Personal Health Insurance Nj

Personal health insurance is a vital aspect of financial planning and healthcare management, especially in states like New Jersey, where healthcare costs can be high. Understanding the nuances of health insurance plans and selecting the right coverage is essential for residents to ensure they have adequate protection for themselves and their families. This comprehensive guide will delve into the specifics of personal health insurance in New Jersey, offering insights, strategies, and practical advice to help individuals make informed decisions about their healthcare coverage.

Navigating the Health Insurance Landscape in New Jersey

The Garden State offers a diverse range of health insurance options, catering to the varied needs of its residents. From major medical plans to supplemental coverage, understanding the available options is the first step towards securing comprehensive healthcare protection.

Major Medical Plans: The Backbone of Personal Health Insurance

Major medical plans, also known as comprehensive health insurance, form the core of personal health coverage. These plans are designed to cover a broad spectrum of healthcare services, including doctor visits, hospital stays, prescription medications, and often, preventive care. In New Jersey, these plans are offered by various insurers, each with its own network of providers and unique coverage benefits.

For instance, UnitedHealthcare offers a range of plans in New Jersey, including their Navigators series, which provide extensive coverage for a variety of healthcare needs. These plans typically cover preventive services such as annual physicals, immunizations, and screenings at 100% coverage, encouraging residents to stay on top of their health.

| Plan Type | Coverage Highlights |

|---|---|

| UnitedHealthcare Navigators Platinum | Covers a broad range of services with a focus on high-quality care. Offers extensive network of providers and specialty care access. |

| UnitedHealthcare Navigators Gold | Provides a balance between comprehensive coverage and cost-effectiveness. Includes coverage for prescription drugs and mental health services. |

| UnitedHealthcare Navigators Silver | Designed for those seeking cost-efficient coverage. Offers lower premiums and higher deductibles, ideal for individuals with limited healthcare needs. |

Another major insurer in New Jersey is Horizon Blue Cross Blue Shield, which provides a wide array of plans, from HMO (Health Maintenance Organization) plans to PPO (Preferred Provider Organization) plans. Their Blue Options series offers flexibility in choosing healthcare providers, while their Blue Access plans provide cost-effective coverage with a more limited provider network.

Understanding Deductibles, Copays, and Coinsurance

Deductibles, copays, and coinsurance are essential components of health insurance plans that impact the out-of-pocket costs for policyholders. Understanding these terms is crucial for residents to make informed decisions about their healthcare coverage and to manage their financial responsibilities effectively.

A deductible is the amount an insured individual must pay out of pocket before the insurance company starts covering the costs. For instance, if a plan has a deductible of $2,000, the insured individual must pay the first $2,000 of covered medical expenses before the insurance kicks in. Deductibles can vary widely depending on the type of plan and the insurer.

A copay, or copayment, is a fixed amount an individual pays for a covered healthcare service, usually at the time of service. Copays can vary depending on the type of service and the provider. For example, a doctor's office visit might have a copay of $30, while a specialist visit might have a higher copay, such as $50.

On the other hand, coinsurance is the percentage of the total cost of a covered healthcare service that an individual is responsible for paying after the deductible has been met. For instance, if a plan has an 80/20 coinsurance structure, the insurance company will cover 80% of the cost of a covered service, and the insured individual will pay the remaining 20%.

It's important to note that these costs can add up quickly, especially for those with high deductibles or who require frequent medical care. Therefore, when choosing a health insurance plan, it's crucial to consider not only the monthly premium but also the potential out-of-pocket costs associated with deductibles, copays, and coinsurance.

Supplemental Health Insurance: Adding Layers of Protection

In addition to major medical plans, New Jersey residents have the option to enhance their coverage with supplemental health insurance. These plans are designed to provide additional financial protection and fill gaps in primary coverage, ensuring that individuals and families have the resources they need to manage their healthcare costs effectively.

Dental and Vision Insurance: Maintaining Oral and Visual Health

Dental and vision insurance are critical components of overall health coverage, as they focus on two essential areas of healthcare often excluded from major medical plans. These supplemental plans offer coverage for a range of services, from routine check-ups and cleanings to more complex procedures, ensuring residents have access to the care they need to maintain good oral and visual health.

For instance, Delta Dental, a leading provider of dental insurance, offers a range of plans in New Jersey. Their Premier plan provides comprehensive coverage for a variety of dental services, including preventive care, basic procedures, and major treatments. This plan typically covers 100% of preventive services, such as dental cleanings and check-ups, encouraging regular dental care.

Similarly, VSP Vision Care offers vision insurance plans that cover eye exams, contact lenses, and a wide range of eyeglasses. Their Signature plan provides extensive coverage, including annual eye exams, a wide selection of frames, and discounts on specialty lenses and contacts.

Critical Illness Insurance: Financial Protection for Serious Health Conditions

Critical illness insurance provides a lump-sum payment upon the diagnosis of a specified critical illness, such as cancer, heart attack, or stroke. This type of coverage can provide financial protection for New Jersey residents, helping to cover costs that may not be fully covered by their primary health insurance, such as travel for specialized treatment, home modifications, or additional caregiving needs.

