Rates Car Insurance

When it comes to car insurance, one of the most frequently asked questions is, "How are rates determined?" Understanding the factors that influence car insurance rates is crucial for policyholders and prospective buyers alike. In this comprehensive guide, we will delve into the world of car insurance rates, exploring the various elements that impact them and offering valuable insights to help you make informed decisions.

Understanding Car Insurance Rates

Car insurance rates, also known as premiums, are the amounts that policyholders pay to insurance companies to obtain coverage for their vehicles. These rates are calculated based on a multitude of factors, each contributing to the overall cost of insurance. By examining these factors, we can gain a deeper understanding of how insurance providers assess risk and determine the appropriate rates for each individual or vehicle.

Insurance companies use a sophisticated process to evaluate the risk associated with insuring a particular vehicle and its driver. This process involves analyzing various aspects of the driver's history, the vehicle's characteristics, and even external factors that could influence the likelihood of an accident or claim. By considering these factors, insurance providers can assign appropriate rates that reflect the level of risk they are assuming.

Key Factors Influencing Car Insurance Rates

Driver’s Profile and History

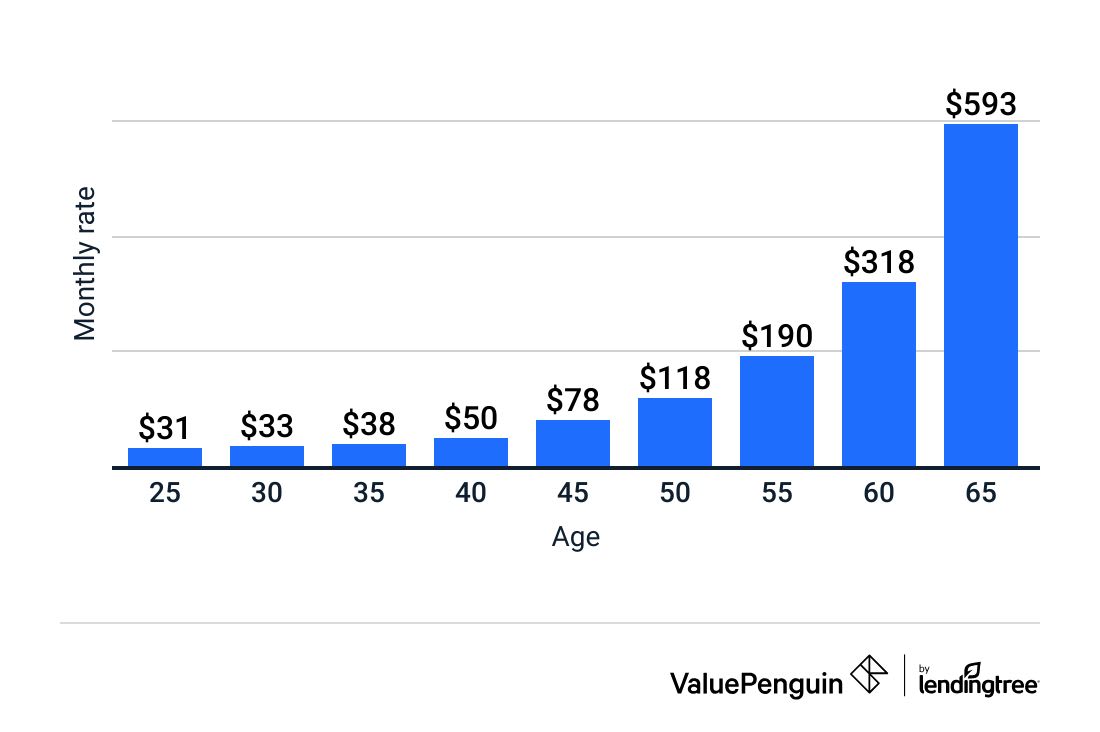

The driver’s profile and history play a significant role in determining insurance rates. Insurance companies carefully examine factors such as age, gender, driving experience, and driving record. Younger drivers, especially those under the age of 25, are often considered higher-risk due to their lack of experience and higher likelihood of being involved in accidents. As a result, they may face higher insurance premiums.

Additionally, insurance providers consider the driver's history of accidents and traffic violations. A clean driving record with no at-fault accidents or serious traffic violations can lead to lower insurance rates. On the other hand, multiple accidents or violations may result in higher premiums or even the denial of coverage by certain insurance companies.

