stable and capable of paying out claims.

- Customer Satisfaction: Research customer reviews and ratings to gauge the insurance company's reputation for customer service and claims handling.

- Discounts: Look for insurance companies that offer discounts for bundling policies, loyalty, or safety features to help reduce your insurance costs.

- Claims Process: Understand the insurance company's claims process, including their response time, claims adjusters' availability, and the overall efficiency of the process.

FAQs

What are the typical coverage options for homeowners’ insurance policies?

+

Homeowners’ insurance policies typically cover a range of perils, including fire, theft, and liability. They may also offer additional coverage options for specific risks like water damage, identity theft, and natural disasters.

How can I save money on my homeowners’ insurance policy?

+

You can save money on your homeowners’ insurance policy by shopping around for quotes, bundling your insurance policies, and taking advantage of discounts offered by insurance companies. Additionally, maintaining a good credit score and installing safety features in your home can lead to lower premiums.

What should I do if I need to file a claim with my insurance company?

+

If you need to file a claim with your insurance company, contact their claims department immediately. Provide detailed information about the incident and any relevant documentation. Work closely with the claims adjuster to ensure a smooth and efficient claims process.

How often should I review my homeowners’ insurance policy?

+

It’s recommended to review your homeowners’ insurance policy annually or whenever you make significant changes to your home or possessions. This ensures that your coverage remains adequate and up-to-date.

What are some common exclusions in homeowners’ insurance policies?

+

Common exclusions in homeowners’ insurance policies include damage caused by earthquakes, floods, and poor maintenance. It’s essential to review your policy’s exclusions carefully to understand what is and isn’t covered.