One notable provider of critical illness insurance is Mutual of Omaha, which offers a range of plans with coverage amounts up to $100,000. Their Critical Advantage plan provides coverage for a broad range of critical illnesses, including cancer, stroke, heart attack, organ transplant, and more. This plan can be particularly beneficial for residents who want financial protection against the high costs associated with serious health conditions.

Hospital Indemnity Insurance: Peace of Mind for Hospital Stays

Hospital indemnity insurance provides a daily benefit for each day an insured individual is confined to a hospital. This type of coverage can help offset the costs associated with hospital stays, which can be significant, especially for long-term illnesses or injuries. It can also provide a source of income for those who may need to take time off work due to a hospital stay.

Aflac, a well-known provider of indemnity insurance, offers a range of plans, including their Hospital Indemnity plan. This plan provides a daily benefit for hospital stays, with benefits payable directly to the insured individual, giving them flexibility in how they use the funds. This can be particularly beneficial for covering out-of-pocket expenses, such as copays or over-the-counter medications, or for any other needs that may arise during a hospital stay.

The Future of Health Insurance: Innovations and Trends

The health insurance landscape in New Jersey, and across the nation, is evolving, driven by advancements in technology, changing healthcare needs, and shifts in consumer preferences. Here’s a look at some of the key trends and innovations that are shaping the future of personal health insurance.

Telehealth and Digital Health Solutions

The rise of telehealth services, facilitated by digital health platforms, is revolutionizing how healthcare is delivered and accessed. New Jersey residents are increasingly turning to telehealth for a range of healthcare needs, from primary care visits to mental health services. This trend is expected to continue, with insurers integrating telehealth services into their plans and offering incentives for their use.

For example, Oscar Health, a tech-focused insurer, offers comprehensive telehealth services as part of their health insurance plans. Oscar's virtual primary care visits, mental health counseling, and other specialty services are accessible through their mobile app, providing residents with convenient and cost-effective healthcare options.

Value-Based Care and Accountable Care Organizations (ACOs)

Value-based care models, which reward healthcare providers for the quality and outcomes of care rather than the quantity of services delivered, are gaining traction in New Jersey and nationwide. These models aim to improve healthcare quality and efficiency while controlling costs. Accountable Care Organizations (ACOs) are a key component of this shift, bringing together healthcare providers to coordinate care and improve patient outcomes.

In New Jersey, Horizon Blue Cross Blue Shield has been a leader in the adoption of value-based care models. Through their ACO program, Horizon coordinates care across a network of providers, ensuring that patients receive the right care at the right time and place. This approach has led to improved health outcomes and reduced costs for patients, as well as enhanced satisfaction among healthcare providers.

Individualized Health Plans and Precision Medicine

The concept of one-size-fits-all health insurance is giving way to more personalized coverage options. Insurers are beginning to offer plans that can be tailored to individual health needs and preferences, taking into account factors such as lifestyle, family history, and genetic makeup. This shift towards precision medicine is expected to continue, offering New Jersey residents more targeted and effective healthcare solutions.

For instance, UnitedHealthcare offers a range of personalized health plans through their Optum platform. These plans leverage advanced analytics and individual health data to tailor coverage and benefits to each person's unique needs. This approach ensures that residents receive the specific care and resources they need, when they need them, enhancing the overall effectiveness of their health insurance coverage.

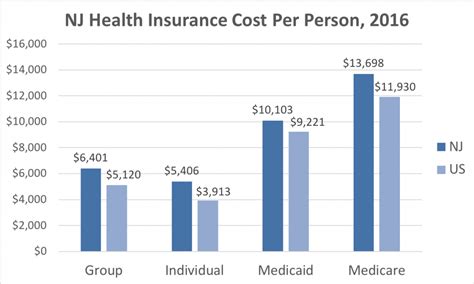

What is the average cost of health insurance in New Jersey?

+The cost of health insurance in New Jersey varies based on factors such as age, location, and the specific plan chosen. On average, a major medical plan for an individual can range from 400 to 800 per month, while family plans can cost upwards of $1,500 per month. It’s important to note that these costs can be significantly reduced with employer-sponsored coverage or government assistance programs like Medicaid or Medicare.

How can I choose the right health insurance plan for my needs?

+When selecting a health insurance plan, consider your healthcare needs, the network of providers, and the cost of premiums and out-of-pocket expenses. Evaluate whether you need a comprehensive plan with a broad network and extensive coverage, or if a more cost-effective plan with a limited network and higher out-of-pocket costs would better suit your needs. It’s also beneficial to compare plans from different insurers to find the best fit for your budget and healthcare requirements.

Are there any government programs that can help with health insurance costs in New Jersey?

+Yes, New Jersey residents may be eligible for government-sponsored health insurance programs such as Medicaid for low-income individuals and families, and Medicare for individuals aged 65 and older or those with certain disabilities. Additionally, the Affordable Care Act (ACA) provides subsidies and tax credits to help lower the cost of health insurance for eligible individuals and families.