Quote For Insurance

The world of insurance can be a complex maze, often filled with jargon and fine print. Navigating this landscape to find the right coverage and an affordable quote can be a daunting task. This article aims to provide an in-depth guide to understanding insurance quotes, shedding light on the process, and empowering you to make informed decisions about your coverage needs.

Unraveling the Insurance Quote Mystery

An insurance quote is more than just a price tag; it’s a carefully calculated assessment of the risks you face and the coverage required to protect against them. This personalized estimate takes into account various factors, each playing a pivotal role in determining the final cost.

Key Factors Influencing Insurance Quotes

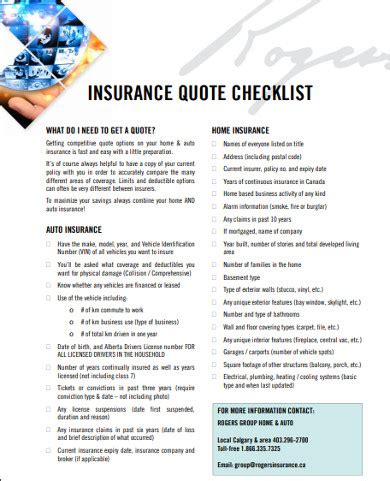

- Risk Assessment: Insurers meticulously evaluate the potential risks associated with the coverage you seek. For instance, in auto insurance, factors like your driving history, the make and model of your vehicle, and even your geographical location can influence the quote.

- Coverage Selection: The type and extent of coverage you choose significantly impact the quote. Comprehensive policies that offer a wide range of protections will typically cost more than basic plans.

- Deductibles and Limits: Your choice of deductibles (the amount you pay out-of-pocket before insurance coverage kicks in) and policy limits (the maximum amount the insurer will pay for a covered loss) can greatly affect the premium.

- Personal Information: Demographic details such as age, gender, and marital status can influence quotes, especially for certain types of insurance like life and health insurance.

- Credit History: In some cases, insurers may consider your credit score when determining your insurance quote, as it can be seen as an indicator of your financial responsibility.

The Art of Comparing Quotes

When seeking the best insurance deal, it’s crucial to compare quotes from multiple providers. This process allows you to evaluate the coverage and costs offered by different companies, ensuring you get the most value for your money.

| Insurance Provider | Quote Amount | Coverage Details |

|---|---|---|

| Provider A | $1,200 annually | Standard home insurance with $1,000 deductible |

| Provider B | $1,500 annually | Enhanced home insurance with flood coverage and $500 deductible |

| Provider C | $950 annually | Basic home insurance with limited liability coverage |

As the table illustrates, quotes can vary significantly based on the provider and the coverage offered. It's essential to understand the specifics of each policy to make an informed decision.

Online Quote Comparison: A Modern Convenience

The digital age has brought forth a plethora of online tools and platforms that simplify the quote comparison process. These platforms aggregate quotes from multiple insurers, allowing you to quickly and easily compare prices and coverage options.

However, it's important to exercise caution when using these tools. Always verify the legitimacy of the platform and the insurers they represent. Ensure the quotes provided are accurate and up-to-date, and read the fine print to understand any limitations or exclusions.

The Role of Insurance Brokers

While online platforms offer convenience, insurance brokers provide a more personalized approach to finding the right coverage. Brokers, as independent professionals, can offer advice and guidance tailored to your specific needs.

Benefits of Working with an Insurance Broker

- Expertise: Brokers possess in-depth knowledge of the insurance market and can provide valuable insights into the coverage options available.

- Personalized Service: They work closely with you to understand your unique circumstances and recommend policies that align with your needs.

- Negotiation Power: Brokers often have established relationships with insurers, which can lead to better rates and more favorable terms.

- Claim Support: In the event of a claim, brokers can provide assistance and advocate on your behalf to ensure a smooth process.

Choosing the Right Broker

When selecting an insurance broker, consider the following:

- Experience: Opt for brokers with a proven track record in the industry and a strong understanding of the products they offer.

- Specialization: Some brokers specialize in specific types of insurance, such as commercial or health insurance. Choose a broker who specializes in the coverage you need.

- Reviews and Testimonials: Read reviews and testimonials from previous clients to gauge the broker’s reputation and level of service.

- License and Credentials: Ensure the broker is licensed and has the necessary credentials to operate in your state or region.

The Future of Insurance Quotes

The insurance industry is evolving rapidly, driven by technological advancements and changing consumer expectations. The future of insurance quotes is likely to be shaped by these trends:

Digital Transformation

Insurance providers are increasingly embracing digital technologies to enhance the quote process. This includes the use of artificial intelligence (AI) and machine learning to streamline risk assessment and quote generation.

Personalized Pricing

The concept of “usage-based insurance” is gaining traction, particularly in auto insurance. This model uses real-time data, such as driving behavior and mileage, to calculate premiums, offering a more personalized and potentially cost-effective approach.

Risk Mitigation Strategies

Insurers are also focusing on helping policyholders mitigate risks. By providing tools and resources to reduce the likelihood of claims, insurers can offer more competitive quotes to responsible individuals.

In Conclusion

Understanding insurance quotes is crucial to making informed decisions about your coverage. Whether you choose to compare quotes online or work with an insurance broker, ensure you have a clear understanding of the coverage you need and the factors that influence the quote. Stay informed, shop around, and don’t be afraid to ask questions. Remember, the right insurance coverage provides peace of mind and financial protection, so it’s worth taking the time to find the best option for your unique situation.

How often should I review my insurance quotes and coverage?

+It’s recommended to review your insurance coverage and quotes annually or whenever your personal circumstances change significantly. This ensures that your coverage remains adequate and that you’re not overpaying for unnecessary features.

What are some common mistakes to avoid when comparing insurance quotes?

+Some common mistakes include focusing solely on the price without considering the coverage, failing to read the policy documents thoroughly, and neglecting to compare multiple providers. Always take the time to understand the fine print and ensure the coverage meets your needs.

Can insurance quotes change after I’ve accepted them?

+Yes, insurance quotes can change. Factors such as changes in your personal circumstances, claims history, or even changes in the insurance market can lead to adjustments in your premium. It’s important to keep your insurer informed of any significant changes that may affect your policy.