Tooth Insurance

Tooth insurance, also known as dental insurance or dental care coverage, is an essential aspect of healthcare that often goes overlooked. It plays a crucial role in ensuring access to affordable dental care, promoting oral health, and preventing more serious health issues down the line. With a rising focus on overall wellness, the importance of dental insurance is gaining recognition, especially as research highlights the deep connection between oral health and general well-being.

In this comprehensive article, we delve into the world of tooth insurance, exploring its various facets, benefits, and implications. We aim to provide an in-depth understanding of this topic, offering valuable insights for individuals and families seeking to make informed decisions about their oral health and financial well-being.

Understanding Tooth Insurance: The Basics

Tooth insurance, at its core, is a form of health insurance designed specifically to cover dental care expenses. It provides financial protection against the potentially high costs of dental treatments, ranging from routine check-ups and cleanings to more complex procedures like root canals, implants, or orthodontic work.

This type of insurance operates similarly to other health insurance plans, with policyholders paying premiums to the insurance provider in exchange for coverage. The specific benefits and coverage limits of a tooth insurance plan can vary widely, depending on the type of plan and the insurance company offering it.

Types of Tooth Insurance Plans

There are several types of tooth insurance plans available, each with its own set of features and benefits:

- Indemnity Plans: Also known as fee-for-service plans, indemnity plans offer the most flexibility. Policyholders can choose their own dentists and are reimbursed a certain percentage of the total cost of dental services, typically ranging from 50% to 80%.

- Preferred Provider Organization (PPO) Plans: PPO plans offer a network of preferred dentists and specialists. Policyholders can visit any dentist they choose but will save more by using an in-network provider. These plans often cover a higher percentage of costs when using in-network providers.

- Health Maintenance Organization (HMO) Plans: HMO plans typically require policyholders to choose a primary care dentist and receive referrals from them to specialists. These plans often have lower premiums and copayments but may have more limited provider choices.

- Discount Dental Plans: Unlike traditional insurance, discount dental plans provide access to a network of dentists at reduced rates. Members pay an annual fee and then receive discounted prices on dental services, but there are no insurance claims or reimbursements.

- Dental Savings Plans: Similar to discount dental plans, these plans offer access to a network of dentists at reduced rates. Members pay an annual fee and receive a specified discount on dental services. These plans are often used as an alternative to traditional insurance and can be especially beneficial for those with pre-existing dental conditions.

