State Farm Liability Insurance

In the complex world of insurance, liability coverage stands as a cornerstone, providing a safety net for individuals and businesses alike. This type of insurance is a vital component of any comprehensive insurance strategy, offering protection against a wide range of potential risks and liabilities. In this article, we will delve deep into the realm of liability insurance, specifically focusing on the renowned provider, State Farm. By the end of this exploration, you will have a thorough understanding of what liability insurance entails, why it's essential, and how State Farm's offerings can be a game-changer in mitigating risks.

The Essence of Liability Insurance

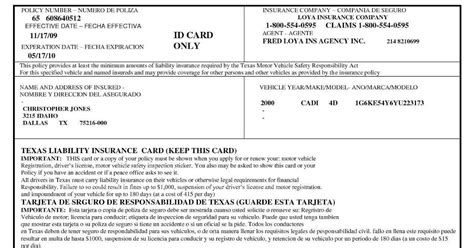

Liability insurance is a form of coverage designed to protect policyholders from financial loss resulting from claims made against them for alleged negligence or wrongdoing. It acts as a safeguard, ensuring that individuals or businesses have the necessary resources to cover potential legal costs, settlements, or damages awarded in a lawsuit. This type of insurance is especially crucial in today’s litigious society, where legal battles can arise from a myriad of everyday situations.

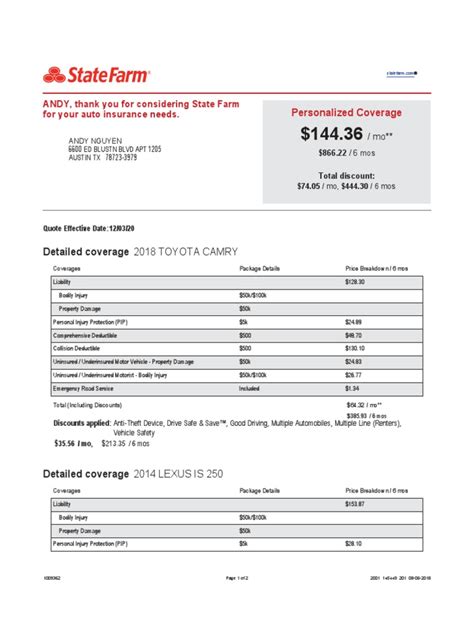

State Farm, a leading provider in the insurance industry, offers a comprehensive suite of liability coverage options tailored to meet the diverse needs of its customers. From personal liability policies to business liability coverage, State Farm's expertise lies in customizing plans that provide the right balance of protection and affordability.

Personal Liability Insurance

For individuals, State Farm’s personal liability insurance offers a vital layer of protection against a wide array of risks. Whether it’s a slip and fall accident on your property, a dog bite claim, or even a libel lawsuit stemming from a social media post, personal liability insurance can provide the necessary coverage to defend against these claims and mitigate financial losses. With limits typically ranging from 100,000 to 1 million, State Farm’s policies ensure individuals have the resources to handle these unexpected situations.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and legal costs if someone is injured on your property or due to your actions. |

| Property Damage Liability | Provides coverage for damage to someone else's property caused by you or your belongings. |

| Personal Liability Umbrella | Offers additional coverage beyond your standard policy limits, providing an extra layer of protection. |

Business Liability Insurance

State Farm’s business liability insurance is tailored to meet the unique needs of small to medium-sized businesses. This coverage is essential for protecting businesses from potential lawsuits arising from a variety of situations, including product defects, advertising injuries, and employee-related incidents. With limits that can be customized to fit the specific risks of your business, State Farm ensures you have the financial protection needed to weather any legal storms.

| Coverage Type | Description |

|---|---|

| General Liability | Covers bodily injury, property damage, and personal injury claims, including legal defense costs. |

| Professional Liability (E&O) | Protects professionals like consultants, accountants, and lawyers against claims of negligence or malpractice. |

| Product Liability | Covers lawsuits arising from defective products or harm caused by your products. |

Why Choose State Farm for Liability Insurance?

State Farm’s reputation as a trusted insurance provider is built on a foundation of comprehensive coverage, competitive pricing, and exceptional customer service. With a network of knowledgeable agents across the country, State Farm offers personalized guidance to help individuals and businesses select the right liability coverage for their unique needs.

Comprehensive Coverage

State Farm’s liability insurance policies are designed to provide broad coverage, ensuring that policyholders are protected from a wide range of potential liabilities. From personal injury lawsuits to property damage claims, State Farm’s policies are tailored to fit the specific risks associated with different lifestyles and businesses.

Competitive Pricing

State Farm understands that insurance is a significant investment, and they strive to offer competitive pricing without compromising on coverage. By leveraging their extensive industry knowledge and experience, State Farm provides cost-effective liability insurance solutions that offer exceptional value.

Exceptional Customer Service

State Farm’s commitment to customer service is unparalleled in the insurance industry. With a dedicated team of knowledgeable agents, State Farm provides personalized guidance and support throughout the insurance process. From policy selection to claim management, State Farm’s agents are there to ensure that policyholders have the resources and support they need.

The Impact of Liability Insurance: Real-World Scenarios

To illustrate the significance of liability insurance, let’s explore a few real-world scenarios where State Farm’s coverage made a difference.

Homeowner’s Liability Claim

Imagine a homeowner who hosts a neighborhood block party in their backyard. During the party, an unattended grill catches fire, causing significant property damage to a neighboring home. The homeowner’s State Farm liability insurance policy steps in, covering the costs of the damages and legal fees, ensuring the homeowner is protected from financial ruin.

Business Liability Claim

A small business owner, insured by State Farm, faces a lawsuit from a customer who slipped and fell in their store. The business liability policy covers the legal costs and any potential settlement, allowing the business owner to focus on running their business without the added stress of financial strain.

Personal Liability Umbrella Policy

An individual with substantial assets, such as a high-value home and investment portfolio, purchases a personal liability umbrella policy from State Farm. This policy provides an additional layer of protection, covering claims that exceed the limits of their standard liability insurance. In the event of a major lawsuit, the umbrella policy ensures their assets are protected.

Navigating the Future with State Farm’s Liability Insurance

As we move forward into an increasingly complex and litigious world, liability insurance remains a critical component of financial planning and risk management. State Farm’s comprehensive liability insurance offerings provide individuals and businesses with the peace of mind that comes with knowing they are protected against a wide range of potential liabilities.

By understanding the nuances of liability insurance and the importance of tailored coverage, individuals and businesses can make informed decisions about their insurance needs. State Farm's commitment to providing personalized, comprehensive, and affordable liability insurance solutions positions them as a trusted partner in mitigating risks and protecting against financial losses.

Frequently Asked Questions

What is the average cost of liability insurance with State Farm?

+The cost of liability insurance with State Farm can vary widely depending on the type of coverage, the policy limits, and individual risk factors. On average, personal liability insurance can range from 200 to 500 annually, while business liability insurance premiums can start from $300 and go up depending on the nature and size of the business.

Does State Farm offer liability insurance for specific industries or professions?

+Yes, State Farm understands the unique risks associated with different industries and professions. They offer specialized liability insurance for professionals like doctors, lawyers, and consultants, as well as coverage tailored for specific industries such as construction, hospitality, and retail.

How does State Farm determine liability in a claim?

+State Farm follows a comprehensive claims process to determine liability. This involves a thorough investigation of the incident, including gathering evidence, statements from witnesses, and reviewing relevant documentation. Based on the findings, State Farm makes a determination of liability and proceeds with the necessary actions, such as settling the claim or defending the insured in court.