State Automobile Insurance

State Automobile Mutual Insurance Company, commonly known as State Auto, is a leading provider of property and casualty insurance across the United States. With a rich history spanning over a century, State Auto has established itself as a trusted insurer, offering a comprehensive range of insurance products and services to meet the diverse needs of its customers.

In this in-depth exploration, we will delve into the world of State Automobile Insurance, uncovering its origins, evolution, key offerings, and the impact it has had on the insurance industry. By examining its journey, we can gain valuable insights into the strategies and innovations that have propelled State Auto to become a prominent player in the highly competitive insurance market.

A Legacy of Protection: The Origins of State Auto

State Auto’s story began in 1921, when Robert Pein, a visionary entrepreneur, founded the company with a mission to provide reliable insurance coverage to motorists. At a time when automobile ownership was rapidly increasing, Pein recognized the growing need for affordable and accessible insurance solutions. With a focus on innovation and customer-centric approaches, State Auto quickly gained traction and established a solid foundation in the insurance industry.

The early years of State Auto were marked by a commitment to excellence and a deep understanding of the evolving needs of its customers. The company introduced innovative underwriting practices and developed customized insurance products tailored to the unique risks faced by individuals and businesses. This customer-centric philosophy became the cornerstone of State Auto's success and set the stage for its future growth.

Expanding Horizons: State Auto’s Journey to Nationwide Coverage

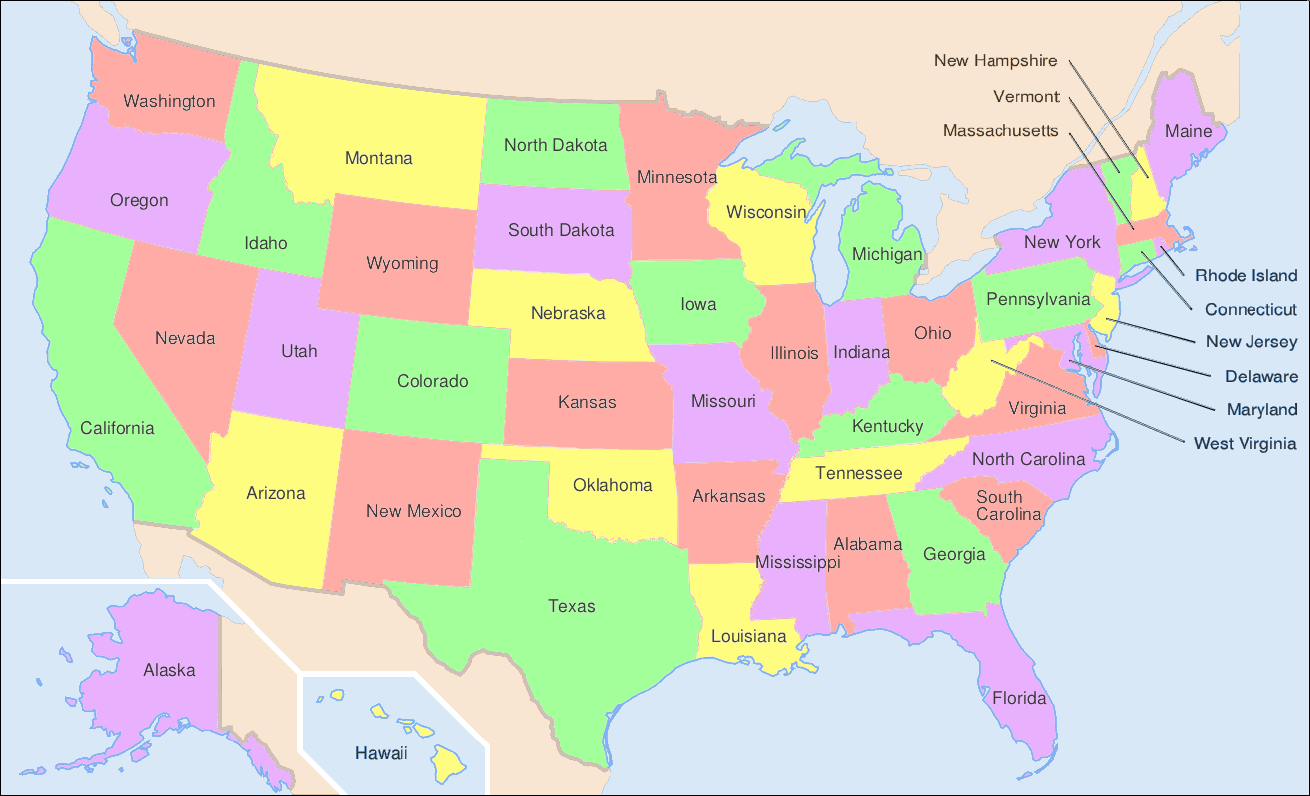

From its humble beginnings in Ohio, State Auto embarked on a journey of expansion, aiming to provide its comprehensive insurance solutions to a broader audience across the nation. Over the decades, the company strategically expanded its reach, establishing a strong presence in key markets and building a network of dedicated agents and brokers.

State Auto's expansion was driven by a combination of organic growth and strategic acquisitions. By carefully selecting insurance carriers and agencies that aligned with its values and vision, State Auto was able to enhance its product offerings and strengthen its market position. This approach allowed the company to offer a diverse range of insurance products, including auto, home, business, and specialty insurance, catering to the diverse needs of its expanding customer base.

