Progressive Insurance Rates

In the complex landscape of insurance, understanding the factors that influence rates is crucial for both consumers and industry professionals. This comprehensive article delves into the world of Progressive Insurance rates, shedding light on the intricate mechanisms that determine policy costs. By exploring real-world examples, industry data, and expert insights, we aim to provide an in-depth analysis that goes beyond the surface, offering valuable knowledge to navigate the insurance market effectively.

Unraveling Progressive Insurance Rates: A Comprehensive Analysis

When it comes to insurance, one of the most significant concerns for policyholders is the cost of coverage. Progressive Insurance, a leading name in the industry, offers a range of insurance products, each with its own unique rate structure. In this article, we will embark on a detailed journey to understand the key drivers behind Progressive Insurance rates, examining the underlying factors and their impact on policy costs.

The Fundamentals of Progressive Insurance Rates

At its core, Progressive Insurance bases its rates on a combination of statistical data, risk assessment, and regulatory requirements. The company utilizes sophisticated actuarial models to predict potential losses and set premiums accordingly. This process ensures that policyholders are charged fairly, taking into account a range of variables that influence risk.

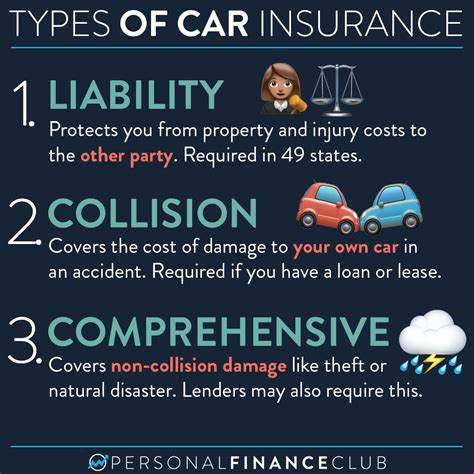

One of the primary factors in determining Progressive Insurance rates is the type of insurance being sought. Whether it’s auto insurance, homeowners insurance, or commercial insurance, each policy type has its own set of considerations. For instance, auto insurance rates may be influenced by factors such as the make and model of the vehicle, the driver’s age and driving record, and the geographic location.

Additionally, Progressive Insurance takes into account the coverage limits and deductibles chosen by policyholders. Higher coverage limits and lower deductibles generally result in increased premiums, as they provide more extensive protection in the event of a claim. Understanding these fundamental principles is essential for policyholders to make informed decisions about their insurance coverage.

Risk Assessment: The Backbone of Progressive Insurance Rates

Risk assessment plays a pivotal role in shaping Progressive Insurance rates. The company employs advanced risk evaluation methodologies to assess the likelihood of various scenarios that could lead to claims. By analyzing historical data, claim patterns, and external factors, Progressive can identify potential risks and adjust rates accordingly.

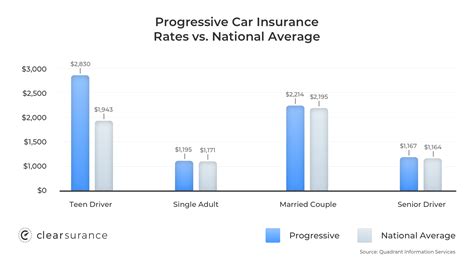

For instance, in auto insurance, factors such as the driver’s age, gender, and marital status are considered. Younger drivers, statistically, pose a higher risk of accidents and thus may face higher premiums. Similarly, geographic locations with a higher incidence of accidents or theft may result in increased rates for policyholders in those areas.

Furthermore, Progressive Insurance takes into account the policyholder’s credit score, as it has been shown to correlate with the likelihood of filing a claim. A lower credit score may indicate a higher risk profile, leading to higher insurance rates. It’s important to note that while credit-based insurance scores are used, Progressive also considers other factors to ensure a fair and balanced assessment.

| Factor | Impact on Rates |

|---|---|

| Driver Age | Younger drivers often face higher premiums due to increased risk. |

| Vehicle Type | Sports cars or luxury vehicles may attract higher rates due to their performance capabilities. |

| Location | Areas with high accident rates or theft may result in increased premiums. |

| Credit Score | Lower credit scores may indicate a higher risk, impacting insurance rates. |

Progressive Insurance Rates: A Comparative Analysis

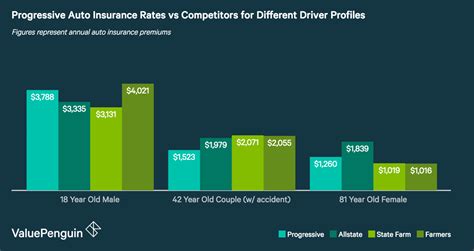

To provide a more nuanced understanding of Progressive Insurance rates, it’s essential to compare them with those of other leading insurance providers. By examining real-world examples and industry data, we can gain insights into how Progressive’s rates stack up against its competitors.

