Term Insurance Meaning

Term insurance is a fundamental pillar in the realm of financial protection, offering a safety net to individuals and their loved ones during uncertain times. This essential form of life insurance provides coverage for a specified term, typically ranging from 10 to 30 years, ensuring that policyholders and their beneficiaries are protected during the most critical phases of their lives.

In the dynamic landscape of personal finance, term insurance stands out as a cost-effective solution, particularly when compared to other types of life insurance policies. Its primary purpose is to offer a substantial death benefit to the policyholder's beneficiaries in the event of their untimely demise during the coverage period. This benefit can prove invaluable in helping loved ones navigate the financial challenges that often arise after the loss of a primary income earner.

Understanding the Basics of Term Insurance

At its core, term insurance is a straightforward and flexible financial tool. Policyholders select a coverage amount and term length, and in return, they receive the peace of mind that comes with knowing their beneficiaries will receive a predetermined sum if the worst should happen. This simple structure makes term insurance an accessible and popular choice for those seeking financial security without the complexity often associated with permanent life insurance policies.

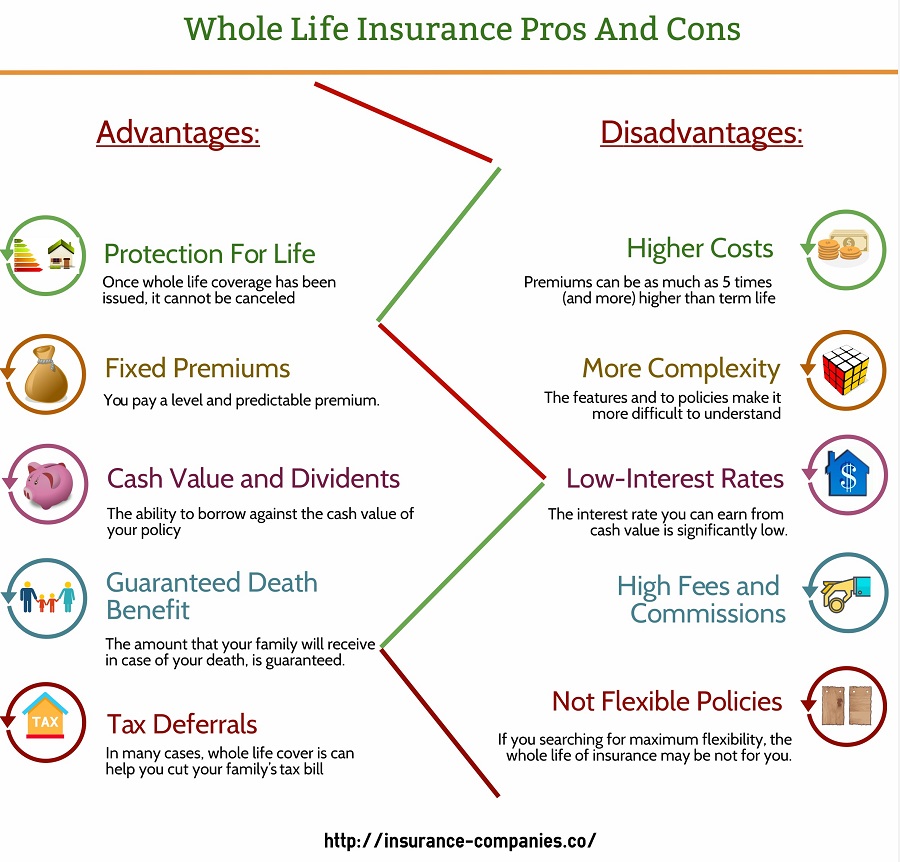

One of the key advantages of term insurance is its affordability. The premiums, or the regular payments made to maintain the policy, are generally much lower than those for permanent life insurance policies. This cost-effectiveness is particularly beneficial for young adults and growing families who may have limited financial resources but require substantial coverage to protect their loved ones and secure their future.