A Comprehensive Portfolio: Insurance Solutions for Every Need

Today, State Auto boasts an extensive portfolio of insurance products designed to protect individuals, families, and businesses from a wide array of risks. The company’s expertise lies in tailoring insurance solutions to meet the unique challenges faced by its customers, ensuring that they receive the coverage they need at competitive rates.

Personal Insurance

State Auto’s personal insurance offerings provide comprehensive protection for individuals and families. The company offers a range of auto insurance policies, including liability, collision, and comprehensive coverage, ensuring motorists are adequately protected on the road. Additionally, State Auto extends its protection to homeowners and renters, providing coverage for their properties, belongings, and personal liability.

| Insurance Type | Coverage Highlights |

|---|---|

| Auto Insurance | Liability, collision, comprehensive, and additional options like rental car coverage and roadside assistance. |

| Homeowners Insurance | Dwelling coverage, personal property protection, liability, and additional endorsements for specific risks. |

| Renters Insurance | Personal property coverage, liability protection, and optional add-ons for valuable items. |

Business Insurance

Recognizing the unique risks faced by businesses, State Auto offers a comprehensive suite of commercial insurance products. From small businesses to large enterprises, State Auto provides tailored coverage to protect against a wide range of liabilities and risks. This includes general liability, property insurance, workers’ compensation, business auto insurance, and specialized coverage for specific industries.

Specialty Insurance

State Auto’s specialty insurance division caters to niche markets and unique insurance needs. This includes insurance solutions for contractors, real estate professionals, agribusinesses, and specialty vehicles. By understanding the specific risks and challenges faced by these industries, State Auto develops customized insurance programs to provide the necessary protection.

Innovation and Technology: Driving the Future of Insurance

State Auto has embraced innovation and technology as key drivers of its success and growth. The company has invested significantly in developing cutting-edge tools and platforms to enhance the insurance experience for its customers and agents. By leveraging technology, State Auto has streamlined its processes, improved efficiency, and provided its customers with convenient and accessible insurance solutions.

One of State Auto's notable technological advancements is its digital platform, which allows customers to manage their policies, file claims, and access important insurance information online. This platform offers a seamless and user-friendly experience, empowering customers to take control of their insurance needs. Additionally, State Auto has implemented advanced data analytics and risk modeling techniques to enhance its underwriting capabilities and provide more accurate and personalized insurance solutions.

Customer Satisfaction and Claims Management

At the heart of State Auto’s success is its unwavering commitment to customer satisfaction. The company understands that providing exceptional service is just as important as offering comprehensive insurance coverage. State Auto’s dedicated customer service team ensures that policyholders receive prompt and personalized assistance whenever they need it.

When it comes to claims management, State Auto prides itself on its efficient and compassionate approach. The company's claims professionals work diligently to resolve claims promptly, ensuring that customers receive the support and compensation they deserve during challenging times. State Auto's focus on customer satisfaction and timely claims resolution has earned it a reputation for excellence in the industry.

Community Engagement and Corporate Responsibility

Beyond its insurance offerings, State Auto actively engages with the communities it serves, demonstrating a strong commitment to corporate social responsibility. The company believes in giving back and supporting initiatives that promote education, safety, and overall well-being.

State Auto's community engagement efforts are multifaceted. The company sponsors various educational programs, supporting initiatives that empower youth and promote financial literacy. Additionally, State Auto partners with local organizations and charities, providing financial support and volunteer hours to address critical community needs. Through these initiatives, State Auto aims to make a positive impact on the lives of individuals and strengthen the fabric of the communities it serves.

Looking Ahead: State Auto’s Future Prospects

As the insurance industry continues to evolve, State Auto remains poised for growth and innovation. With a strong foundation built on a century of experience, the company is well-positioned to adapt to changing market dynamics and emerging trends. State Auto’s focus on technological advancements, customer-centric approaches, and community engagement sets it apart as a forward-thinking insurer.

Looking ahead, State Auto aims to continue expanding its market presence, leveraging its strong brand reputation and comprehensive insurance offerings. The company is committed to staying at the forefront of industry innovations, exploring new technologies, and developing cutting-edge insurance solutions. By remaining agile and responsive to the needs of its customers, State Auto is poised to thrive in a rapidly changing insurance landscape.

How can I obtain a quote for State Auto insurance?

+To obtain a quote for State Auto insurance, you can visit their official website and use the online quote tool. Alternatively, you can reach out to a State Auto agent or broker in your area, who can provide you with personalized insurance options and guidance.

What makes State Auto’s insurance products unique?

+State Auto’s insurance products stand out for their customization and attention to detail. The company understands that every customer has unique needs, and thus, they offer tailored insurance solutions. Additionally, State Auto’s focus on innovation and technology ensures that their products are efficient, accessible, and up-to-date with industry trends.

How does State Auto ensure prompt claims resolution?

+State Auto has a dedicated claims management team that works diligently to resolve claims efficiently. They utilize advanced technology and streamlined processes to ensure a timely response. The company’s commitment to customer satisfaction and its focus on compassionate claims handling contribute to its excellent reputation in claims resolution.