Key Coverage Components

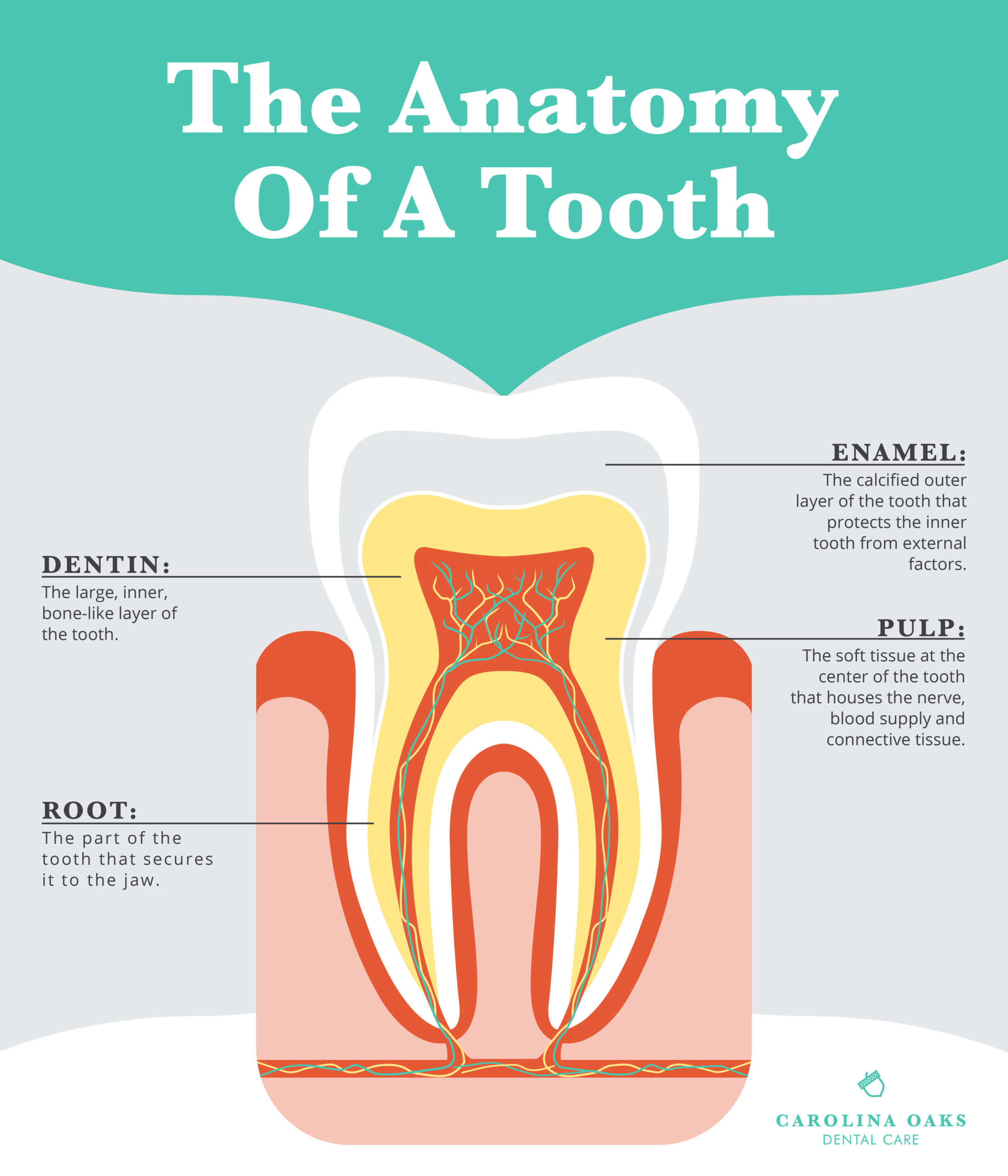

Tooth insurance plans typically cover three main categories of dental services, each with its own coverage limits and restrictions:

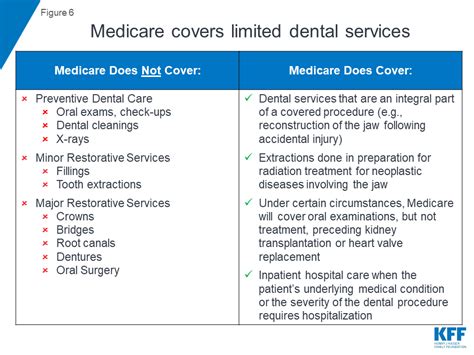

- Preventive Care: This includes routine check-ups, cleanings, X-rays, and fluoride treatments. Most plans cover these services at 100% with no deductible, as they are considered essential for maintaining good oral health.

- Basic Restorative Care: Basic restorative care covers treatments like fillings, root canals, and simple extractions. The coverage limits and copayments for these services can vary widely between plans.

- Major Restorative Care: Major restorative care includes more complex procedures such as crowns, bridges, dentures, and oral surgery. These services often have higher out-of-pocket costs and may require prior authorization from the insurance provider.

It's important to carefully review the details of any tooth insurance plan to understand the specific coverage limits, deductibles, copayments, and any exclusions or limitations.

The Benefits of Tooth Insurance

Tooth insurance offers a range of benefits that extend beyond financial protection. Here are some of the key advantages of having dental insurance coverage:

Promoting Regular Dental Check-Ups

Regular dental check-ups and cleanings are fundamental to maintaining good oral health. Tooth insurance plans typically cover these preventive services at 100%, encouraging policyholders to prioritize their oral hygiene. This proactive approach can help identify potential issues early on, leading to more effective and less costly treatments.

Early Detection and Treatment of Dental Issues

Tooth insurance facilitates early detection of dental problems through regular check-ups and X-rays. By catching issues like cavities, gum disease, or oral infections early, individuals can receive prompt treatment, often preventing more severe and costly complications down the line.

Cost Savings on Dental Procedures

The cost of dental procedures can be a significant financial burden, especially for those without insurance. Tooth insurance plans help policyholders manage these costs by covering a portion of the expenses. This can make necessary treatments more accessible and reduce the financial strain associated with unexpected dental issues.

Improved Oral Health and Overall Well-Being

Good oral health is not just about a bright smile and fresh breath. Research has consistently shown a strong link between oral health and overall systemic health. Tooth insurance encourages individuals to take care of their oral health, which can have positive effects on their general well-being, including a reduced risk of heart disease, diabetes, and other serious health conditions.

Protection Against Unexpected Dental Emergencies

Dental emergencies, such as broken teeth, severe infections, or accidents involving the mouth, can be both physically and financially challenging. Tooth insurance provides coverage for these unexpected situations, offering peace of mind and ensuring access to timely and necessary treatment.

Choosing the Right Tooth Insurance Plan

Selecting the right tooth insurance plan involves considering several factors, including individual dental needs, budget, and the availability of different plan types. Here are some key considerations when choosing a tooth insurance plan:

Assessing Dental Needs

Understanding your current and potential future dental needs is crucial. Consider factors like the frequency of check-ups and cleanings, the likelihood of needing more complex procedures like root canals or implants, and any ongoing dental conditions or treatments. This self-assessment will help guide your choice of plan type and coverage limits.

