State Farm Insurance Make A Payment

State Farm Insurance is a renowned name in the insurance industry, offering a comprehensive range of insurance policies and financial services to individuals and businesses across the United States. Making payments for your State Farm insurance policies is a straightforward process, designed to provide convenience and flexibility to policyholders. In this article, we will explore the various methods available to make a payment for your State Farm insurance, ensuring you stay up-to-date with your premiums and maintain coverage.

Understanding Your State Farm Insurance Payment Options

State Farm offers a variety of payment methods to cater to different preferences and needs. Understanding these options is crucial to choosing the most suitable and convenient payment method for your insurance policies.

Online Payment

One of the most popular and convenient ways to make a State Farm insurance payment is through their online platform. The State Farm website provides a secure and user-friendly interface for policyholders to manage their accounts and make payments. Here’s a step-by-step guide to making an online payment:

- Visit the State Farm website and navigate to the My Account section.

- Log in to your account using your username and password. If you're a new user, you'll need to create an account by providing your policy details and some personal information.

- Once logged in, locate the Make a Payment option. This is typically found under the Payments & Billing tab.

- Select the insurance policy for which you wish to make a payment. State Farm allows you to manage multiple policies under one account, so ensure you choose the correct one.

- Choose your preferred payment method. State Farm accepts various payment methods, including credit cards, debit cards, and electronic checks (e-checks). You'll need to provide the necessary details, such as your card number, expiration date, and security code.

- Review the payment amount and confirm the transaction. State Farm provides a summary of your payment, including the due date and any applicable fees. Ensure the details are correct before proceeding.

- Complete the payment process. You'll receive a confirmation number or email as proof of your payment. Keep this for your records.

Online payments are typically processed immediately, and you can access your payment history and account details at any time through your State Farm account.

Mobile App Payment

For those who prefer a more mobile approach, State Farm offers a dedicated mobile app for iOS and Android devices. The app provides the same functionality as the online platform, allowing you to manage your insurance policies and make payments on the go. Here’s how to make a payment using the State Farm mobile app:

- Download and install the State Farm mobile app from the Apple App Store or Google Play Store.

- Open the app and log in to your account using your credentials.

- Navigate to the Payments section, which is usually located in the main menu or dashboard.

- Select the insurance policy for which you want to make a payment.

- Choose your preferred payment method, similar to the online payment process. State Farm accepts the same payment methods through its mobile app.

- Review the payment details and confirm the transaction.

- Complete the payment process, and you'll receive a confirmation notification within the app.

The mobile app provides an additional layer of convenience, allowing you to make payments anytime, anywhere, without the need for a desktop or laptop.

Automatic Payments

State Farm offers an automatic payment option, which is an excellent choice for those who prefer a hands-off approach to managing their insurance payments. With automatic payments, you can set up recurring payments from your bank account or credit/debit card, ensuring your insurance premiums are paid on time without any manual intervention.

To set up automatic payments, you'll need to provide State Farm with your bank account details or credit/debit card information. You can choose the frequency of payments, such as monthly, quarterly, or annually. State Farm will then deduct the premium amount from your account on the due date, ensuring uninterrupted coverage.

Automatic payments provide peace of mind and help you avoid late fees or lapses in coverage due to forgotten or missed payments.

Mail-In Payments

For those who prefer a more traditional approach, State Farm accepts payments by mail. You can send your payment directly to State Farm’s payment processing center using a check or money order. Here’s how to make a mail-in payment:

- Obtain the payment address from your State Farm policy documents or by contacting their customer service.

- Prepare a check or money order made payable to State Farm Insurance Companies.

- Include your policy number and any other relevant information, such as the due date or payment amount, on the check or money order.

- Mail the payment to the provided address, ensuring sufficient postage.

- Allow for sufficient processing time. Mail-in payments typically take a few days to process, so ensure you send your payment well in advance of the due date.

State Farm recommends including a self-addressed, stamped envelope to receive a payment confirmation. This method is suitable for those who prefer a more physical approach to payments or who may not have access to online banking or the State Farm mobile app.

Payment by Phone

State Farm provides a dedicated customer service phone number for making payments over the phone. This option is ideal for those who prefer a more personal approach or who may have questions or concerns about their payment.

- Contact State Farm's customer service department at (800) STATE-FARM (800-782-8332) or the number provided on your policy documents.

- Provide your policy number and any other requested information to the customer service representative.

