Pmi Insurance Cost

Welcome to a comprehensive guide on understanding the costs associated with PMI insurance. This article will delve into the factors influencing the price of PMI, explore average costs, and provide insights on how you can potentially reduce your PMI expenses. By the end, you'll have a clear understanding of this essential aspect of homeownership and be equipped with the knowledge to make informed decisions.

Understanding PMI Insurance Costs

Private Mortgage Insurance, commonly known as PMI, is a financial safeguard for lenders when homebuyers make a down payment of less than 20% on their property. It protects the lender in case the borrower defaults on the loan, making it an essential component for many prospective homeowners.

The cost of PMI is typically expressed as a percentage of the loan amount, with rates varying based on several factors. Understanding these variables is crucial to gauging the overall expense of PMI and managing your financial obligations effectively.

Key Factors Influencing PMI Costs

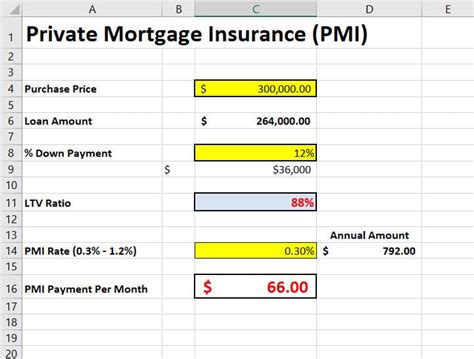

- Loan-to-Value Ratio (LTV): This is one of the primary determinants of PMI costs. LTV is calculated by dividing the loan amount by the property’s value. The higher the LTV, the more risk the lender assumes, which often translates to higher PMI premiums.

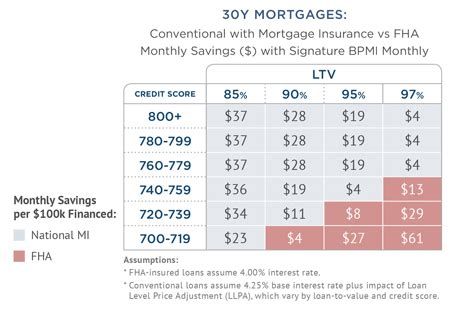

- Credit Score: A borrower’s credit score plays a significant role in determining PMI rates. Lenders consider a high credit score as an indicator of financial responsibility and may offer lower PMI rates. Conversely, borrowers with lower credit scores may face higher PMI costs.

- Loan Type: Different loan types, such as conventional, FHA, or VA loans, have varying PMI structures. The specific terms and conditions of each loan type can impact the cost and duration of PMI coverage.

- PMI Provider: Just like any insurance, the cost of PMI can vary between different providers. It’s essential to compare quotes from multiple sources to ensure you’re getting the best rate for your circumstances.

- Property Type: The type of property you’re purchasing can also influence PMI costs. For instance, condominiums or co-ops may have different requirements and costs compared to single-family homes.

Let's explore some real-world scenarios to illustrate these factors in action.

Case Study: Impact of Credit Score on PMI Costs

Imagine two borrowers, Jane and John, seeking a conventional mortgage with a 10% down payment. Jane has an excellent credit score of 780, while John’s credit score is lower at 620.

| Borrower | Credit Score | PMI Rate |

|---|---|---|

| Jane | 780 | 0.55% |

| John | 620 | 0.85% |

In this scenario, Jane's high credit score qualifies her for a lower PMI rate, potentially saving her thousands of dollars over the life of her loan. On the other hand, John's lower credit score results in a higher PMI rate, making his monthly mortgage payments more expensive.

Average PMI Costs: A Real-World Perspective

Understanding average PMI costs can provide a benchmark for your financial planning. While exact costs will vary based on individual circumstances, here’s a breakdown of average PMI rates and how they translate into monthly and yearly expenses.

Conventional Loans: Exploring Average PMI Rates

For conventional loans, PMI rates typically range from 0.5% to 1% of the loan amount annually. This means that for a 200,000 loan, the annual PMI cost could range from 1,000 to $2,000. Here’s a breakdown:

| PMI Rate | Annual PMI Cost | Monthly PMI Cost |

|---|---|---|

| 0.5% | $1,000 | $83.33 |

| 1% | $2,000 | $166.67 |

Keep in mind that these rates can change over time and may be subject to adjustments based on market conditions and your loan-to-value ratio.