Insurance companies also assess the driver's credit history, as studies have shown a correlation between credit scores and the likelihood of filing insurance claims. Drivers with lower credit scores may face higher insurance rates due to the perceived increased risk of filing claims.

Vehicle Characteristics and Usage

The characteristics of the insured vehicle and its intended usage are also critical factors in determining insurance rates. Insurance providers consider aspects such as the make, model, and age of the vehicle, as well as its safety features and accident history.

Vehicles that are more expensive to repair or have a higher risk of theft may result in higher insurance premiums. Additionally, vehicles with advanced safety features, such as collision avoidance systems or lane departure warnings, may be eligible for discounts, as these features reduce the likelihood of accidents and subsequent claims.

The intended usage of the vehicle is another important consideration. Insurance rates may vary depending on whether the vehicle is used primarily for commuting, pleasure driving, or business purposes. Insurance companies assess the potential risks associated with each type of usage and adjust rates accordingly.

Location and Geographical Factors

The geographical location where the vehicle is registered and primarily used can significantly impact insurance rates. Insurance companies analyze regional data, including crime rates, traffic patterns, and the overall accident frequency in a particular area.

Areas with higher crime rates or a history of frequent accidents may be considered higher-risk, leading to increased insurance premiums. Conversely, locations with lower crime rates and a lower incidence of accidents may enjoy more competitive insurance rates.

Furthermore, insurance companies may consider factors such as weather conditions and natural disasters when assessing rates. Regions prone to severe weather events or natural disasters may face higher insurance costs due to the increased likelihood of damage to vehicles.

Coverage Options and Deductibles

The level of coverage and the chosen deductibles also influence insurance rates. Comprehensive and collision coverage, which protect against damage to the insured vehicle, typically result in higher premiums compared to liability-only coverage, which only covers damages to other parties in an accident.

Additionally, the choice of deductible can impact insurance rates. A higher deductible, which requires the policyholder to pay a larger portion of the claim out of pocket, often results in lower insurance premiums. This is because policyholders with higher deductibles are less likely to file smaller claims, reducing the overall claims costs for insurance companies.

Comparative Analysis: How Different Factors Impact Rates

To illustrate the impact of various factors on insurance rates, let’s consider a comparative analysis using real-world examples. Imagine we have three hypothetical drivers: Driver A, Driver B, and Driver C.

Driver A is a 22-year-old male with a clean driving record. He drives a 2018 Toyota Corolla and primarily uses his vehicle for commuting to work. Driver B is a 35-year-old female with a minor traffic violation on her record. She drives a 2020 Honda Civic and uses her vehicle for both commuting and pleasure driving. Driver C is a 50-year-old male with an excellent driving record and no traffic violations. He drives a 2015 Ford Escape and primarily uses his vehicle for business purposes.

Based on these profiles, we can expect the following impact on insurance rates:

| Driver | Age | Gender | Driving Record | Vehicle Make/Model | Vehicle Usage | Estimated Insurance Rate |

|---|---|---|---|---|---|---|

| Driver A | 22 | Male | Clean | Toyota Corolla | Commuting | $1,200 annually |

| Driver B | 35 | Female | Minor Violation | Honda Civic | Commuting & Pleasure | $950 annually |

| Driver C | 50 | Male | Excellent | Ford Escape | Business | $800 annually |

As seen in the table, Driver A, being a younger male with a clean driving record, is expected to pay the highest insurance rate. Driver B, with a minor violation and a slightly older vehicle, enjoys a lower rate. Driver C, with an excellent driving record and a vehicle used primarily for business, benefits from the lowest insurance rate in this scenario.

Tips for Lowering Car Insurance Rates

While insurance rates are influenced by various factors, there are several strategies that policyholders can employ to potentially lower their insurance costs. Here are some tips to consider:

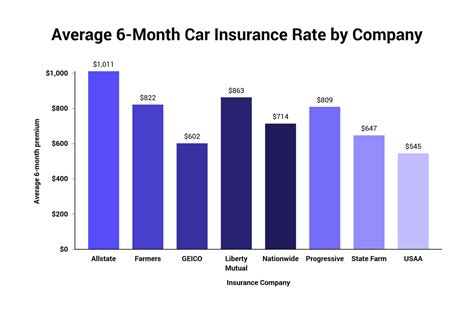

- Shop Around and Compare Rates: Insurance rates can vary significantly between different insurance companies. Take the time to compare quotes from multiple providers to find the best rate for your specific circumstances.