- Choose your preferred payment method. State Farm accepts credit/debit card payments and electronic checks over the phone.

- The representative will guide you through the payment process, including verifying your account details and processing the transaction.

- Receive a confirmation number or email as proof of your payment.

Payment by phone offers real-time assistance and allows you to clarify any questions or concerns you may have about your insurance policy or payment options.

Benefits of Timely State Farm Insurance Payments

Making timely payments for your State Farm insurance policies offers several advantages. Firstly, it ensures uninterrupted coverage, providing peace of mind that your assets and liabilities are protected in the event of an accident or unforeseen circumstance. Late or missed payments can lead to policy cancellation or lapses in coverage, leaving you vulnerable to financial risks.

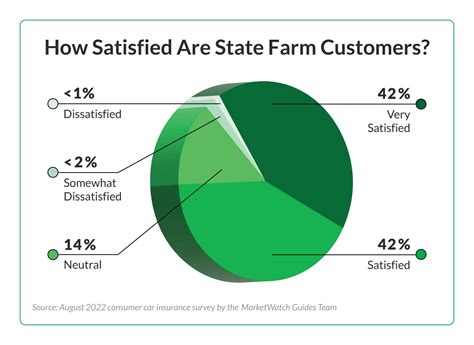

Additionally, timely payments help you maintain a positive relationship with State Farm, which can be beneficial in the long run. State Farm rewards loyal customers with various perks, such as discounts, loyalty programs, and priority customer service. By staying current with your payments, you can take advantage of these benefits and build a strong insurance portfolio.

Furthermore, making regular payments can help you budget effectively. By setting up automatic payments or utilizing the online or mobile app, you can easily track your insurance expenses and ensure they align with your financial plan. This proactive approach to payment management can help you avoid unexpected costs and maintain financial stability.

Tips for Efficient State Farm Insurance Payment Management

To make the most of your State Farm insurance payment process, here are some tips to consider:

- Set Reminders: Use the State Farm app or online platform to set up payment reminders. This ensures you're aware of upcoming due dates and can plan your payments accordingly.

- Explore Discounts: State Farm offers various discounts for eligible policyholders. Discuss potential discounts with your agent or review your policy to identify opportunities to reduce your premiums.

- Bundle Policies: If you have multiple insurance needs, such as auto, home, and life insurance, consider bundling your policies with State Farm. Bundling can often result in significant savings and streamlined payment management.

- Review Payment History: Regularly review your payment history through the State Farm online platform or app. This helps you track your payments, identify any discrepancies, and ensure accurate record-keeping.

- Contact Customer Service: If you have questions or concerns about your payment options or policy coverage, don't hesitate to contact State Farm's customer service. Their team is available to provide assistance and guidance, ensuring you make informed decisions about your insurance needs.

By staying proactive and utilizing the various payment options and resources provided by State Farm, you can effectively manage your insurance payments and maintain a strong relationship with one of the leading insurance providers in the United States.

Frequently Asked Questions

Can I make a partial payment for my State Farm insurance policy?

+Yes, State Farm allows partial payments for insurance policies. However, it’s important to note that partial payments may not always be accepted and may depend on your specific policy and payment history. Contact State Farm’s customer service to inquire about the possibility of making a partial payment and to understand any potential implications.

What happens if I miss a payment for my State Farm insurance policy?

+Missing a payment for your State Farm insurance policy can have consequences. State Farm may charge late fees, and if the payment remains overdue, your policy may be canceled or lapsed. It’s essential to stay up-to-date with your payments to maintain continuous coverage and avoid additional fees or penalties.

Can I make a payment for someone else’s State Farm insurance policy?

+Yes, you can make a payment for someone else’s State Farm insurance policy. However, you’ll need their policy number and consent. State Farm allows third-party payments, which can be particularly useful for family members or individuals assisting with another person’s insurance payments.

Are there any fees associated with State Farm insurance payments?

+State Farm may charge fees for certain payment methods, such as credit card payments. These fees are typically a small percentage of the total payment amount. It’s advisable to review the payment options and associated fees before choosing a payment method to ensure you’re aware of any additional costs.

How can I update my payment information with State Farm?

+To update your payment information with State Farm, log in to your online account or mobile app. Navigate to the Payments or Billing section and select the option to Update Payment Information. You can then enter your new payment details, such as a new bank account or credit card number. Ensure you review and confirm the changes before submitting them.