Small Insurance Companies Near Me

The insurance industry is vast and diverse, with a range of providers offering various types of coverage. While large, well-known insurance companies often dominate the market, small and local insurance businesses play a vital role in providing personalized and community-focused services. These smaller entities offer unique advantages and cater to specific needs, making them an attractive option for many individuals and businesses seeking tailored insurance solutions.

Understanding Small Insurance Companies

Small insurance companies, often referred to as independent or local insurers, are typically privately owned and operated businesses with a more localized focus. They differ from larger, national or multinational insurance corporations in terms of scale, reach, and operational strategies. These companies are typically characterized by their smaller customer base, personalized service, and flexibility in product offerings.

The advantages of working with a small insurance company are numerous. They often have a deeper understanding of the local market and can provide more tailored coverage options. For instance, they might offer specialized policies for local businesses, unique risk scenarios, or niche markets that larger insurers might overlook. Additionally, small insurers are known for their exceptional customer service, often providing more personalized attention and faster claim processing.

Locating Small Insurance Companies Near You

Finding small insurance companies near you can be a straightforward process, especially with the right tools and resources. Here are some effective methods to identify and connect with these local insurers:

Online Directories and Search Engines

Start your search by utilizing online directories and search engines. These platforms allow you to filter results based on your location and insurance needs. Simply enter keywords like “small insurance companies near me” or specify the type of insurance you’re seeking, such as “local auto insurance providers.” This will yield a list of relevant results, often with ratings and reviews to help you assess the reputation and reliability of each company.

Community Resources and Referrals

Engage with your local community to gather recommendations and referrals. Word-of-mouth can be a powerful tool in identifying trusted and reliable small insurance companies. Ask friends, family, neighbors, and local business owners about their experiences with local insurers. They might provide valuable insights into the services, coverage options, and customer satisfaction levels offered by these companies.

Industry Networks and Associations

Industry networks and associations can be excellent resources for locating small insurance companies. These organizations often have directories or listings of their members, allowing you to explore a range of options within your specific industry or niche. For instance, if you’re a small business owner, you might explore associations catering to entrepreneurs or specific sectors, which often have insurance recommendations or partnerships.

Local Business Directories and Chamber of Commerce

Explore local business directories and engage with your local Chamber of Commerce. These entities often maintain lists or databases of local businesses, including insurance providers. They can provide valuable insights into the reputation and reliability of these companies, helping you make informed decisions. Additionally, attending local business events or networking sessions can provide opportunities to connect with insurance professionals directly.

Online Comparison Platforms

Online comparison platforms have revolutionized the insurance industry, making it easier than ever to compare policies and providers. These platforms often allow you to filter results by location, coverage type, and price. By specifying your location, you can explore a range of small insurance companies and their offerings, helping you find the best fit for your needs.

| Directory | Website |

|---|---|

| Local Insurers Hub | Local Insurers Hub |

| Small Insurance Companies Directory | Small Insurance Companies Directory |

| Local Brokers Network | Local Brokers Network |

Benefits of Choosing a Small Insurance Company

Opting for a small insurance company can offer several advantages over larger insurers. Here are some key benefits to consider:

Personalized Service and Attention

Small insurance companies often pride themselves on providing personalized service. Unlike larger insurers, where you might feel like just another policy number, small insurers take the time to understand your unique needs and circumstances. This personalized approach ensures that you receive tailored coverage options and advice, catering to your specific requirements.

Local Market Knowledge

Being rooted in the local community, small insurance companies have an in-depth understanding of the local market. They are well-versed in the unique risks and challenges faced by individuals and businesses in the area. This local expertise allows them to offer more accurate and comprehensive coverage, ensuring you’re adequately protected against specific local risks.

Flexible Coverage Options

Small insurers often have the flexibility to offer customized coverage options. They can work with you to create a policy that aligns with your specific needs and budget. This level of customization is often not possible with larger insurers, who tend to offer more standardized policies. Whether you require additional coverage for specific assets or have unique risk management needs, a small insurance company can accommodate your requests.

Faster Claim Processing

One of the significant advantages of working with a small insurance company is their ability to process claims more efficiently. With fewer policies to manage, they can often provide faster claim processing times, ensuring you receive the compensation you’re entitled to without unnecessary delays. This can be especially beneficial in urgent situations, such as natural disasters or unforeseen accidents.

Community Support and Engagement

Small insurance companies are often deeply involved in their local communities. They may sponsor local events, support charities, or actively participate in community initiatives. By choosing a small insurer, you not only receive excellent service but also contribute to the growth and development of your local area. This sense of community support can be a compelling reason to opt for a local insurance provider.

Factors to Consider When Choosing a Small Insurance Company

While small insurance companies offer numerous advantages, it’s essential to consider several factors to ensure you make an informed decision. Here are some key considerations:

Financial Stability and Reputation

When choosing an insurance company, financial stability is paramount. Ensure that the small insurance company you’re considering has a solid financial foundation. Check their ratings and reviews to understand their financial health and reputation in the industry. A stable insurer will provide peace of mind, ensuring that they can honor your claims when needed.

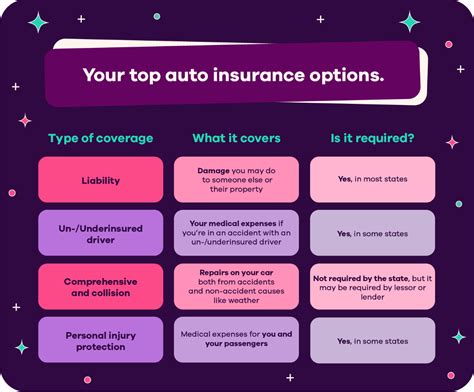

Coverage Options and Customization

Evaluate the range of coverage options offered by the small insurance company. Ensure that they provide the specific types of insurance you require, whether it’s auto, home, business, or specialty coverage. Additionally, assess their willingness and ability to customize policies to meet your unique needs. A flexible insurer can offer significant advantages in terms of tailored protection.

Customer Service and Claim Handling

The quality of customer service and claim handling processes is crucial. Research the insurer’s track record in these areas. Look for online reviews and testimonials to gauge customer satisfaction. A responsive and efficient insurer will make the entire insurance experience more pleasant and stress-free.

Local Presence and Accessibility

Consider the insurer’s local presence and accessibility. Having an office nearby can be beneficial, especially if you prefer face-to-face interactions. Additionally, ensure that their business hours align with your availability. A local insurer with convenient hours can make it easier to discuss your insurance needs and address any concerns promptly.

Conclusion: Embracing the Benefits of Small Insurance Companies

Small insurance companies offer a refreshing alternative to larger insurers, providing personalized service, local market expertise, and flexible coverage options. By leveraging online resources, community connections, and industry networks, you can easily locate these local insurers and explore their offerings. When choosing a small insurance company, consider factors such as financial stability, coverage options, customer service, and local presence to ensure a positive and secure insurance experience.

What are the advantages of choosing a small insurance company over a larger one?

+Small insurance companies offer several advantages, including personalized service, local market expertise, flexible coverage options, faster claim processing, and community support. They provide a more tailored and responsive insurance experience, catering to unique needs and local circumstances.

How can I find small insurance companies near me?

+You can find small insurance companies near you by utilizing online directories, search engines, community resources, industry networks, local business directories, and online comparison platforms. These resources allow you to explore local insurers and their offerings based on your specific needs and location.

What factors should I consider when choosing a small insurance company?

+When choosing a small insurance company, consider factors such as financial stability, coverage options, customer service, claim handling processes, local presence, and accessibility. Assessing these aspects will help you make an informed decision and ensure a positive insurance experience.