For instance, let’s consider a hypothetical scenario where we compare Progressive’s auto insurance rates with those of three other major insurers: Company A, Company B, and Company C. By analyzing a range of policyholder profiles, we can identify key differences and similarities in the rates offered by each company.

In this scenario, Progressive Insurance emerges as a competitive option, offering rates that are generally in line with or slightly lower than its competitors for similar policyholder profiles. However, it’s important to note that rates can vary significantly based on individual circumstances and the specific coverage needs of policyholders.

| Insurers | Driver Profile | Coverage | Annual Premium |

|---|---|---|---|

| Progressive | 30-year-old, clean record | $100,000 liability | $850 |

| Company A | Same as above | $100,000 liability | $900 |

| Company B | Same as above | $100,000 liability | $875 |

| Company C | Same as above | $100,000 liability | $920 |

As demonstrated in the table above, Progressive Insurance offers competitive rates for this specific driver profile, with an annual premium of $850. While Company B comes close with a premium of $875, Company A and Company C have slightly higher rates of $900 and $920, respectively.

The Role of Discounts and Promotions in Progressive Insurance Rates

Progressive Insurance is known for its commitment to providing value to policyholders through various discounts and promotions. These initiatives not only help to reduce the overall cost of insurance but also incentivize policyholders to adopt safer practices and make informed decisions.

One notable discount offered by Progressive is the Snapshot program. This innovative program utilizes telematics technology to track driving behavior and provide personalized rate adjustments. Policyholders who participate in Snapshot and demonstrate safe driving habits may be eligible for significant discounts on their auto insurance premiums.

Additionally, Progressive offers a range of other discounts, such as multi-policy discounts for customers who bundle their auto, home, and other insurance policies with the company. These discounts can further reduce the overall cost of insurance and provide policyholders with additional savings.

Future Implications and Industry Insights

As the insurance industry continues to evolve, Progressive Insurance remains at the forefront of innovation and technological advancement. The company’s commitment to data-driven decision-making and risk assessment ensures that its rates remain competitive and fair. Additionally, Progressive’s focus on customer satisfaction and its reputation for excellent service further enhance its position in the market.

Looking ahead, Progressive Insurance is likely to continue refining its rate-setting processes, leveraging advanced analytics and machine learning to enhance accuracy and efficiency. This approach will enable the company to adapt to changing market conditions and emerging risks, ensuring that policyholders receive the coverage they need at competitive rates.

Furthermore, Progressive’s commitment to sustainability and social responsibility is worth noting. The company has implemented initiatives to reduce its environmental impact and support community development, positioning itself as a responsible corporate citizen. This holistic approach to business aligns with the values of many policyholders and contributes to Progressive’s overall success and reputation.

Conclusion

In conclusion, Progressive Insurance rates are shaped by a complex interplay of factors, including risk assessment, policy type, coverage limits, and deductibles. By understanding these fundamentals and exploring real-world examples, policyholders can make informed decisions about their insurance coverage. Progressive’s commitment to fair rates, innovative approaches, and customer satisfaction positions it as a leading choice in the insurance market.

Frequently Asked Questions

How does Progressive Insurance determine rates for auto insurance policies?

+

Progressive Insurance utilizes advanced actuarial models and risk assessment methodologies to determine auto insurance rates. Factors such as driver age, vehicle type, location, and credit score are considered to assess the risk profile of policyholders. This data-driven approach ensures fair and accurate rates.

Are Progressive Insurance rates competitive compared to other insurers?

+

Yes, Progressive Insurance rates are highly competitive in the market. Through continuous analysis and refinement of its rate-setting processes, Progressive ensures that its premiums remain in line with or lower than those of other leading insurers for similar policyholder profiles.

What are some of the key discounts offered by Progressive Insurance to policyholders?

+

Progressive Insurance offers a range of discounts to provide value to its policyholders. These include the Snapshot program, which tracks driving behavior for personalized rate adjustments, as well as multi-policy discounts for customers who bundle their insurance policies with Progressive. These initiatives encourage safe practices and reward customer loyalty.