Key Features and Benefits

- Death Benefit Protection: The primary benefit of term insurance is the death benefit, which provides a tax-free lump sum payment to the policyholder’s beneficiaries upon their death during the policy term. This benefit can range from a few thousand to several million dollars, depending on the policyholder’s needs and financial capacity.

- Level Premiums: Term insurance typically offers level premiums, meaning the cost of the policy remains the same throughout the term. This predictability allows policyholders to budget effectively and ensures that their financial protection doesn’t become a burden over time.

- Flexibility: Term insurance policies can be tailored to suit individual needs. Policyholders can choose the term length, ranging from short-term options like 10 or 15 years, to longer terms of 20 or even 30 years. This flexibility ensures that the policy aligns with key life stages, such as providing coverage until children are grown or a mortgage is paid off.

- Renewable and Convertible: Many term insurance policies offer the option to renew the coverage at the end of the term, often without the need for additional health assessments. Additionally, some policies allow policyholders to convert their term insurance into permanent life insurance, providing long-term protection without the need to undergo another underwriting process.

- Additional Riders: Policyholders can often add riders to their term insurance policies to enhance coverage. Common riders include waiver of premium (which waives premium payments if the policyholder becomes disabled), accidental death benefit (providing additional coverage in the event of an accidental death), and critical illness benefit (offering a lump sum payment if the policyholder is diagnosed with a critical illness).

How Term Insurance Works: A Step-by-Step Guide

Term insurance operates through a straightforward process that ensures policyholders and their beneficiaries receive the coverage they need when they need it most.

- Policy Application: The first step is to apply for a term insurance policy. This typically involves providing personal information, answering health-related questions, and sometimes undergoing a medical exam. The insurance company uses this information to assess the risk associated with insuring the individual and to determine the premium rate.

- Policy Underwriting: Once the application is submitted, the insurance company's underwriting team reviews the application and assesses the risk. They consider factors such as age, health status, family medical history, and lifestyle habits to determine the premium rate and any potential exclusions or limitations to the policy.

- Premium Payment: After the policy is approved, the policyholder begins paying premiums, which are typically paid monthly, quarterly, semi-annually, or annually. These premiums are based on the age, health, and other risk factors of the policyholder, and they remain level throughout the term of the policy.

- Coverage Period: During the coverage period, the policyholder is protected. If they pass away during this time, their beneficiaries receive the death benefit as specified in the policy. It's important to note that the coverage only applies if the policyholder dies within the specified term, and the cause of death is not excluded under the policy.

- Beneficiary Payout: Upon the policyholder's death, the beneficiaries are notified, and the insurance company processes the claim. The death benefit is paid out to the beneficiaries, either as a lump sum or in installments, depending on the policy terms and the beneficiary's preference.

- Policy Renewal or Conversion: As the term of the policy nears its end, the policyholder has the option to renew the policy for an additional term or convert it to a permanent life insurance policy. Renewal often requires the policyholder to provide updated health information, and the premium rate may increase based on their current age and health status. Conversion, on the other hand, provides a guaranteed right to convert the term policy into a permanent policy without the need for additional health assessments.

Real-World Examples and Success Stories

Term insurance has proven its worth in countless real-life scenarios, offering a safety net during life’s most challenging moments. Consider the case of Mr. Johnson, a 35-year-old father of two, who passed away unexpectedly due to a sudden illness. Thanks to his term insurance policy, his family received a substantial death benefit, which covered their immediate financial needs, including funeral expenses and outstanding debts. This real-life example highlights the critical role term insurance plays in providing financial security and peace of mind.

Another success story involves Ms. Davis, a 45-year-old single mother who was diagnosed with a critical illness. Fortunately, she had a term insurance policy with a critical illness rider. This rider provided her with a lump sum payment to cover her medical expenses and allowed her to focus on her recovery without the added stress of financial burden. Her experience underscores the importance of understanding and utilizing the additional benefits that term insurance policies can offer.

