Nonowner Car Insurance

Nonowner car insurance is a unique type of auto insurance policy designed to cater to individuals who do not own a vehicle but frequently borrow, rent, or drive other people's cars. This coverage offers protection for drivers in various situations, providing peace of mind and financial security when operating vehicles that are not their own. With the rise in car-sharing services, ride-sharing platforms, and the growing trend of multiple drivers using a single vehicle, nonowner car insurance has become an essential consideration for many.

In this comprehensive guide, we delve into the intricacies of nonowner car insurance, exploring its benefits, coverage options, and real-world applications. By understanding the nuances of this specialized policy, drivers can make informed decisions to ensure they are adequately protected on the road.

Understanding Nonowner Car Insurance

Nonowner car insurance, also known as a non-owner liability policy, is tailored for individuals who do not own a car but still require auto insurance coverage. It provides liability protection for bodily injury and property damage when the policyholder borrows or rents a vehicle. This type of insurance is particularly beneficial for those who:

- Frequently borrow a friend or family member's car.

- Use car-sharing services like Zipcar or Turo.

- Drive for ride-sharing companies like Uber or Lyft (often required by these platforms)

- Are in between vehicles and need temporary coverage.

- Have a learner's permit and are practicing driving with a family member's car.

By investing in nonowner car insurance, drivers can ensure they are financially protected in the event of an accident, regardless of the vehicle they are operating. This policy covers the policyholder's liability, ensuring they are not personally responsible for the costs associated with causing bodily injury or property damage to others.

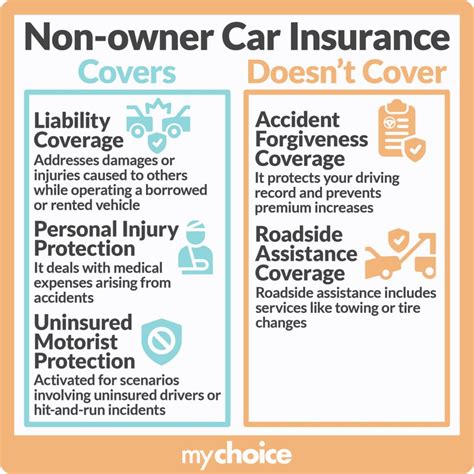

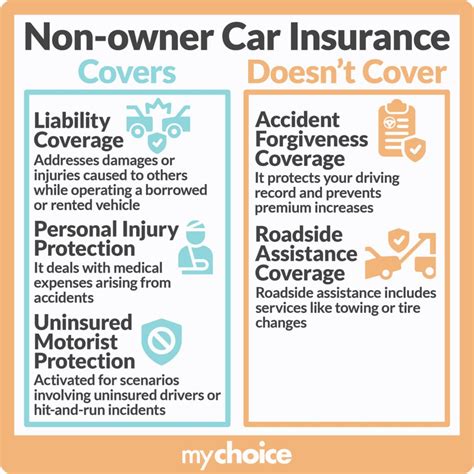

Coverage Options and Benefits

Nonowner car insurance offers a range of coverage options, allowing policyholders to tailor their protection to their specific needs. Here are some key coverage components:

Liability Coverage

The cornerstone of nonowner car insurance is liability coverage. This coverage protects the policyholder in the event they are at fault for an accident, covering the costs of bodily injury and property damage to others. Liability coverage typically includes:

- Bodily Injury Liability: Covers medical expenses and lost wages for individuals injured in an accident caused by the policyholder.

- Property Damage Liability: Pays for the repair or replacement of property damaged in an accident, including other vehicles, structures, and personal belongings.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, provides additional protection for the policyholder and their passengers. It covers medical expenses for injuries sustained in an accident, regardless of fault. This coverage is particularly beneficial for ensuring prompt medical attention without worrying about immediate financial burdens.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage protects the policyholder when involved in an accident with a driver who either lacks insurance or has inadequate coverage. This coverage ensures the policyholder is not left financially responsible for damages caused by an uninsured or underinsured driver.

Rental Car Coverage

Nonowner car insurance can also include rental car coverage, which provides compensation for the cost of renting a vehicle while the policyholder’s car is being repaired or in the event they are involved in an accident with a rental car. This coverage ensures uninterrupted mobility and peace of mind during unforeseen circumstances.