- Improve Your Driving Record: Maintaining a clean driving record is crucial. Avoid traffic violations and accidents to keep your insurance rates as low as possible. Consider taking a defensive driving course to improve your skills and potentially qualify for discounts.

- Bundle Policies: If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same insurance company. Many providers offer discounts for policyholders who bundle multiple policies, resulting in lower overall insurance costs.

- Choose a Higher Deductible: As mentioned earlier, selecting a higher deductible can lead to lower insurance premiums. However, ensure that you can afford the higher out-of-pocket expense in the event of a claim.

- Take Advantage of Discounts: Insurance companies often offer discounts for various reasons. These can include discounts for safe driving, installing anti-theft devices, maintaining good grades (for young drivers), or even discounts for certain occupations or membership in specific organizations. Inquire about available discounts and ensure you meet the criteria to take advantage of them.

- Review Your Coverage Regularly: Your insurance needs may change over time. Regularly review your coverage to ensure it aligns with your current circumstances and needs. Consider adjusting your coverage limits or deductibles to find the right balance between cost and protection.

Future Implications and Industry Trends

The car insurance industry is constantly evolving, and several trends are shaping the future of insurance rates. Here are some key developments to watch:

- Telematics and Usage-Based Insurance: Telematics technology, which uses sensors and data collection devices to monitor driving behavior, is gaining traction. Usage-based insurance programs allow insurance companies to assess driving habits in real-time, offering personalized rates based on actual driving behavior. This technology may lead to more accurate risk assessments and potentially lower rates for safe drivers.

- Autonomous Vehicles and Safety Innovations: The rise of autonomous vehicle technology and advanced safety features is expected to have a significant impact on insurance rates. As these technologies become more widespread, accident rates may decrease, leading to lower insurance costs for policyholders.

- Digitalization and Online Insurance Platforms: The insurance industry is embracing digitalization, with many providers offering online platforms for policy management and claims processing. These digital platforms can streamline processes, reduce overhead costs, and potentially pass on savings to policyholders in the form of lower insurance rates.

- Climate Change and Weather-Related Risks: As climate change continues to impact weather patterns, insurance companies are increasingly considering the potential risks associated with severe weather events. Regions vulnerable to natural disasters may face higher insurance rates, while areas with more stable weather conditions may see more competitive rates.

Conclusion: Navigating Car Insurance Rates

Understanding the factors that influence car insurance rates is essential for making informed decisions about your insurance coverage. By considering your driver profile, vehicle characteristics, geographical location, and coverage options, you can gain a clearer picture of the costs associated with car insurance. Remember, shopping around, maintaining a safe driving record, and exploring available discounts can all contribute to lowering your insurance rates.

As the car insurance industry continues to evolve, staying informed about emerging trends and innovations can help you navigate the changing landscape. Embrace the opportunities presented by technological advancements, such as telematics and autonomous vehicles, which have the potential to positively impact insurance rates and overall safety on the roads.

Whether you're a new driver or an experienced motorist, knowledge is power when it comes to car insurance. By staying informed and actively managing your insurance needs, you can ensure you're getting the coverage you need at a competitive rate.

Can my insurance rates change over time?

+Yes, insurance rates can fluctuate over time. Insurance companies periodically review their rates based on various factors, including changes in claims trends, regulatory requirements, and market conditions. Additionally, your own circumstances may change, such as a clean driving record leading to lower rates or the addition of a teen driver resulting in higher rates.

How can I find the best car insurance rate for my specific situation?

+To find the best car insurance rate, it’s essential to shop around and compare quotes from multiple insurance companies. Consider using online comparison tools or contacting insurance brokers who can provide quotes from various providers. Additionally, be sure to review the coverage options and choose the right level of coverage for your needs.

Are there any discounts available for car insurance?

+Yes, insurance companies offer a variety of discounts to policyholders. These can include discounts for safe driving, bundling multiple policies, installing anti-theft devices, maintaining good grades (for young drivers), and more. Be sure to inquire about available discounts and meet the criteria to qualify for them.

Can I switch insurance companies to get a better rate?

+Absolutely! Switching insurance companies is a common practice, and it can lead to significant savings. If you find a better rate with another provider, you can cancel your existing policy and switch to the new insurer. Just ensure that you understand the terms and conditions of the new policy and any potential cancellation fees associated with your current policy.