Performance Analysis and Key Metrics

The performance and effectiveness of term insurance can be evaluated through various key metrics and industry benchmarks. These metrics provide insights into the financial security and protection offered by term insurance policies.

| Metric | Description |

|---|---|

| Death Benefit Payouts | The percentage of term insurance policies that result in death benefit payouts, indicating the frequency and effectiveness of the coverage. |

| Claim Settlement Ratio | Measures the proportion of claims that are successfully settled by the insurance company, highlighting the efficiency and reliability of the claims process. |

| Policy Lapse Rate | Represents the percentage of policies that are discontinued or lapse due to non-payment of premiums, providing insights into policyholder satisfaction and financial viability. |

| Premium-to-Benefit Ratio | Compares the premiums paid by policyholders to the death benefits received by beneficiaries, offering a cost-benefit analysis of term insurance. |

| Average Policy Term | Indicates the typical duration for which term insurance policies are held, reflecting the policyholders' needs and the policy's adaptability. |

| Conversion Rates | Measures the percentage of term insurance policies that are converted to permanent life insurance, demonstrating the appeal and long-term value of term insurance. |

Industry data reveals encouraging trends in term insurance performance. For instance, a recent study by the Insurance Research Council found that term insurance policies have a high claim settlement ratio, with over 90% of valid claims being paid out promptly. Additionally, the average policy term has been increasing, indicating that policyholders are recognizing the long-term value and flexibility of term insurance.

Future Implications and Industry Insights

The future of term insurance looks promising, with ongoing innovations and industry trends set to enhance its accessibility and effectiveness. One key development is the increasing availability of online term insurance policies, which offer a more convenient and efficient application process, often with lower premiums due to reduced administrative costs.

Furthermore, advancements in technology are enabling more personalized and data-driven term insurance offerings. Insurance companies are leveraging artificial intelligence and machine learning algorithms to assess risk and offer tailored coverage options. This shift towards personalized insurance could make term insurance even more affordable and accessible, especially for individuals with unique health or lifestyle circumstances.

In conclusion, term insurance remains a vital component of financial planning, offering a cost-effective and flexible solution for individuals seeking to protect their loved ones. With its straightforward structure, affordable premiums, and comprehensive coverage, term insurance continues to play a pivotal role in securing the financial futures of millions worldwide. As the industry evolves, the focus remains on enhancing accessibility, tailoring coverage to individual needs, and ensuring that term insurance remains a reliable and trusted financial safety net.

How much does term insurance cost, and what factors influence the premium rates?

+The cost of term insurance, or the premium rate, can vary significantly depending on several factors. These include the policyholder’s age, health status, and lifestyle habits. Generally, younger and healthier individuals can expect lower premiums. Additionally, the term length and coverage amount chosen will also impact the premium rate. It’s important to shop around and compare quotes from different insurance companies to find the best rate for your specific circumstances.

Can I renew or extend my term insurance policy when the term ends?

+Yes, many term insurance policies offer the option to renew or extend the coverage at the end of the initial term. Renewal often requires the policyholder to provide updated health information, and the premium rate may increase based on their current age and health status. Some policies may also have age limits for renewal, so it’s essential to review the policy terms and conditions.

What happens if I want to cancel my term insurance policy before the term ends?

+If you decide to cancel your term insurance policy before the term ends, you may be eligible for a partial refund of the premiums paid, depending on the terms of your policy and the insurance company’s regulations. However, it’s important to note that canceling your policy may leave you without coverage, so it’s advisable to carefully consider your financial situation and future needs before making such a decision.

Are there any tax benefits associated with term insurance policies?

+Term insurance policies offer tax benefits in certain circumstances. The death benefit received by beneficiaries is typically tax-free, providing a significant financial advantage. Additionally, in some countries, the premiums paid for term insurance may be eligible for tax deductions, depending on the specific tax laws and regulations. It’s advisable to consult with a tax professional to understand the tax implications in your jurisdiction.