Student Insurance Car

Introduction: Navigating the Road Ahead

As students, we often find ourselves navigating life’s journey with a unique set of challenges and priorities. One crucial aspect that should not be overlooked is ensuring adequate insurance coverage, especially when it comes to our vehicles. Student car insurance is a vital component of financial planning, offering protection and peace of mind during your academic years and beyond. In this comprehensive guide, we will delve into the world of student insurance, exploring the factors that influence coverage, the benefits it provides, and the steps to secure the best policy for your needs.

Understanding Student Car Insurance

Student car insurance is tailored to meet the specific needs and circumstances of students, offering coverage options that are often more affordable and flexible than traditional auto insurance policies. It recognizes that students may have unique driving habits, limited budgets, and varying levels of experience behind the wheel. By understanding the nuances of student insurance, you can make informed decisions and safeguard your future.

Factors Influencing Student Insurance Rates

Several key factors play a role in determining the cost and coverage of student car insurance policies:

Age and Driving Experience: Younger students, particularly those under 25, often face higher insurance premiums due to their lack of driving experience. Insurers consider age as a significant risk factor, as younger drivers tend to be involved in more accidents. However, as you gain driving experience and maintain a clean record, your premiums may decrease over time.

Vehicle Type and Usage: The type of vehicle you drive and its intended usage can impact your insurance rates. Insurers assess the make, model, and age of your car, as well as its safety features and potential repair costs. Additionally, if you primarily use your vehicle for commuting to school or part-time jobs, you may qualify for lower rates compared to students who drive frequently for leisure or long-distance travel.

Academic Status and Grades: Many insurance providers offer discounts or incentives for students who maintain good academic standing. This recognition of academic achievement acknowledges that students with higher grades may exhibit responsible behavior, which can translate to safer driving habits. So, keeping your grades up may not only benefit your future career prospects but also result in savings on your insurance premiums.

Driver Training and Safety Programs: Completing a recognized driver training program or enrolling in safety courses can demonstrate your commitment to responsible driving. Insurers often reward students who take these initiatives by offering discounts or reduced rates. These programs not only enhance your driving skills but also provide tangible benefits when it comes to insurance coverage.

Multi-Policy Discounts: Bundling your insurance policies can lead to significant savings. If you already have homeowner’s or renter’s insurance, consider adding your car insurance to the same provider. Many insurance companies offer multi-policy discounts, allowing you to save on your overall insurance costs.

The Benefits of Student Car Insurance

Student car insurance offers a range of advantages that go beyond the basic coverage provided by traditional policies. Here are some key benefits to consider:

Affordable Premiums: Student insurance policies are designed with cost-effectiveness in mind. Insurers understand the financial constraints that students face and offer competitive rates to ensure coverage is accessible. By shopping around and comparing quotes, you can find policies that fit within your budget without compromising on essential coverage.

Flexible Payment Options: Recognizing that students may have limited income or irregular cash flow, many insurance providers offer flexible payment plans. This allows you to spread out your insurance costs over time, making it more manageable to maintain coverage throughout your academic journey.

Comprehensive Coverage: Student car insurance policies typically provide comprehensive coverage, including liability, collision, and comprehensive protection. Liability coverage safeguards you against financial losses if you’re found at fault in an accident, while collision and comprehensive coverage protect your vehicle from damage or theft. Additionally, some policies may offer optional coverage for specific needs, such as rental car reimbursement or roadside assistance.

Discounts and Rewards: Insurance companies often provide discounts and incentives specifically for students. These may include good student discounts, discounts for completing driver education courses, or even discounts for maintaining a clean driving record. By taking advantage of these incentives, you can further reduce your insurance costs and make your policy more affordable.

Peace of Mind and Financial Security: Perhaps the most significant benefit of student car insurance is the peace of mind it provides. Knowing that you’re adequately insured can alleviate stress and anxiety, allowing you to focus on your studies and personal growth. In the event of an accident or unexpected vehicle issue, you’ll have the financial support needed to handle repairs or cover liabilities, ensuring your academic and personal life remain uninterrupted.

Choosing the Right Student Car Insurance Policy

When selecting a student car insurance policy, it’s essential to consider your unique circumstances and needs. Here are some steps to guide you through the process:

Assess Your Needs: Begin by evaluating your driving habits, the type of vehicle you drive, and your budget. Consider the level of coverage you require and any optional add-ons that may benefit you. By understanding your specific needs, you can narrow down your options and choose a policy that aligns with your requirements.

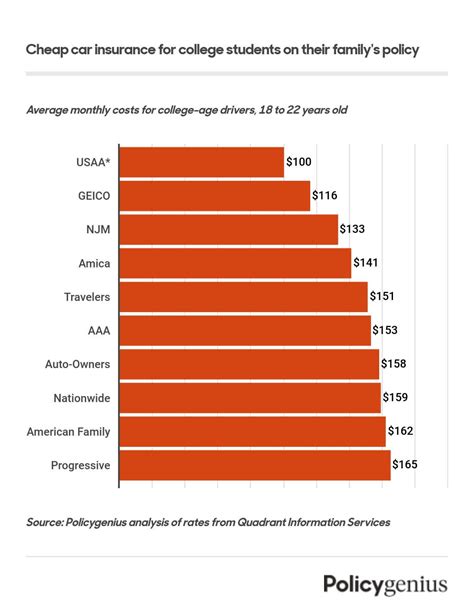

Research Insurance Providers: Take the time to research and compare different insurance companies. Look for providers that specialize in student insurance or offer tailored policies for young drivers. Consider factors such as their financial stability, customer service reputation, and the range of coverage options they provide. Online reviews and ratings can also offer valuable insights into the provider’s reliability and customer satisfaction.