FHA Loans: Understanding PMI Costs

FHA loans have a different structure for PMI, often referred to as Mortgage Insurance Premiums (MIP). There are two components to FHA MIP: an upfront premium and an annual premium.

- Upfront MIP: This is typically 1.75% of the loan amount, which can be financed into the mortgage or paid out-of-pocket at closing.

- Annual MIP: The annual MIP rate for FHA loans can range from 0.45% to 1.05% of the loan amount, depending on the loan term and down payment.

Let's calculate the annual MIP for an FHA loan with a 3.5% down payment and a loan amount of $250,000:

| MIP Rate | Annual MIP Cost | Monthly MIP Cost |

|---|---|---|

| 0.85% | $2,125 | $177.08 |

Strategies to Reduce PMI Costs

While PMI is a necessary expense for many homebuyers, there are strategies you can employ to potentially reduce these costs and save money in the long run.

Building Equity Faster: A Key to PMI Cancellation

One of the most effective ways to reduce PMI costs is to build equity in your home faster. As your equity increases, your loan-to-value ratio decreases, and you may become eligible to cancel your PMI.

There are several strategies to accelerate equity buildup:

- Make Larger Down Payments: Putting down a larger percentage of the home's value at the time of purchase reduces your loan amount and can lower your LTV ratio from the outset.

- Refinance Your Mortgage: If interest rates drop or your financial situation improves, consider refinancing your mortgage. This can reduce your monthly payments and potentially increase your equity.

- Make Extra Payments: Paying a little extra each month or making additional principal payments can reduce your loan balance faster, helping you reach the 20% equity threshold sooner.

Negotiating PMI Cancellation: A Proactive Approach

Another strategy to consider is negotiating with your lender for PMI cancellation. While lenders have different policies, many will allow you to cancel PMI once you reach a certain equity level, typically 20%.

Here are some steps to take when negotiating PMI cancellation:

- Understand Your Loan Terms: Review your loan documents to familiarize yourself with the PMI cancellation provisions. Some loans may have specific requirements or timelines for cancellation.

- Request a New Appraisal: If you believe your home's value has increased significantly, consider getting a new appraisal. This can help demonstrate that you've reached the necessary equity level to cancel PMI.

- Discuss with Your Lender: Reach out to your lender and express your interest in canceling PMI. Provide any relevant documentation, such as the new appraisal, to support your request.

Conclusion: Navigating PMI Costs for a Successful Homeownership Journey

Understanding the costs associated with PMI is a crucial step in the home buying process. By grasping the factors that influence PMI rates, exploring average costs, and implementing strategies to reduce these expenses, you can make more informed decisions and potentially save thousands of dollars over the life of your loan.

Remember, while PMI is a necessary expense for many homebuyers, it's not a permanent one. With careful planning and proactive strategies, you can work towards canceling PMI and enjoying the full benefits of homeownership.

FAQ

Can I avoid PMI altogether when buying a home?

+While it’s not always possible to avoid PMI, there are strategies you can employ. Making a down payment of at least 20% is one way to avoid PMI, as it brings your loan-to-value ratio below the threshold where PMI is typically required. Another option is to consider a piggyback loan, which is a combination of a first mortgage and a second mortgage that can help you avoid PMI.

How long do I have to pay PMI on my mortgage?

+The duration of PMI payments depends on various factors, including the type of loan and the lender’s policies. For conventional loans, PMI is typically required until you reach 20% equity in your home. However, some lenders may allow you to request PMI cancellation once you reach a certain equity level, such as 22% or 25%.

Can I get a refund if I pay off my mortgage early and have been paying PMI?

+Whether you can receive a refund for PMI after paying off your mortgage early depends on the terms of your loan and the PMI provider. In some cases, you may be eligible for a partial refund if you cancel your PMI coverage early. It’s advisable to review your loan documents or consult with your lender to understand your specific refund policy.

Are there any tax benefits associated with PMI payments?

+Yes, PMI payments may be tax-deductible for certain borrowers. To be eligible for the deduction, you must itemize your deductions on your tax return and meet specific criteria set by the IRS. It’s recommended to consult with a tax professional to determine if you can deduct your PMI payments and understand the applicable rules and regulations.