Real-World Applications

Nonowner car insurance finds its application in various scenarios, offering protection and peace of mind to drivers in different situations.

Car-Sharing Services

With the popularity of car-sharing services like Zipcar and Turo, nonowner car insurance is an essential consideration. These services allow individuals to rent cars on an as-needed basis, providing flexibility and convenience. However, accidents can happen, and nonowner car insurance ensures that drivers are covered even when using a rented vehicle.

Ride-Sharing Platforms

For drivers working with ride-sharing platforms like Uber and Lyft, nonowner car insurance is often a requirement. These platforms typically provide insurance coverage during active rides, but there are gaps in coverage during periods of waiting for a ride request or personal use. Nonowner car insurance fills these gaps, ensuring continuous protection for drivers who use their vehicles for ride-sharing purposes.

Borrowing a Friend’s Car

Friends and family members often share their vehicles, and nonowner car insurance is a prudent measure to ensure all drivers are adequately covered. In the event of an accident while borrowing a friend’s car, nonowner car insurance provides liability protection, ensuring financial stability and peace of mind for both the borrower and the vehicle owner.

Learner’s Permit Holders

Individuals with a learner’s permit often practice driving with a family member’s car. Nonowner car insurance can be a valuable asset in these situations, providing liability coverage for the learner and ensuring they are protected during their driving education.

Performance Analysis and Real-World Examples

To illustrate the effectiveness of nonowner car insurance, let’s examine a few real-world scenarios and analyze how this coverage can provide essential protection:

Scenario 1: Car-Sharing Accident

Imagine you’re using a car-sharing service like Zipcar for a weekend getaway. Unfortunately, you get into an accident while driving the rented vehicle. Without nonowner car insurance, you would be personally liable for any bodily injury or property damage caused. However, with nonowner car insurance, your liability coverage would kick in, covering these expenses and protecting your financial well-being.

Scenario 2: Ride-Sharing Insurance Gap

You’re a driver for a ride-sharing platform, and during a period of waiting for a ride request, you get into an accident while running a personal errand. The platform’s insurance coverage doesn’t apply in this situation, leaving you vulnerable. Nonowner car insurance steps in to provide the necessary liability coverage, ensuring you are not personally responsible for the accident’s consequences.

Scenario 3: Borrowing a Friend’s Car

Your friend lends you their car for a quick errand, but while driving, you accidentally hit a parked car. Without nonowner car insurance, you would be solely responsible for the repair costs. However, with this specialized coverage, your liability protection would cover the damages, saving you from unexpected financial strain.

Evidence-Based Future Implications

As the sharing economy continues to grow and car-sharing services become more prevalent, the demand for nonowner car insurance is likely to increase. This specialized coverage offers a vital safety net for individuals who frequently drive borrowed or rented vehicles. With the rise of ride-sharing platforms and the evolving nature of mobility, nonowner car insurance is poised to play a crucial role in ensuring driver protection and financial security.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects against bodily injury and property damage claims. |

| Medical Payments Coverage | Covers medical expenses for the policyholder and passengers. |

| Uninsured/Underinsured Motorist Coverage | Provides protection when involved with drivers lacking or having inadequate insurance. |

| Rental Car Coverage | Compensates for rental car costs during repairs or accidents involving rental vehicles. |

Who needs nonowner car insurance?

+Nonowner car insurance is beneficial for individuals who frequently borrow, rent, or drive other people’s cars. This includes those who use car-sharing services, ride-sharing platforms, or borrow vehicles from friends and family. It provides liability protection in various driving scenarios.

What is covered by nonowner car insurance?

+Nonowner car insurance typically covers liability for bodily injury and property damage. It also offers optional coverage for medical payments, uninsured/underinsured motorists, and rental car expenses. The specific coverage depends on the policy chosen.

How much does nonowner car insurance cost?

+The cost of nonowner car insurance varies based on factors such as the policyholder’s driving history, location, and the coverage limits chosen. On average, nonowner policies can range from 200 to 500 annually. It’s best to obtain quotes from multiple insurers to find the most competitive rates.

Does nonowner car insurance cover rental cars?

+Yes, nonowner car insurance can include coverage for rental cars. This provides protection for the policyholder when renting a vehicle, ensuring they are covered for liability and other specified expenses. However, the exact coverage and limits may vary, so it’s essential to review the policy details.