Comparing Plan Options

Research and compare different tooth insurance plans offered by various providers. Consider the types of plans outlined earlier (indemnity, PPO, HMO, etc.) and evaluate their coverage, provider networks, costs (premiums, deductibles, copayments), and any exclusions or limitations. Online resources, insurance brokers, and dental offices can provide valuable information to aid in your decision.

Understanding Coverage and Exclusions

Read the fine print of any tooth insurance plan carefully to understand what is and isn’t covered. Pay attention to the coverage limits for different types of procedures, any waiting periods before certain treatments are covered, and any pre-authorization requirements. Also, be aware of any exclusions, such as cosmetic dentistry or certain types of treatments, which may not be covered by the plan.

Considering Premium and Out-of-Pocket Costs

Tooth insurance plans come with various premium and out-of-pocket costs. Evaluate the balance between the monthly premiums, deductibles, copayments, and any additional out-of-pocket expenses you might incur. Consider your financial situation and determine a plan that aligns with your budget while still offering adequate coverage.

Evaluating Provider Networks

If you have a preferred dentist or specialist, check if they are in the network of the tooth insurance plan you’re considering. Network providers typically offer more significant cost savings compared to out-of-network providers. If you don’t have a preferred dentist, review the plan’s network to ensure it includes a range of providers in your area to give you flexibility in choosing a dentist.

The Future of Tooth Insurance

The landscape of tooth insurance is evolving, driven by advancements in dental technology, changes in healthcare policies, and a growing focus on preventive care. Here are some key trends and developments shaping the future of tooth insurance:

Focus on Preventive Care and Wellness

There is a growing recognition of the importance of preventive dental care in maintaining overall health and well-being. As a result, tooth insurance plans are increasingly emphasizing preventive services and providing incentives for policyholders to prioritize their oral health. This trend is expected to continue, with more plans offering comprehensive preventive care coverage and encouraging regular check-ups and screenings.

Integration with Overall Health Plans

Tooth insurance is becoming more integrated with overall health plans, recognizing the deep connection between oral health and systemic health. This integration is expected to improve as healthcare systems adopt a more holistic approach to patient care. It may lead to more comprehensive plans that cover both medical and dental needs, providing seamless and coordinated care for policyholders.

Advancements in Dental Technology

Advancements in dental technology, such as digital X-rays, 3D printing for dental prosthetics, and laser dentistry, are making dental procedures more efficient, precise, and comfortable. As these technologies become more widely adopted, they are likely to influence tooth insurance coverage. Plans may start to cover these advanced procedures, offering policyholders access to the latest and most effective treatments.

Increasing Focus on Patient Education

Tooth insurance providers are recognizing the importance of patient education in promoting oral health. Many plans now offer resources and tools to help policyholders understand their coverage, make informed decisions about their dental care, and prioritize preventive measures. This trend is expected to continue, with insurance providers playing a more active role in educating their policyholders about oral health and hygiene.

Exploring Alternative Models

The traditional tooth insurance model is evolving, with the emergence of alternative plans like discount dental plans and dental savings plans. These plans offer a more affordable option for individuals who may not qualify for or need comprehensive coverage. As the demand for these alternative models grows, insurance providers are likely to continue developing and refining these plans to meet the diverse needs of policyholders.

Conclusion

Tooth insurance is an essential component of healthcare, offering a range of benefits that extend beyond financial protection. It promotes regular dental check-ups, facilitates early detection and treatment of dental issues, provides cost savings on procedures, and contributes to overall well-being. When selecting a tooth insurance plan, it’s crucial to assess individual needs, compare plan options, understand coverage and exclusions, and consider premium and out-of-pocket costs. The future of tooth insurance looks promising, with a growing focus on preventive care, integration with overall health plans, advancements in dental technology, increased patient education, and the exploration of alternative models.

What is the average cost of tooth insurance plans?

+The cost of tooth insurance plans can vary widely based on several factors, including the type of plan, the coverage limits, and the insurance provider. On average, individual plans can range from 30 to 50 per month, while family plans may cost between 80 and 150 per month. However, these are just estimates, and actual costs can be higher or lower depending on the specific plan and your location.

Do tooth insurance plans cover cosmetic dentistry procedures?

+The coverage of cosmetic dentistry procedures varies depending on the tooth insurance plan. While some plans may offer limited coverage for certain cosmetic procedures, such as teeth whitening, most plans primarily focus on restorative and preventive care. It’s important to carefully review the plan’s coverage details to understand what is and isn’t covered.

Can I switch tooth insurance plans if I’m not satisfied with my current coverage?

+Yes, you can switch tooth insurance plans if you’re not satisfied with your current coverage. However, it’s important to understand the implications of switching plans, such as potential waiting periods for certain procedures or changes in provider networks. Research and compare different plans to ensure you find one that better aligns with your dental needs and budget.