Obtain Multiple Quotes: To ensure you’re getting the best deal, obtain quotes from multiple insurance providers. Many companies offer online quote tools or provide quotes over the phone. Compare the coverage, premiums, and any additional benefits or discounts offered. Remember, the cheapest policy may not always be the best option, so consider the overall value and suitability of each policy.

Review Policy Details: When reviewing policy details, pay close attention to the coverage limits, deductibles, and any exclusions or limitations. Ensure that the policy provides adequate protection for your needs and that you understand the terms and conditions. Look for policies that offer flexible coverage options, allowing you to customize your plan to match your preferences and budget.

Consider Add-Ons and Endorsements: Depending on your circumstances, you may benefit from adding optional coverage endorsements to your policy. For example, if you frequently travel long distances or plan to study abroad, consider adding rental car coverage or travel assistance. These add-ons can provide additional peace of mind and ensure you’re prepared for unexpected situations.

Read Reviews and Seek Recommendations: Before finalizing your choice, read reviews and seek recommendations from fellow students or trusted sources. Hearing about others’ experiences can provide valuable insights into the insurance provider’s performance, claim handling process, and overall customer satisfaction.

Bundle Policies for Savings: If you already have other insurance policies, such as homeowner’s or renter’s insurance, consider bundling your car insurance with the same provider. Bundling policies often results in significant discounts and can simplify your insurance management process.

Case Study: A Student’s Journey with Car Insurance

Let’s illustrate the benefits of student car insurance with a real-life example. Meet Sarah, a dedicated student who recently purchased her first car. Sarah understood the importance of insurance and wanted to ensure she had adequate coverage while managing her finances effectively.

Sarah began her insurance journey by researching reputable providers specializing in student insurance. She obtained multiple quotes and compared the coverage, premiums, and additional benefits offered. After careful consideration, she chose a policy that provided comprehensive coverage at an affordable rate.

Throughout her academic years, Sarah benefited from the flexibility and affordability of her student car insurance policy. She took advantage of the good student discount, maintaining her grades and qualifying for reduced premiums. Additionally, the policy’s optional add-ons allowed her to customize her coverage to suit her needs, including roadside assistance and rental car reimbursement.

As Sarah’s driving experience grew, she maintained a clean driving record, which further reduced her insurance costs. The peace of mind provided by her insurance policy allowed her to focus on her studies and pursue her academic goals without financial worries. When an unexpected accident occurred during her final year of studies, Sarah’s insurance coverage proved invaluable, providing the financial support needed to repair her vehicle and cover any associated liabilities.

Expert Insights and Future Considerations

As a student, it’s crucial to stay informed about the evolving landscape of insurance and the potential changes that may impact your coverage. Here are some expert insights and future considerations to keep in mind:

Emerging Technologies: The insurance industry is constantly evolving, and technological advancements are shaping the future of coverage. Telematics, for example, uses data-driven technology to assess driving behavior and offer personalized insurance rates. As these technologies become more prevalent, students may have the opportunity to further customize their policies and potentially reduce premiums by demonstrating safe driving habits.

Insurance-Tech Innovations: The rise of insurtech startups and digital platforms is revolutionizing the insurance industry. These innovative companies are leveraging technology to offer more efficient and personalized insurance experiences. Students should stay informed about these developments, as they may provide access to new coverage options, simplified claim processes, and enhanced customer service.

Climate Change and Natural Disasters: Climate change is increasingly impacting insurance coverage, particularly in regions prone to natural disasters. As extreme weather events become more frequent, insurance providers are adapting their policies and rates to account for these risks. Students living in areas susceptible to natural disasters should be aware of the potential implications on their insurance costs and coverage availability.

Sharing Economy and Ridesharing: The sharing economy, including ridesharing services like Uber and Lyft, is gaining popularity among students as an affordable transportation option. However, it’s essential to understand the insurance implications of these services. Many ridesharing companies provide limited insurance coverage during certain periods, leaving drivers vulnerable in other situations. Students should carefully review the insurance policies associated with ridesharing to ensure they are adequately protected while participating in these services.

Frequently Asked Questions (FAQ)

What is the average cost of student car insurance?

The average cost of student car insurance can vary depending on factors such as age, location, and driving history. However, students can expect to pay an average of 1,500 to 2,000 annually for basic coverage. It’s important to shop around and compare quotes to find the most affordable rates.

Can I get student car insurance if I’m a part-time student?

Absolutely! Student car insurance is not limited to full-time students. Part-time students can also benefit from tailored insurance policies designed to meet their needs and budget. Many insurance providers offer flexible options for part-time students, recognizing the unique circumstances and financial considerations associated with part-time study.

Are there any discounts available for student car insurance?

Yes, student car insurance often comes with a range of discounts to make coverage more affordable. These may include good student discounts, discounts for completing driver education courses, or multi-policy discounts when bundling your car insurance with other policies, such as homeowner’s or renter’s insurance.

Can I add my parents as additional drivers on my student car insurance policy?

Yes, it is possible to add your parents as additional drivers on your student car insurance policy. This can be beneficial if your parents occasionally use your vehicle or if you frequently drive their car. Adding additional drivers to your policy ensures that all drivers are covered and protected in the event of an accident or claim.

What happens if I move to a different state during my studies?

If you plan to move to a different state during your studies, it’s important to notify your insurance provider and update your policy accordingly. Insurance rates and coverage requirements can vary by state, so ensuring your policy remains valid and up-to-date is crucial. Your insurance provider can guide you through the process of updating your coverage to comply with the new state’s regulations.